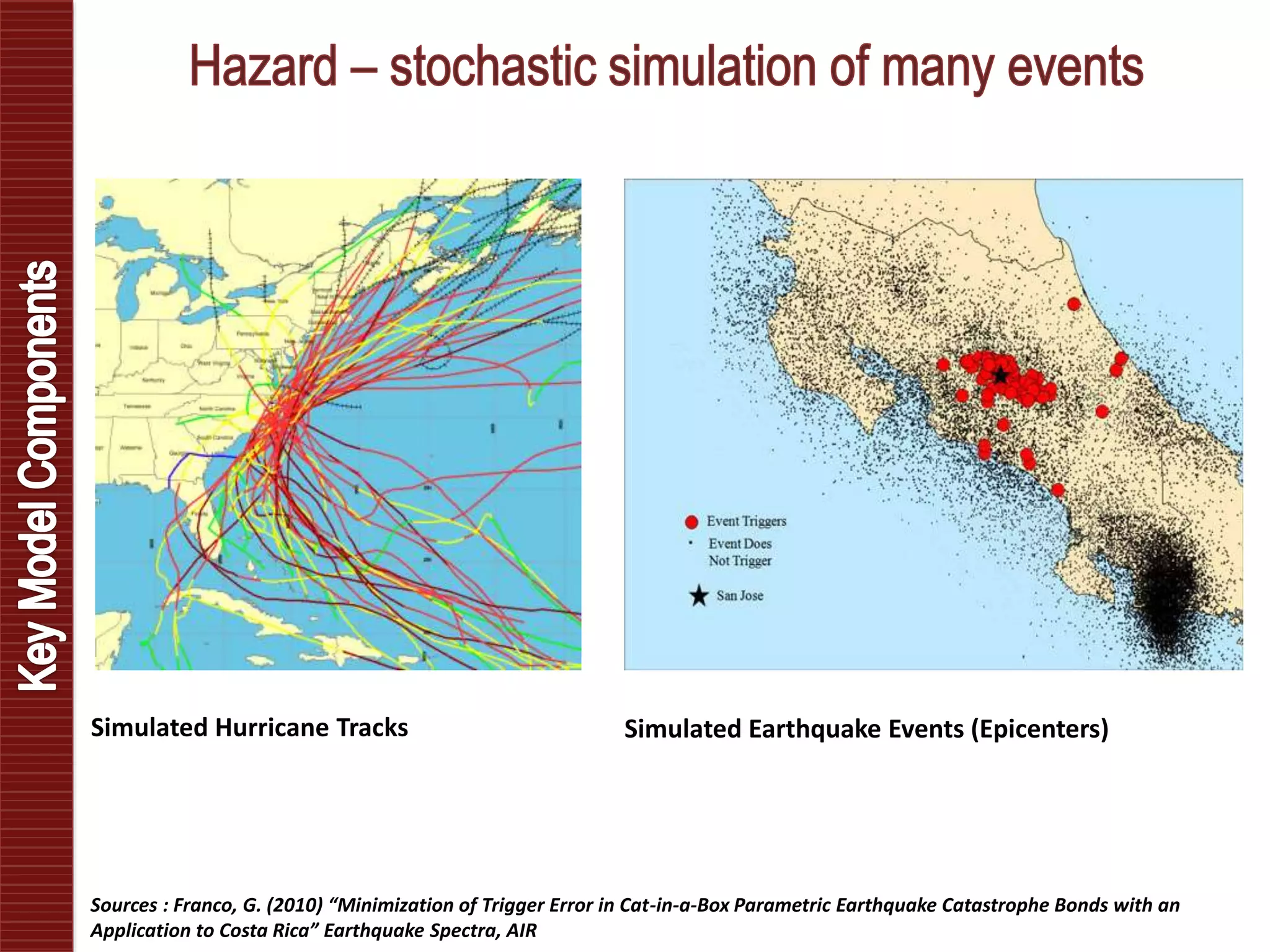

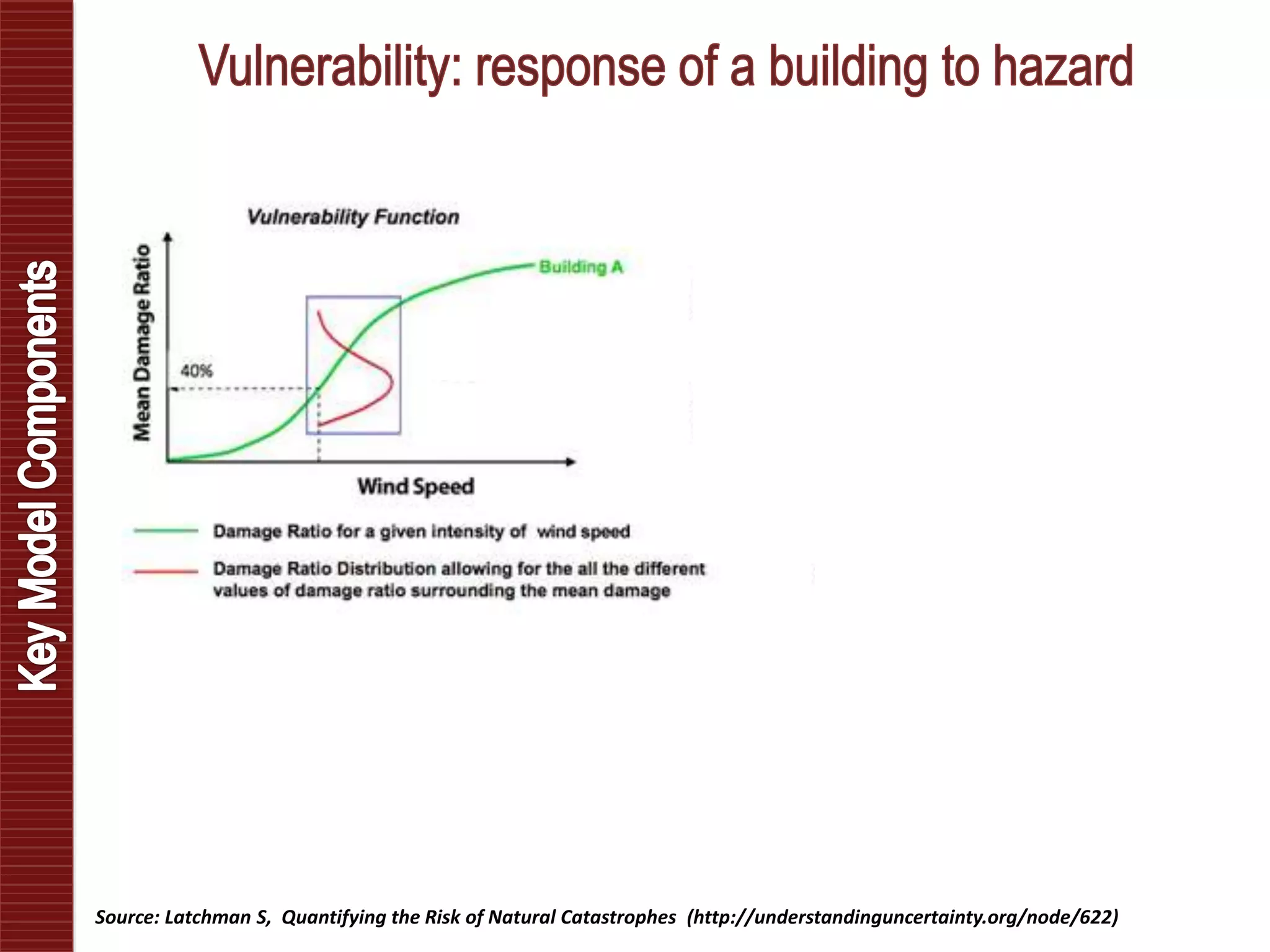

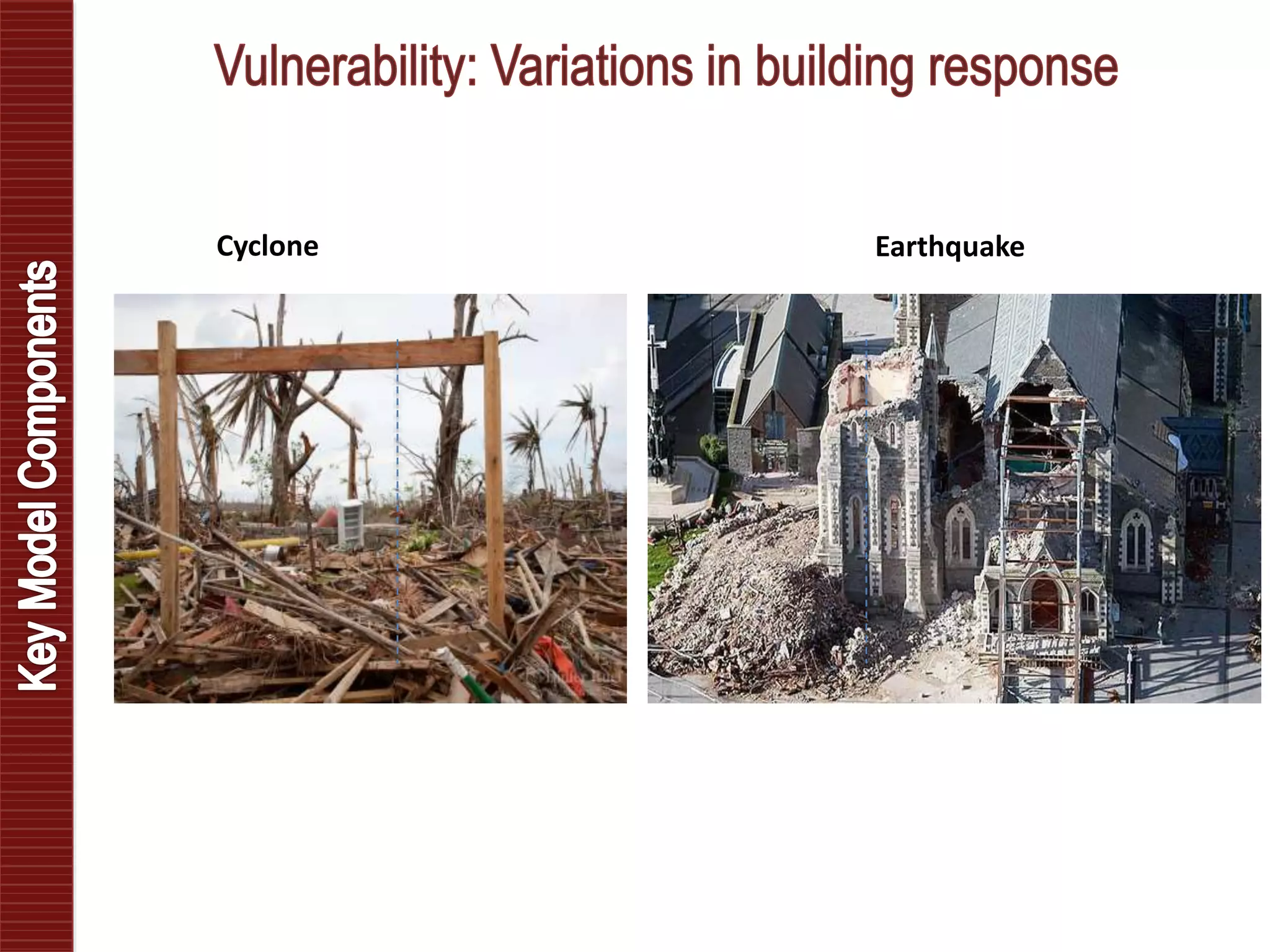

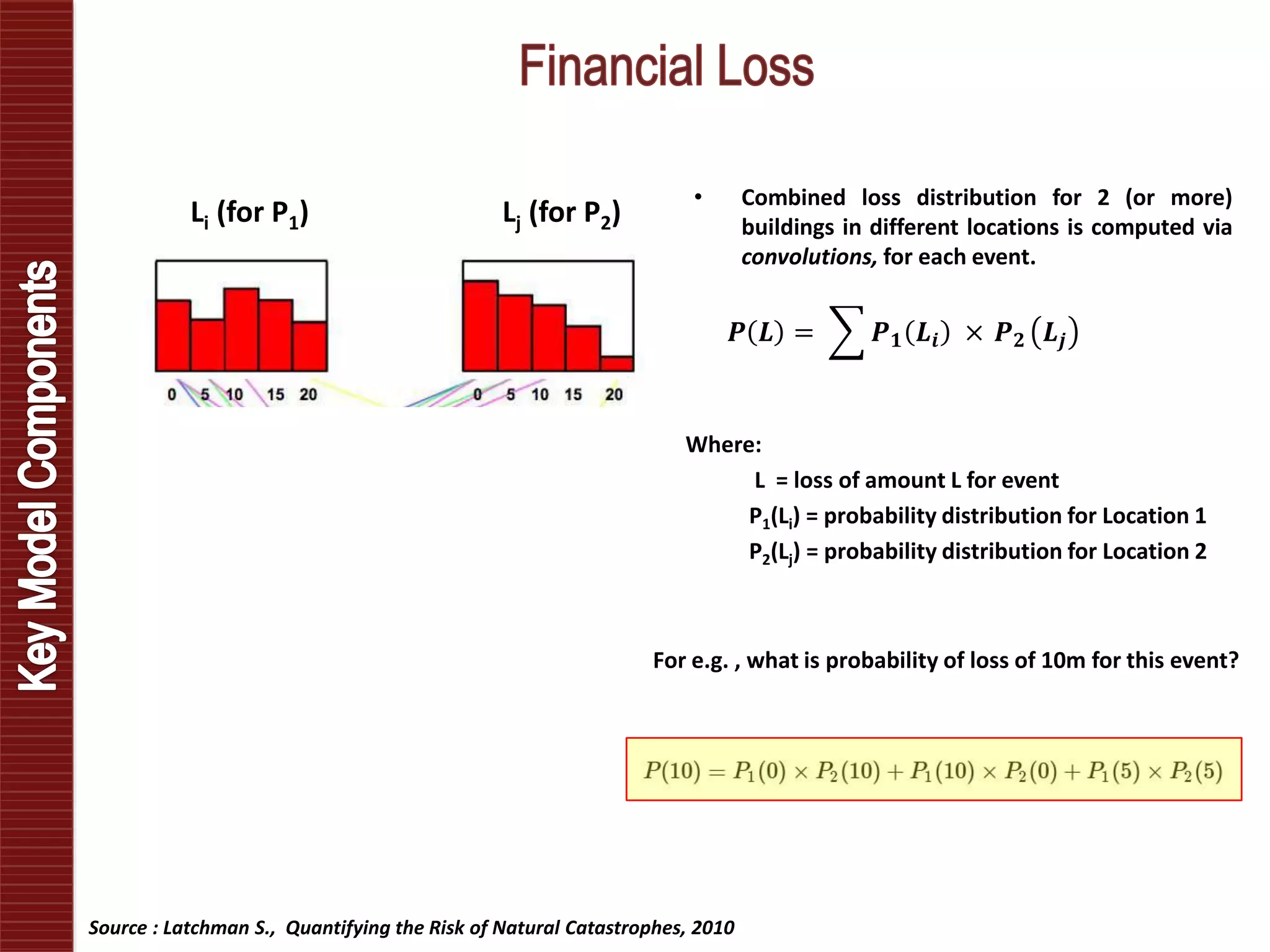

