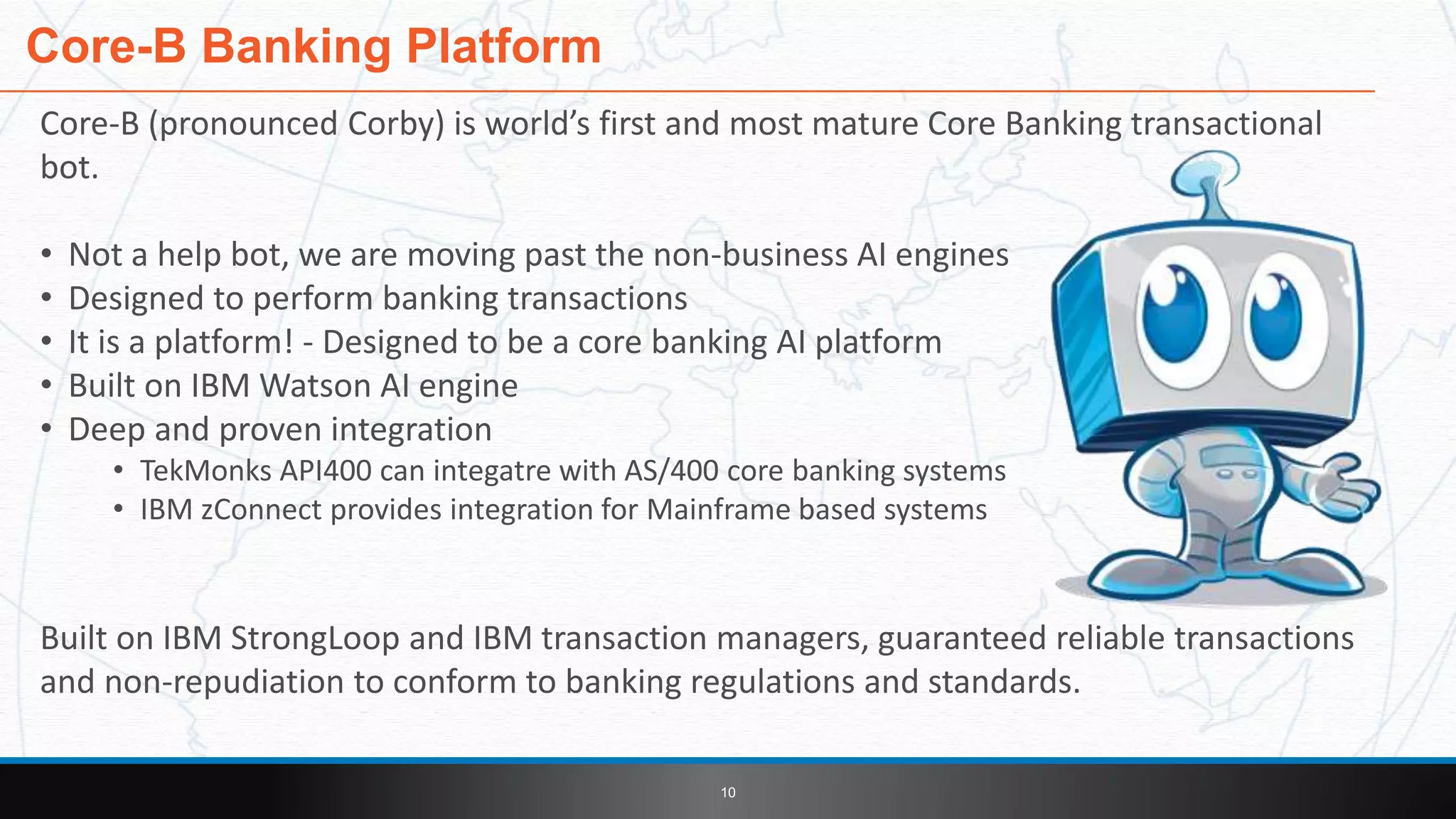

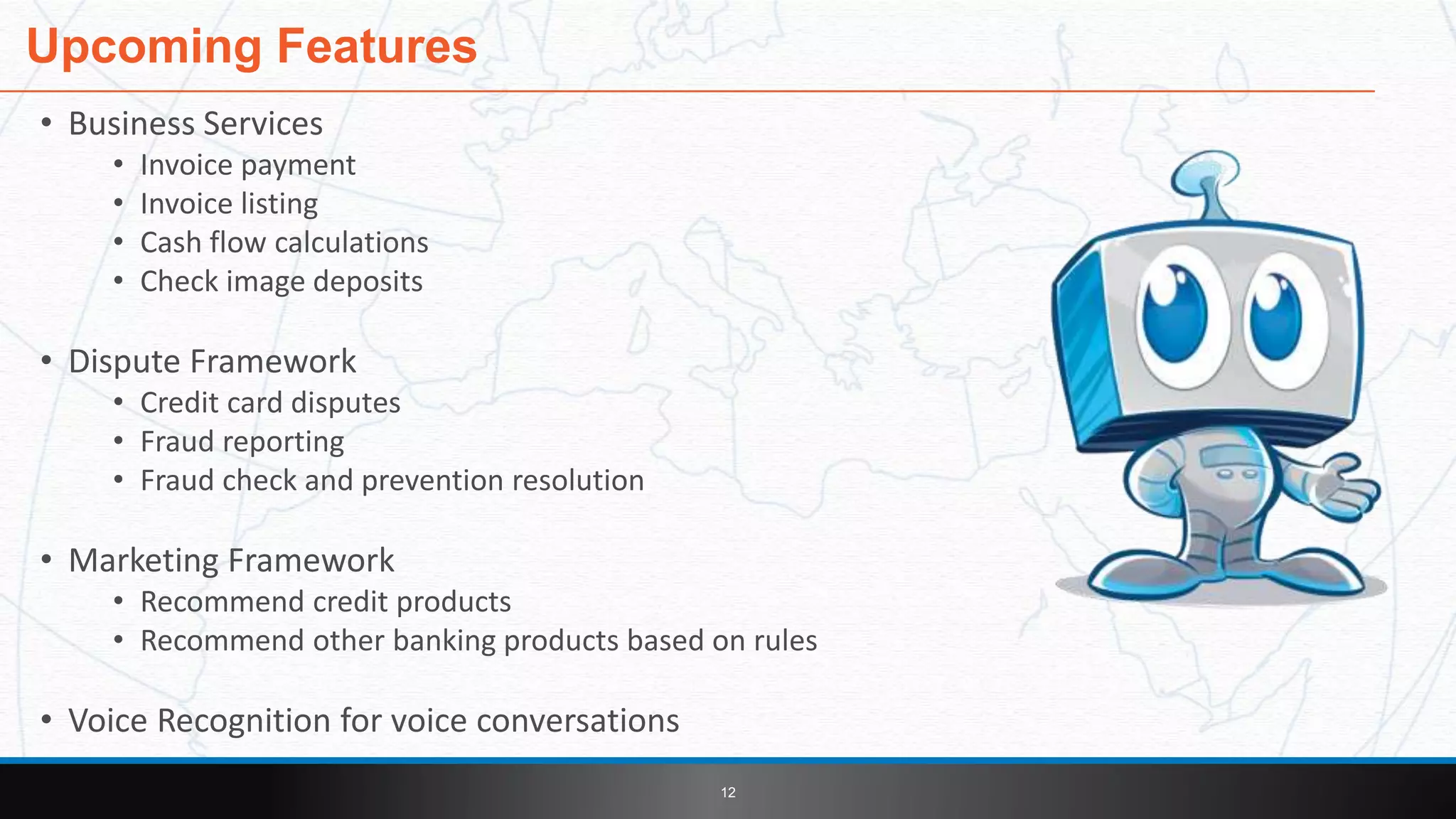

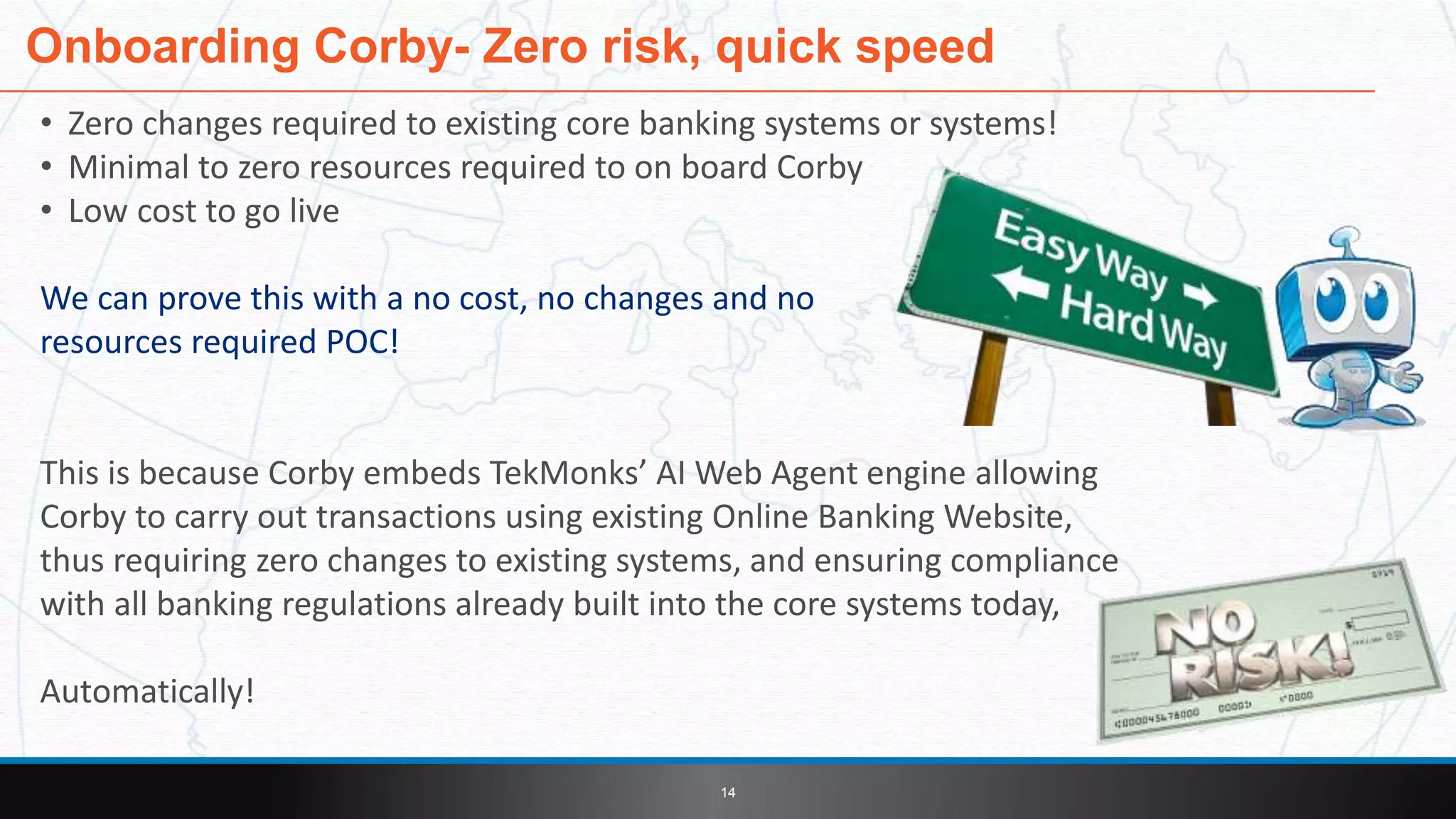

