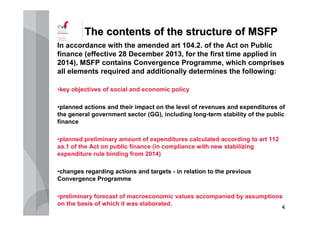

The document outlines Poland's Multiannual State Financial Plan (MSFP), which is a key component of the public finance reform initiated in 2008. The MSFP provides a framework for effective fiscal management and long-term economic planning, requiring annual adoption and linking budget allocations to social and economic priorities. Reports on the implementation of the MSFP are mandated, fostering transparency and accountability in public finance.