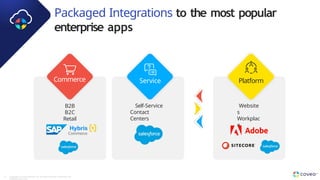

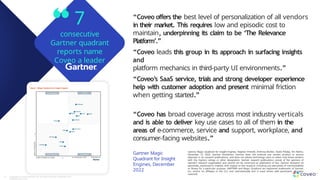

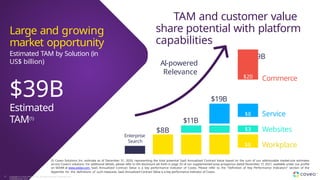

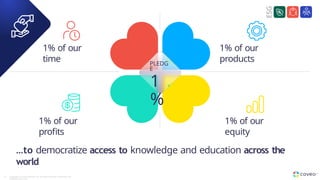

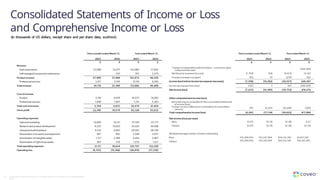

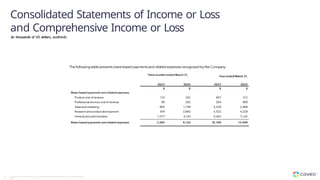

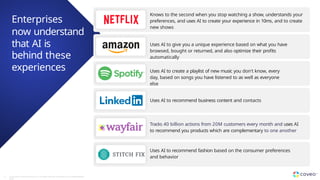

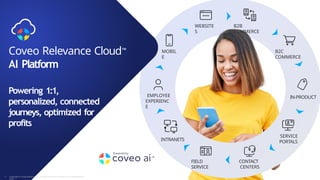

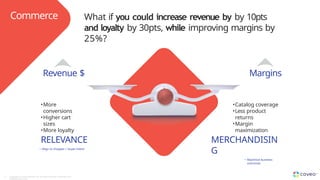

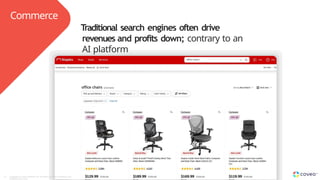

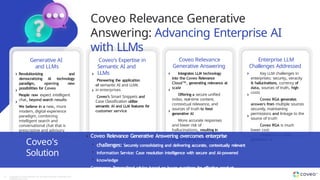

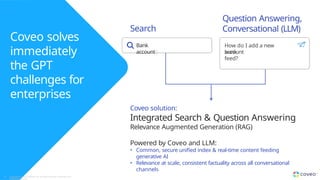

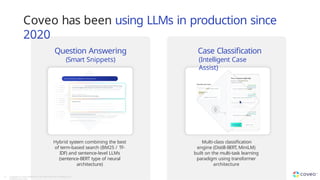

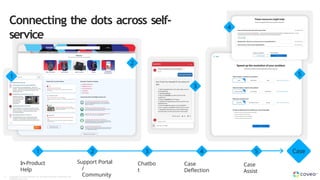

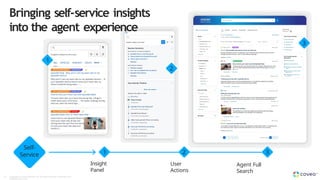

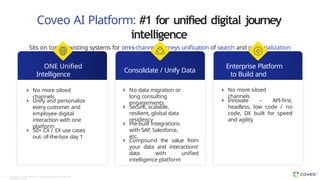

Coveo Solutions Inc.'s May 2023 investor presentation highlights its role in transforming business through AI, alongside essential financial disclosures and forward-looking statements on revenue and growth strategies. The presentation emphasizes the importance of understanding market data and financial performance metrics while cautioning investors about the inherent risks and uncertainties. Additionally, it underscores Coveo's commitment to leveraging AI to enhance customer experiences and outcomes.

![Formerly Qubit Q4M

Campaign management

Insights & analytics

Personalized content

Recommendations &

badges Product listings

[new]

Future:

Profit

optimization

Retail media

Coveo

Merchandising

Hub

Copyright © Coveo Solutions Inc. All rights reserved. Proprietary and

CONFIDENTIAL 2023

19](https://image.slidesharecdn.com/cove31-241016173513-9d3d393b/85/cove3-inv-presentation-deck-quarter-1-pptx-19-320.jpg)

![Coveo Relevance Cloud™ AI

platform

Our Lines of

Business

Self-Service

Contact

Centers

Commerce Service

B2B

B2C

Retail

Revenue, Margins,

Experience, Loyalty

Knowledge,

CSAT / NPS, lower Costs

Website

s

Workplac

e

Platform

Unified AI-Powered

Search Benefits

Copyright © Coveo Solutions Inc. All rights reserved. Proprietary and

CONFIDENTIAL 2023

32

LANDnew logos – [high, immediate ROI

solutions]

EXPANDcustomers](https://image.slidesharecdn.com/cove31-241016173513-9d3d393b/85/cove3-inv-presentation-deck-quarter-1-pptx-32-320.jpg)