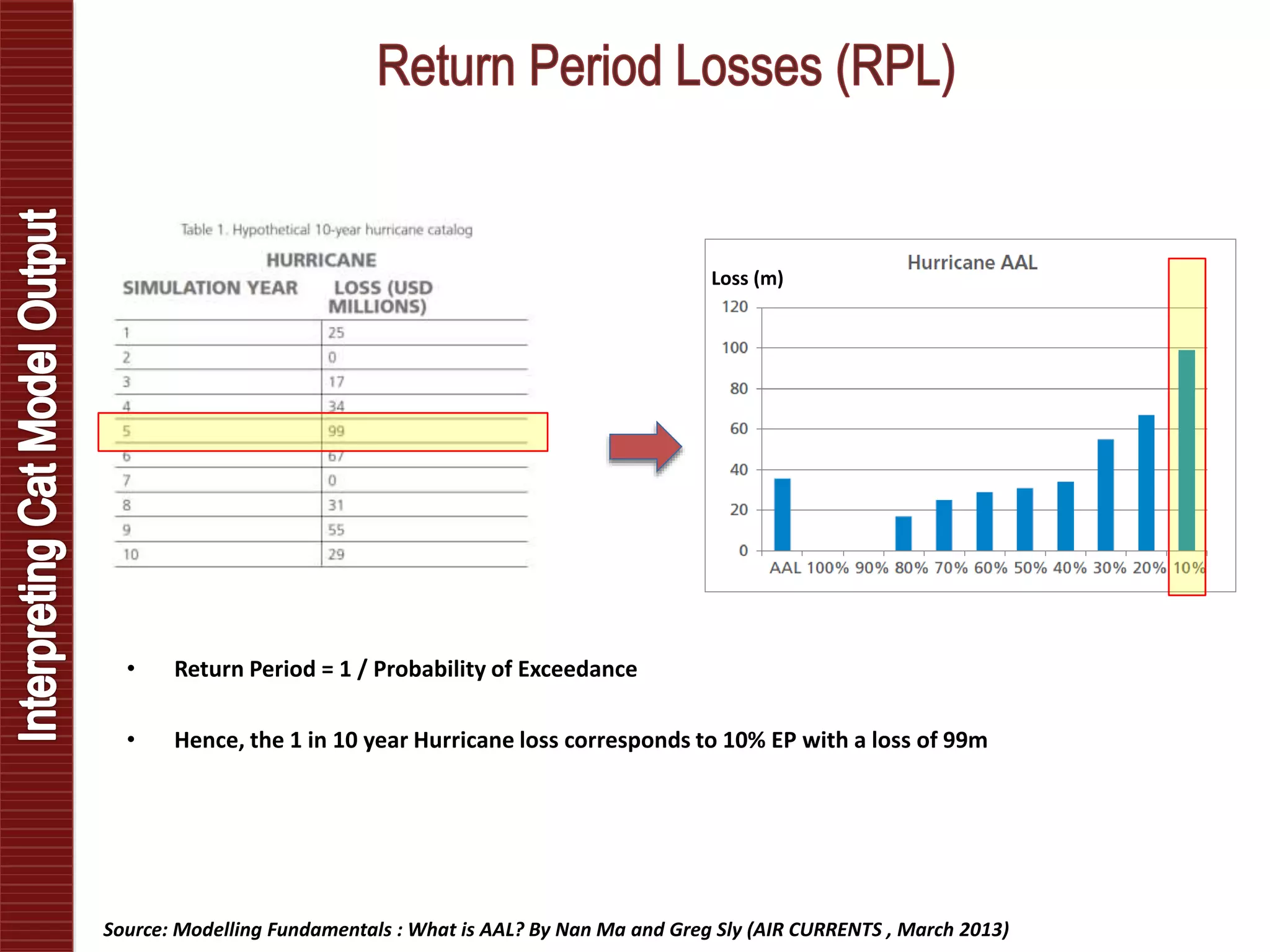

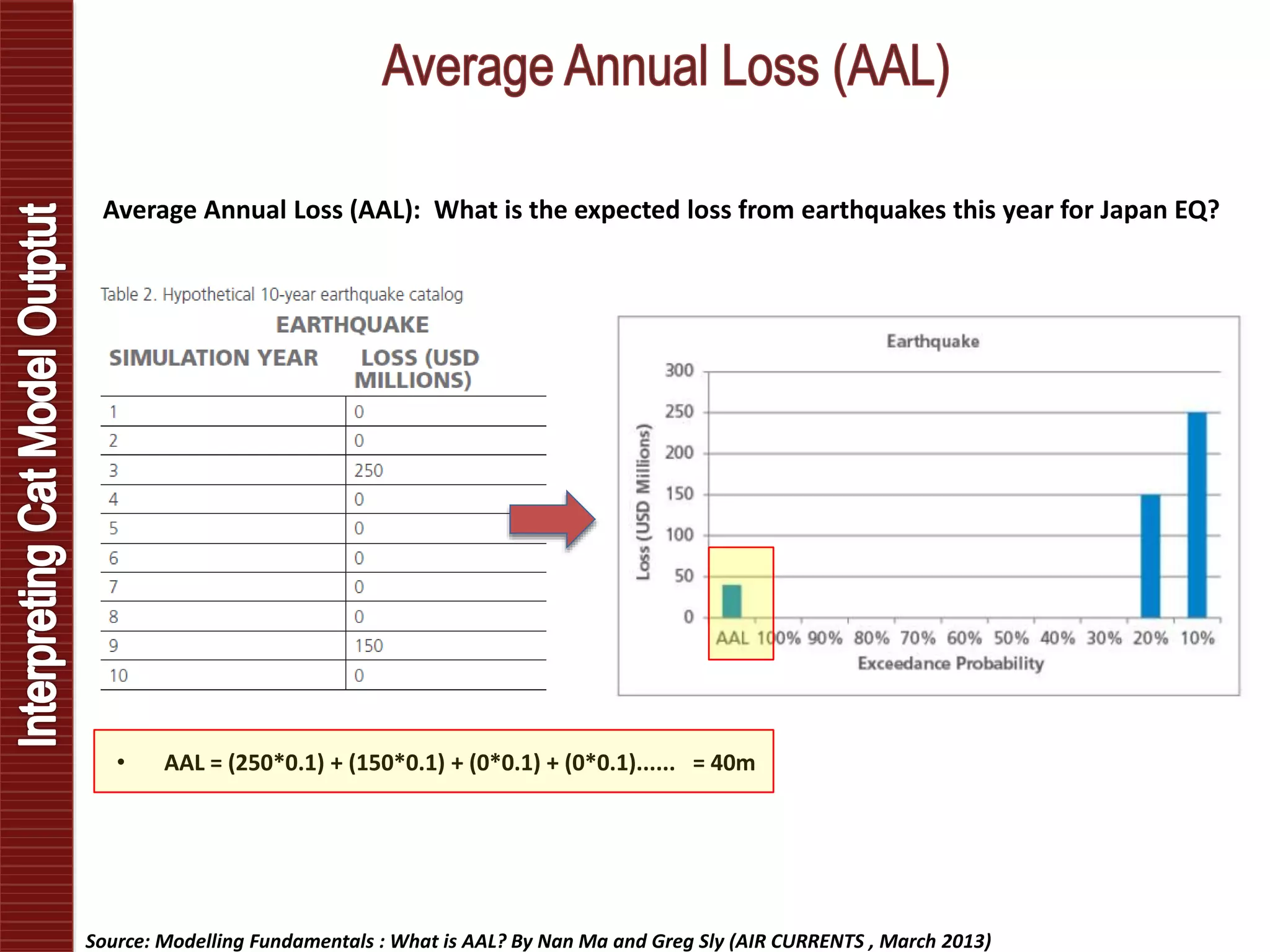

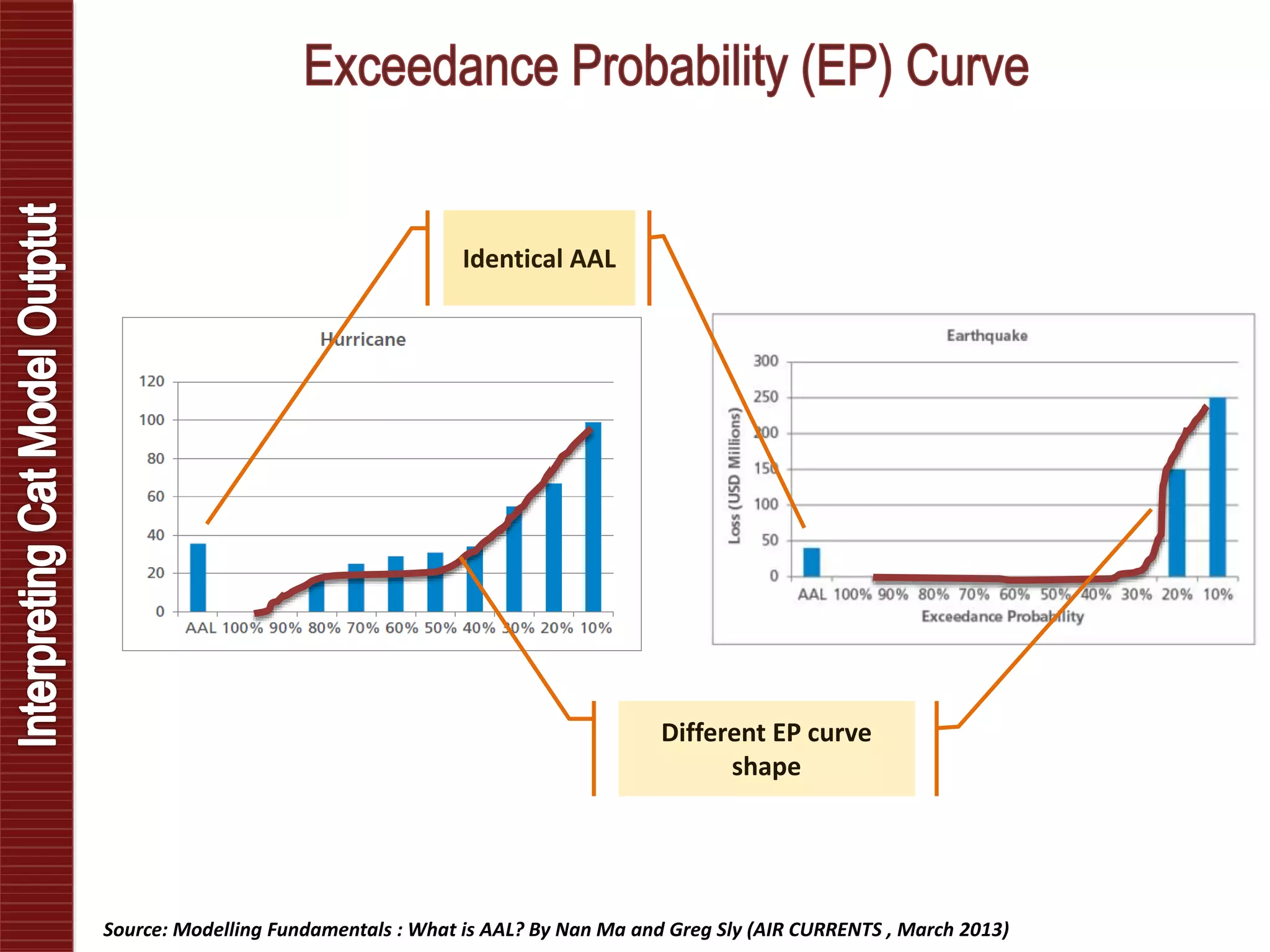

