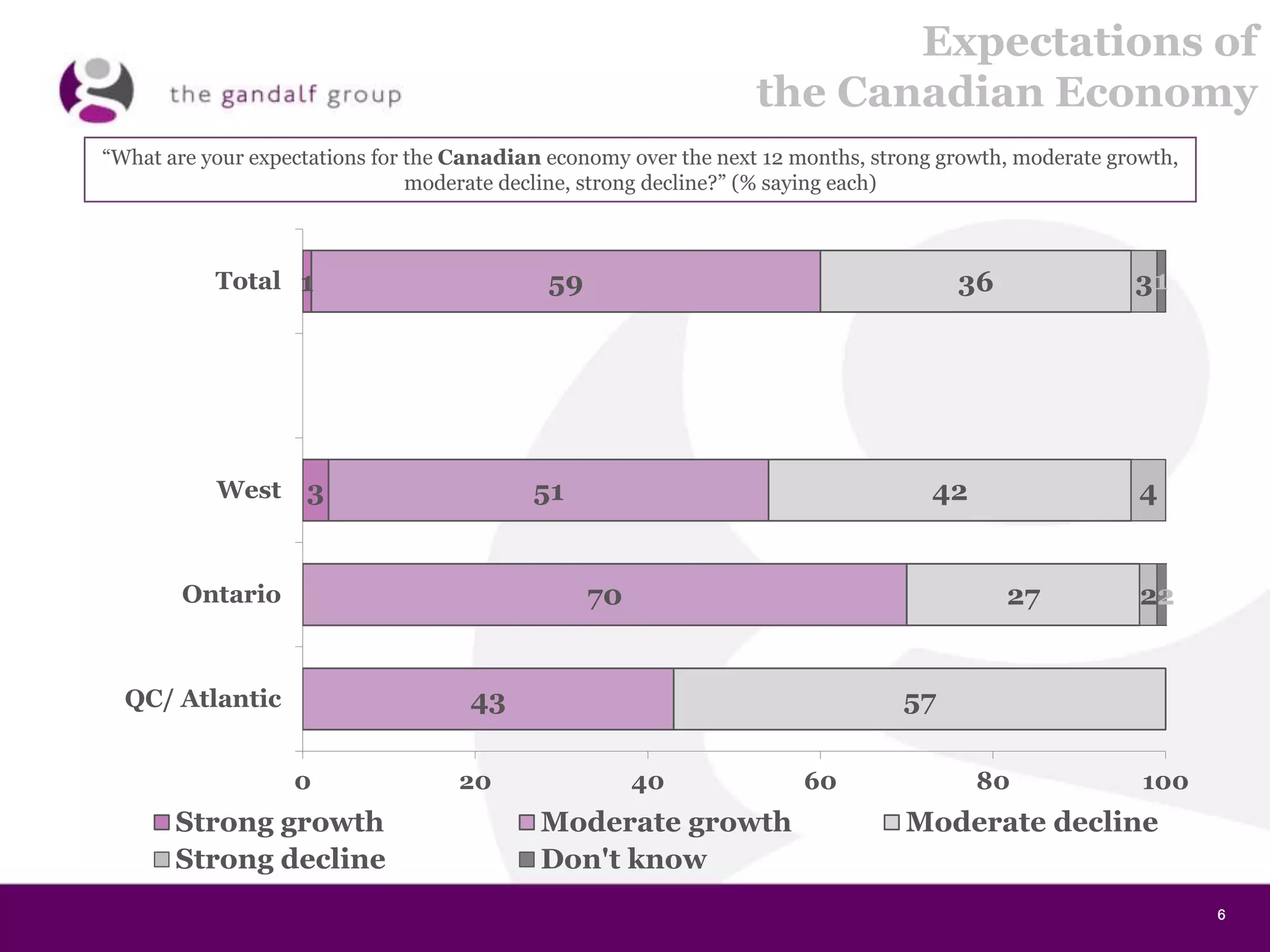

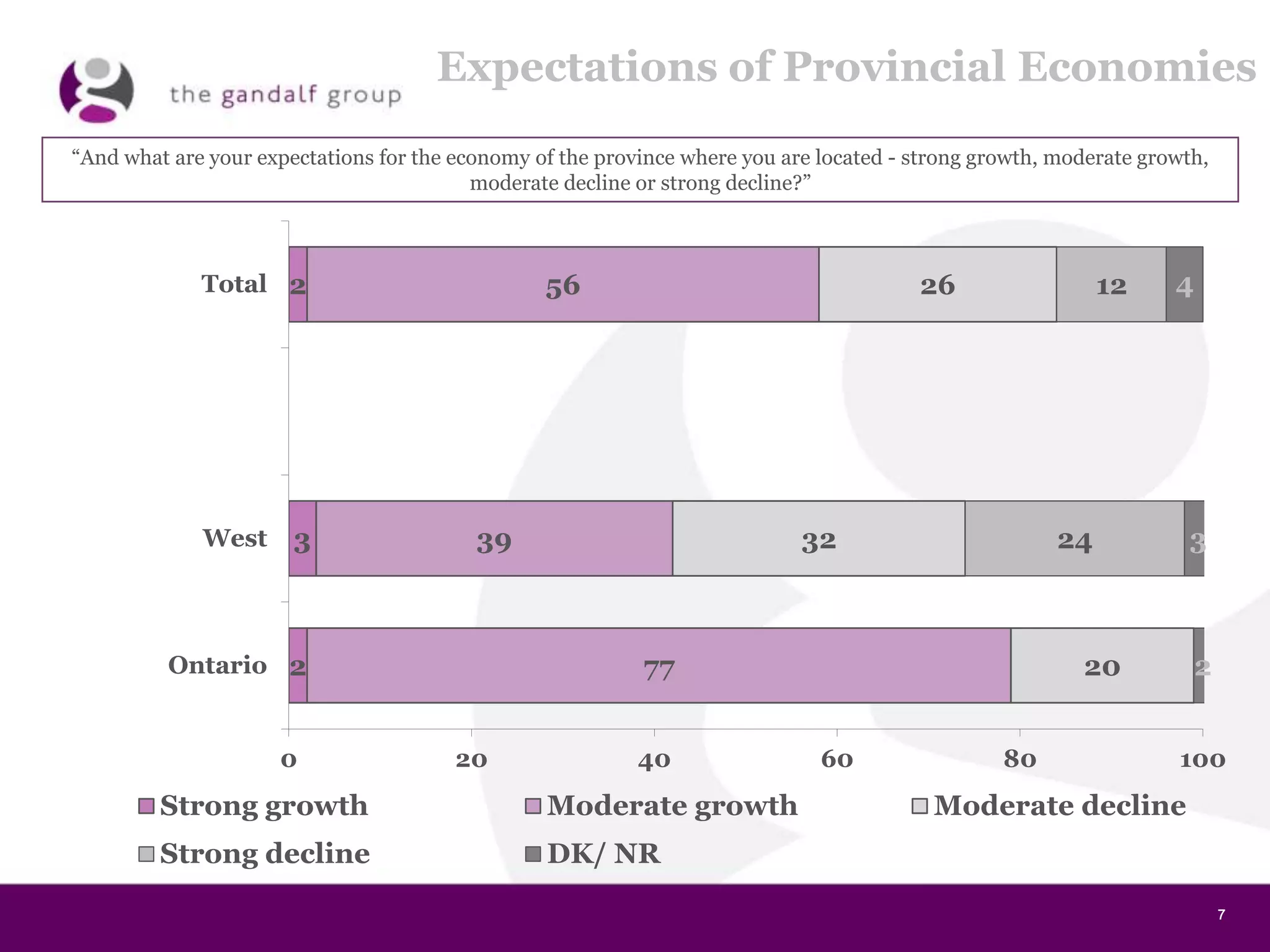

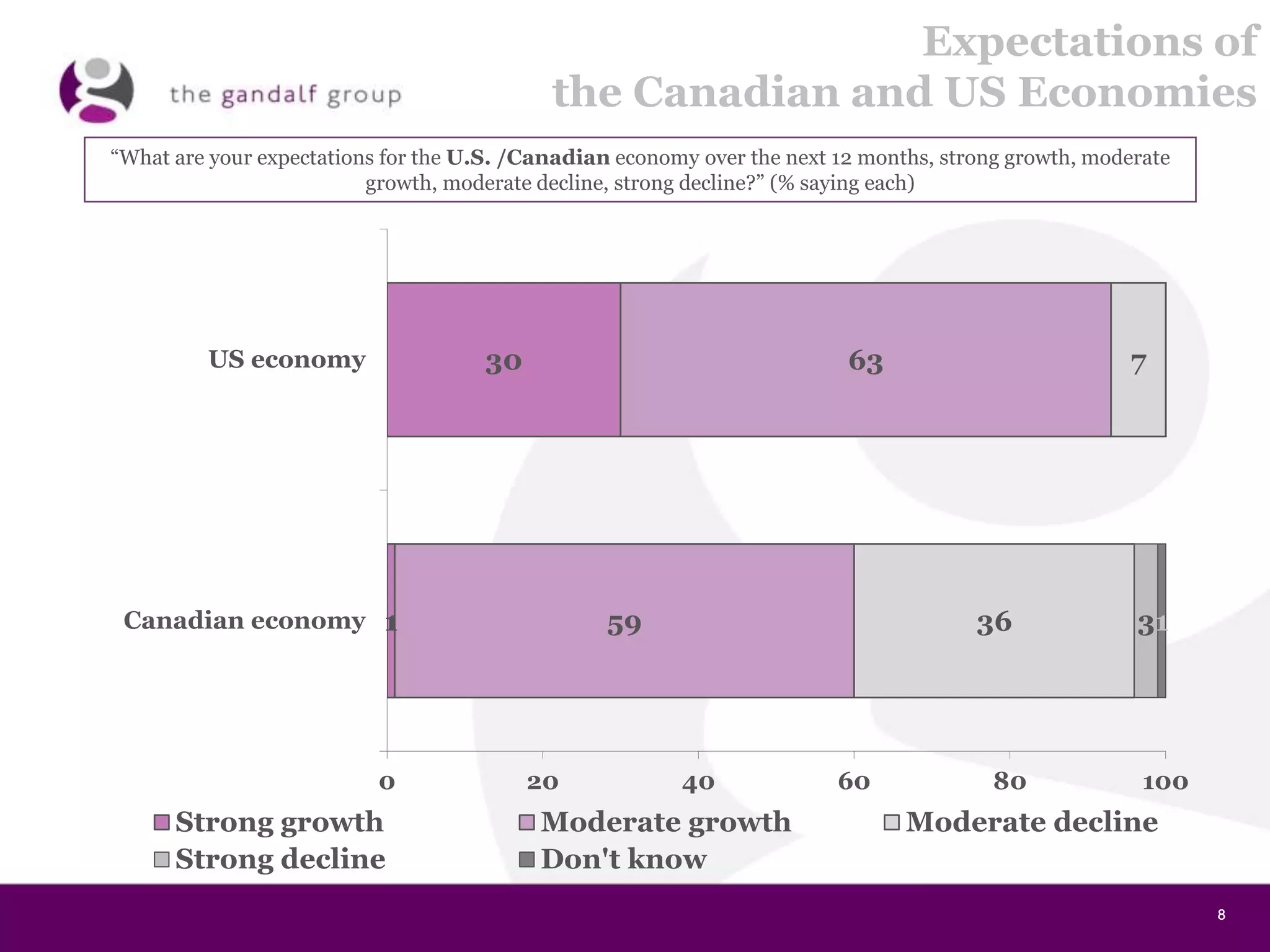

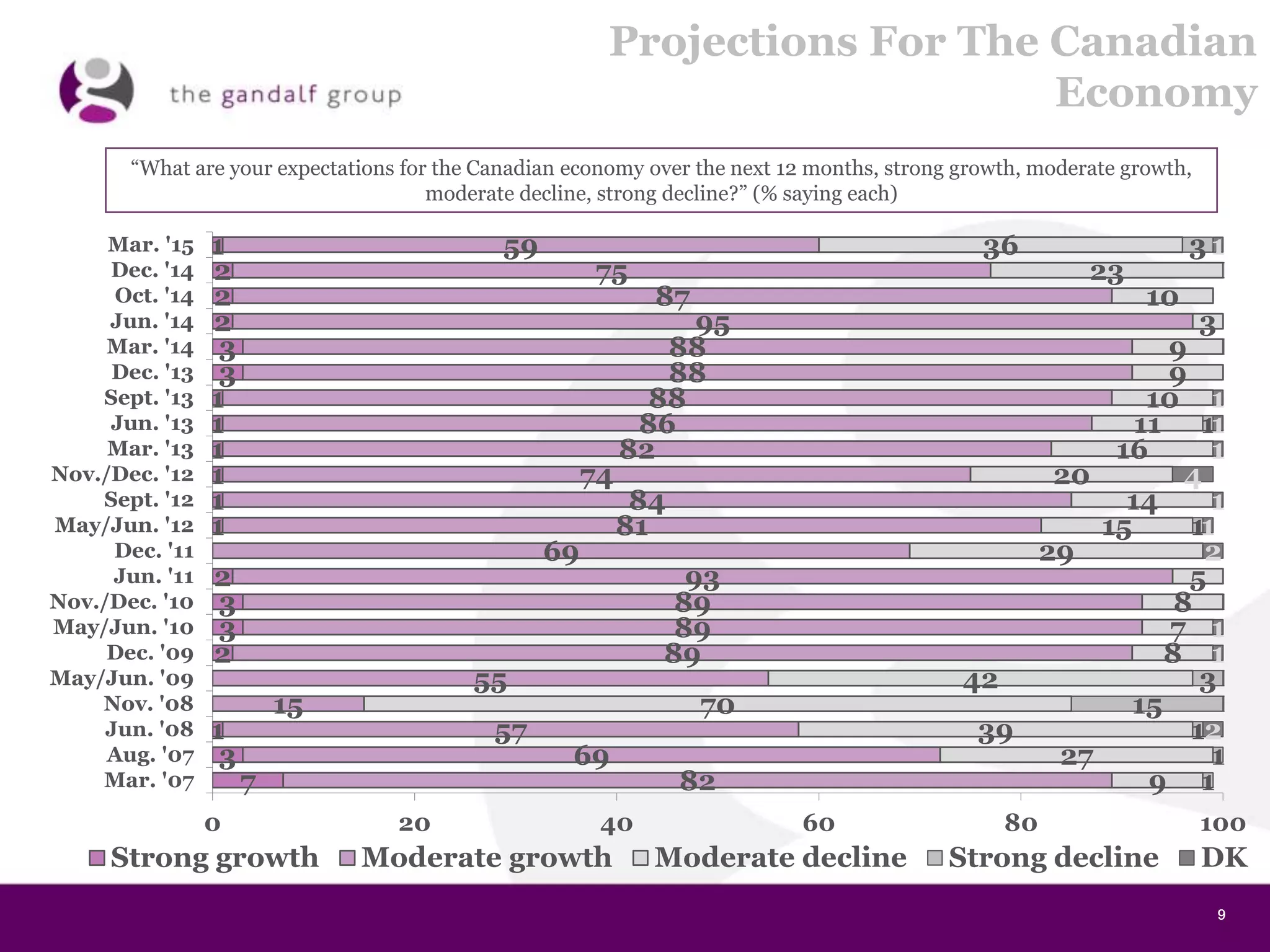

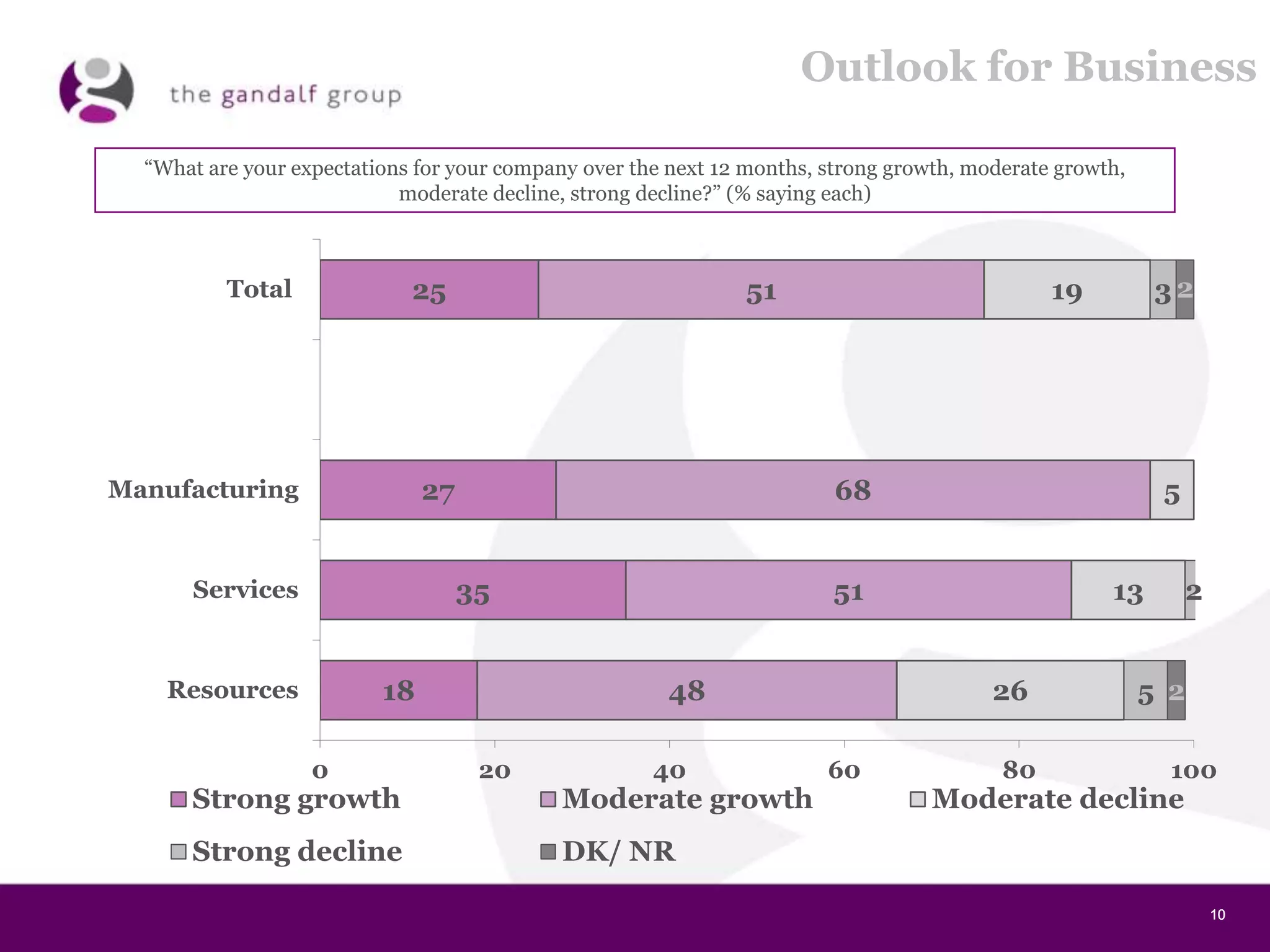

