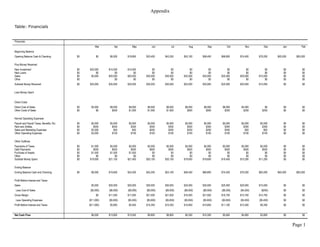

This document provides an executive summary and overview of Covenant Financial Advisors, LLC. It discusses the company's mission to provide retirement counseling and financial planning services with integrity and expertise. The company specializes in developing customized portfolios for pre-retirees, retirees, and women. Research shows the growing retirement market and consumer distrust in traditional financial institutions, positioning independent advisors like Covenant Financial Advisors for growth. The executive summary outlines the company's products and services, competitive strengths, and financial projections showing profitability.