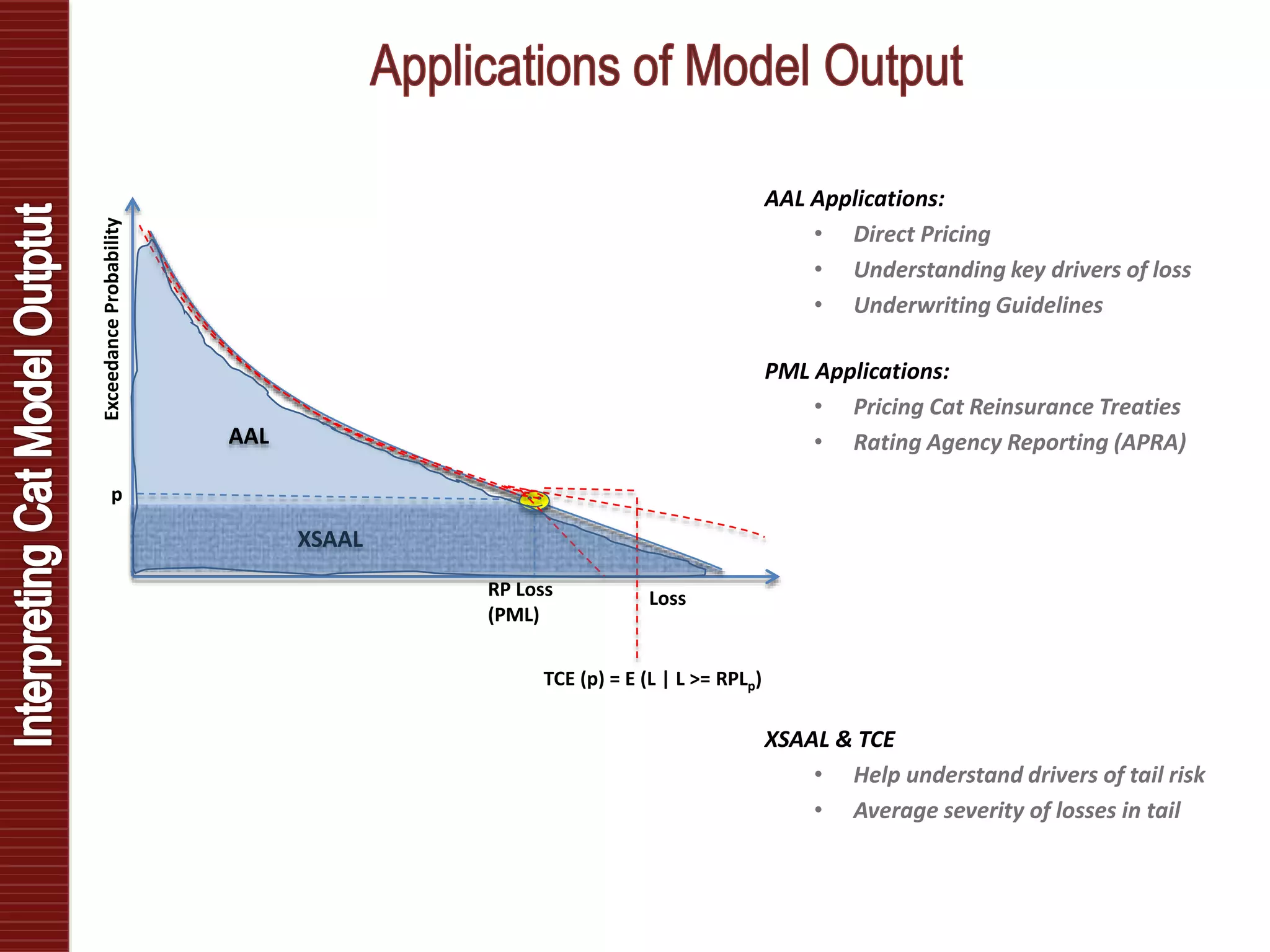

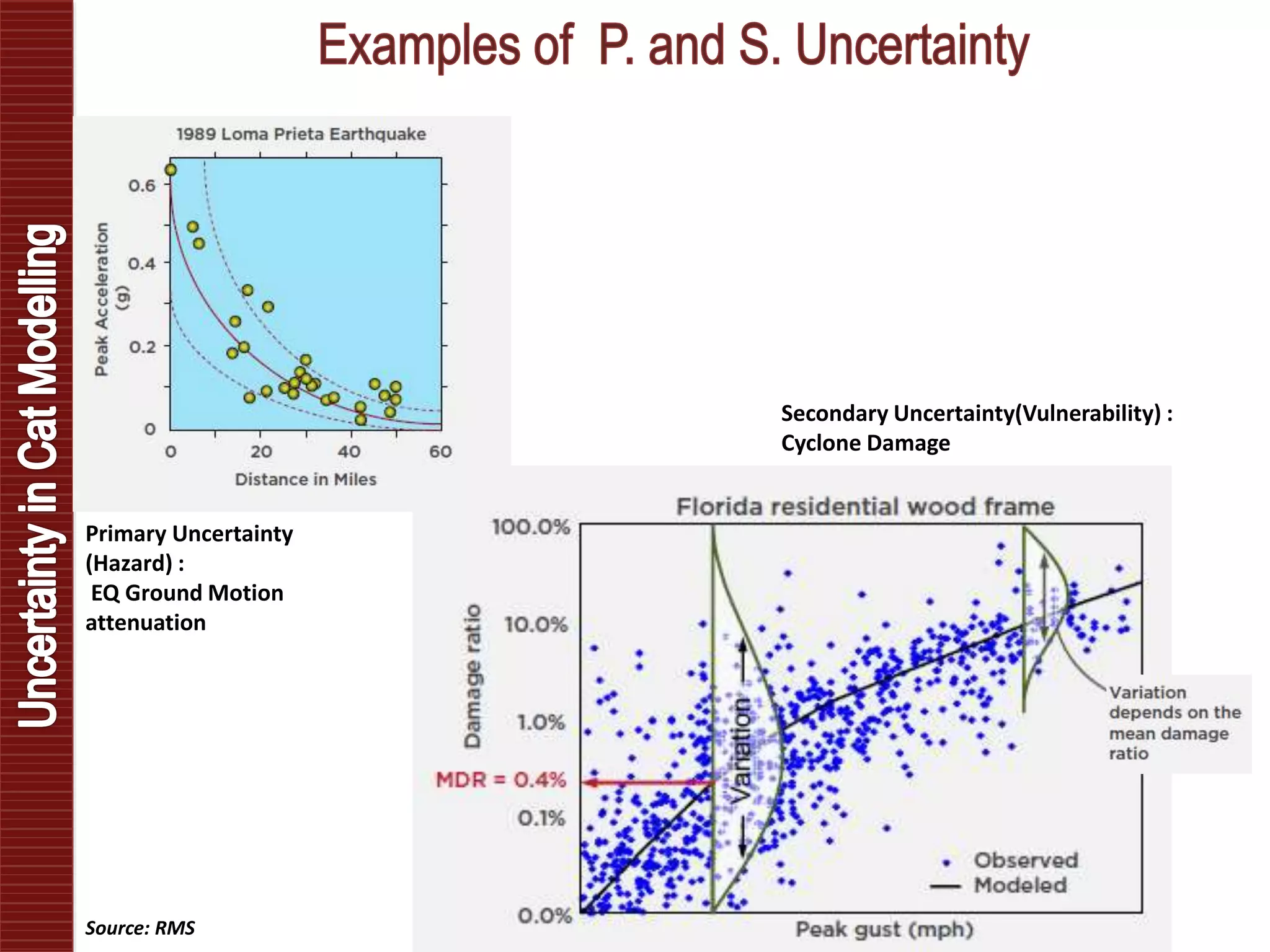

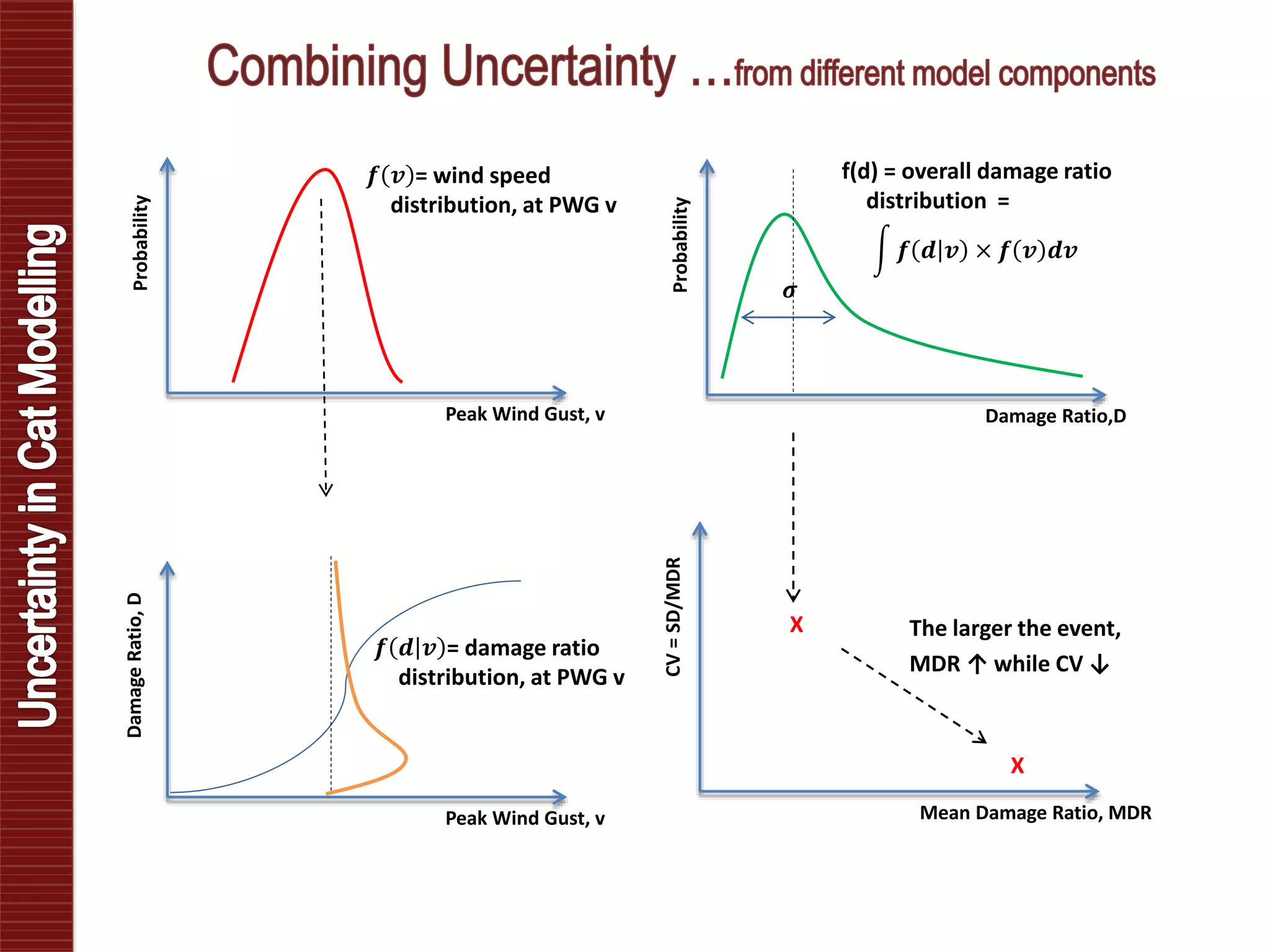

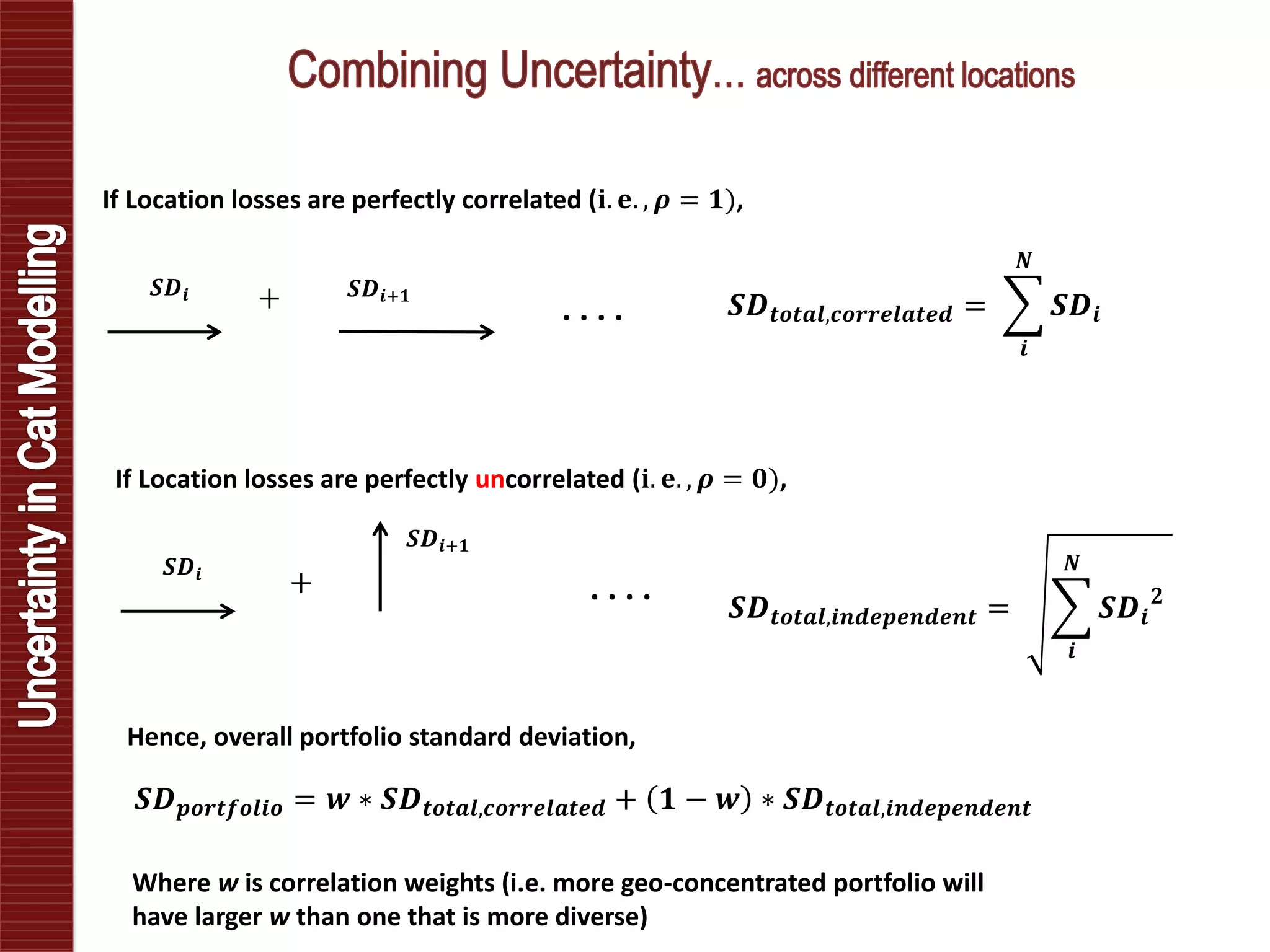

