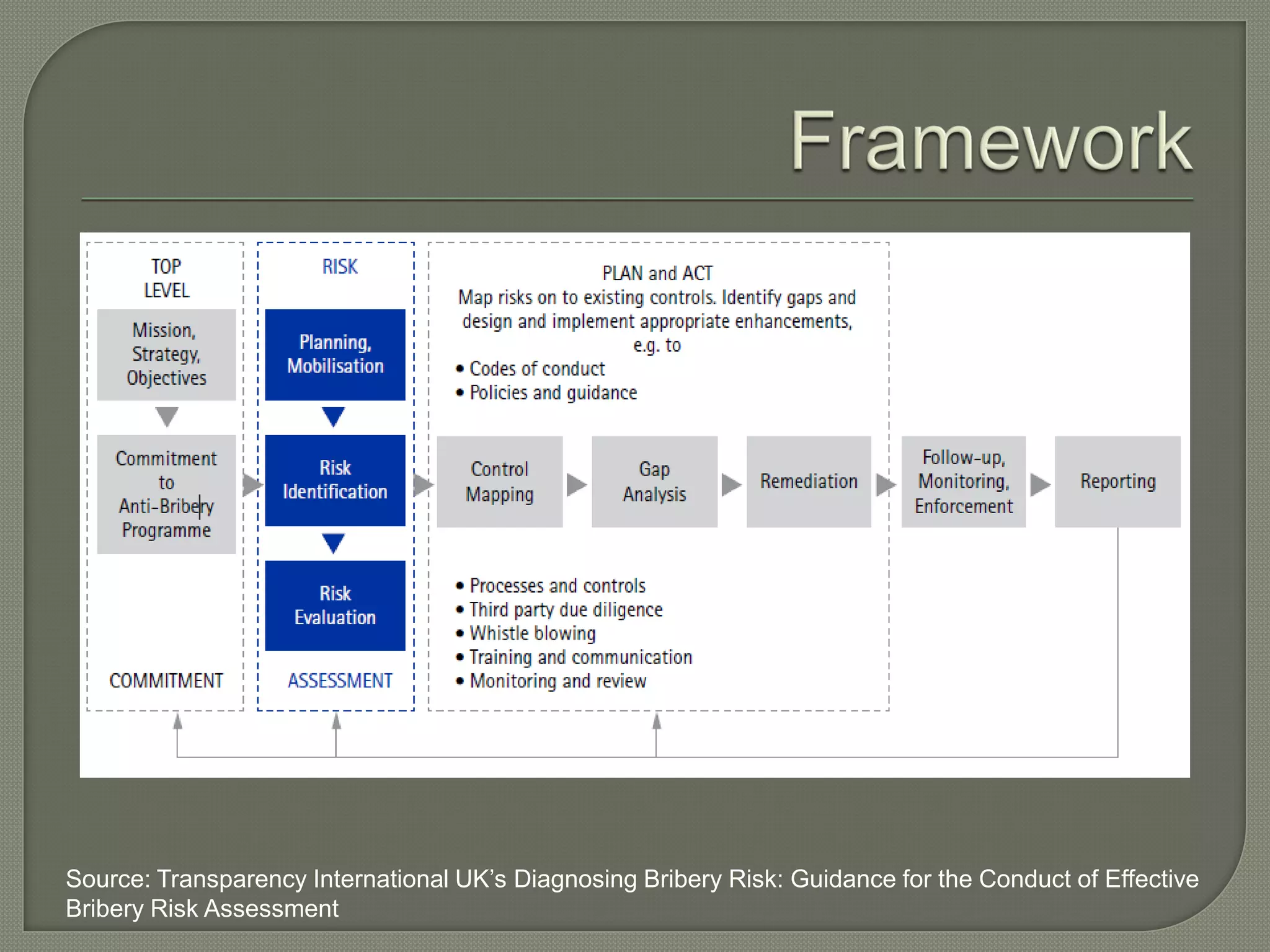

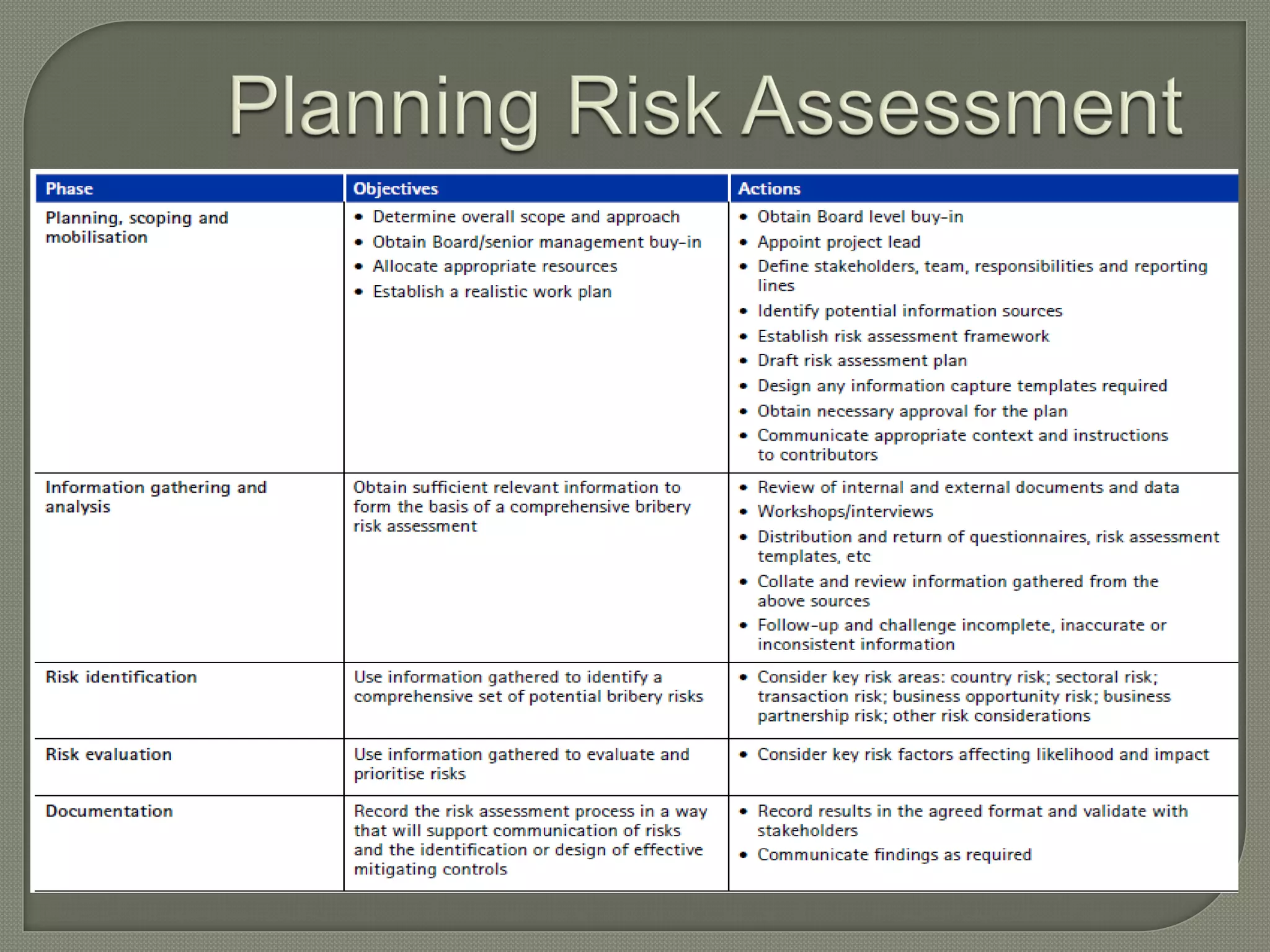

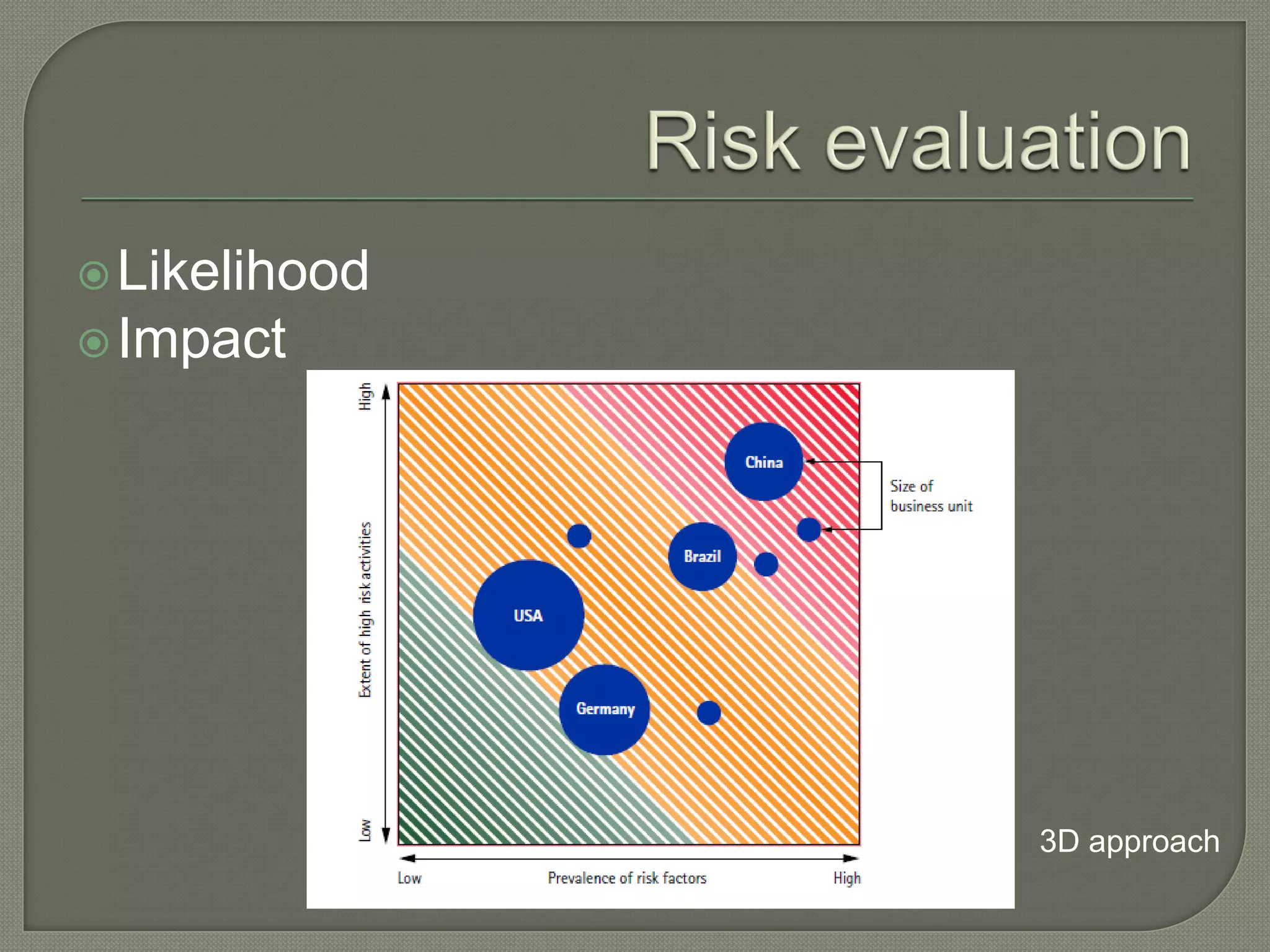