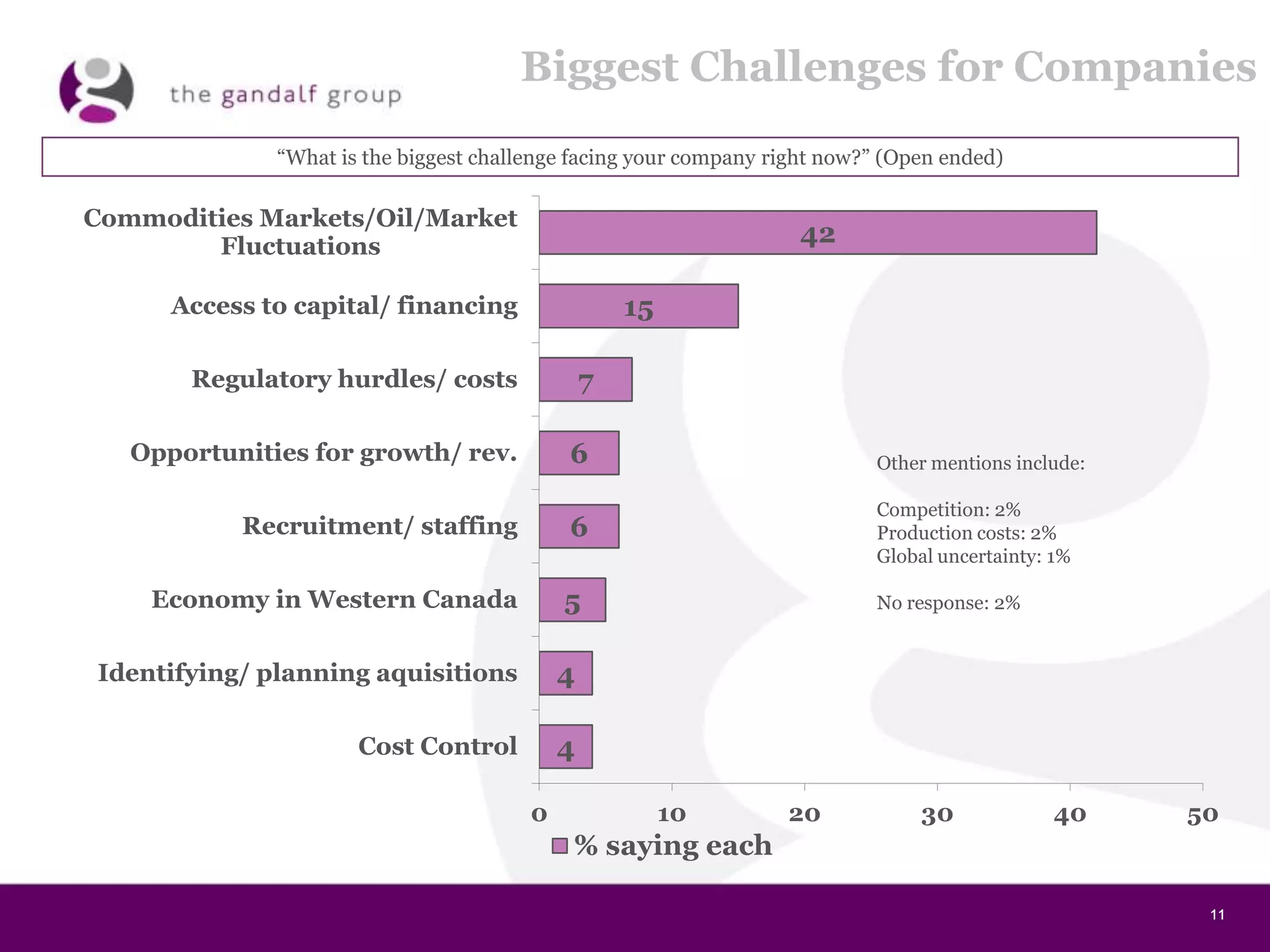

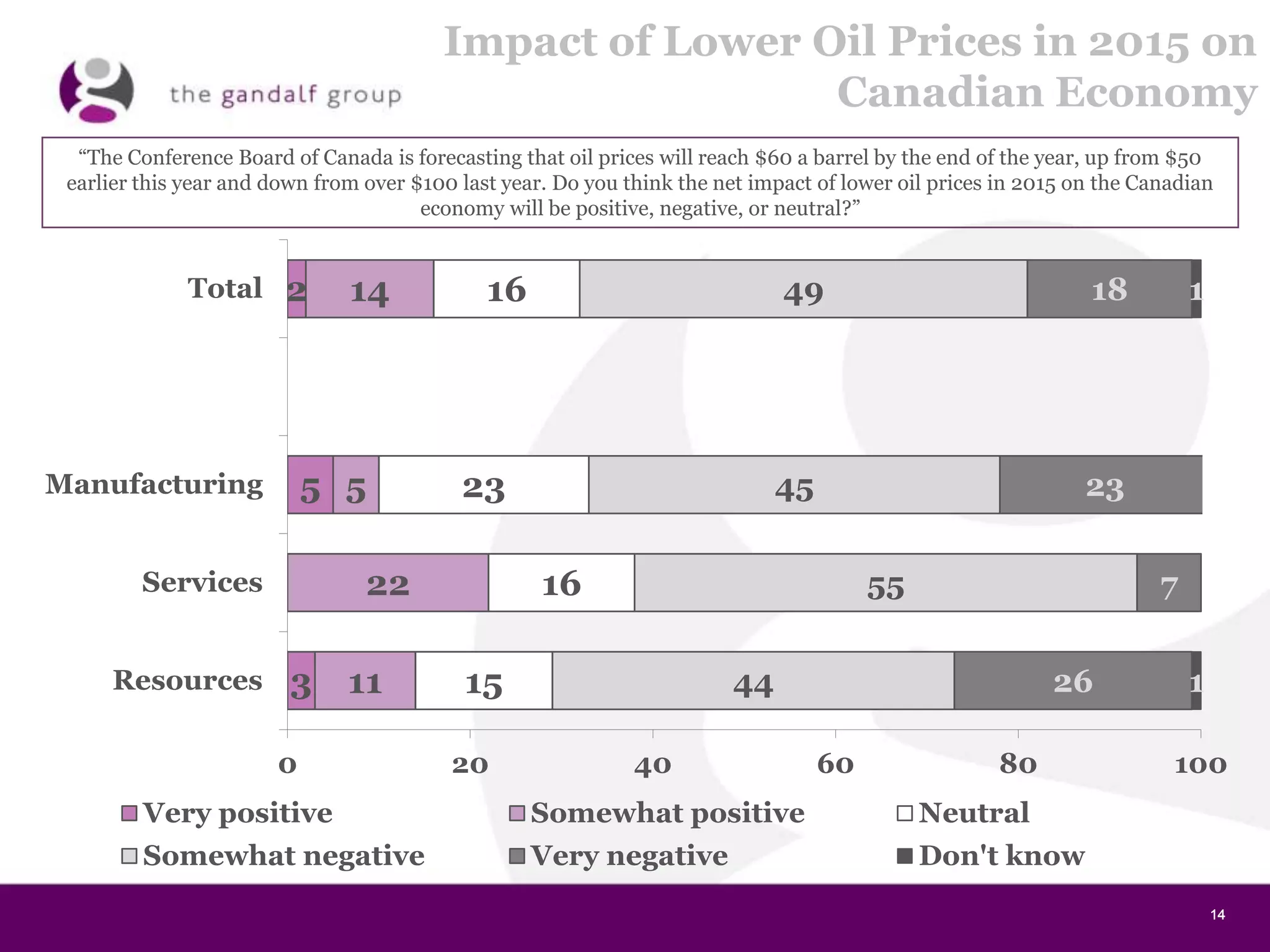

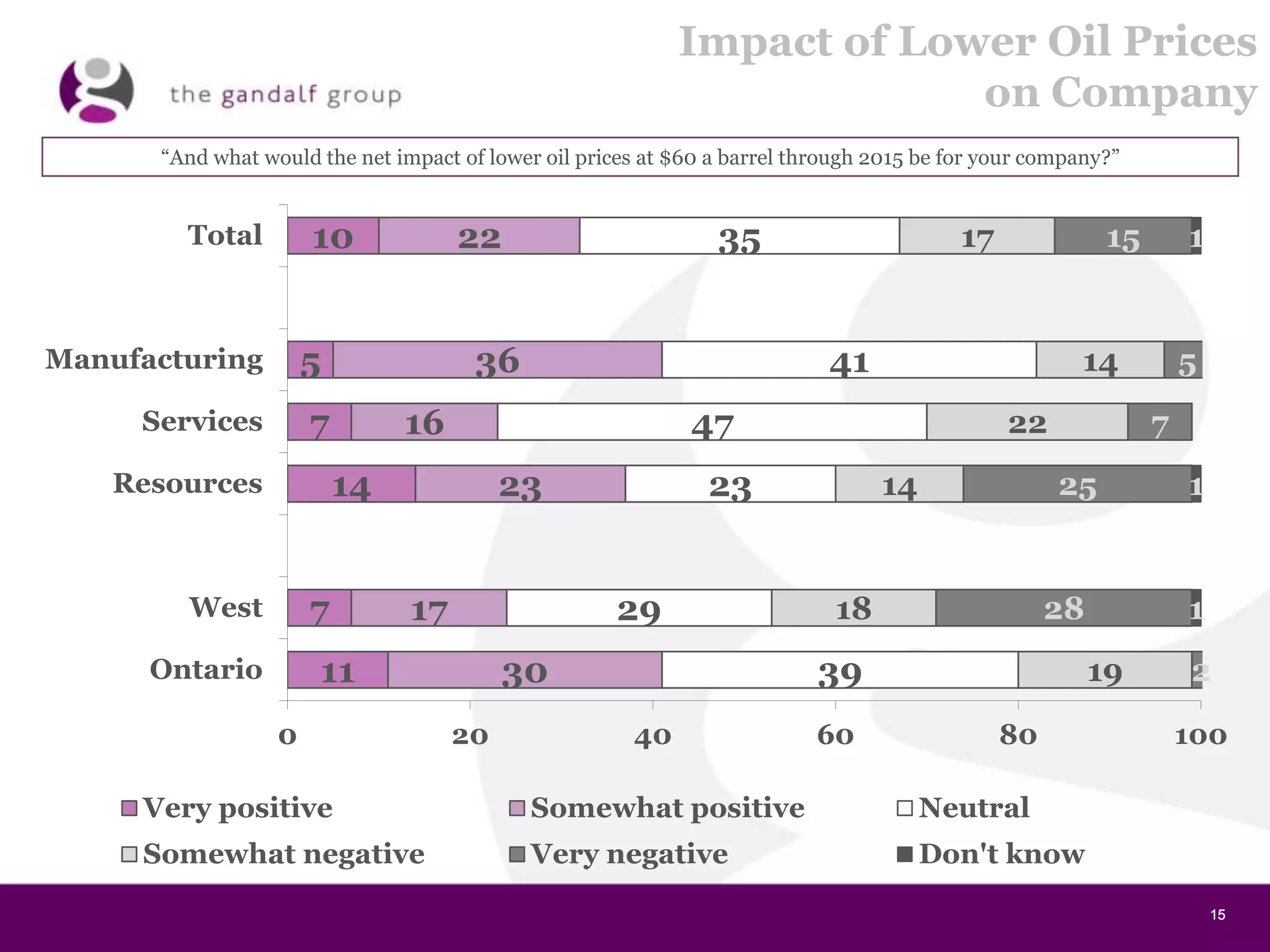

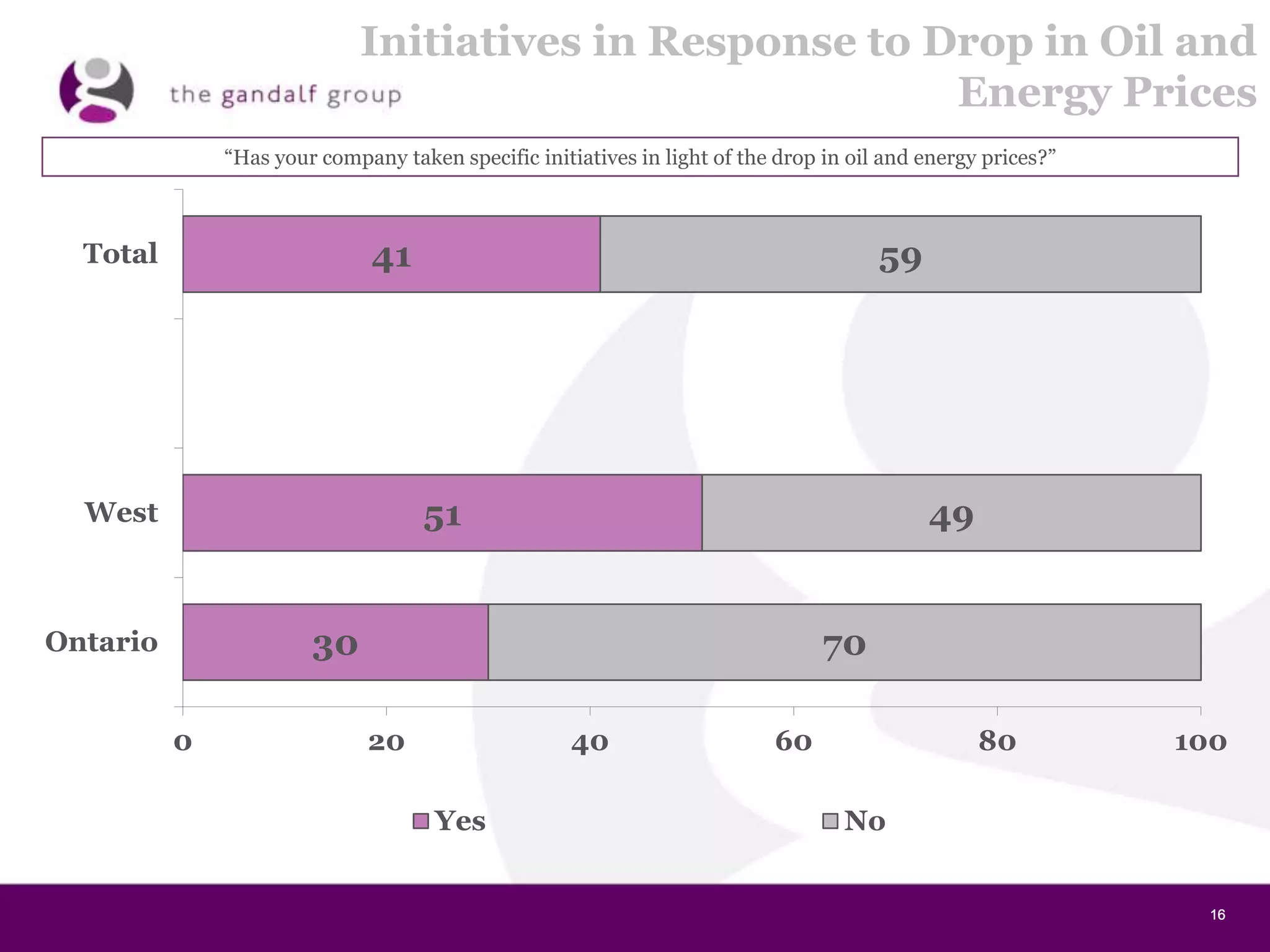