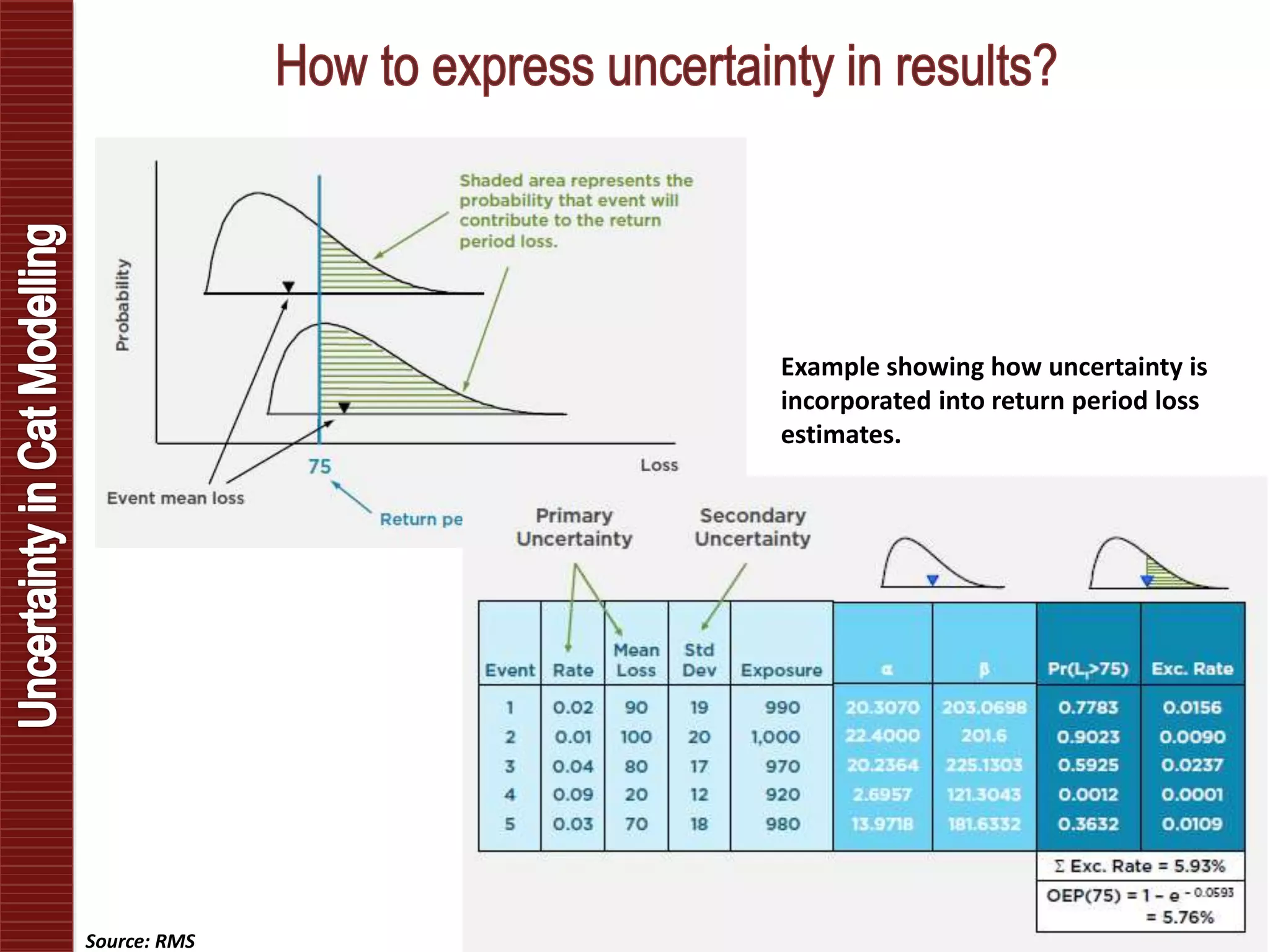

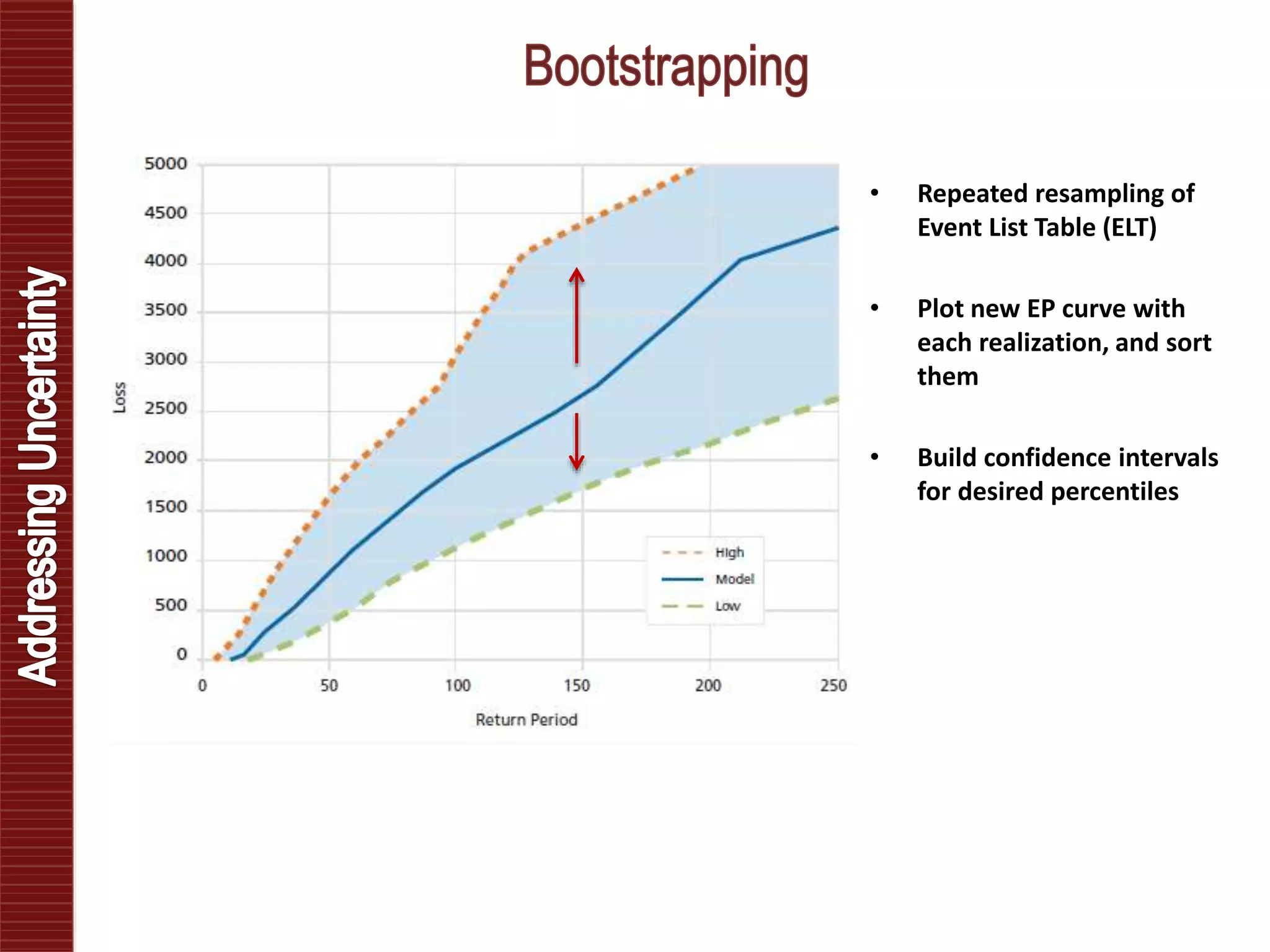

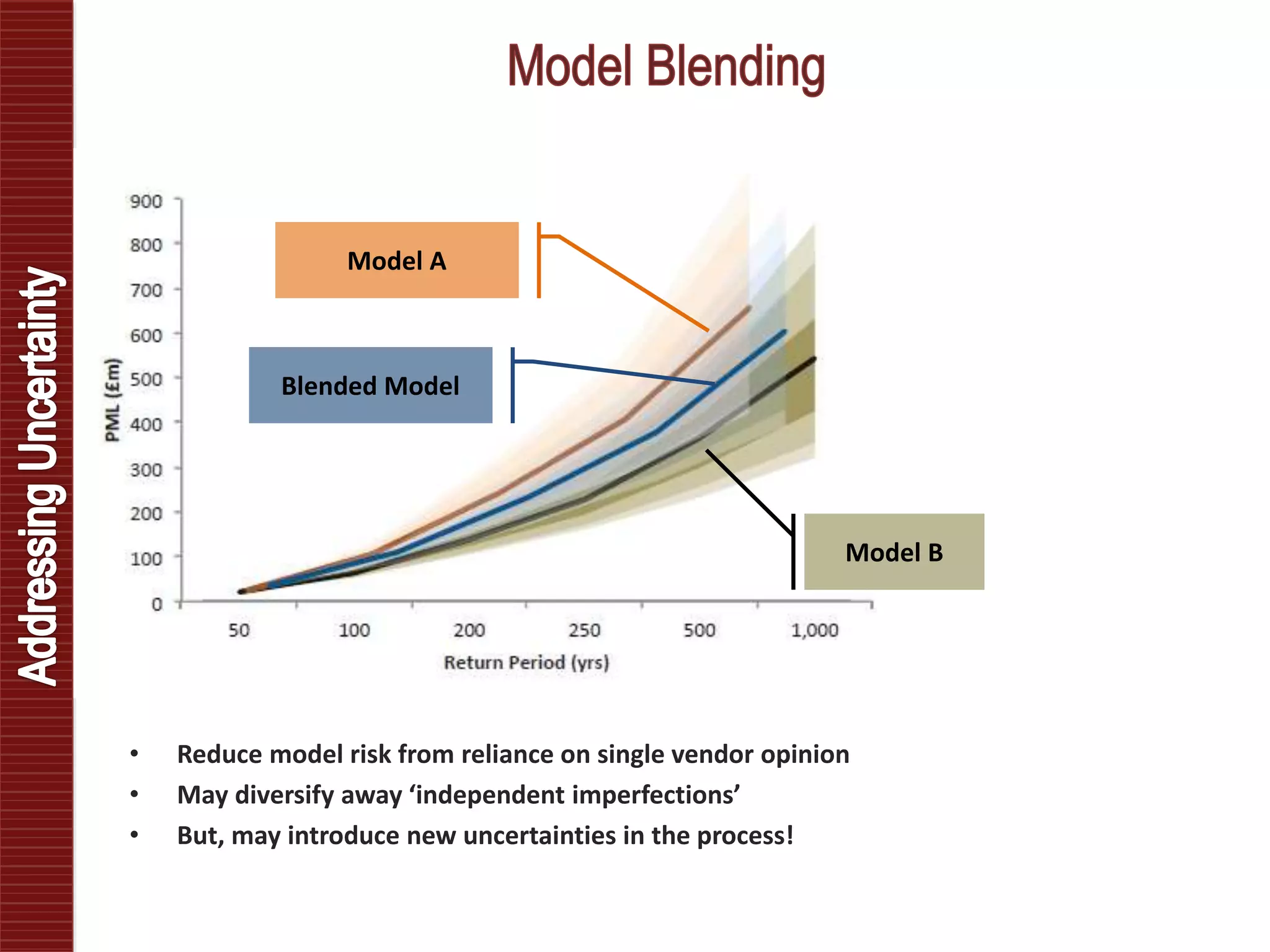

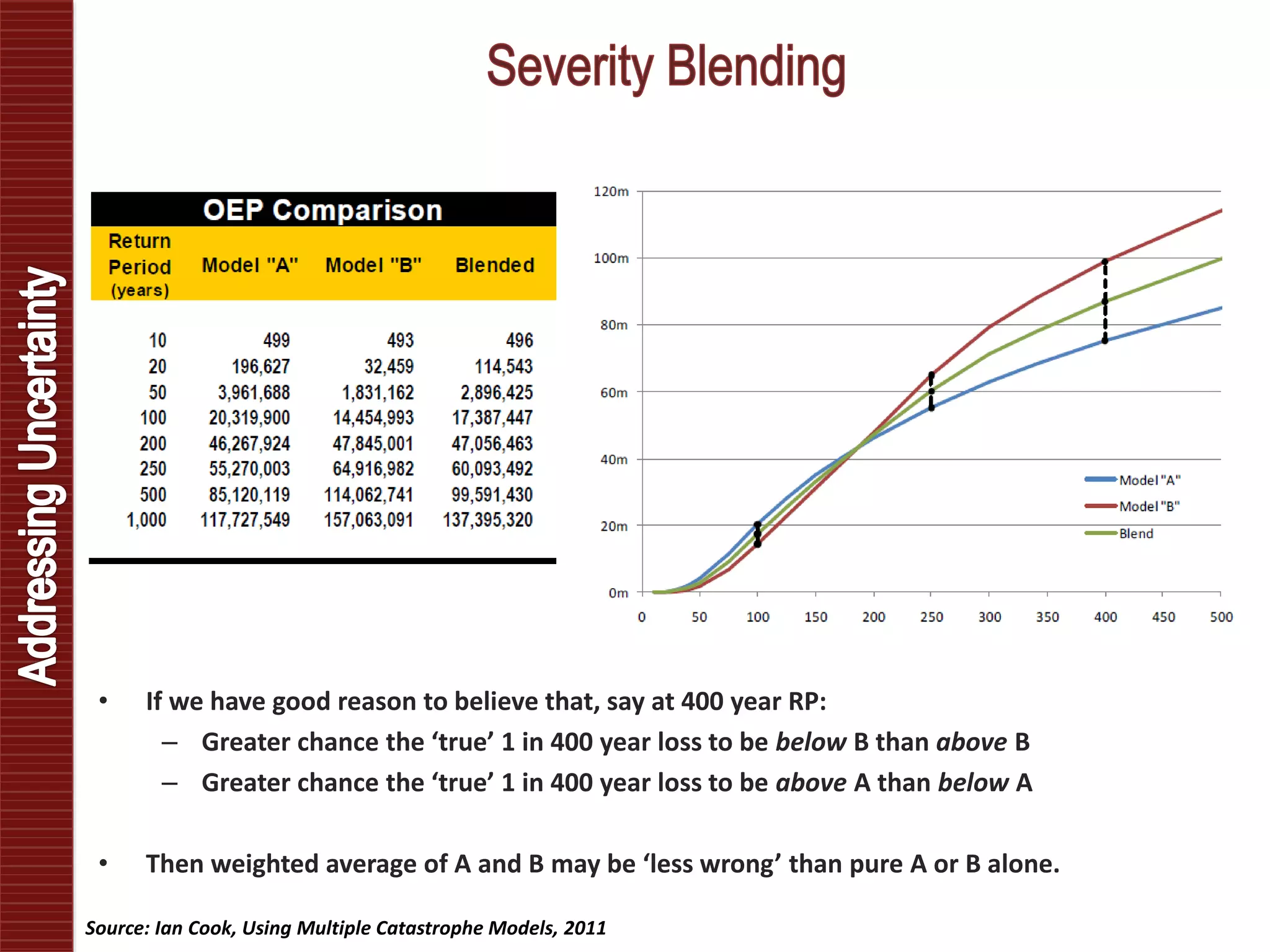

