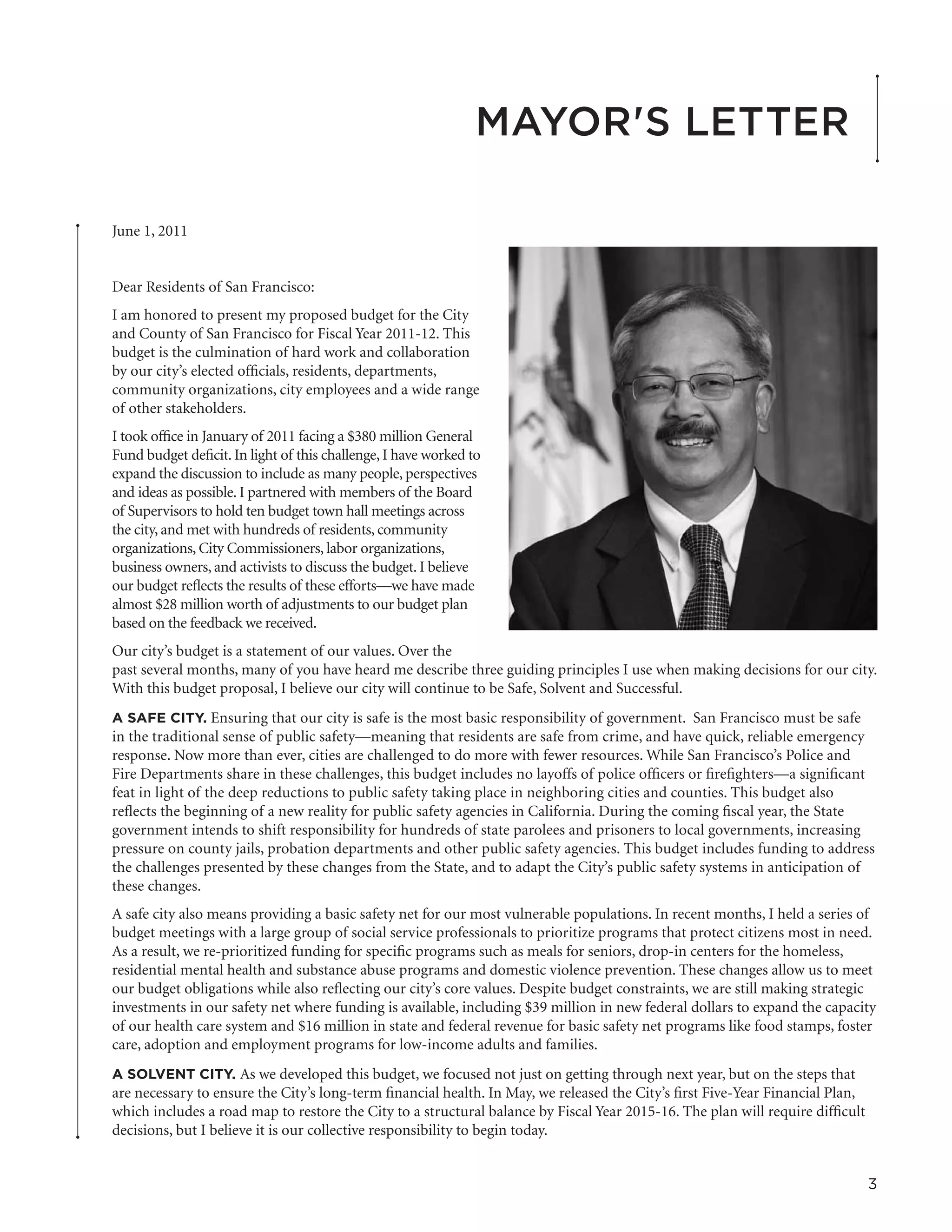

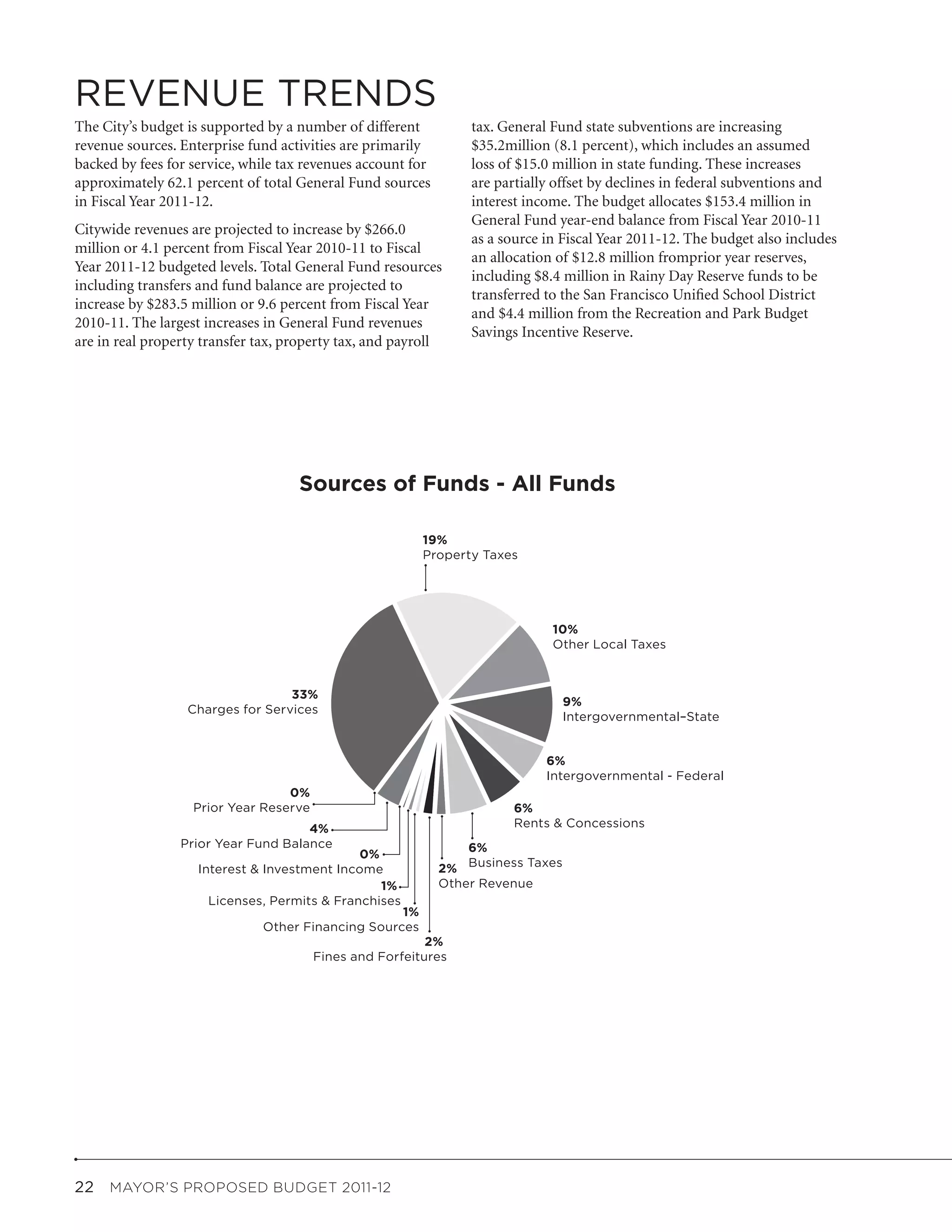

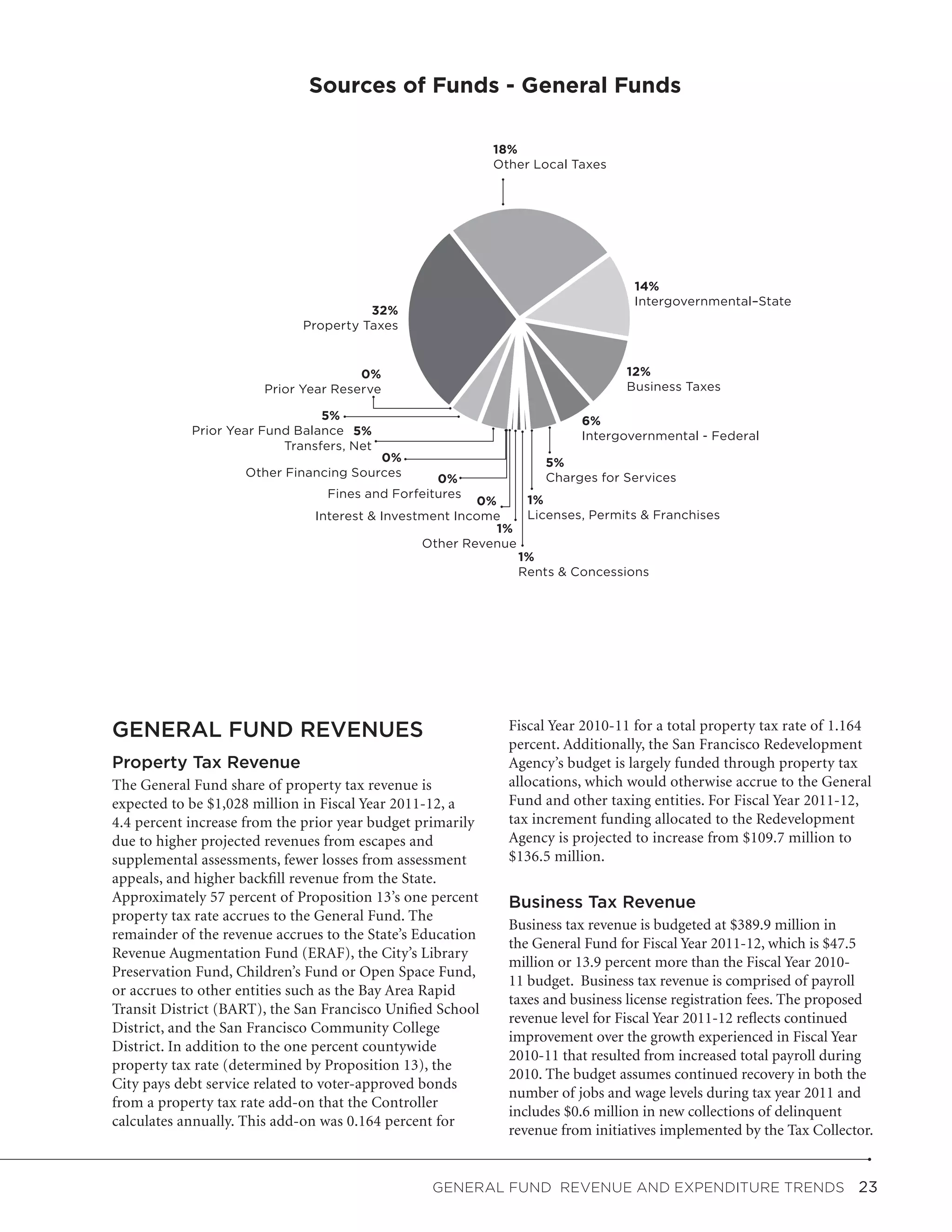

