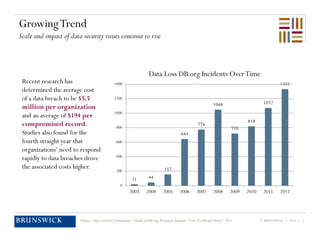

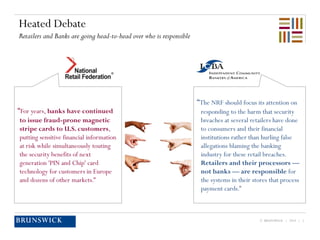

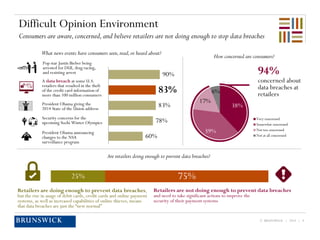

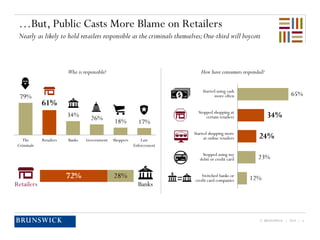

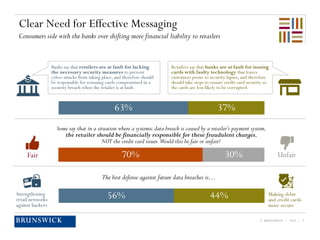

Data breaches are increasingly impactful, with an average cost of $5.5 million per incident, leading to a heated debate between retailers and banks over accountability. Consumers express significant concern about retailers' handling of data security, with a notable portion blaming them alongside criminals. A call for improved security measures has emerged, highlighting the need for effective communication and a shift in financial responsibility towards retailers in cases of breaches.