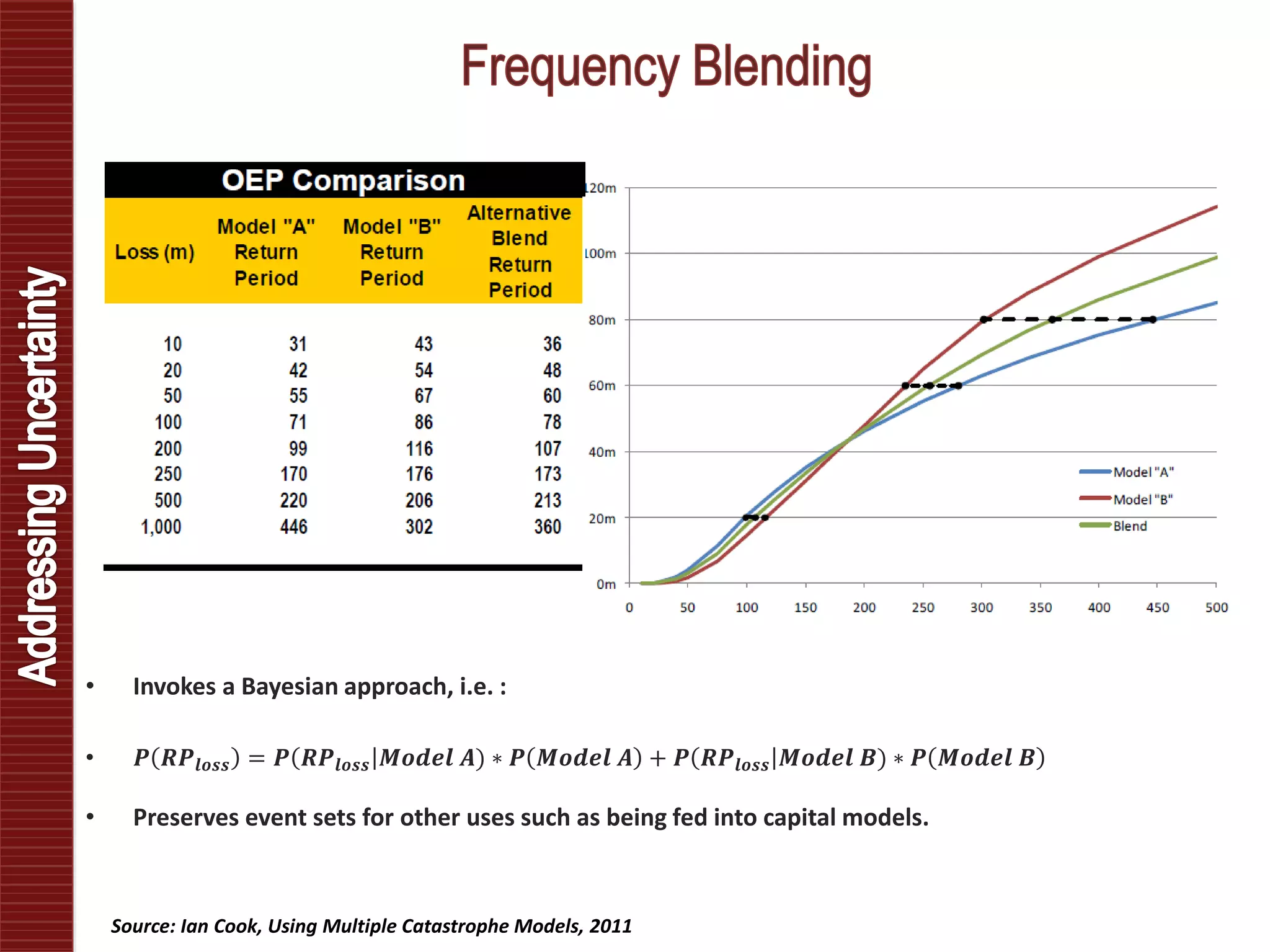

Catastrophe models are used to understand natural disaster risk exposure and aid in pricing and structuring reinsurance programs. The models simulate hazard events and calculate potential financial losses by considering a building's vulnerability and the costs of damage. Key outputs include loss exceedance probabilities, average annual losses, and probable maximum losses. However, there is uncertainty in catastrophe modeling given limitations in data, science, and sampling. Model results are best interpreted as a range rather than a single value.