Solomon Capital provides investment banking services including fundraising, debt financing, restructuring, and mergers and acquisitions. Their services include early stage financing between $2-5 million, pre-IPO financing between $4-8 million, and public offerings in London between $10-50 million. They also offer financial and business restructuring services for leveraged buyouts in London between $20-100 million and distressed company buyouts.

![Our Services at a Glance

Investment Banking

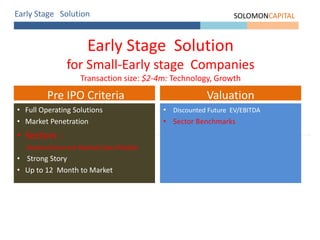

Early Stage Financing $2-5m

Pre IPO $4-8m

Public Offering mainly in London $10-50m

Consulting

Firm Valuation [for Private and Public companies]

Analyst reports for Public companies

Business & Strategic Planning

3

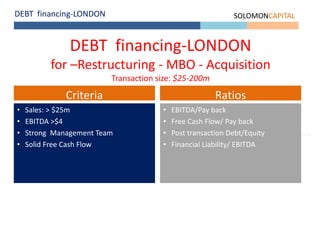

Financial and Business Restructuring

LBO Services London [$20-100m]

Distressed Companies buy-out

LBO & Restructuring

SOLOMONCAPITAL

Co Brokering

Co-Brokering services for Israeli based

companies listed or going public on the

London stock exchange [AIM and Main List]

Up TO 25% of IPO

Re-structuring

Financial and Business Restructuring

LBO Services London [$20-100m]

Distressed Companies buy-out

AUG 2014April 2015](https://image.slidesharecdn.com/crossbordersolomoncapitalevent552015-150605101642-lva1-app6892/85/Cross-Border-Funding-2015-FROM-SOLOMON-CAPITAL-EVENT-3-320.jpg)

![Experience at a Glance

David Solomon Books : [Sold out]

8

SOLOMONCAPITAL

April 2015](https://image.slidesharecdn.com/crossbordersolomoncapitalevent552015-150605101642-lva1-app6892/85/Cross-Border-Funding-2015-FROM-SOLOMON-CAPITAL-EVENT-8-320.jpg)

![IPO Solution -LONDON SOLOMONCAPITAL

IPO Solution -LONDON

for Small-Mid Companies

Transaction size: $10m -$50m

Technology, Growth, Pre Market Cap $50m -$200m

• Sales: > $5, Next Year> $8m

• 4 Quarter sales

• EBITDA>1, Next Year>$2-4

• Strong Management Team [CFO]

• Strong Story

IPO Criteria

• PE

• EV/EBITDA

• DCF [Not Likely]

• Sector Benchmarks

Valuation](https://image.slidesharecdn.com/crossbordersolomoncapitalevent552015-150605101642-lva1-app6892/85/Cross-Border-Funding-2015-FROM-SOLOMON-CAPITAL-EVENT-14-320.jpg)

![Pre IPO Solution SOLOMONCAPITAL

Pre IPO Solution

for Small-Early stage Companies

Transaction size: $2-10m: Technology, Growth

• Sales: > $1 Next Year> $5m

• 2 Quarter sales

• EBITDA Next Year>$2

• Strong Management Team [CFO]

• Strong Story

• 18 Month to IPO

Pre IPO Criteria

• Discounted Future EV/EBITDA

• DCF [Not Likely]

• Sector Benchmarks

Valuation](https://image.slidesharecdn.com/crossbordersolomoncapitalevent552015-150605101642-lva1-app6892/85/Cross-Border-Funding-2015-FROM-SOLOMON-CAPITAL-EVENT-15-320.jpg)

![24

Main Causes for Unsuccessful Fundraising SOLOMONCAPITAL

April 2015

Main Causes for Unsuccessful Fundraising

• STRATEGY - Lack of Clear strategy or wrong strategy [wrong source, wrong timing,

wrong valuation]

• PREPARATION - Poor Preparation

• COMMUNICATION - Poor Company/Investor Communication,..Losing

Credibility

• BAD LUCK…

If you fail to plan you plan to fail](https://image.slidesharecdn.com/crossbordersolomoncapitalevent552015-150605101642-lva1-app6892/85/Cross-Border-Funding-2015-FROM-SOLOMON-CAPITAL-EVENT-24-320.jpg)

![25

The Process

s

SOLOMONCAPITAL

April 2015

The Process

Pre

• Reality check - Evaluation, Reality check and putting together the right

STORY

• Strategy - Building up the best Strategy

• Preparation - Be ready… Plan and Preparation

On Air

• Communication

• Pitch - [road show]

• Negotiation](https://image.slidesharecdn.com/crossbordersolomoncapitalevent552015-150605101642-lva1-app6892/85/Cross-Border-Funding-2015-FROM-SOLOMON-CAPITAL-EVENT-25-320.jpg)

![26

Our fundraising Process SOLOMONCAPITAL

April 2015

1 2 3 4

EVALUATION

Status, Vision, Market

FUNDRAISING STRATEGY

Valuation, Source, Size …

FUNDRAISING PLAN

Business Plan, Pitch Presentation

Targeting

COMMUNICATION

Introductions, Materials..

5

MINI ROAD SHOW

Face to face meetings

6

TERM SHEET

7

DEAL

CLOSING

STAGE I : PREPARATION [1 MONTH] STAGE II : FUNDING [3-6 MONTH]](https://image.slidesharecdn.com/crossbordersolomoncapitalevent552015-150605101642-lva1-app6892/85/Cross-Border-Funding-2015-FROM-SOLOMON-CAPITAL-EVENT-26-320.jpg)

![29

Our Fundraising Process

1 2 3 4

EVALUATION

Status, Vision, Market

FUNDRAISING STRATEGY

Valuation, Source, Size …

FUNDRAISING PLAN

Business Plan, Pitch Presentation

Targeting

COMMUNICATION

Introductions, Materials..

5

MINI ROAD SHOW

Face to face meetings

6

TERM SHEET

7

DEAL

CLOSING

STAGE I : PREPARATION [1 MONTH] STAGE II : FUNDING [3-4 MONTH]

SOLOMONCAPITAL

April 2015](https://image.slidesharecdn.com/crossbordersolomoncapitalevent552015-150605101642-lva1-app6892/85/Cross-Border-Funding-2015-FROM-SOLOMON-CAPITAL-EVENT-29-320.jpg)

![30

Our Restructuring [Turn-Around] Process

1 2 3 4

CHECK UP

Basic Analysis & DD

EVALUATION

Full DD, Valuation

RESTRUCTURING PLAN

Strategy, Business Plan

Restructuring Plan

REALITY CHECK

Building up key- players support

[Owners, Management, Banks, Employees]

5

FINANCIAL RESTRUCTURING

Debt , Equity, Cash flow

6

BUSINESS & OPERATIONAL

RESTRUCTURING

[Markets, Products, Cost reduction]

7

END GAME

VALUE GENERATION

STAGE II: EXECUTION [3-6 MONTH]STAGE I: PLANNING [1 MONTH]

SOLOMONCAPITAL

9/2014](https://image.slidesharecdn.com/crossbordersolomoncapitalevent552015-150605101642-lva1-app6892/85/Cross-Border-Funding-2015-FROM-SOLOMON-CAPITAL-EVENT-30-320.jpg)