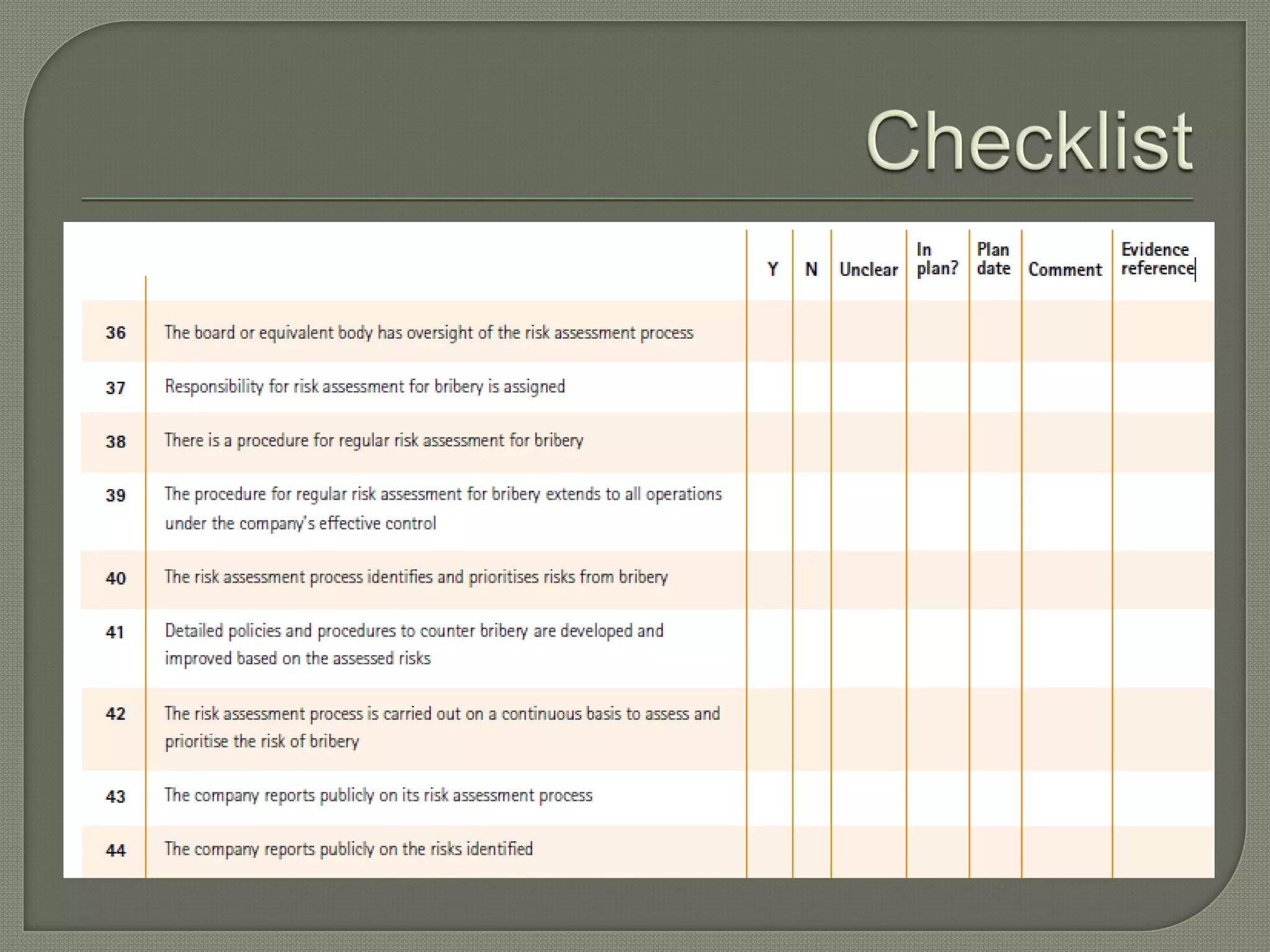

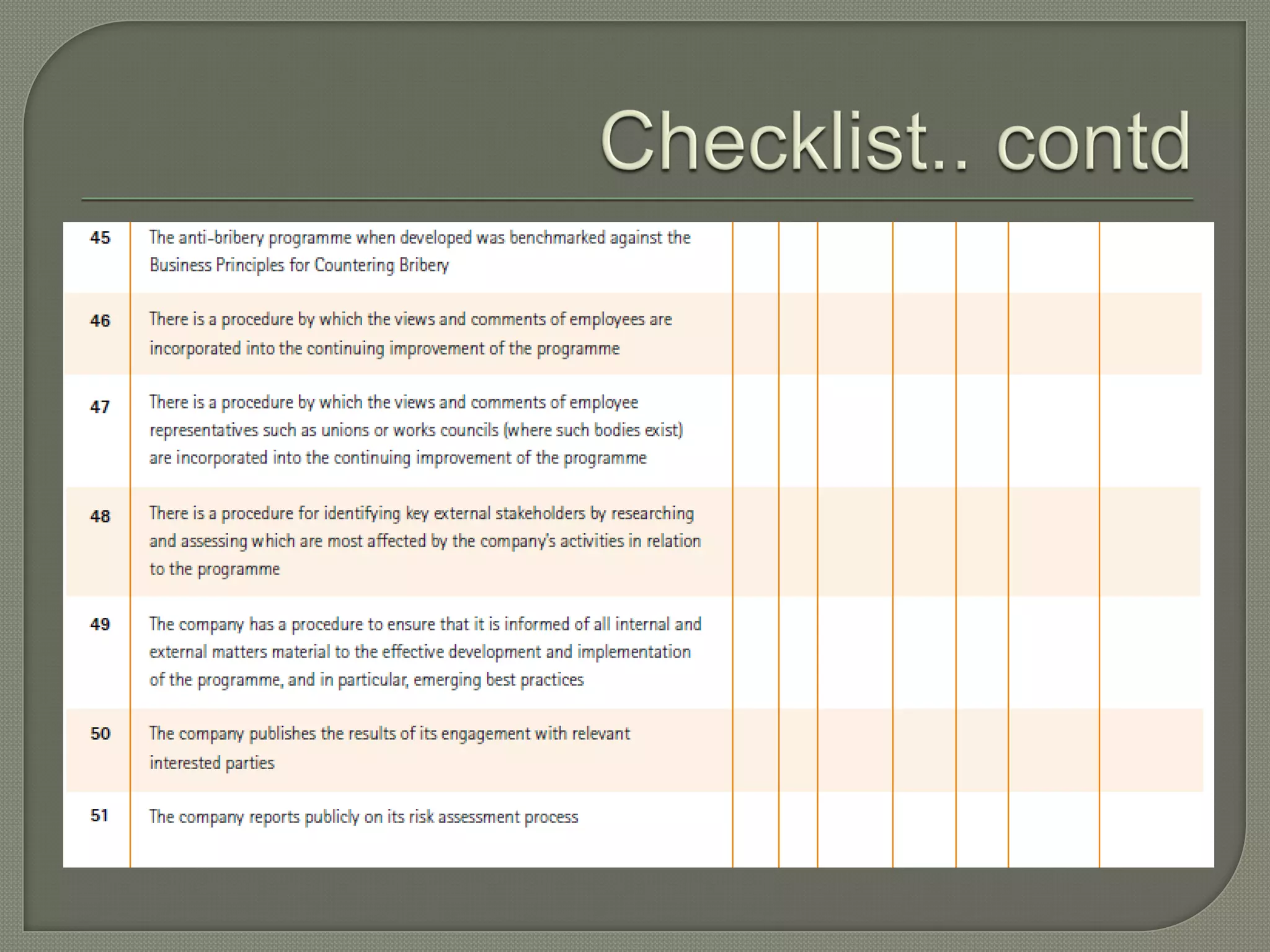

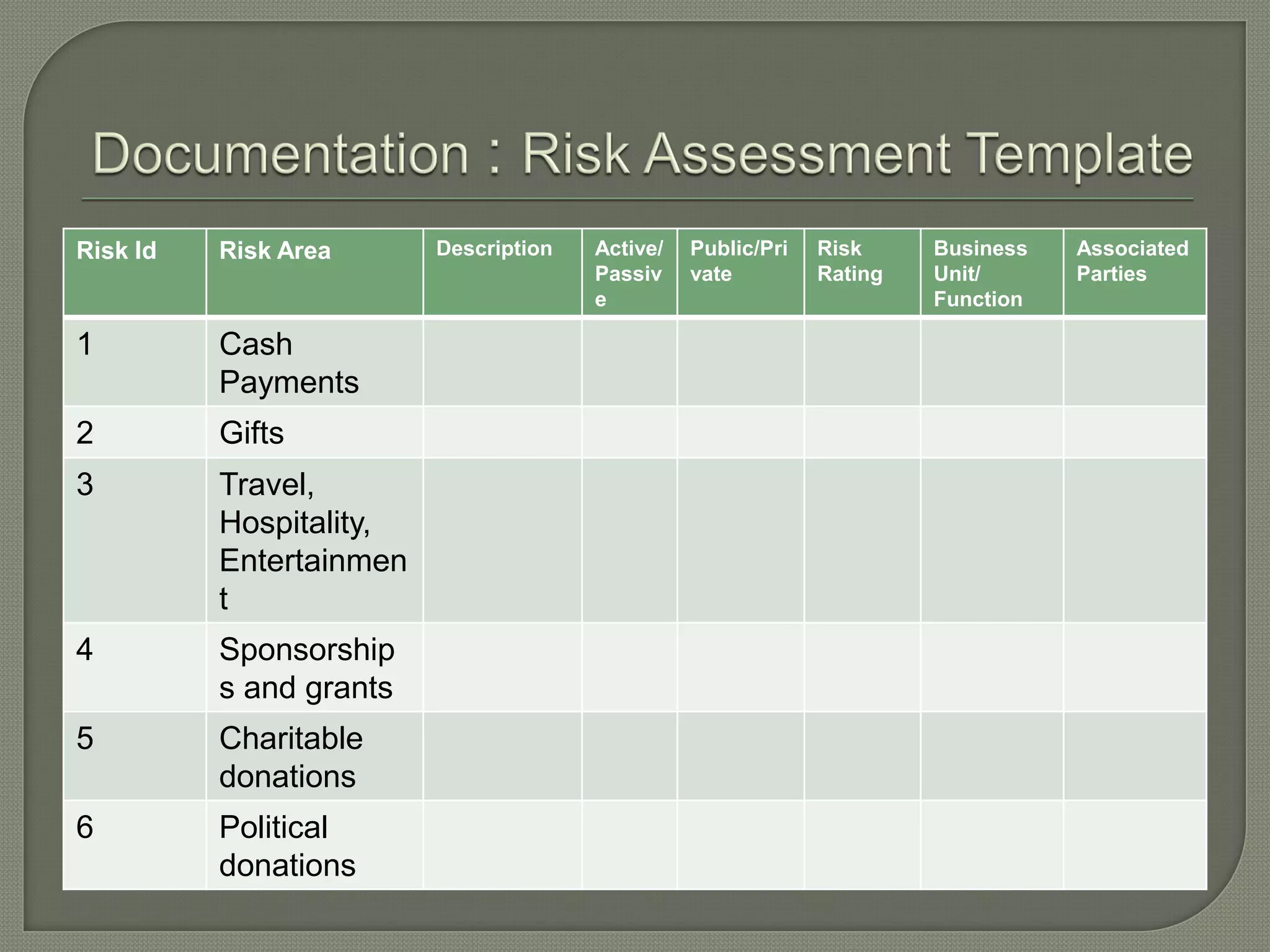