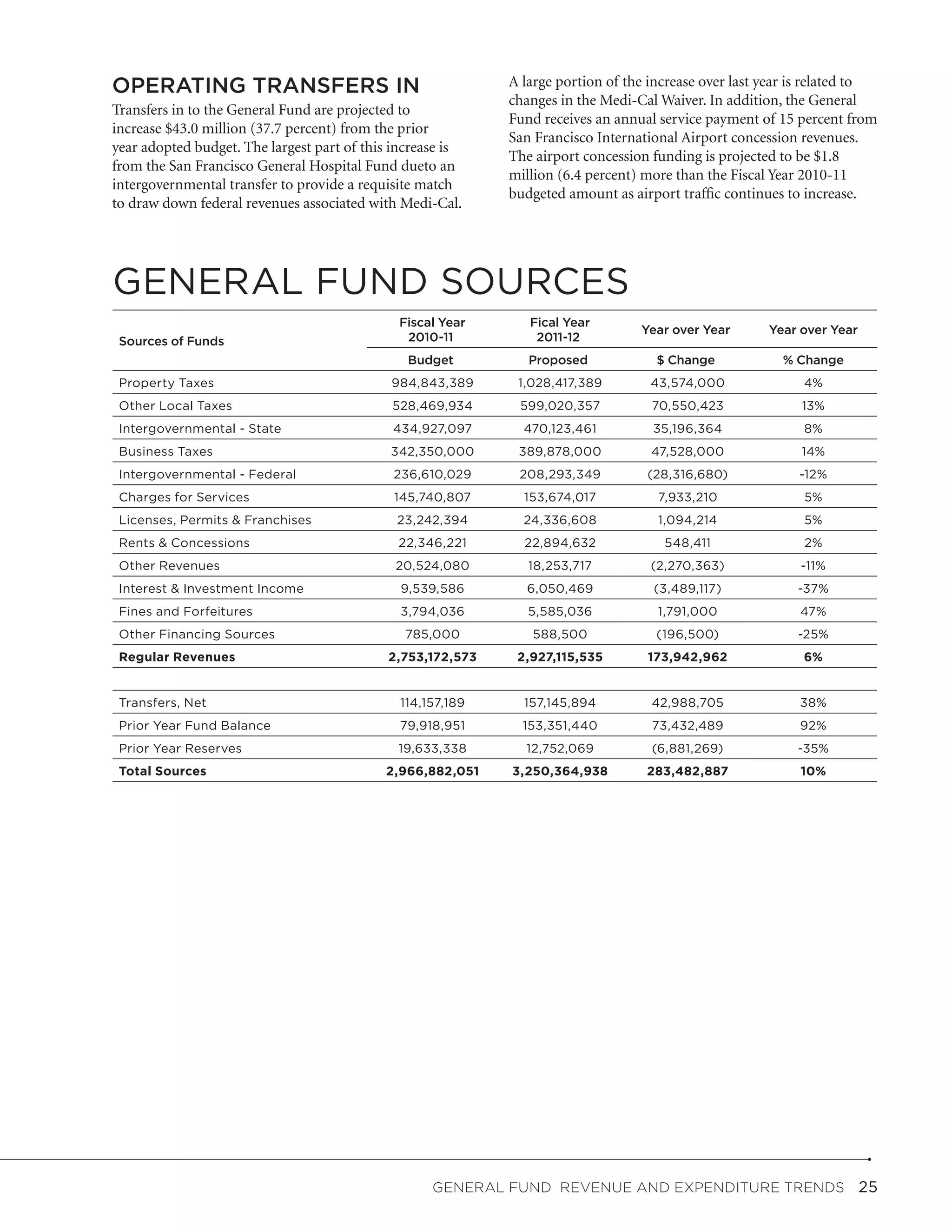

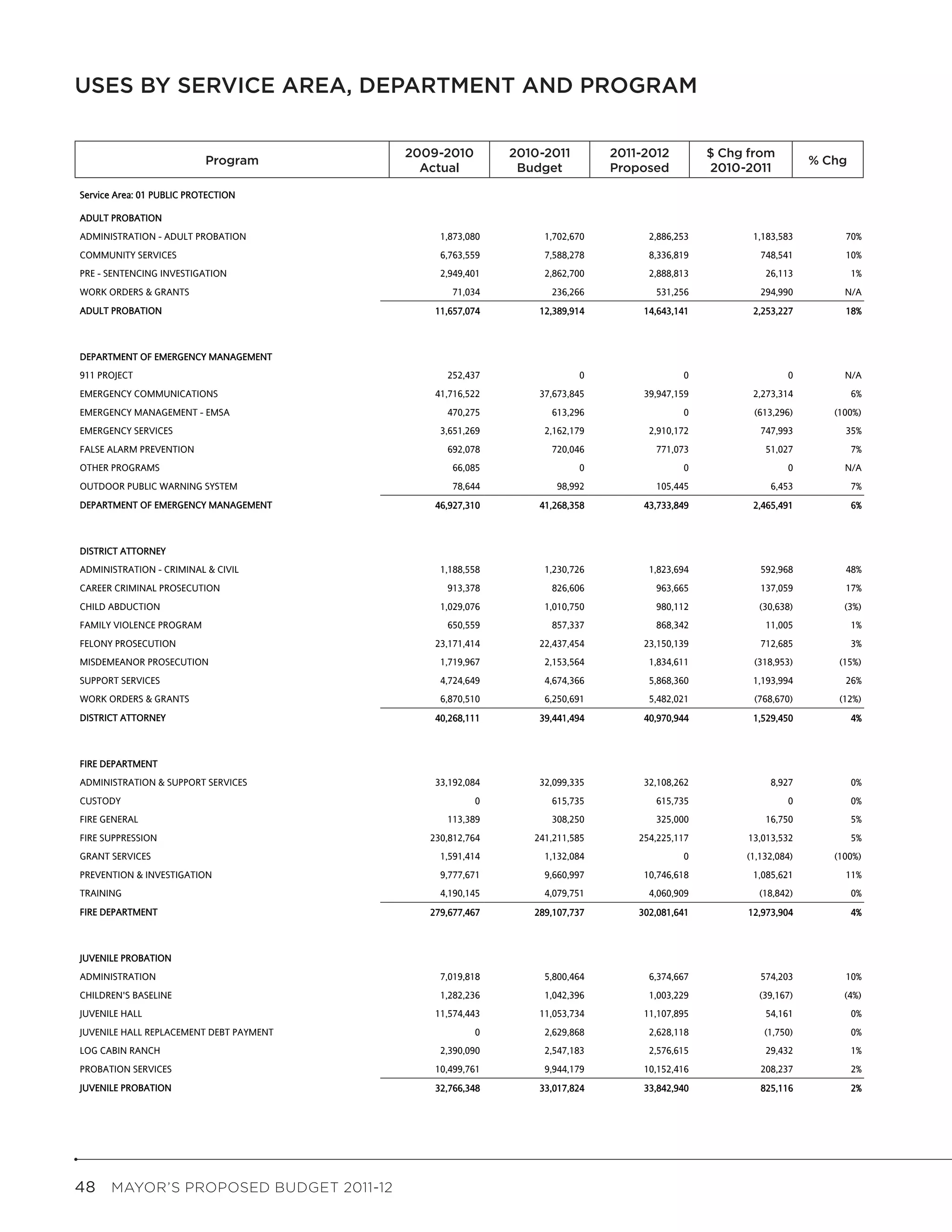

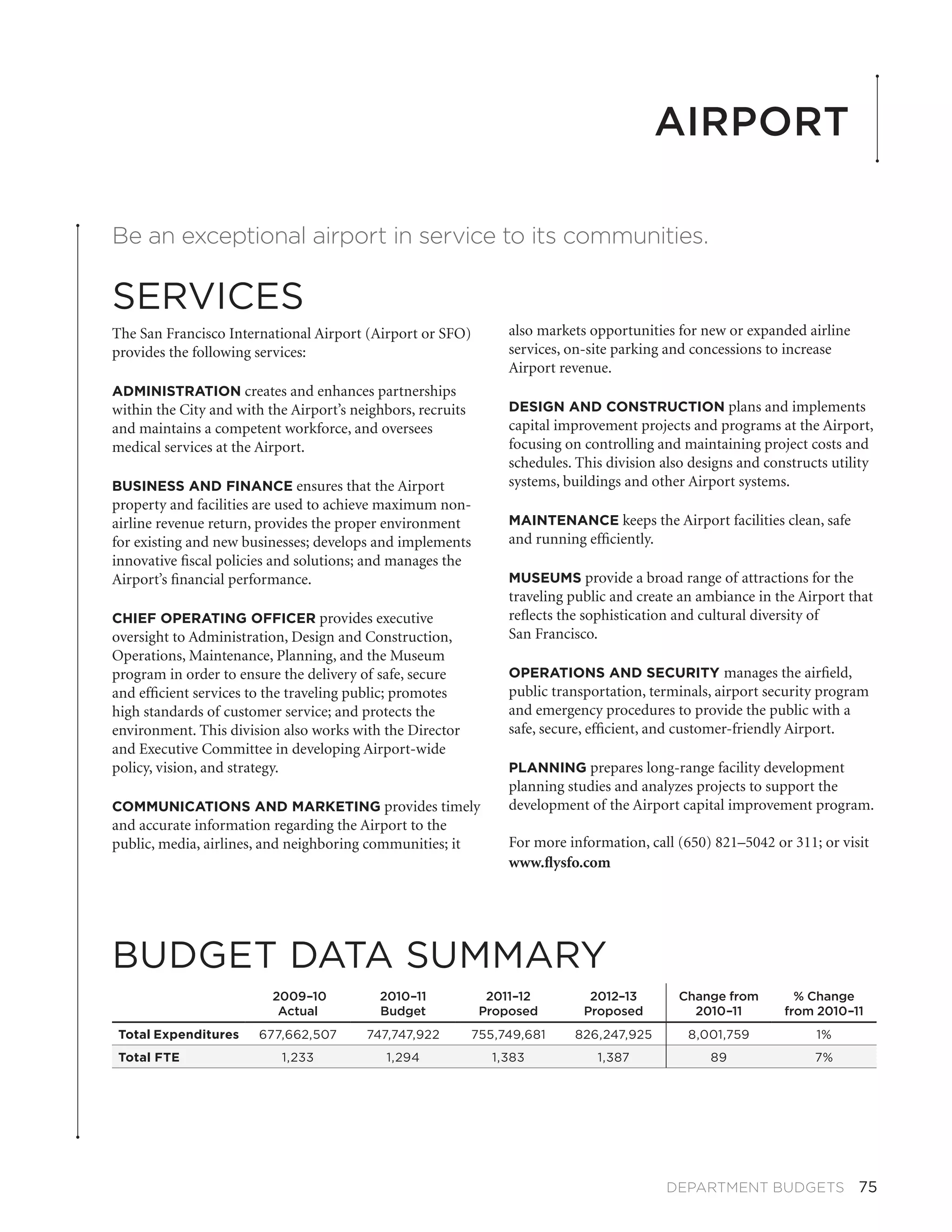