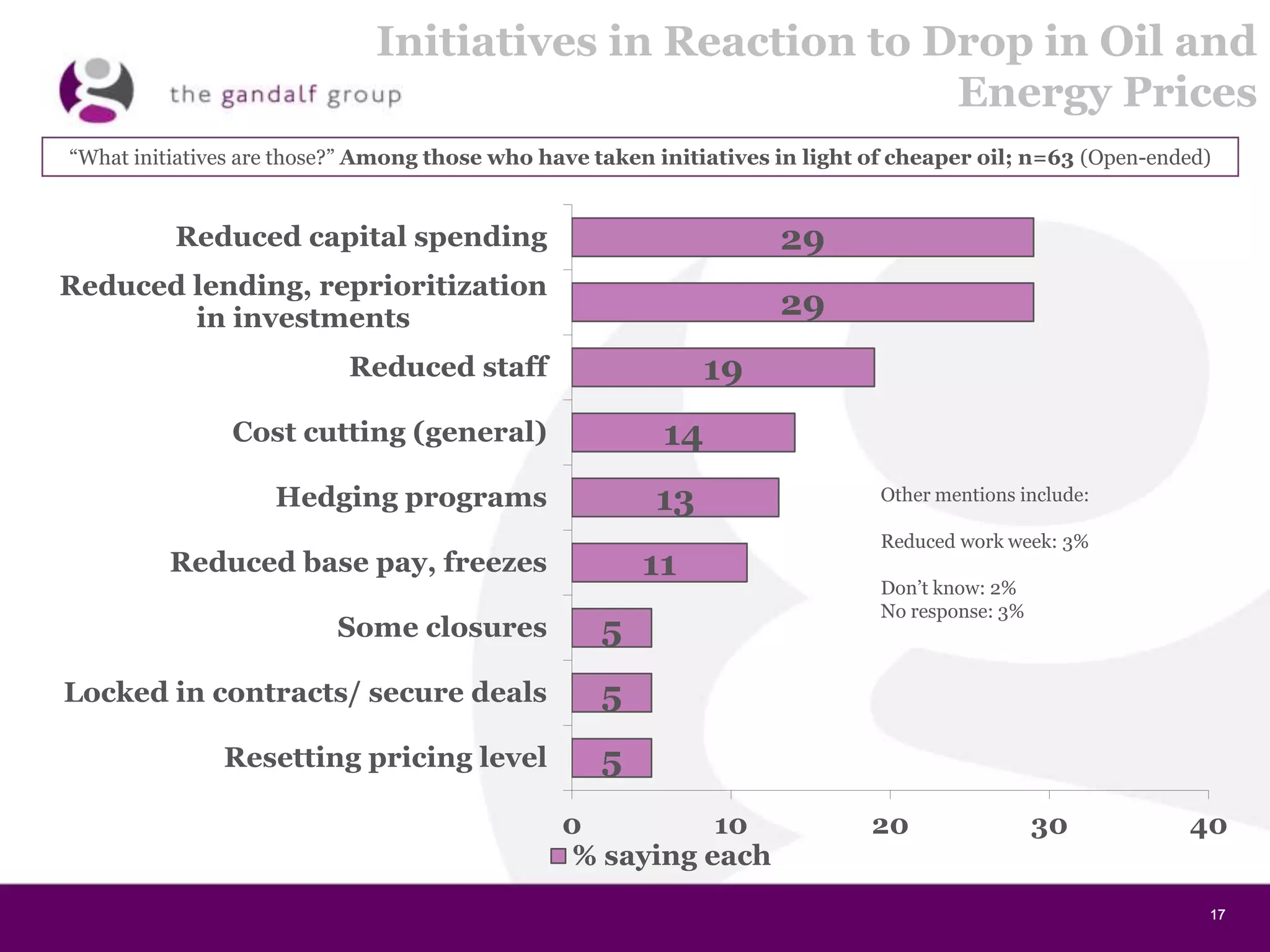

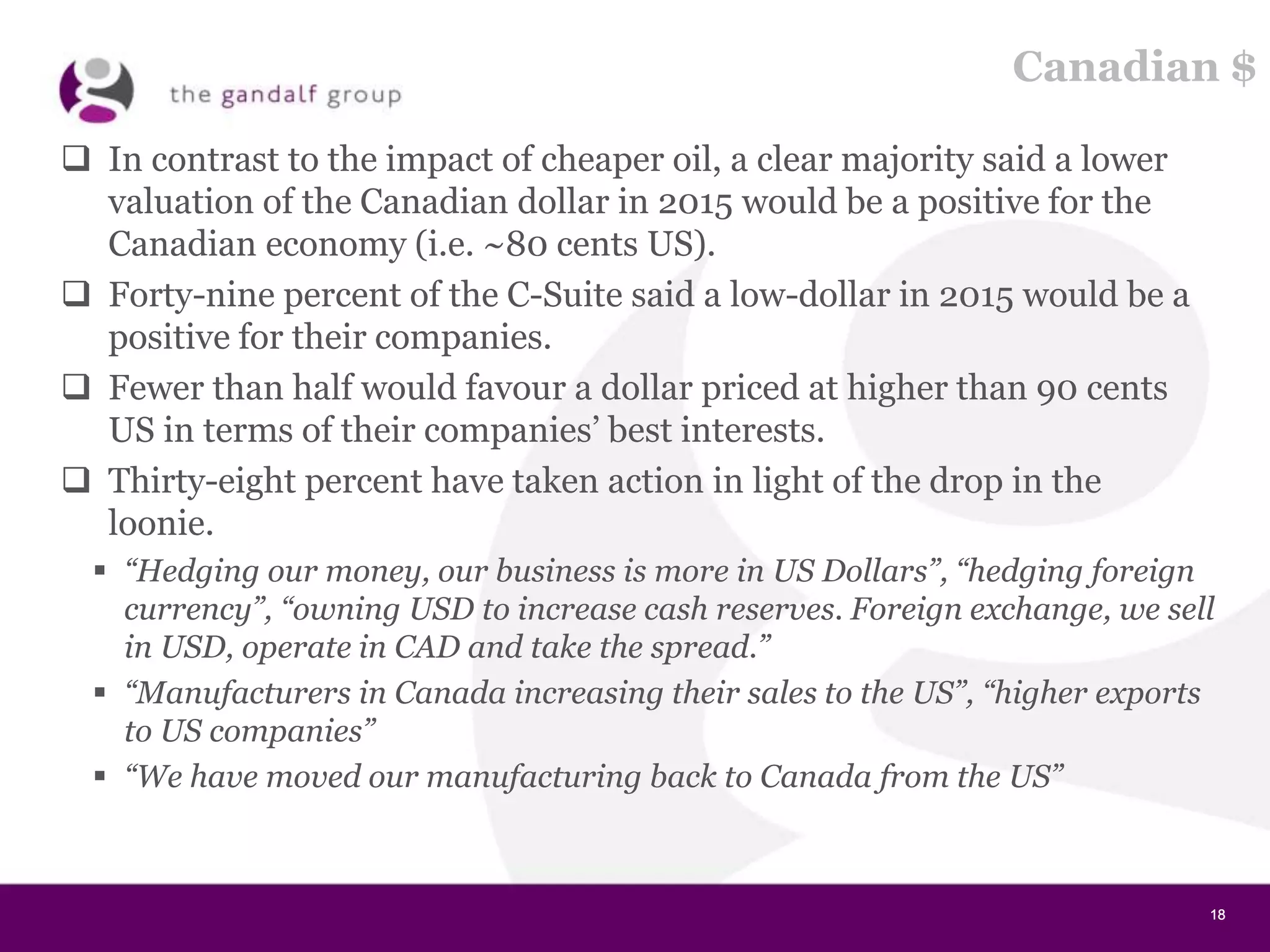

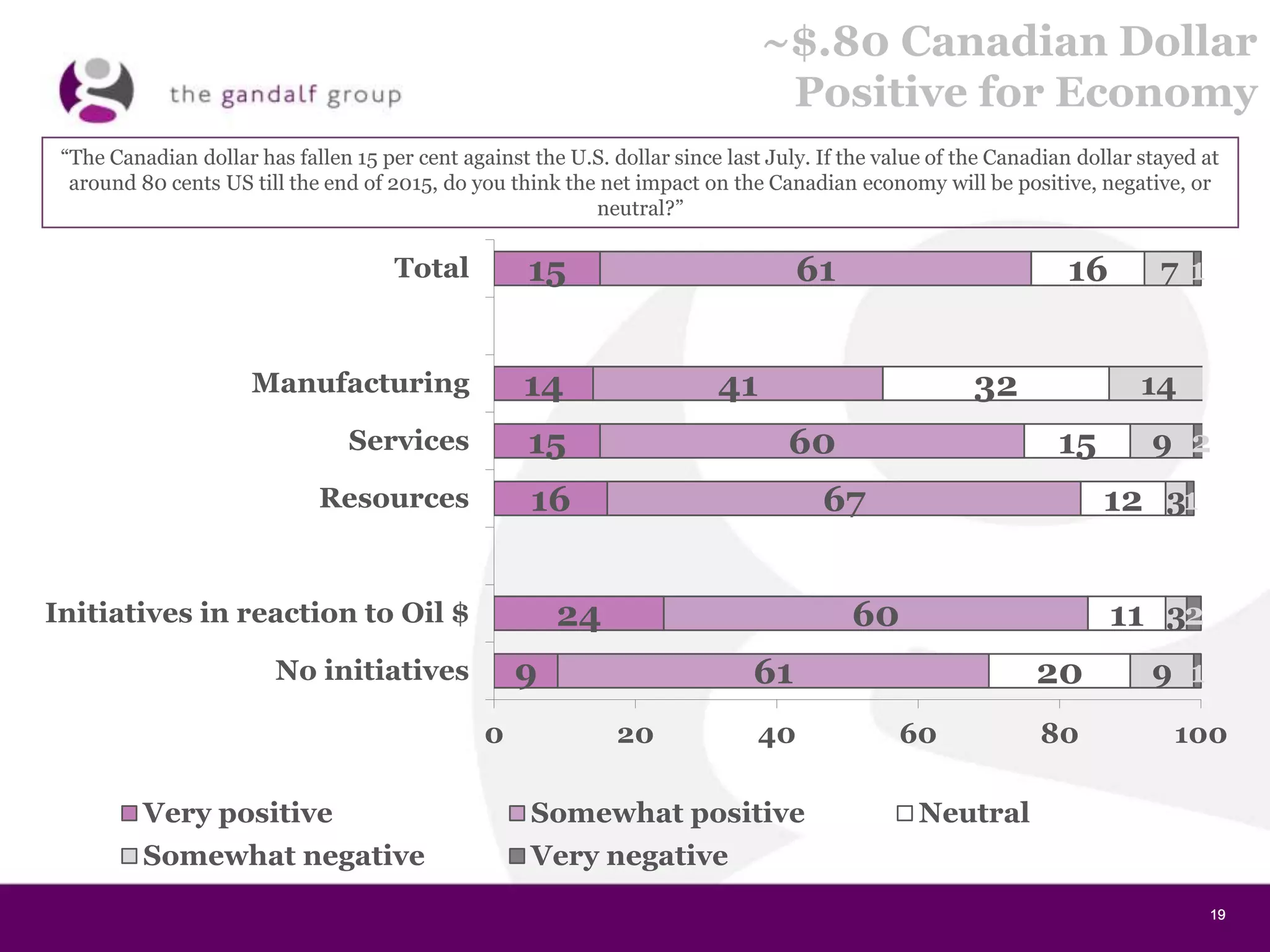

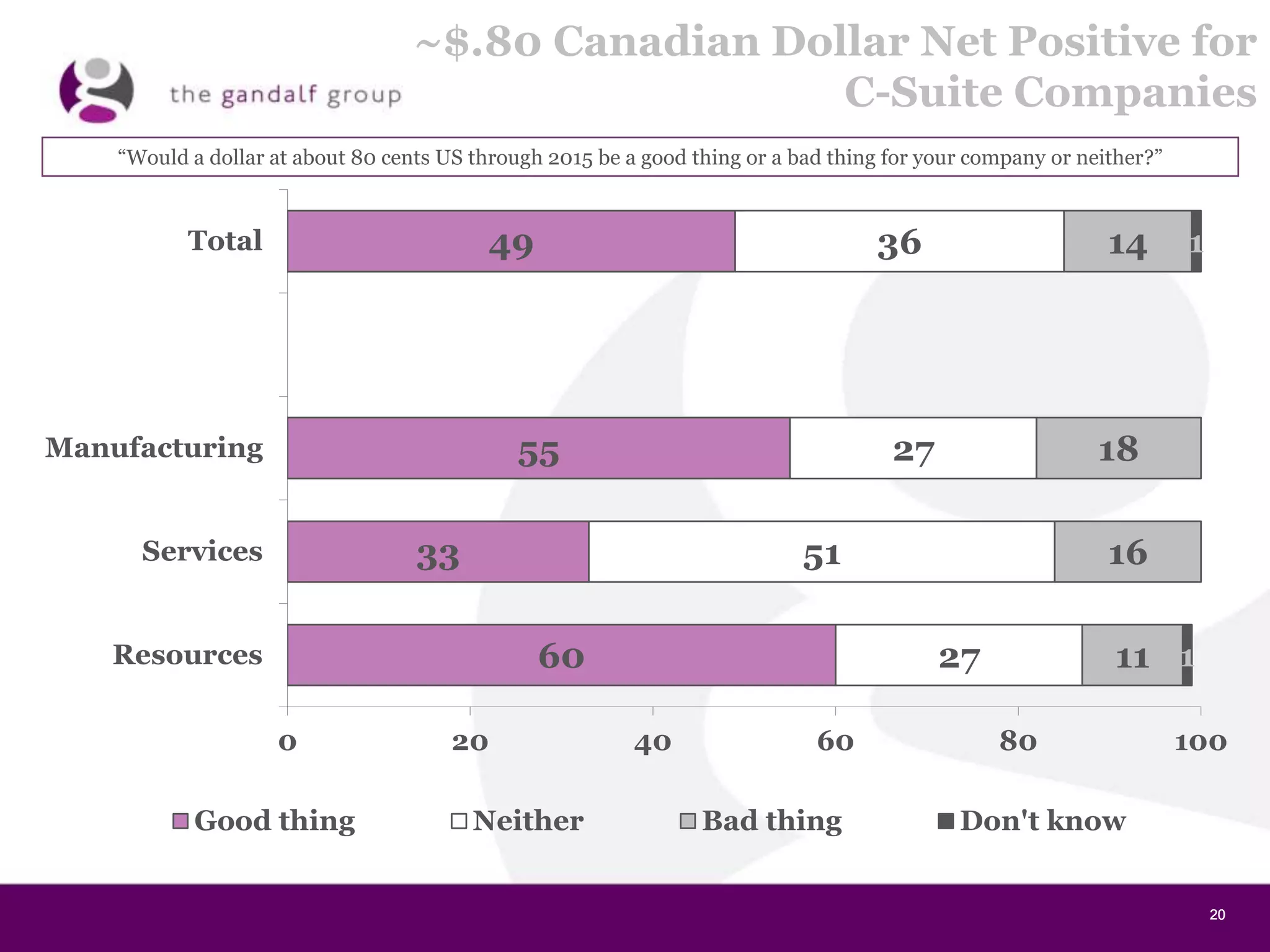

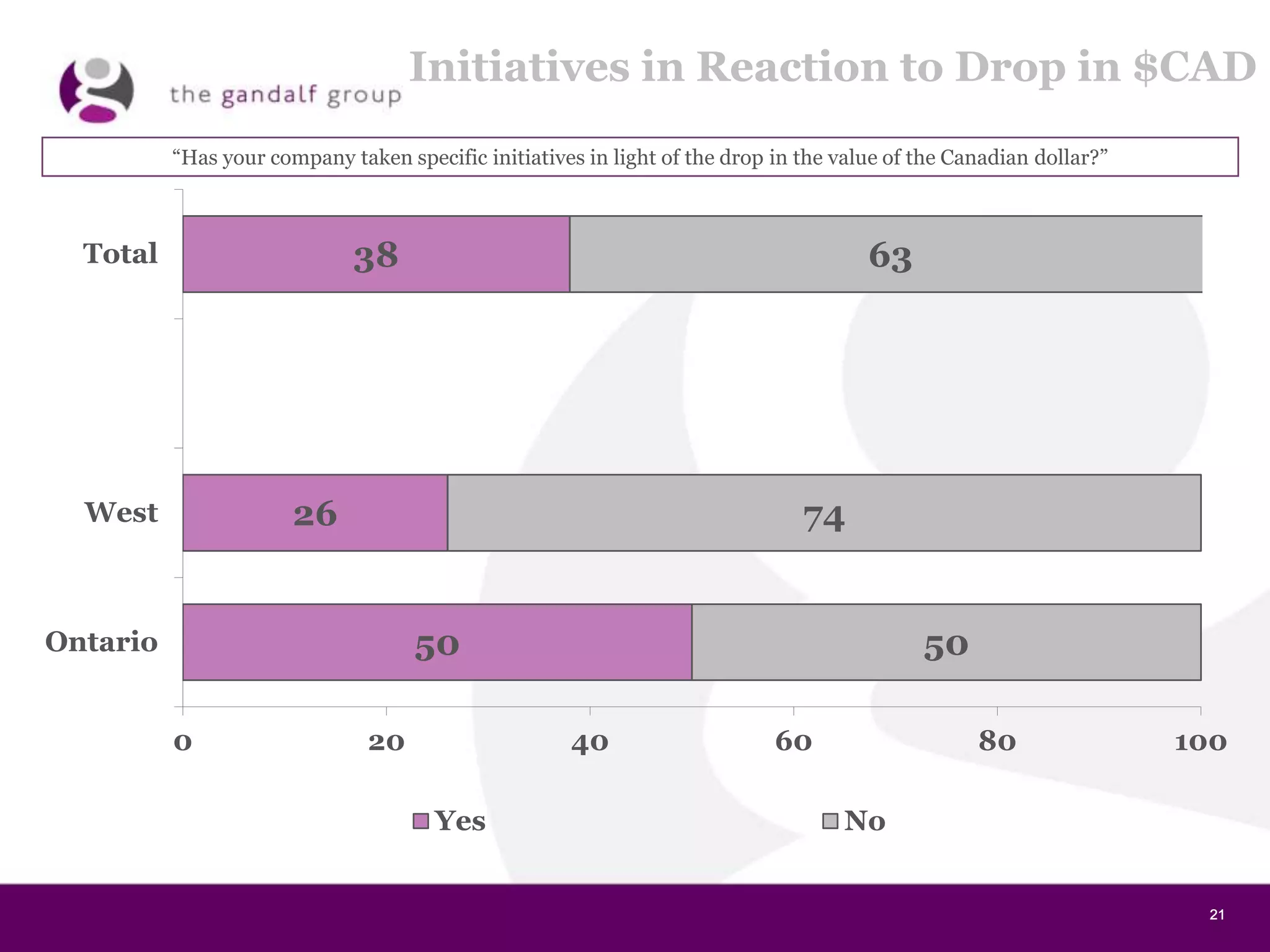

