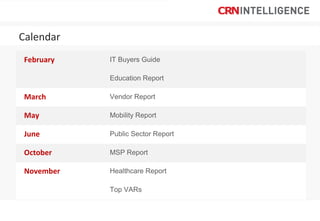

This document provides information about various subscription packages from CRN that provide market research reports and analysis. The reports summarize key findings from surveys of IT decision makers, resellers, vendors and other industry participants. Report topics include the IT buyers guide, vendor performance ratings, top UK resellers, the managed services market, mobility trends, and segments like education, public sector and healthcare. Subscription packages provide access to 3-5 selected reports and range in price from £15,995 to £24,995 depending on the level of access and customization. The platinum package includes all reports and a consultation session with CRN's executive editor.