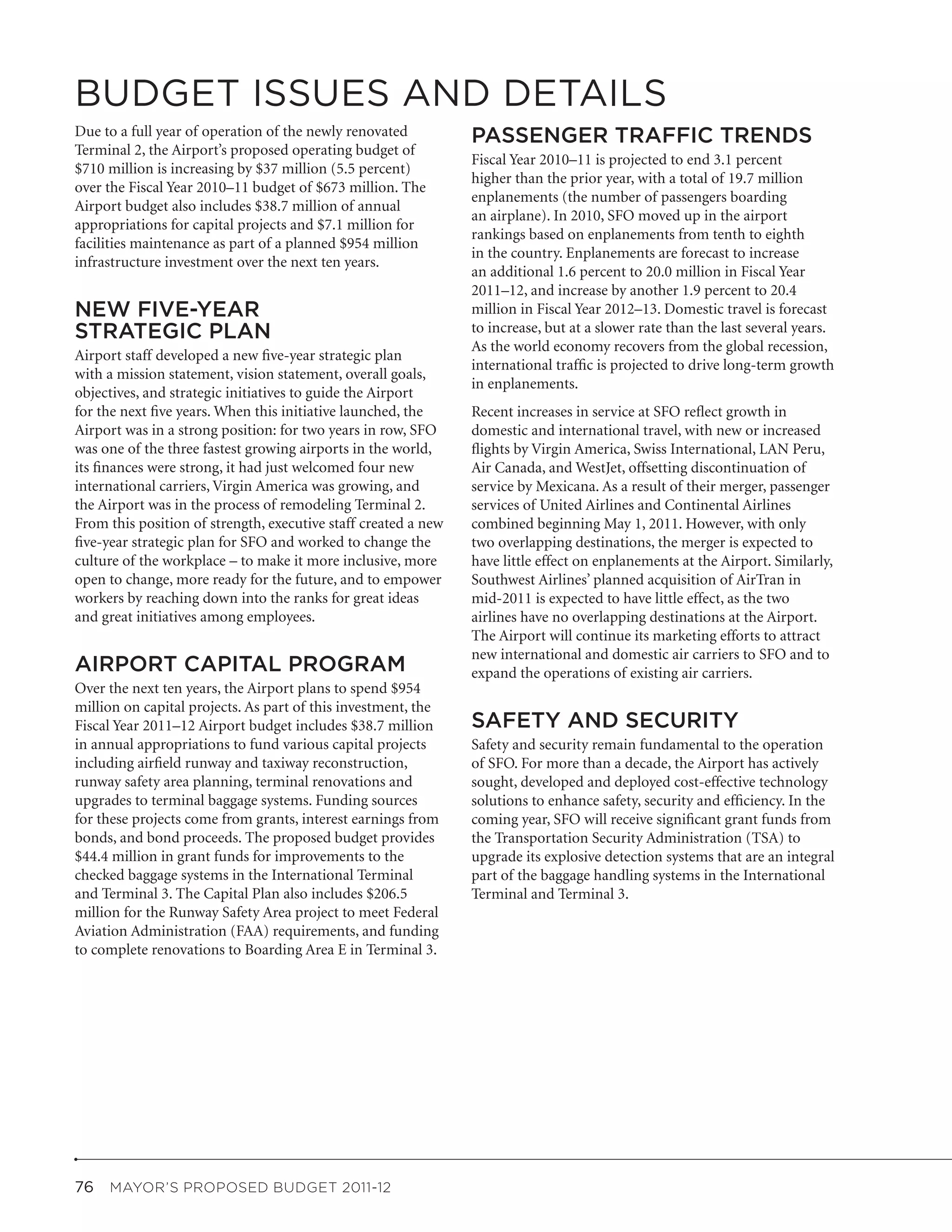

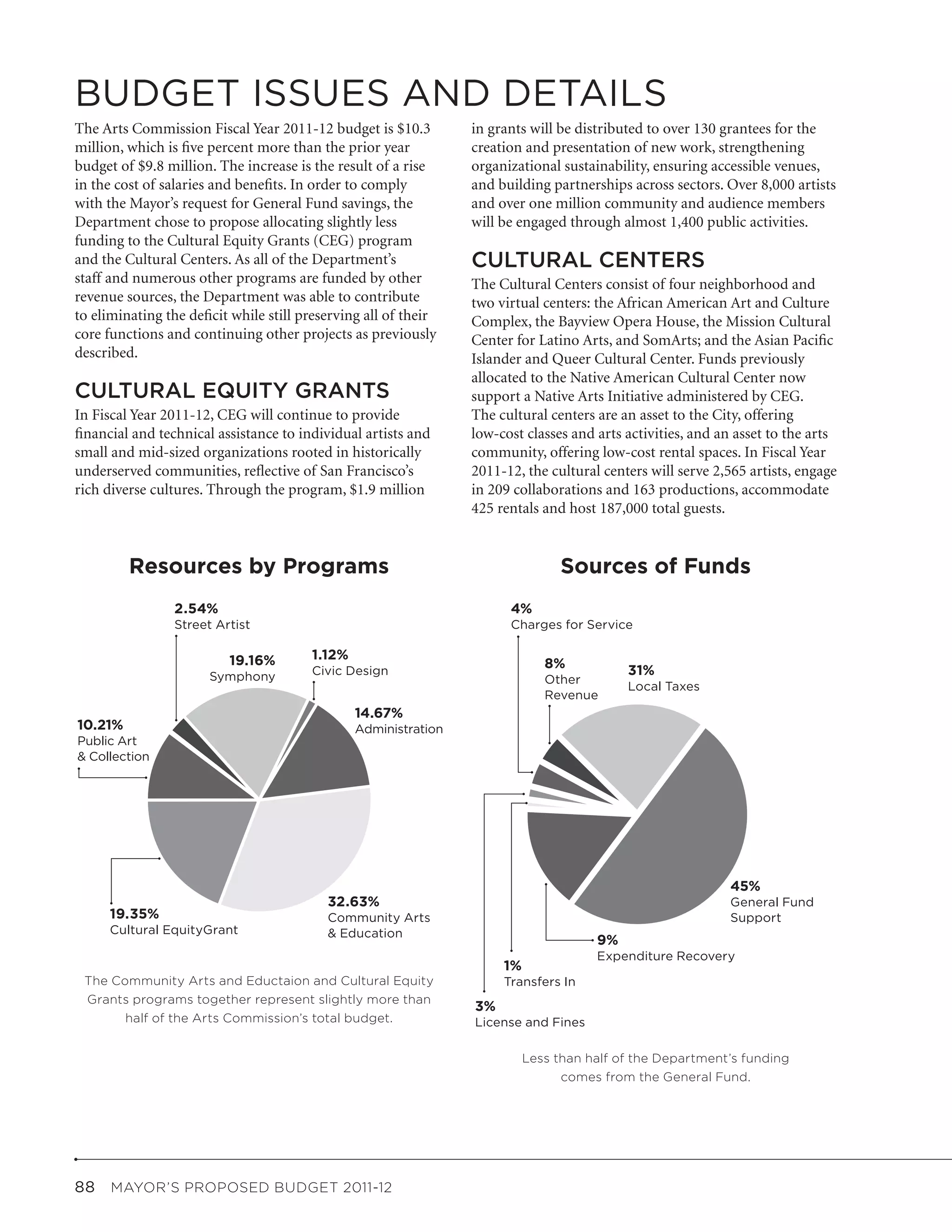

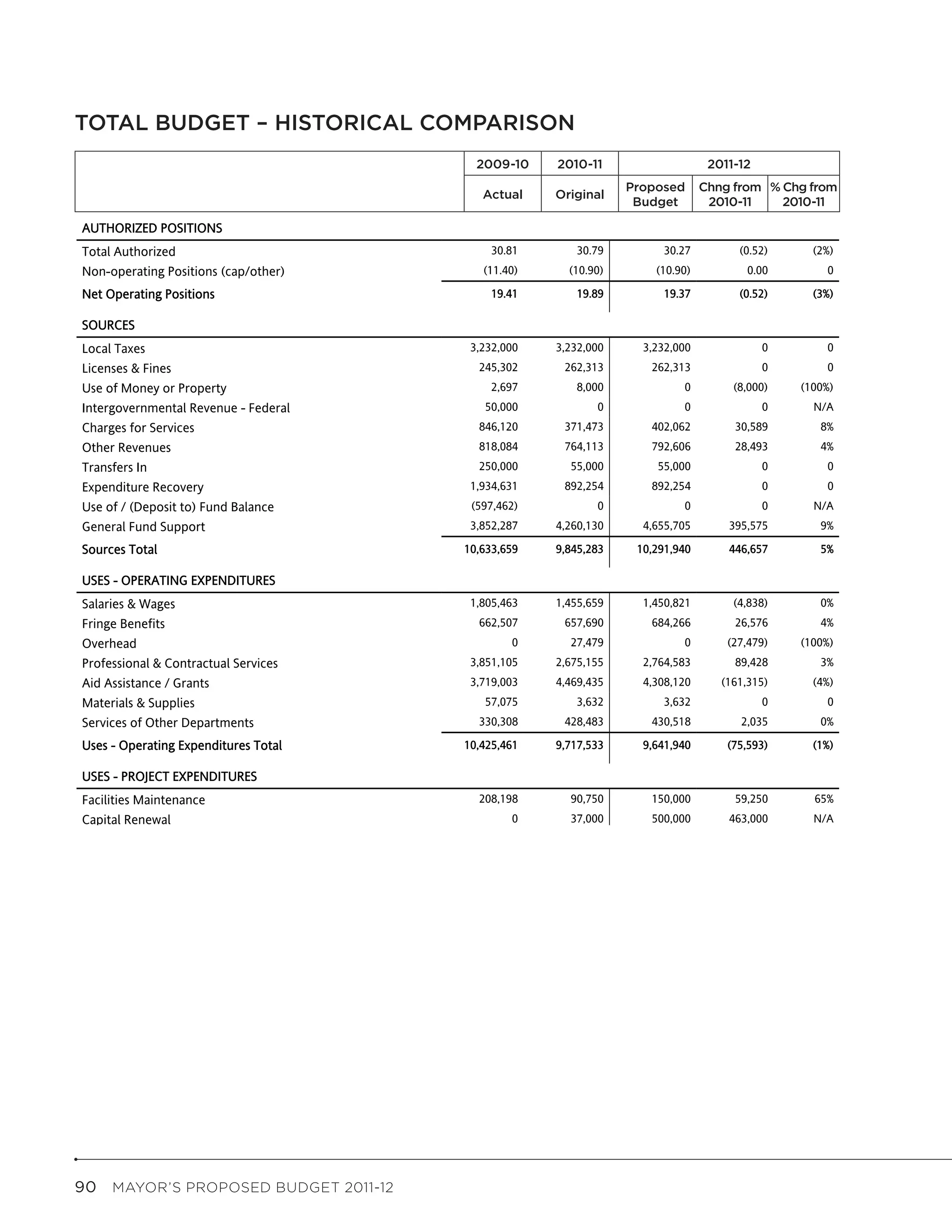