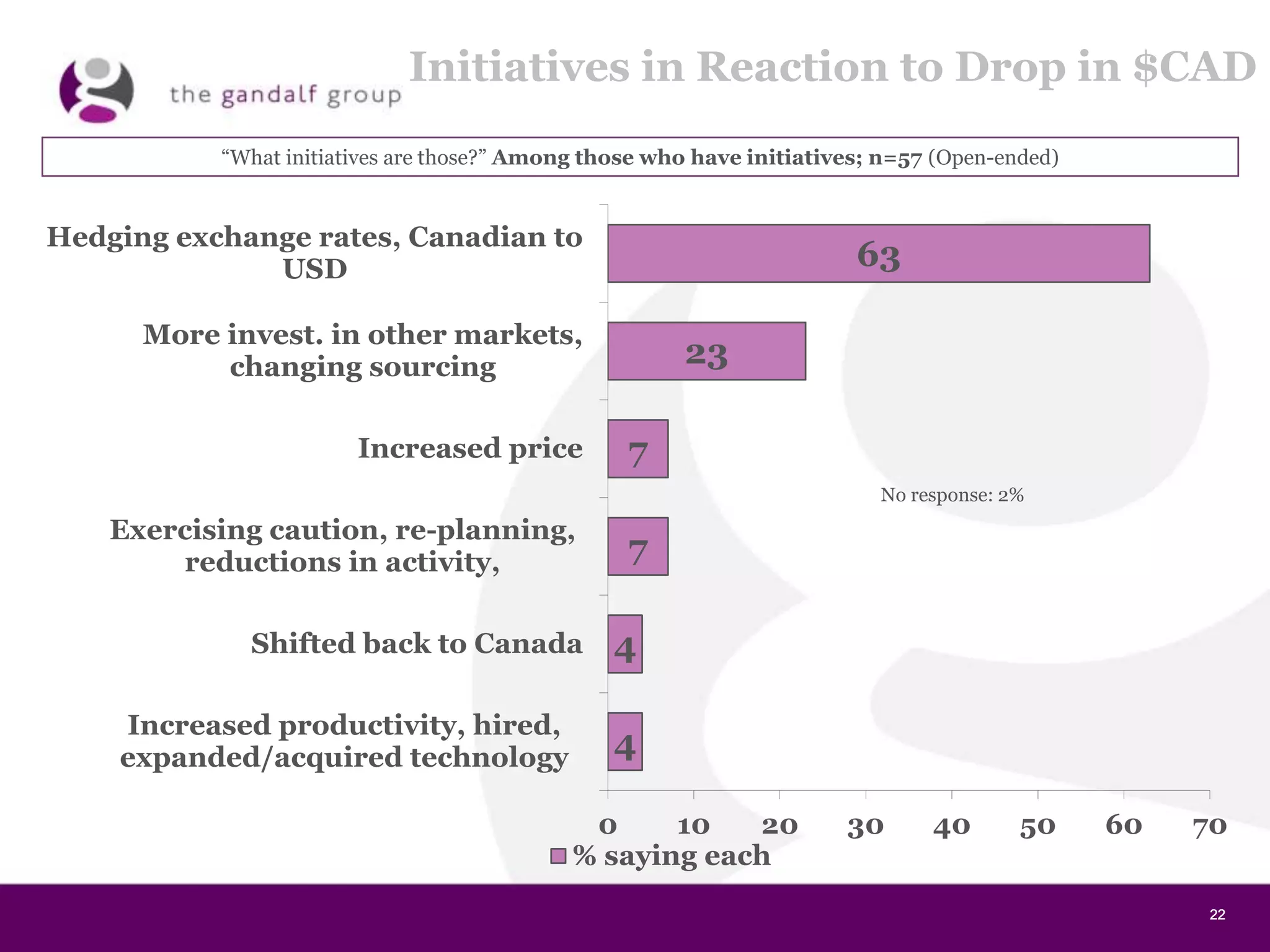

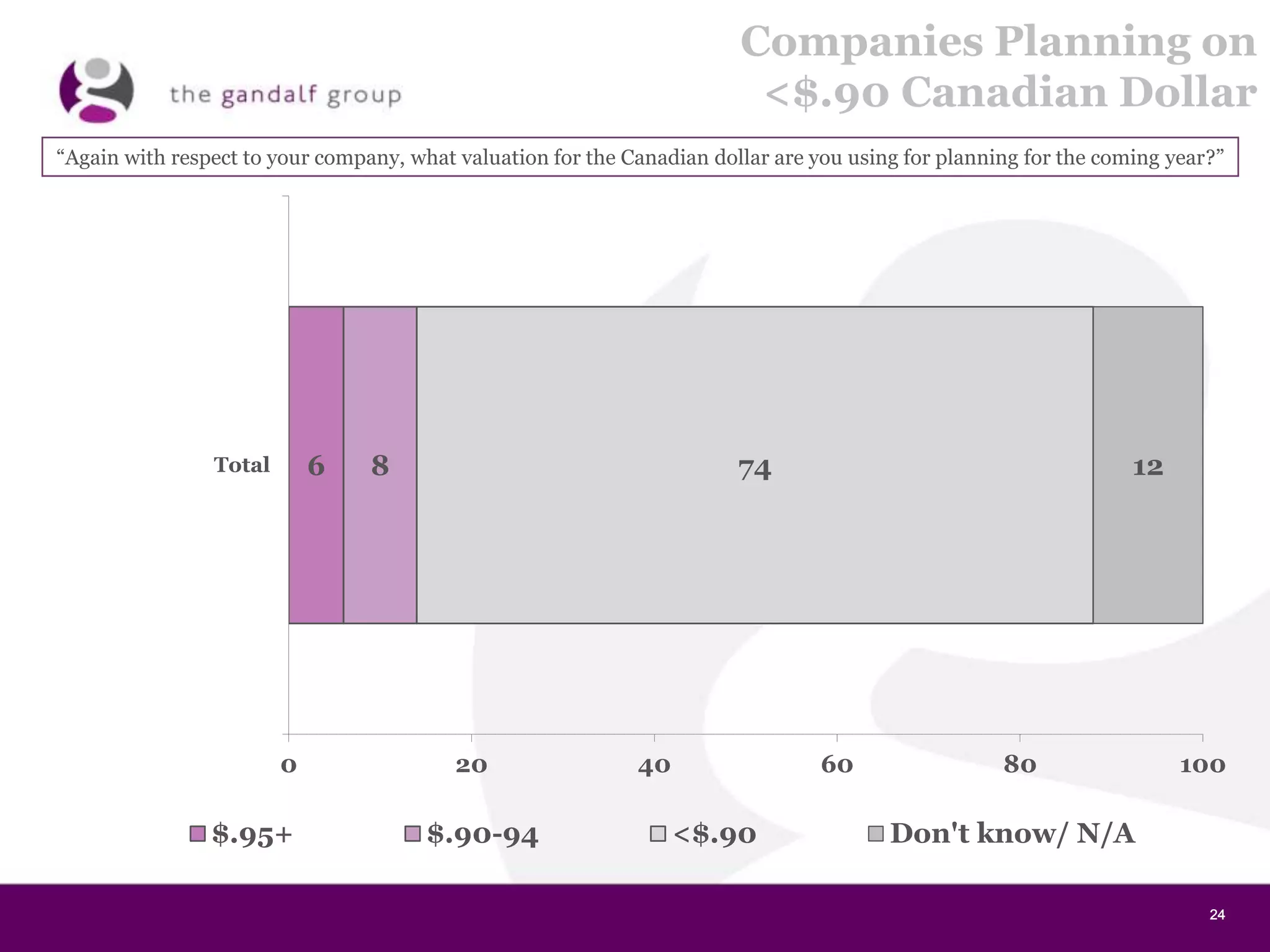

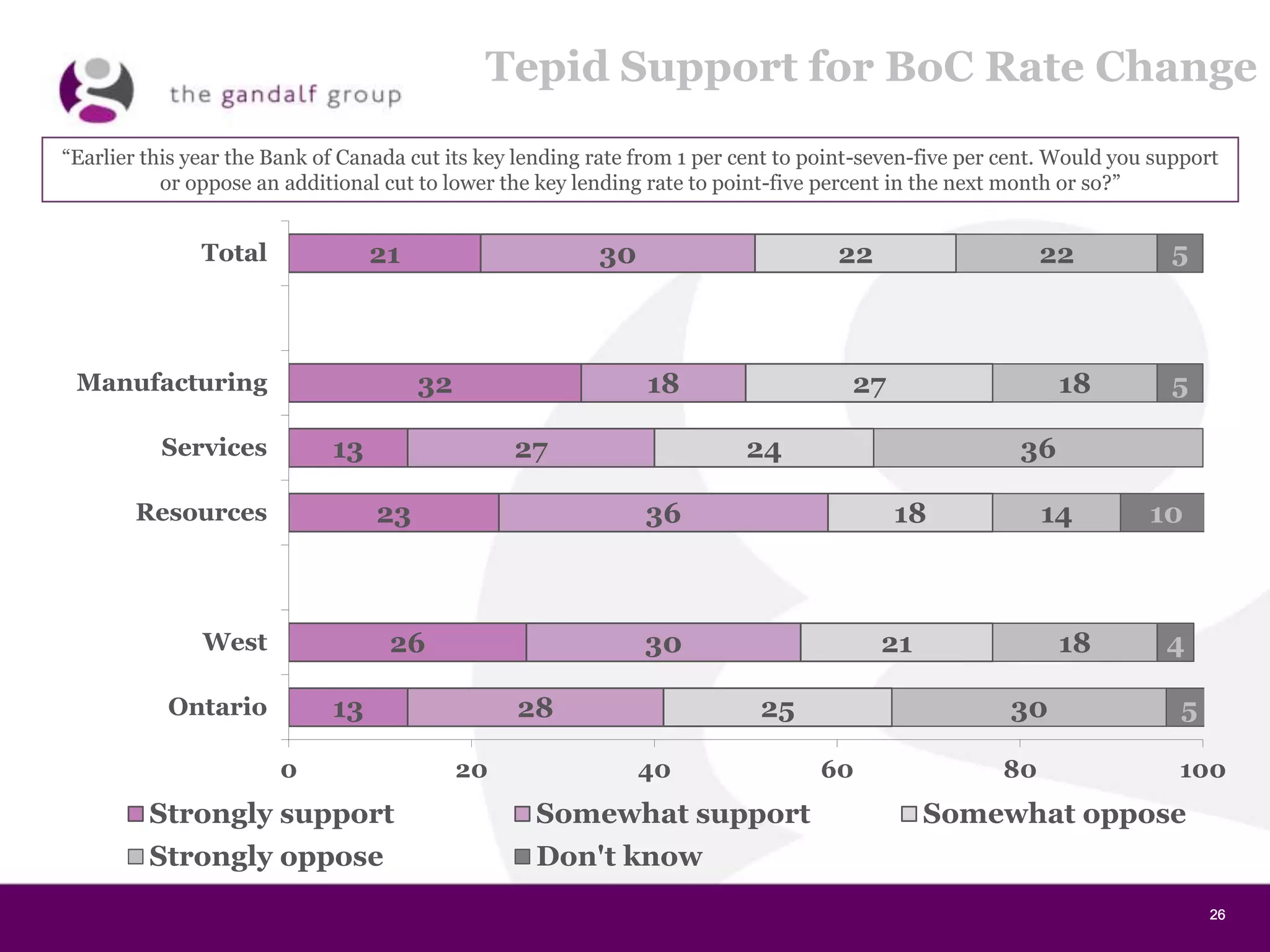

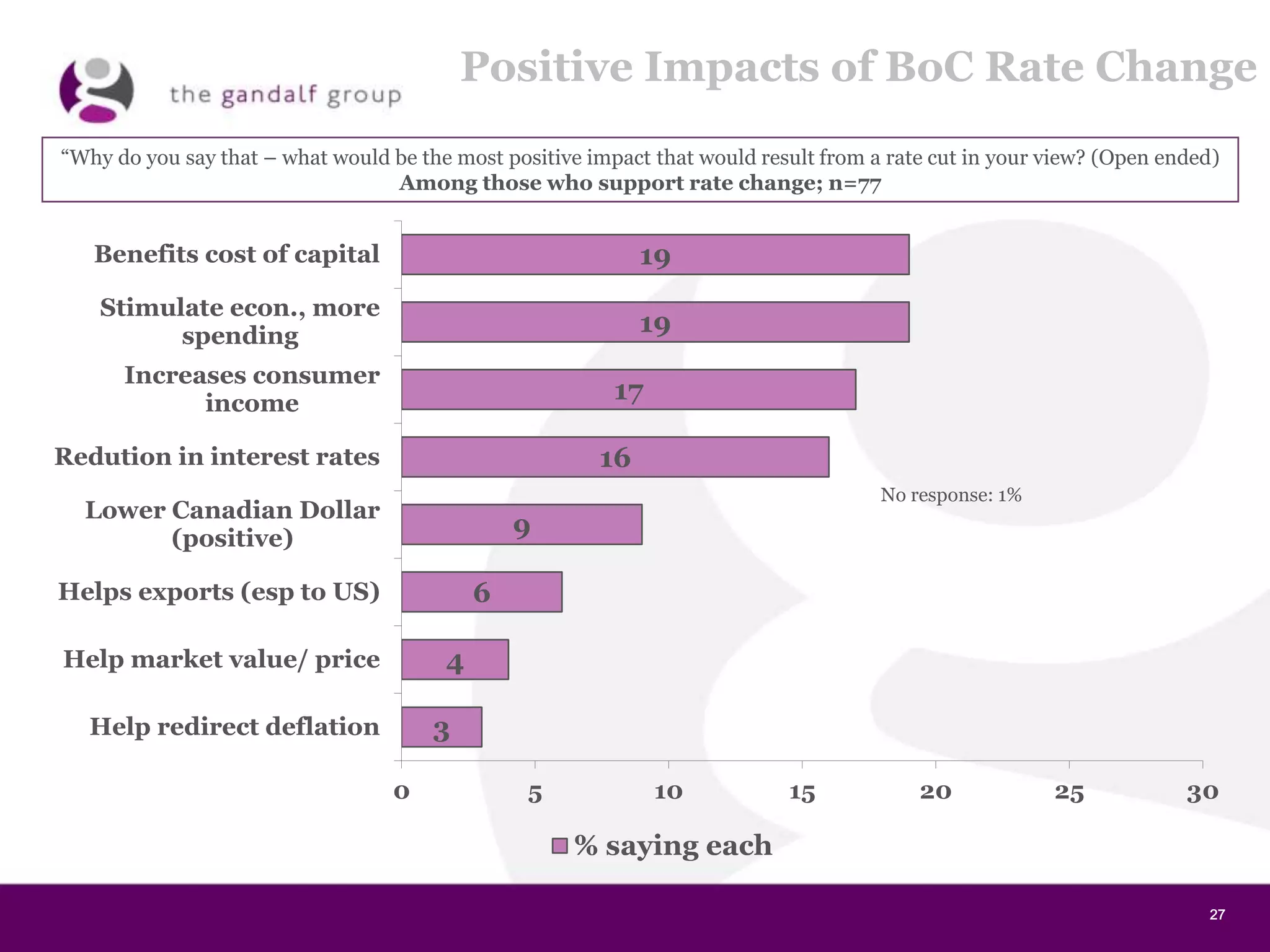

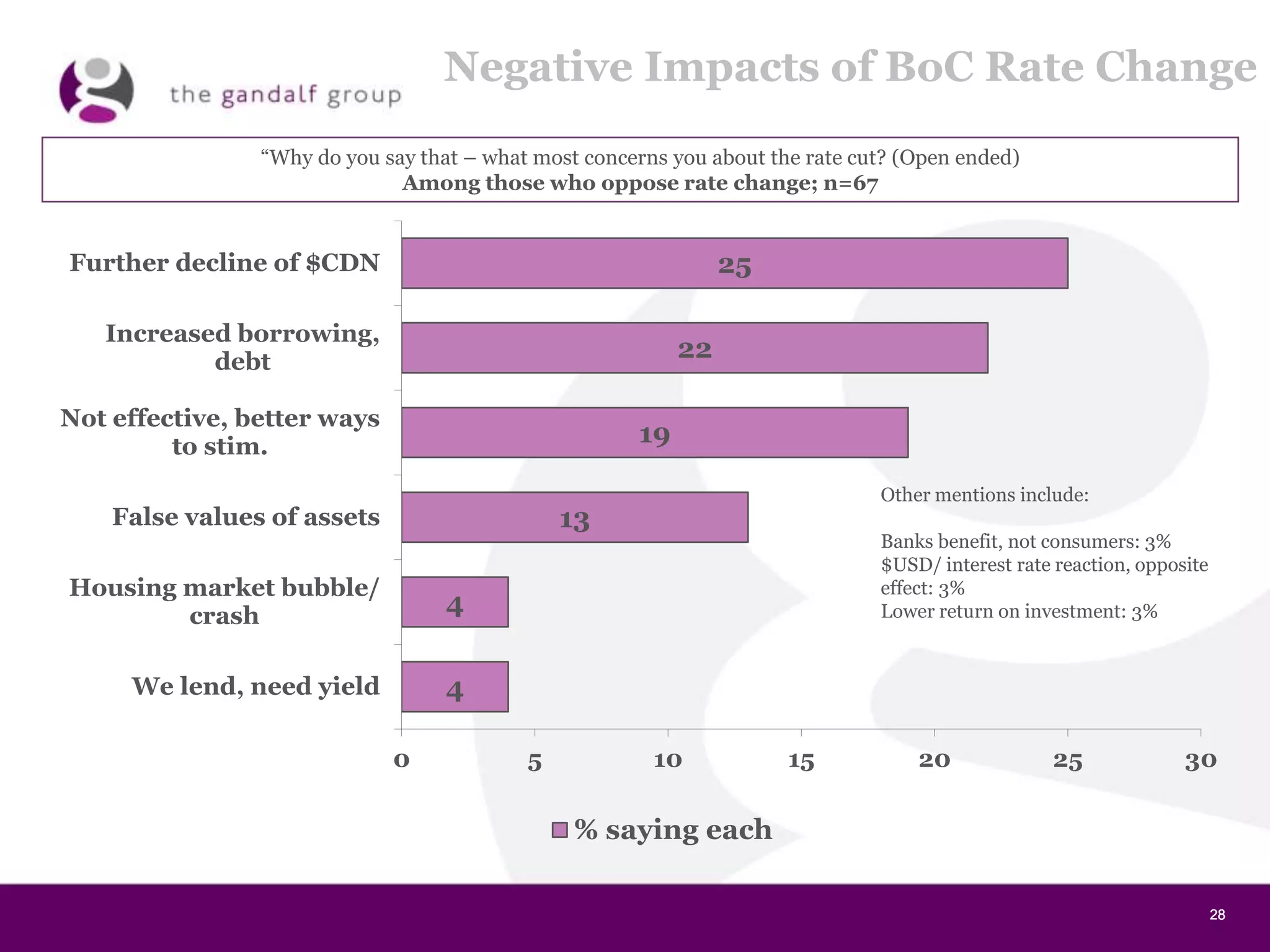

