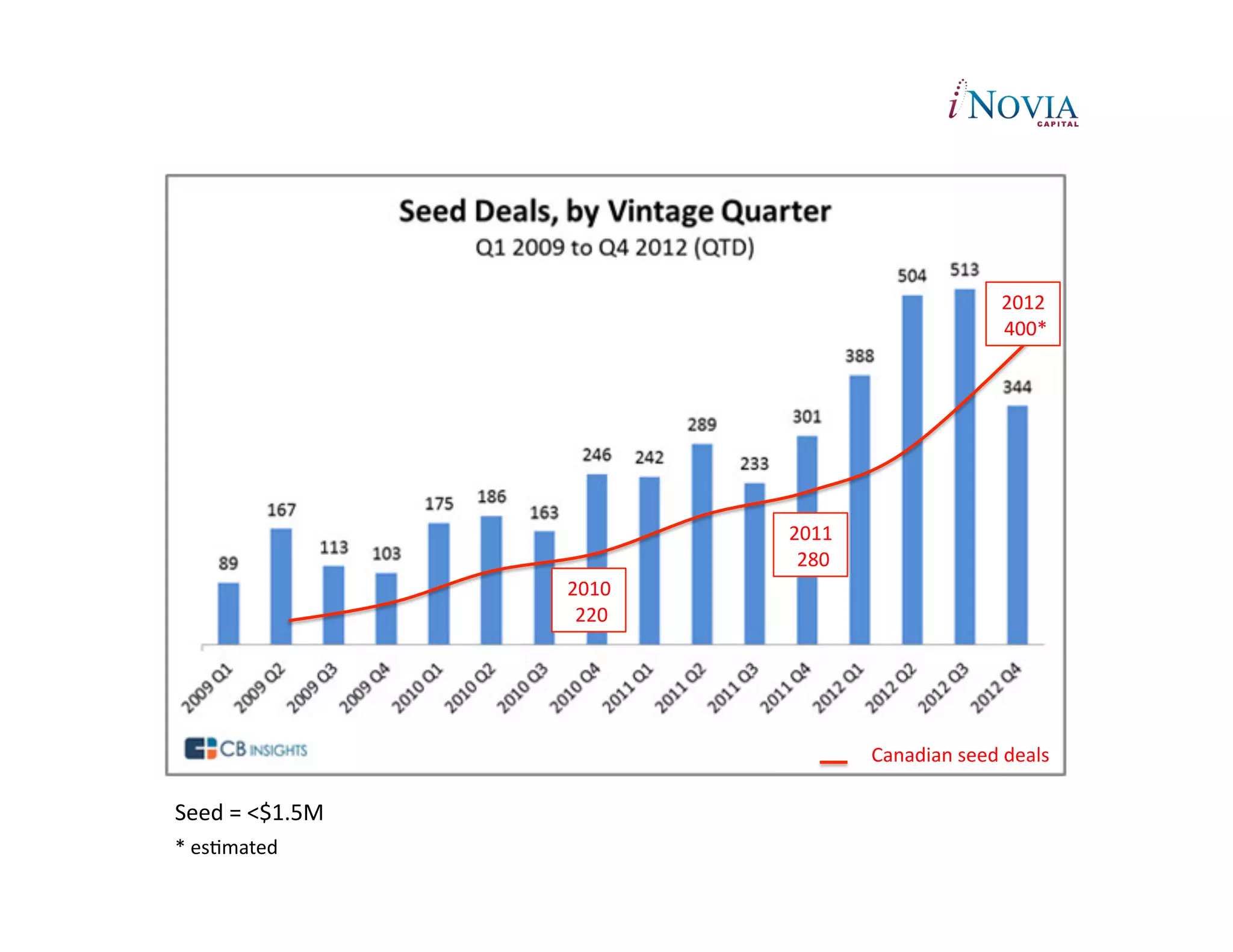

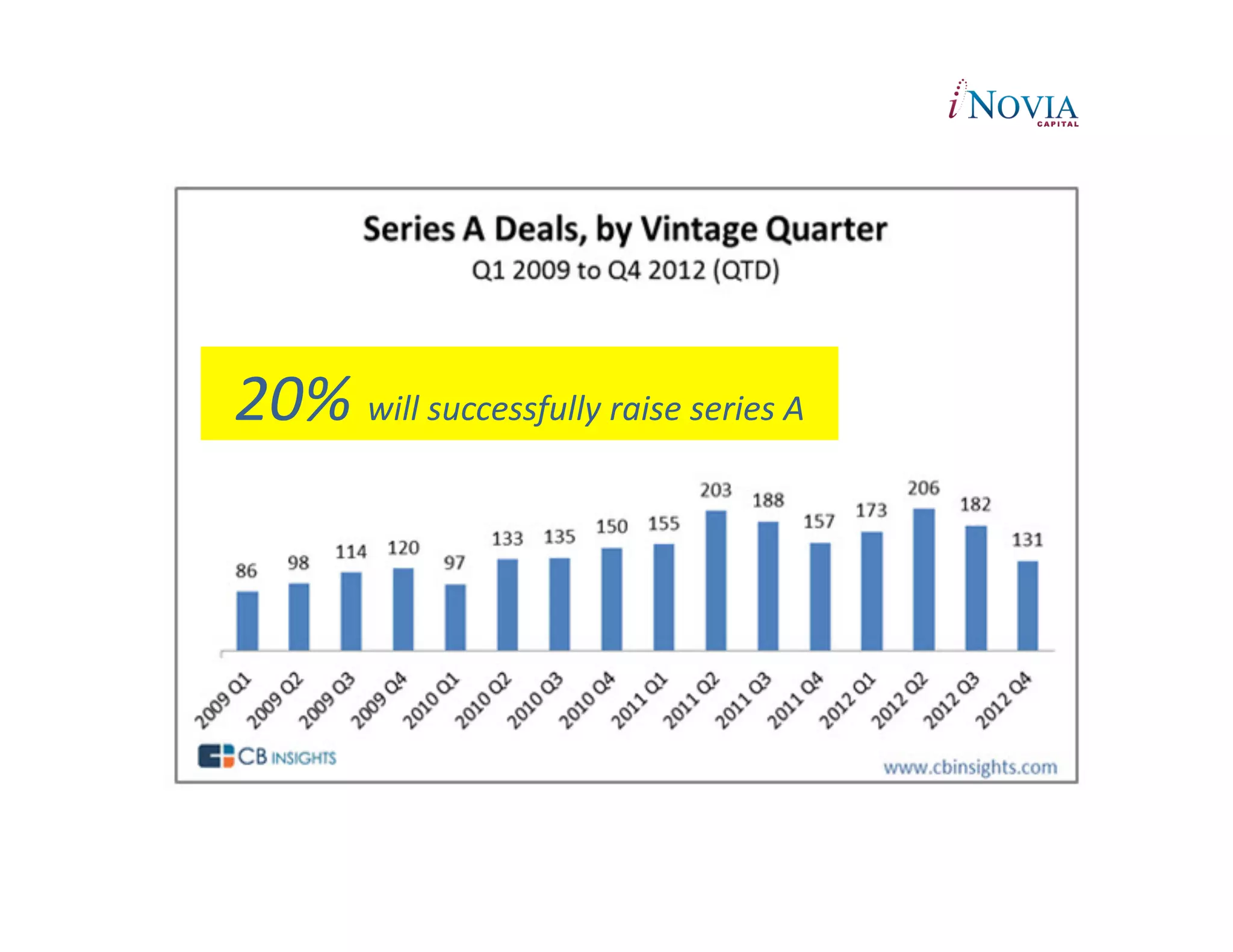

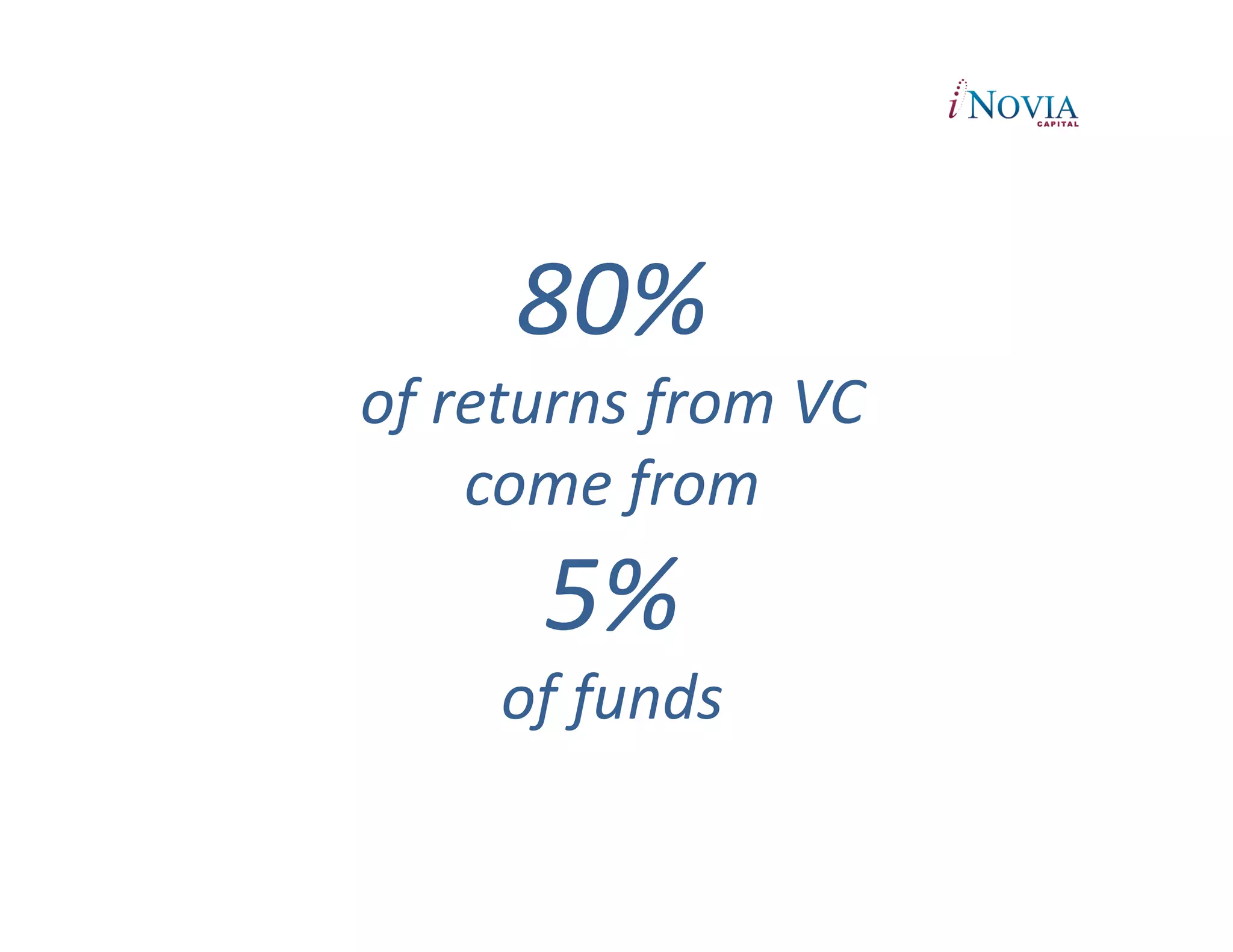

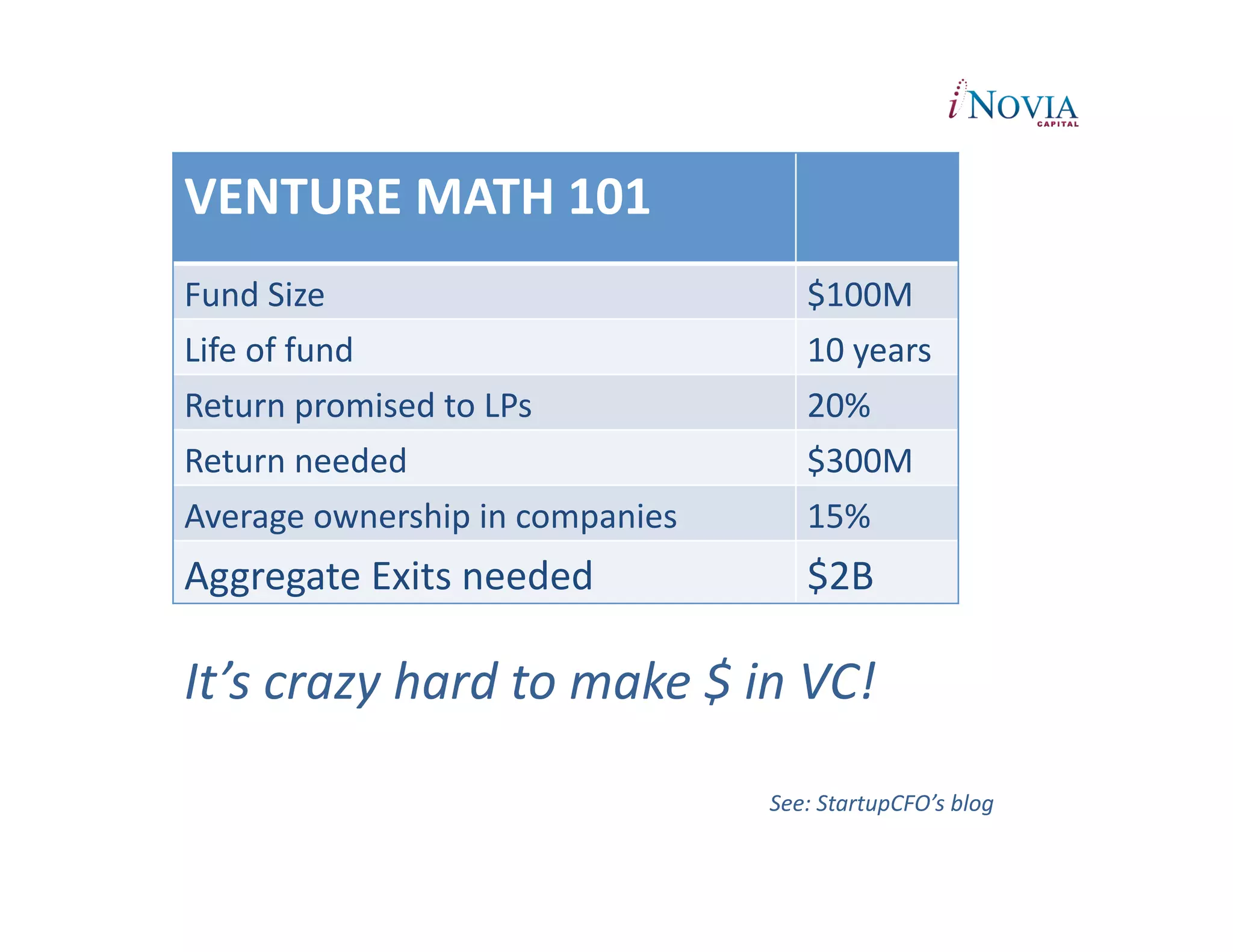