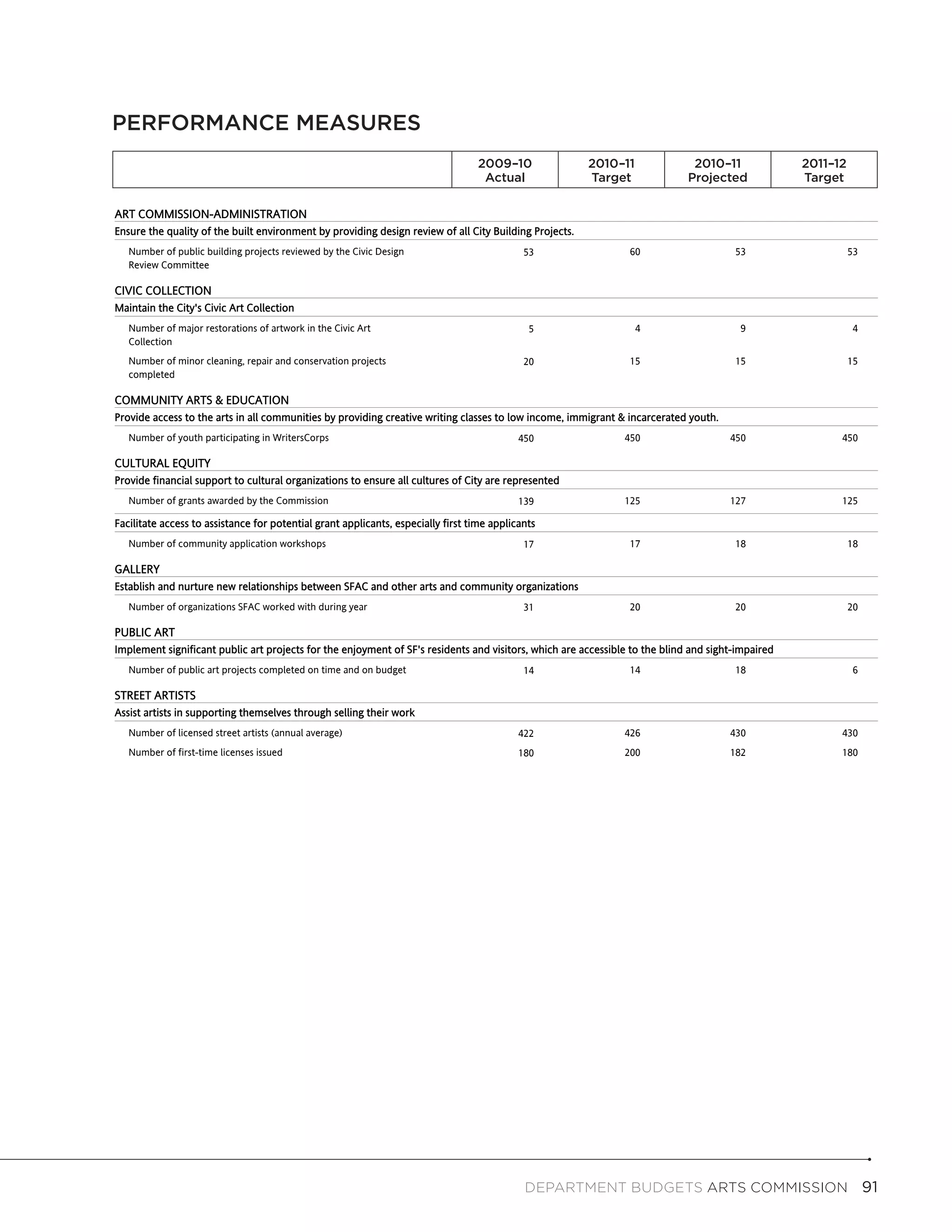

This document summarizes the Mayor's proposed budget for fiscal year 2011-2012. It begins with an introduction from the Mayor highlighting three guiding principles: that the city remains safe, solvent, and successful. To ensure safety, the budget prioritizes public safety and social services while avoiding layoffs of police and firefighters. To ensure solvency, the budget aims to balance the budget by 2015-2016 through difficult decisions. The budget was created through an extensive public process including numerous town halls across the city.