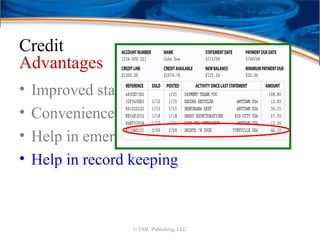

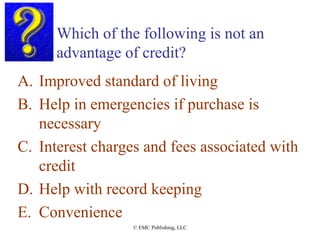

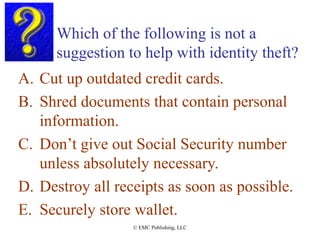

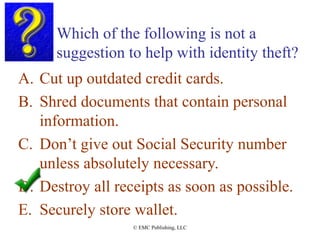

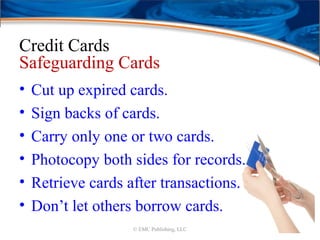

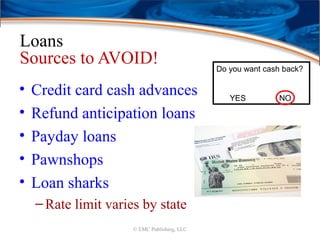

This document discusses various topics related to personal finance and credit. It provides information on the advantages and disadvantages of using credit, tips for preventing identity theft, different types of credit (such as credit cards and loans), and sources for obtaining loans. Some key points covered include improved standard of living and convenience as advantages of credit, interest charges and fees as disadvantages, and payday loans as the most expensive type of loan source.