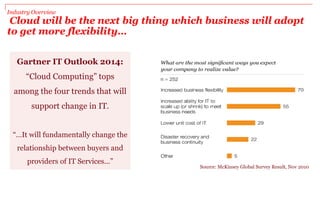

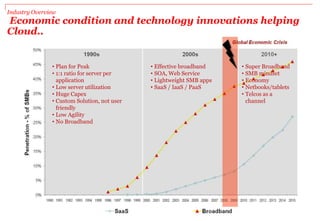

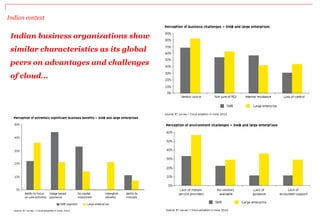

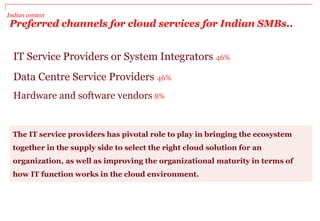

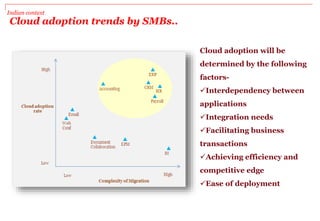

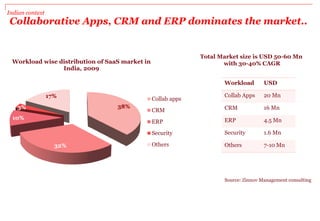

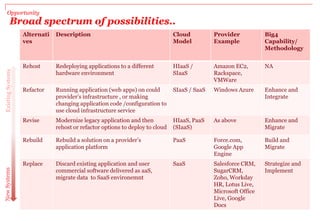

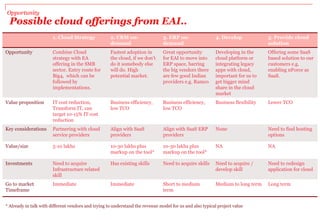

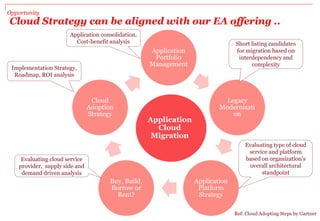

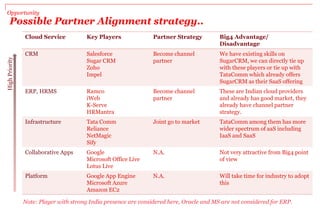

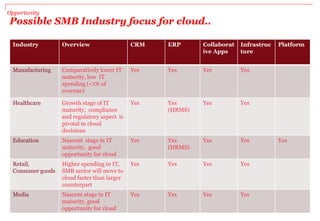

This document analyzes cloud opportunities for Big4 in India. It provides an industry overview noting cloud's growth and how Indian SMBs are poised to adopt cloud. The document outlines opportunities for Big4 in cloud strategy, CRM/ERP-as-a-service, and developing cloud solutions. Potential partners are identified in various cloud areas. Key industries for cloud focus include manufacturing, healthcare, education, retail, and media. The document concludes by thanking the reader.