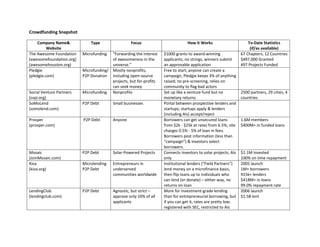

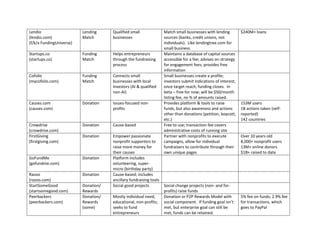

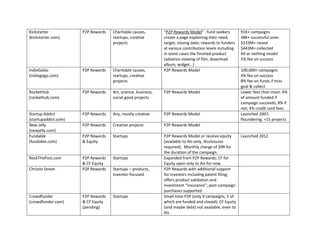

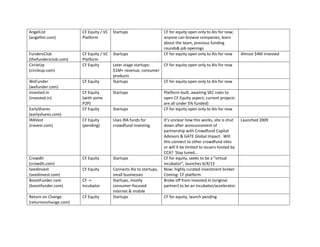

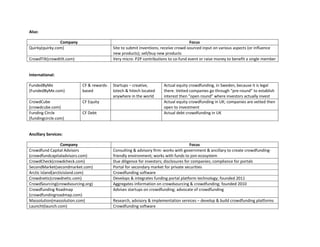

The document provides a comprehensive overview of various crowdfunding platforms, detailing their types, focuses, operational structures, and to-date statistics. It categorizes platforms into microfunding, peer-to-peer debt, donation-based, and crowdfunding for equity, highlighting noteworthy players in each category and their key metrics. The information includes grant amounts, fundraising success rates, and unique features of each platform.