This document analyzes biopharmaceutical company Macrogenics and recommends selling its stock. Key points include:

- Macrogenics focuses on developmental oncology which has low success rates and faces competition from biosimilars.

- Its lead drug margetuximab faces uncertainty due to expected biosimilar competition for breast cancer treatments.

- Macrogenics will need to continue dilutive equity offerings to fund clinical programs and manufacturing expansions.

- The company's platforms are speculative without FDA approvals demonstrating safety and efficacy.

- Macrogenics is overvalued and does not align with the investor's value strategy due to binary risks and clinical uncertainty.

![UOIG 5

University of Oregon Investment Group January 29th

, 2016

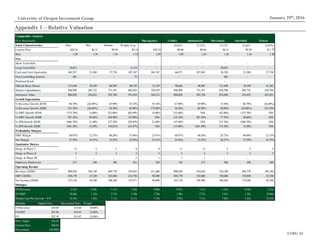

Macro factors

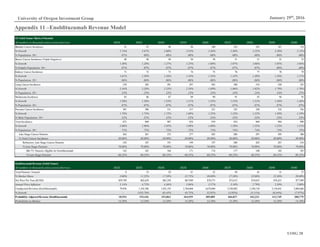

External factors influencing the biotechnology industry tend to be based in

demographics and government policy. The largest demand driver for immuno-

oncology treatments, for example, is growth in over-65s (Figure 11), the age-

cohort most likely to develop cancer. Furthermore, the Affordable Care Act has

led to a marked decrease in the uninsured, increasing the addressable market for

cancer treatments.

Recently, scrutiny over dramatic price increases of previously affordable generics

has led to political pressure to mitigate the rise of medical costs. One response has

been to whether to restrict government drug formularies based on drug pricing

and value-based efficacy. (Formularies refer to drugs approved for reimbursement

by insurers, government payers and pharmacy benefits managers.) Drug firms

unable to secure formulary approval risk losing physician coverage and hence,

sales to similar drugs eligible for reimbursement.

Strategic Positioning

Proprietary Technology Platform

Macrogenics’ proprietary technology platforms employ methods in protein

engineering to treat diseases by multiple theoretical mechanisms which seek to

fortify the body’s immune system and response to foreign threats. The firm keeps

an extensive library of 2,000+ purified antibodies aimed at a large number

of cell targets, allowing for the ability to simultaneously address multiple

theorized mechanisms against cancerous and other pathogenic cells. This library

is used in the drug discovery process by offering potential candidates for further

analysis.

Dual Affinity Re-Targeting (DART)

The DART platform seeks to take advantage of the immune system’s natural

mechanisms towards targeting and destroying pathogens. The platform enables

antibody molecules to simultaneously bind to two targets at the cellular level with

the goal of creating “a more significant biological effect than binding [to] either

one of [them] separately.” This contrasts with most current antibody-based

treatments, which bind to a single target (“monoclonal”). Previous attempts by

researchers to create dual affinity antibodies were thwarted by manufacturing

inefficiencies.

Fc Optimization

Macrogenics’ Fc Optimization platform modifies the constant (“FC”) region of

the immune system’s existing antibodies. This modification enhances how

immune cells recognize therapeutic antibodies to better cooperate in destroying

cancerous cells.

Cancer Stem-Like Cells (CSLC)

The CSLC platform is employed in discovering potential cancer cell attributes

that can be targeted using one of the above technologies. It aims to ascertain novel

cell targets not amenable to current antibody-based cancer treatments. This is

accomplished through the theorized notion that cancer stem cells serve as the basis

for tumor regrowth.

Business Growth Strategies

Overview

Macrogenics’ long-term objective is to be involved in all aspects of the drug-

making process, from discovery and development to manufacturing,

commercialization, marketing and sales. Prior to gaining drug approval, this will

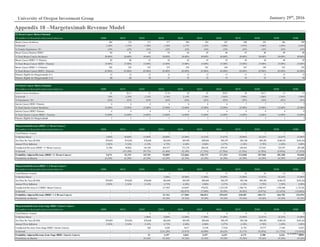

Figure 10: US Prescription Expenditure

Components, 2000-2014

Source: CMMS.gov

Figure 11: US Population Over-65, 2000A-2020E

Source: IBISWorld

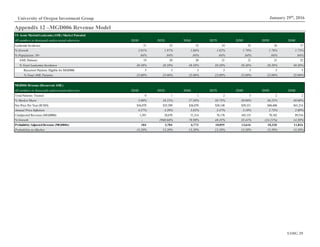

Figure 12: Macrogenics Pipeline by Platform

Source: Macrogenics Investor Relations

Figure 13: Platform Patent Expirations

Source: Macrogenics Investor Relations

$0B

$50B

$100B

$150B

$200B

$250B

$300B

2000 2002 2004 2006 2008 2010 2012 2014

Out of Pocket Private Health Insurance Medicare Medicaid

0%

1%

2%

3%

4%

5%

0

10

20

30

40

50

60

70

2000 2005 2010 2015 2020

Population Over-65 % Change

Drug Name Platform

Enoblituzumab Fc Optimization

Margetuximab Fc Optimization

MGD006 DART

MGD007 DART

MGD009 DART

MGD010 DART

MGD011 DART

MGD012 Fc Optimization

MGD013 DART

MGD014 DART

Platform Patent Expiration

CSLC 2028

DART 2026 - 2031

Fc Optimization 2024](https://image.slidesharecdn.com/mgnx-171111032653/85/Macrogenics-Equity-Research-Report-5-320.jpg)