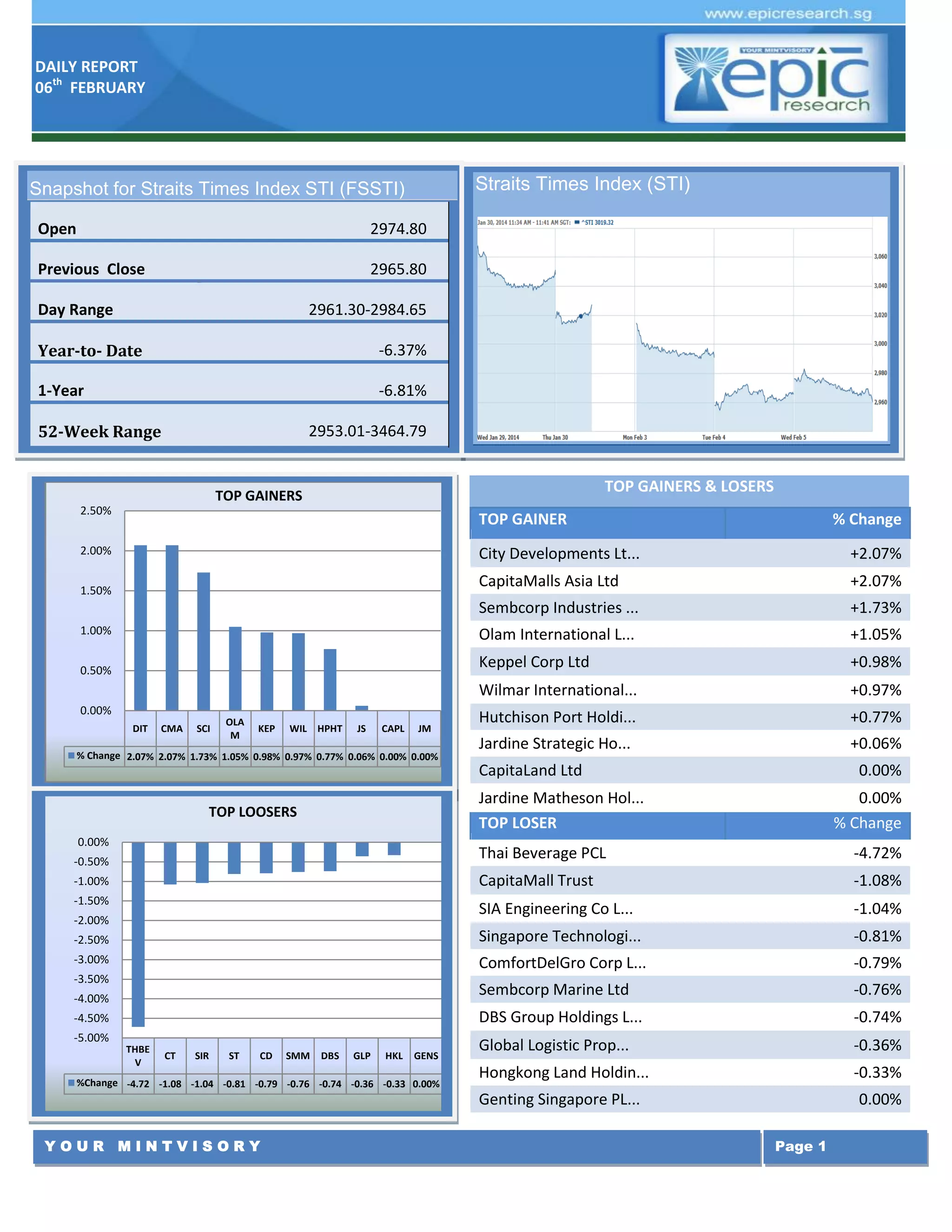

- The Straits Times Index (STI) opened at 2974.80, slightly higher than the previous close of 2965.80. Year-to-date and 1-year returns were negative. City Developments Ltd and CapitaMalls Asia Ltd were the top gainers, rising over 2%. Thai Beverage PCL lost the most, falling 4.72%.

- Singapore executives were pessimistic about the domestic economy. Securities trading volumes on the Singapore Exchange declined 44% in January from the previous year while clearing activities grew.

- A research report from DBS noted that CapitaRetail China Trust saw positive earnings growth despite income loss from MZLY.