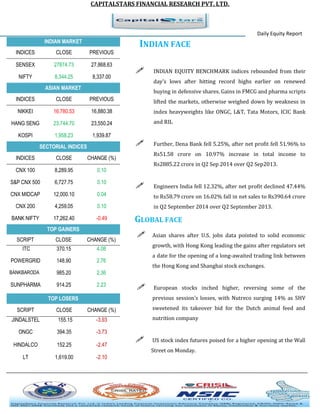

- Indian equity benchmarks rebounded from early losses to end higher, led by gains in FMCG and pharmaceutical stocks. Key indices like the Sensex ended up 0.19% while the Nifty rose 0.11%.

- Asian shares rose after positive US jobs data, while European stocks also edged higher on company deal news. US stock futures pointed to a higher opening on Wall Street.

- Top gainers during the day included ITC and Powergrid, while losers were Jindal Steel and ONGC. FII activity was positive with a net buy of Rs. 8,091 crore versus a net sell of Rs. 2,537 crore by DIIs.

![CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

Daily Equity Report MARKET MOVERS UPSIDE

NIFTY SPOT TREND STRATEGY

BULLISH

BUY ON DIPS PIVOT POINTS

S3

S2

S1

P

R1

R2

R3

8,186

8,265

8,304

8,343

8,383

8,422

8,501 NIFTY SUPPORT RESISTANCE

S1-8290

R1-8350

S2-8260

R2-8430 BANK NIFTY FUTURE TREND STRATEGY

BULLISH

BUY ON DIPS PIVOT POINTS

S3

S2

S1

P

R1

R2

R3

16,954

17,174

17,268

17,394

17,488

17,614

17,834 BANK NIFTY SUPPORT RESISTANCE

S1-17030

R1-17280

S2-16900

R2-17350

SCRIPT

CLOSE

CHANGE (%)

ITC

371.70

4.51

COAL INDIA

349.10

1.32

HDFC BANK

904.65

0.58

SUNPHARMA

911.25

1.9 MARKET MOVERS DOWNSIDE

SCRIPT

CLOSE

CHANGE (%)

TCS

2569.65

[0.12]

ONGC

394.20

[3.77]

RELIANCE

355.65

[1.14]

INFOSYS

899.45

[0.03] FII & DII ACTIVITY

INSTITUTION

NET BUY (CR.)

NET SELL (CR)

FII

8091.15

2537.13

DII

1818.33

-192.2 NSE TOTALS

INDICES

ADVANCES

DECLINES

NIFTY

25

25

BANK NIFTY

3

8](https://image.slidesharecdn.com/dailyequityreport-141111013943-conversion-gate01/85/Daily-equity-report-3-320.jpg)