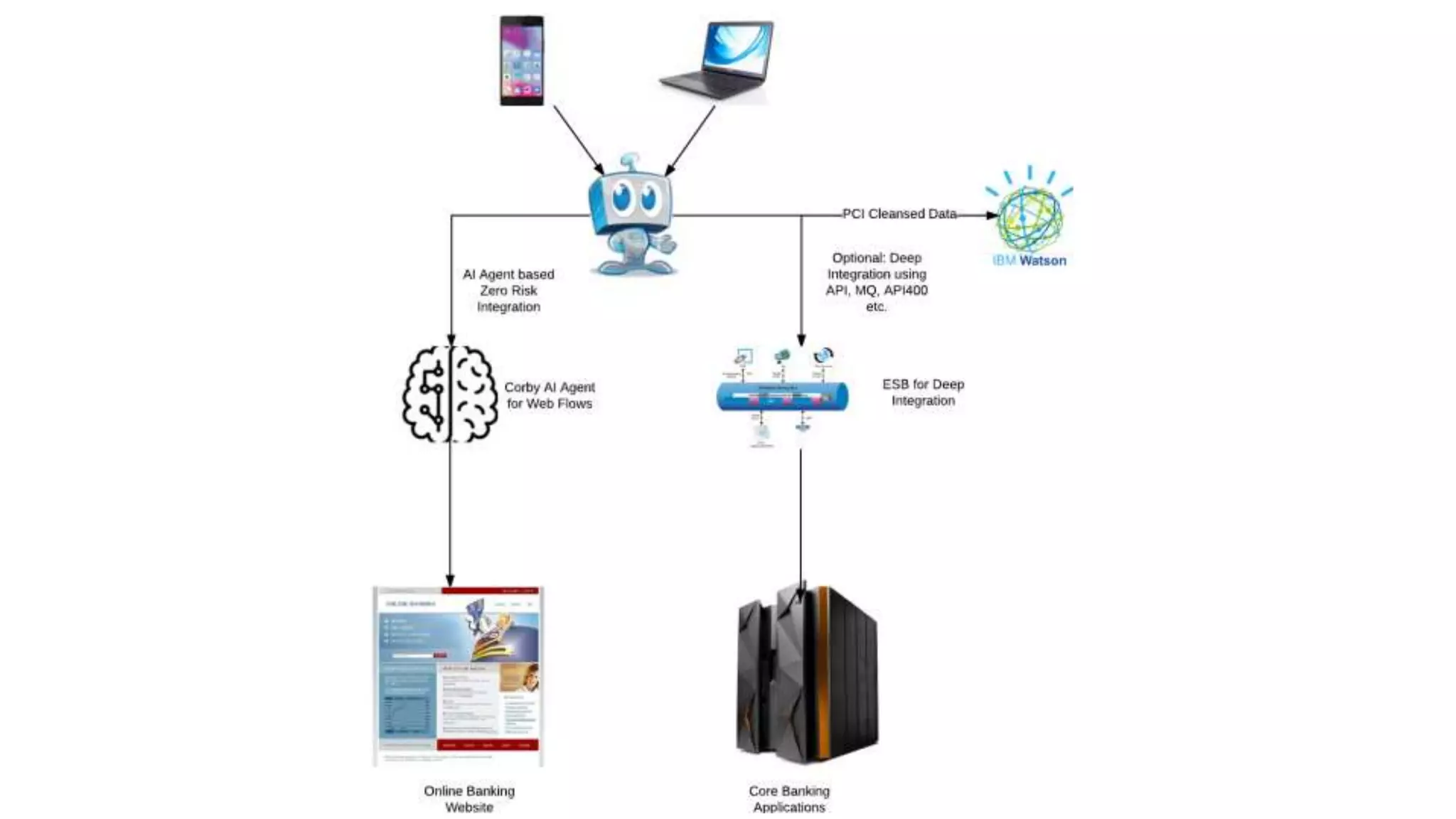

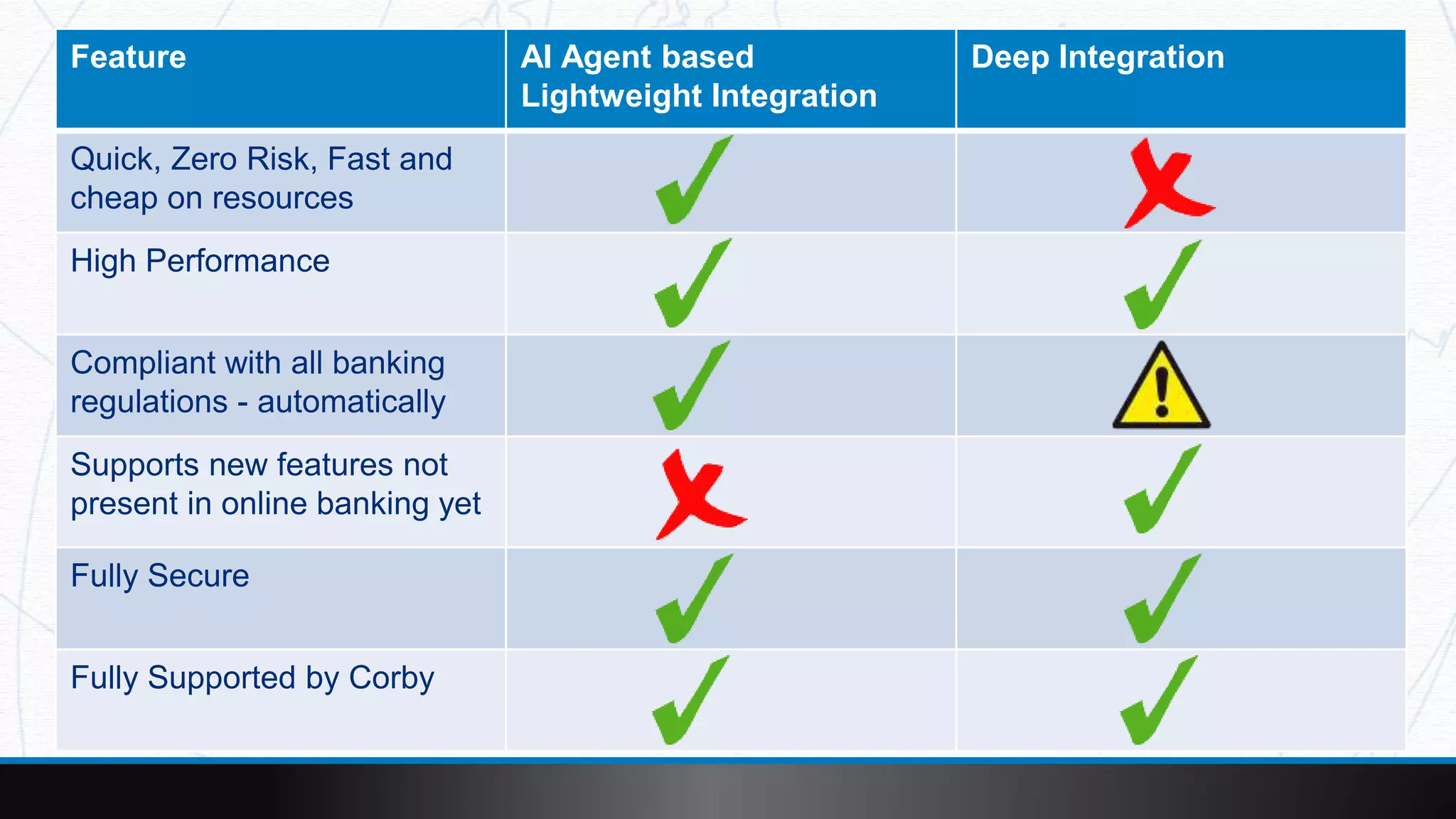

TekMonks Corby is the world's first core banking AI bot, designed to integrate into existing banking systems and facilitate secure transactions using IBM's Watson AI engine. It aims to revolutionize the banking industry by implementing advanced features like multi-factor authentication and compliance with banking regulations. The platform offers a seamless onboarding experience with zero changes to existing systems, enabling banks to leverage high-performance, AI-driven banking solutions rapidly.