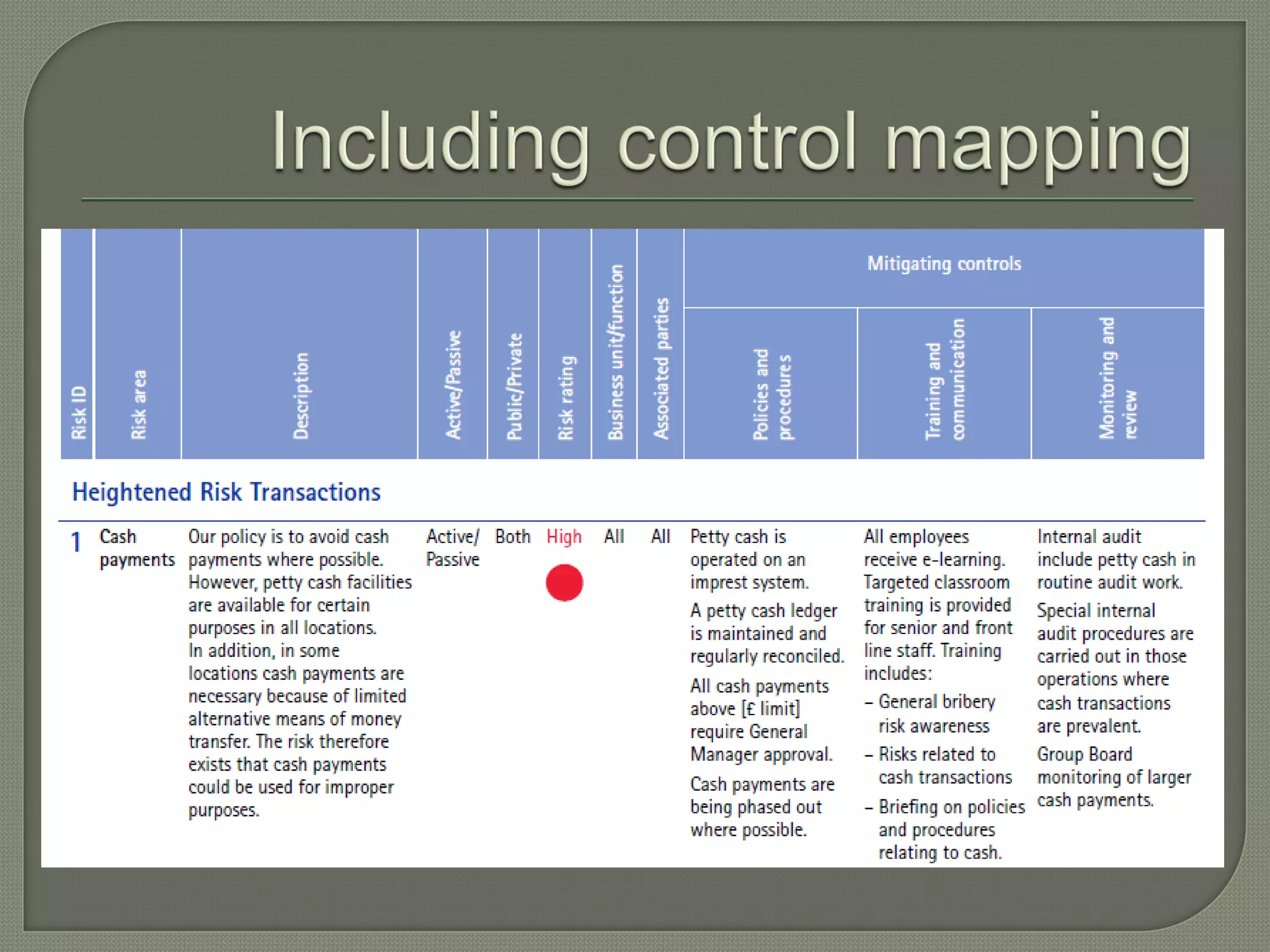

This document discusses the importance of conducting corruption risk assessments for companies operating in multiple jurisdictions. It notes that both the UK Bribery Act and US Foreign Corrupt Practices Act (FCPA) guidance emphasize assessing risks, as one-size-fits-all compliance programs are ineffective. The document provides examples of internal and external information sources to consult during risk assessments, as well as categories of risk like country, sectoral, transactional, and business partnership risks. It also discusses approaches to identifying, analyzing, and responding to identified risks.