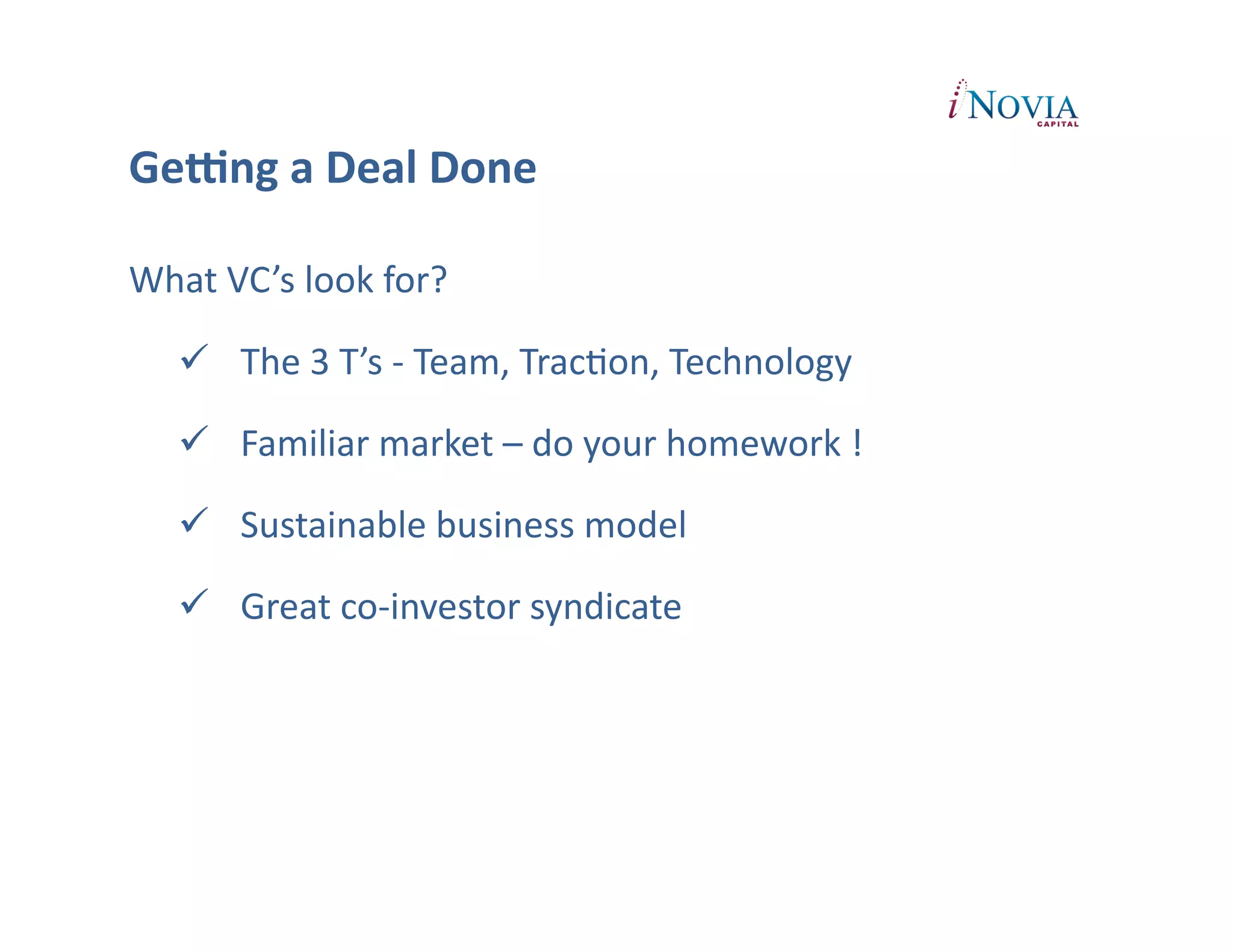

This document discusses the challenges of raising a Series A round of funding. It notes that while seed funding is relatively easy to obtain, Series A funding is much more difficult due to increased competition and higher investor expectations. Investors are looking for strong metrics, validation, team, and large, sustainable businesses. They invest in areas they are familiar with and look for companies demonstrating exponential growth. While raising a Series A is challenging, companies with great execution, traction, and teams that meet new, higher criteria can still obtain funding.