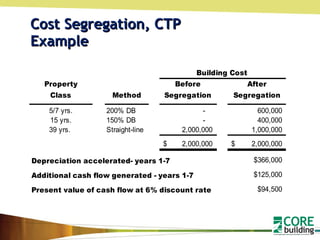

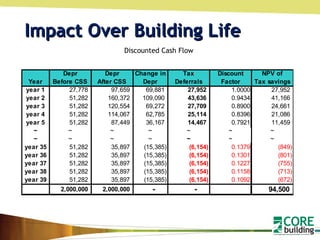

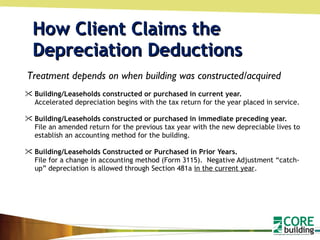

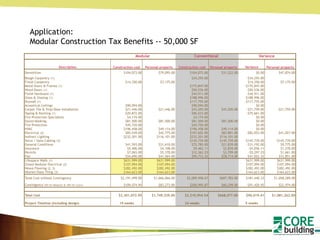

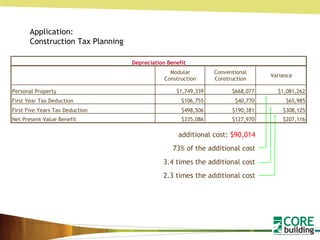

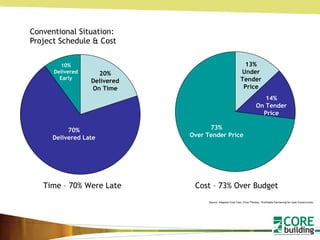

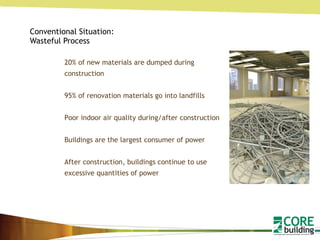

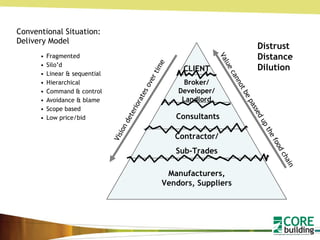

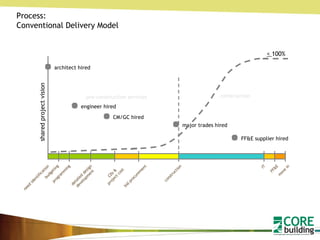

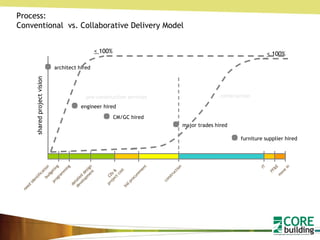

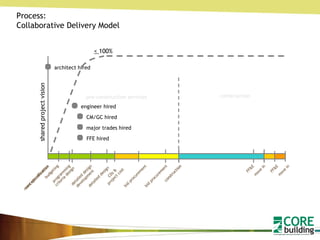

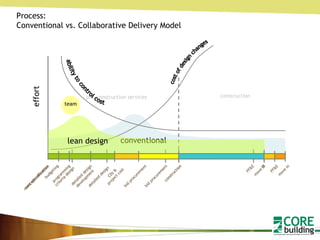

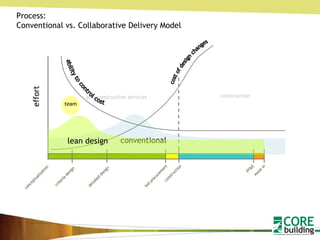

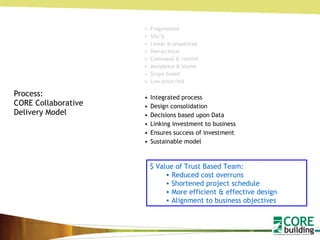

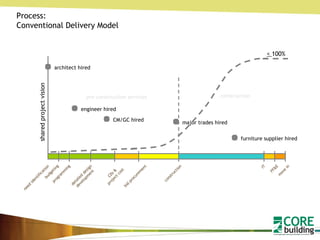

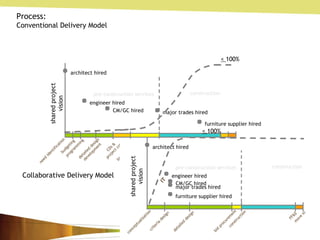

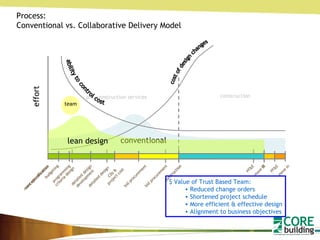

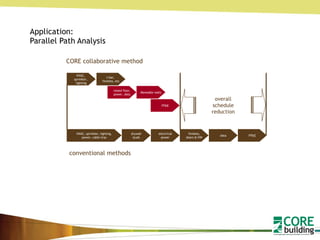

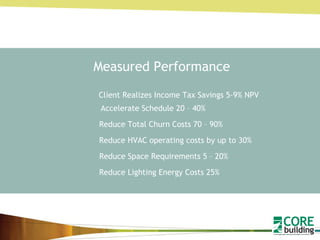

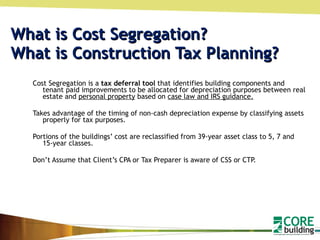

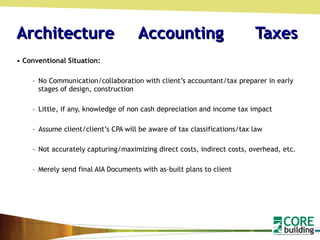

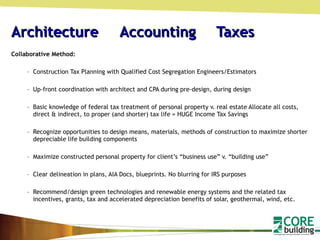

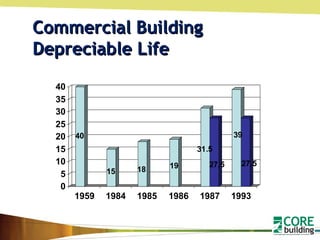

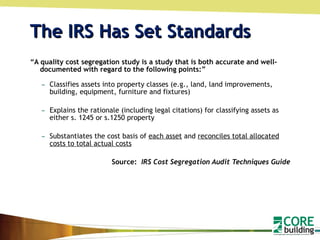

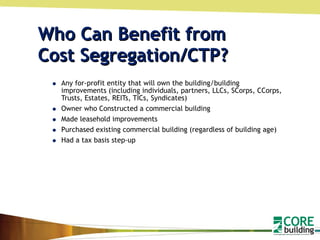

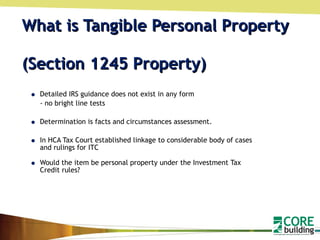

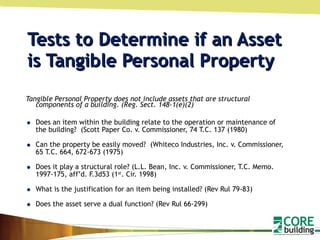

The document discusses the conventional and collaborative approaches to construction project delivery. Under the conventional approach, 70% of projects are late and 73% are over budget. The collaborative approach aims to integrate stakeholders early, reduce costs by up to 17%, and accelerate schedules by 20-40% through improved communication and coordination. Cost segregation studies identify which construction costs can be allocated to faster depreciation timeframes, providing tax savings for building owners.

![Favorable Tax Changes Renewable Energy Investment Federal Income tax 5-Year class life and accelerated benefit for solar, wind, geothermal. (Instead of 39 Year life). Bonus Depreciation 30% from 9/11/01 to 5/5/03, 50% from 5/6/03 to 12/31/04, and 50% for 2008 and 2009, 2010. Section 179 Deduction . Increased from $25,000 in 2002 to $250,000 for 2008 and 2009-10. Section 481(a). Section 481(a) deductions not taken in previous years can be taken in the year of change. [Rev. Proc. 2002-19] Automatic Consent for change the method of accounting. [Rev Proc 2002-9] 5-year NOL Carryback available for 2008 and 2009 returns.](https://image.slidesharecdn.com/corecpepresentationaia-1298034871233-phpapp02/85/CORE-AIA-Presentation-39-320.jpg)