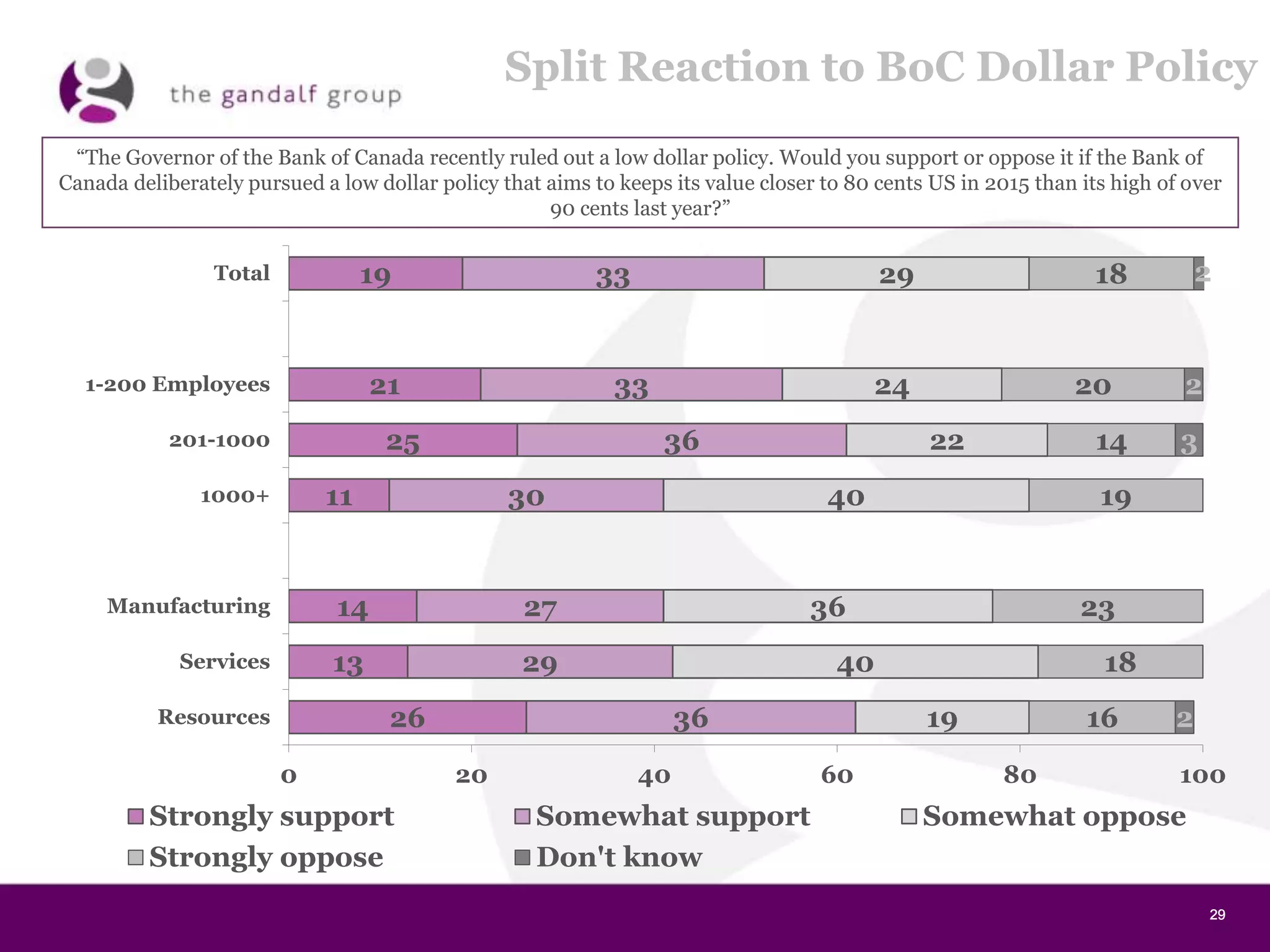

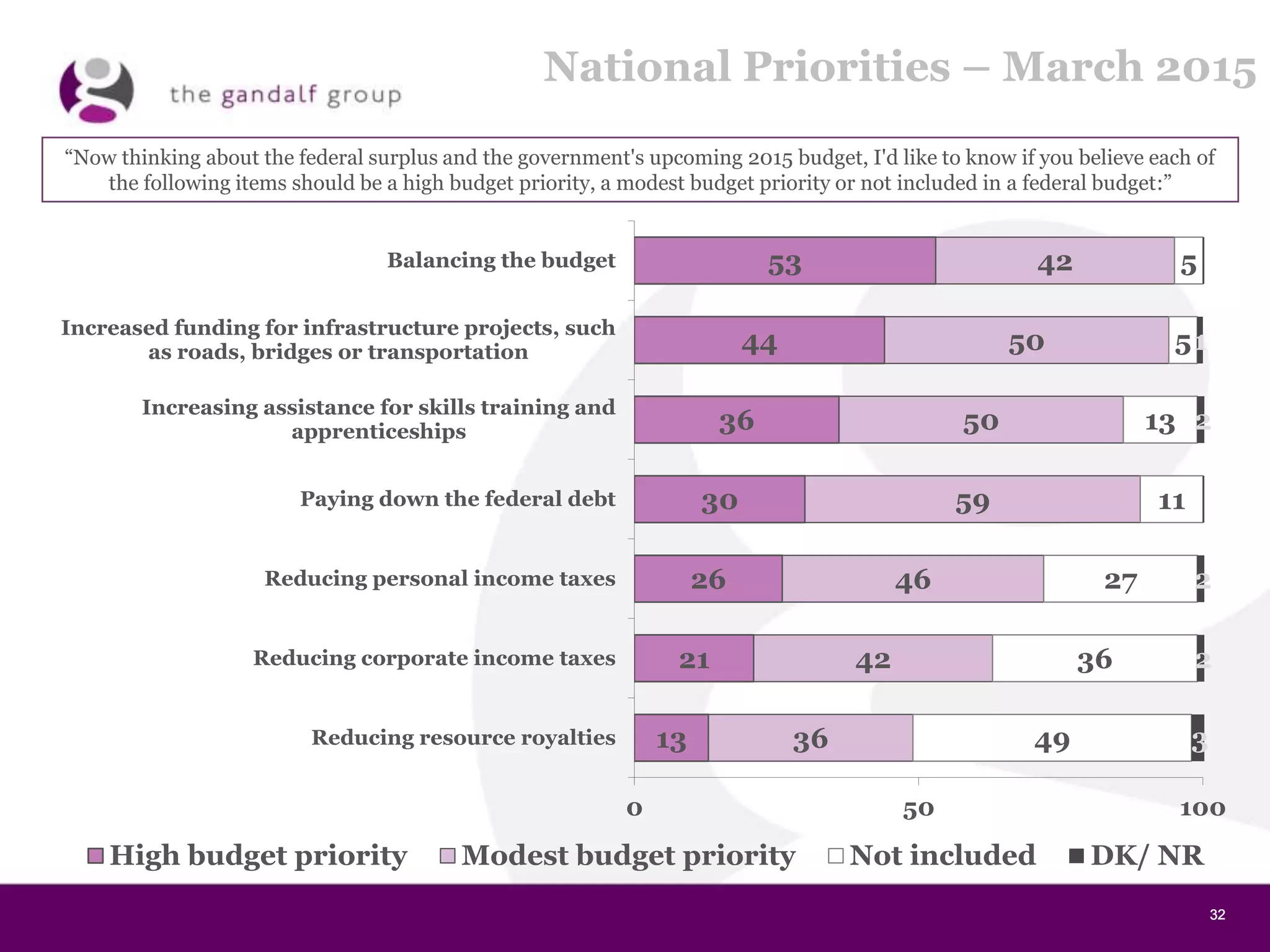

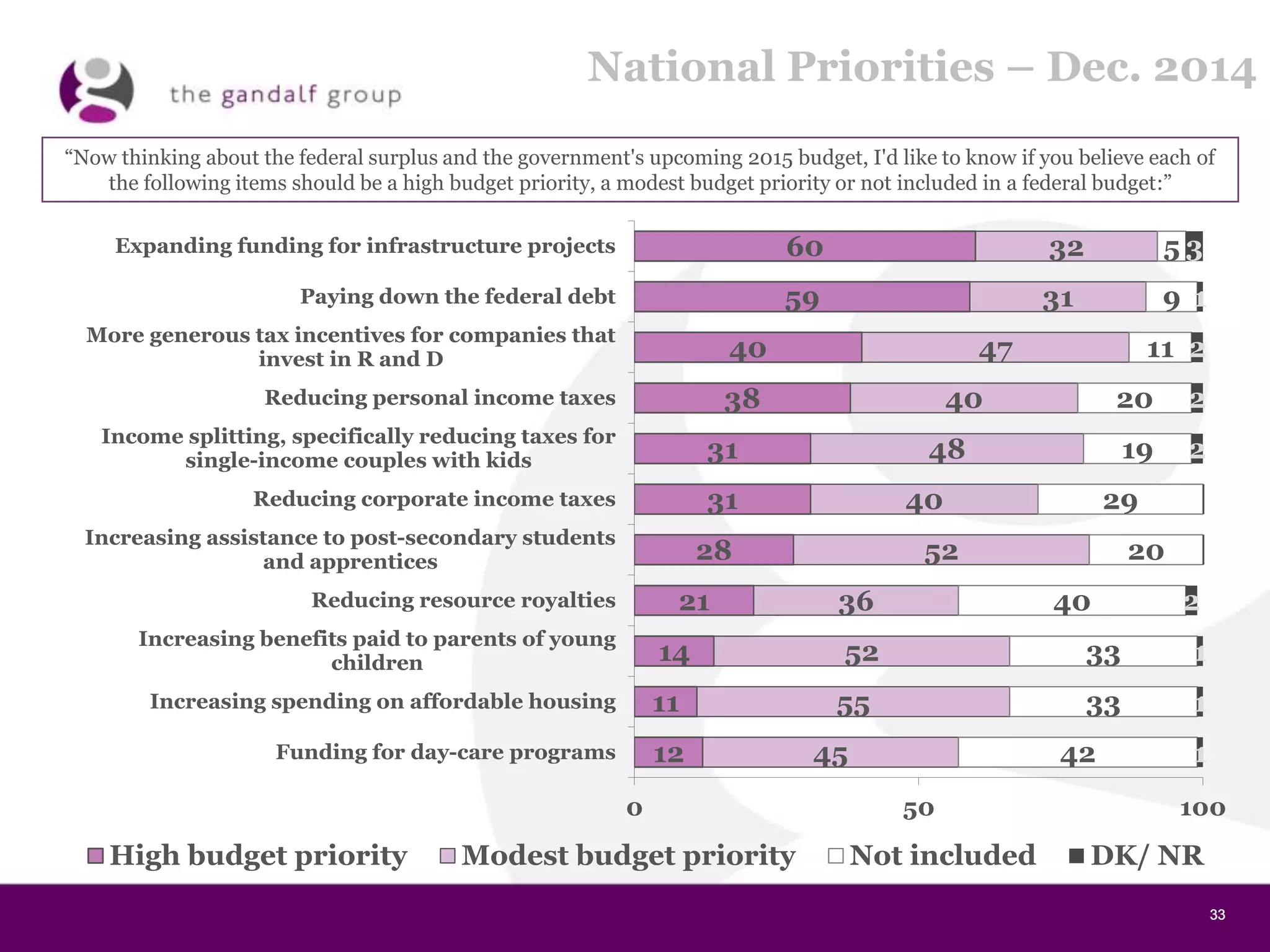

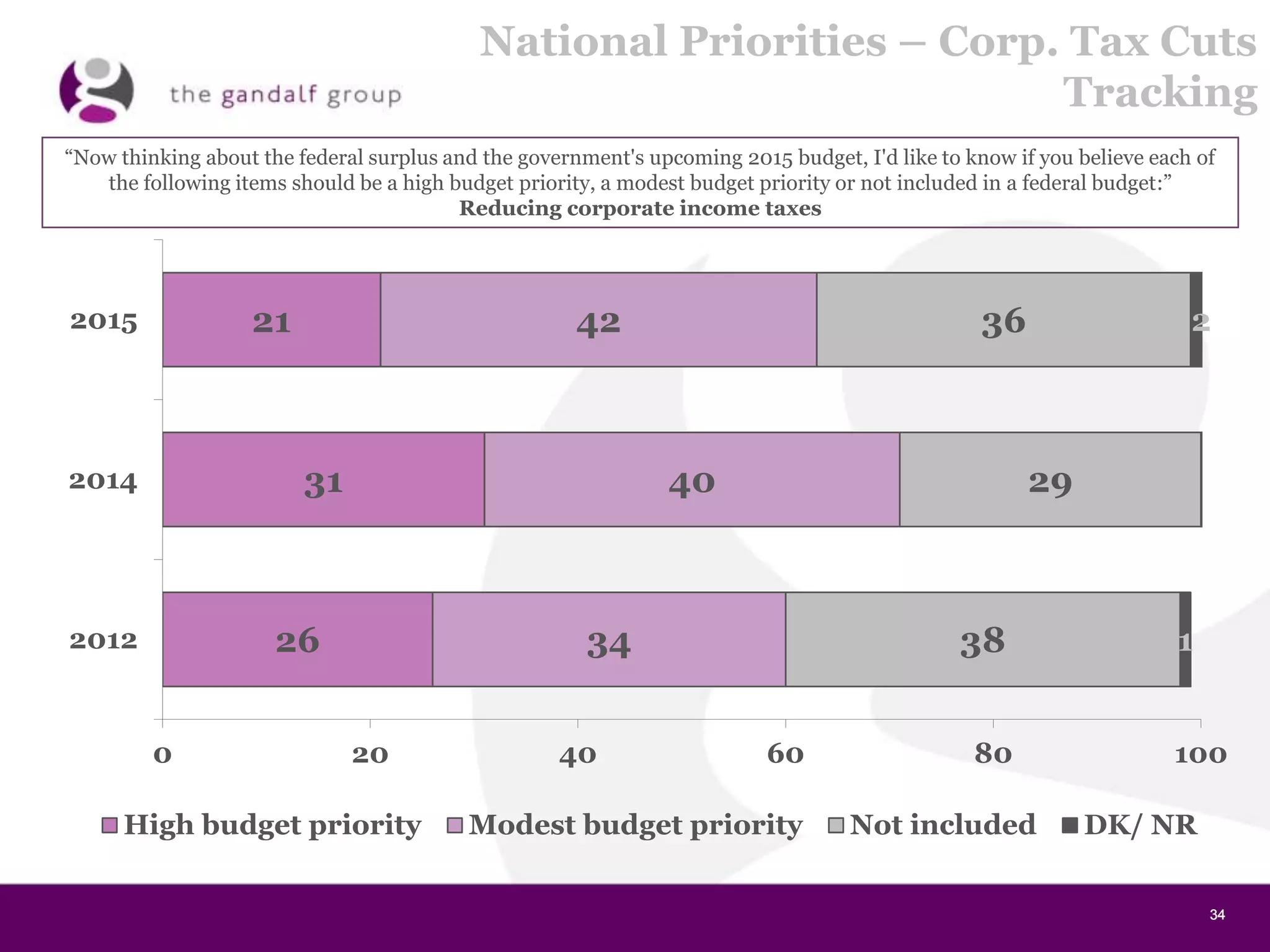

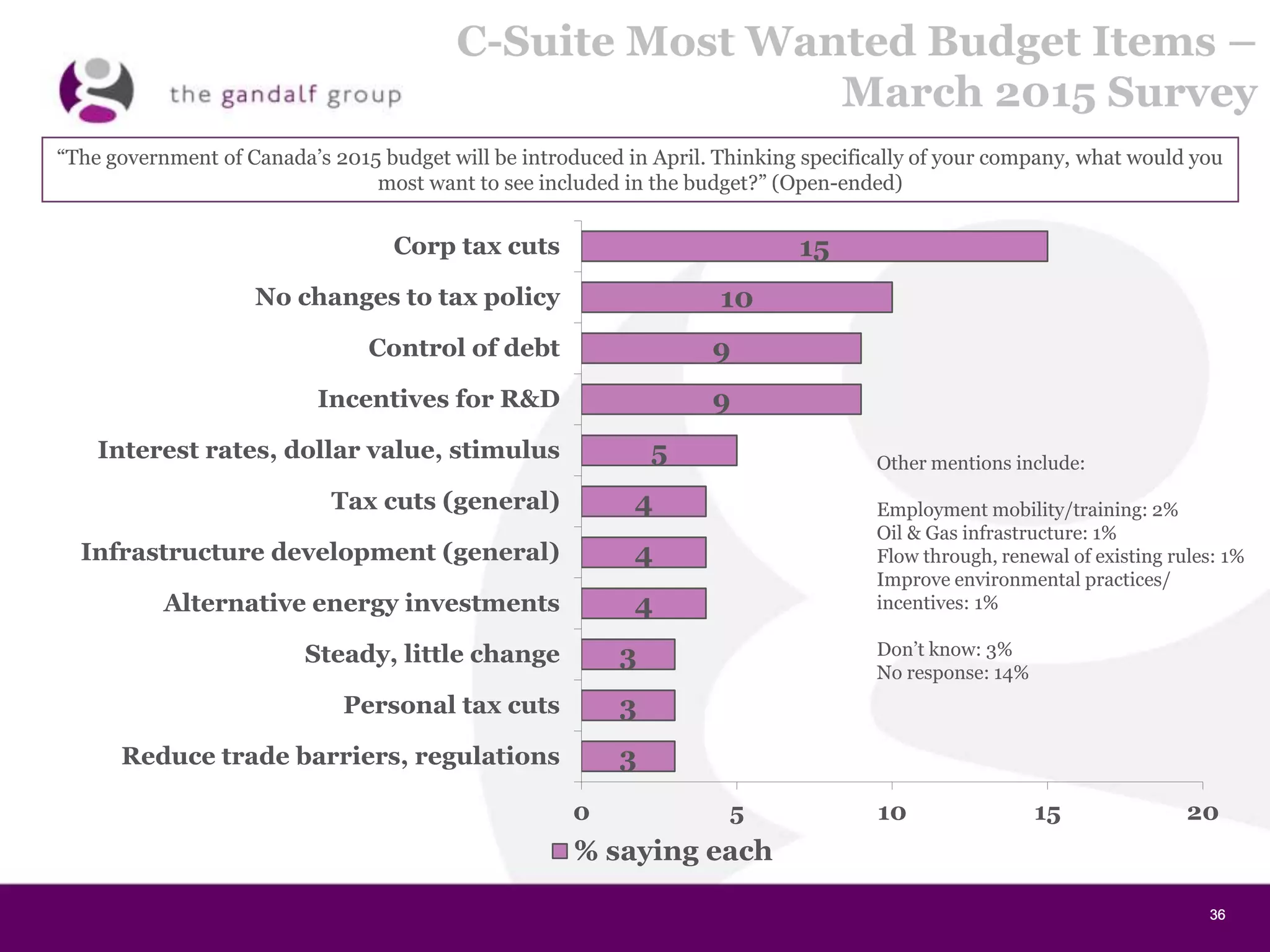

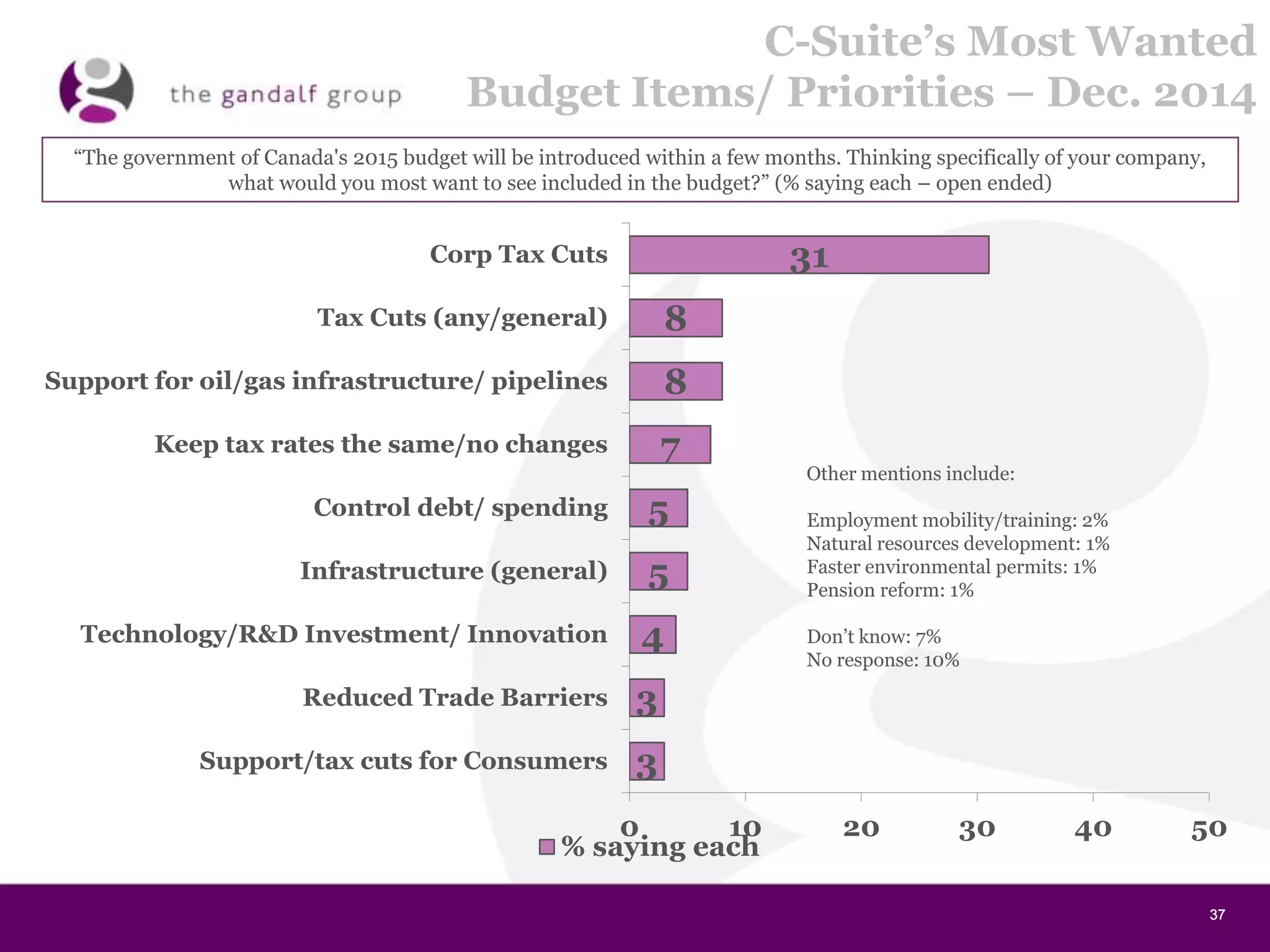

The 38th C-Suite quarterly survey reveals a pessimistic outlook for the Canadian economy due to lower oil prices and unfavorable currency conditions, with many executives reporting declines in their own businesses. While a majority view a lower Canadian dollar positively, concerns about access to finance and the overall economic situation persist. Additionally, half of the executives support further interest rate cuts by the Bank of Canada but prioritize federal budget balancing and infrastructure spending over tax cuts.