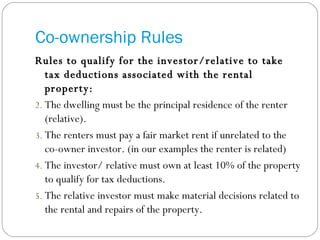

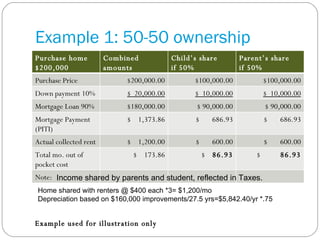

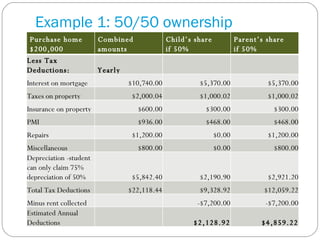

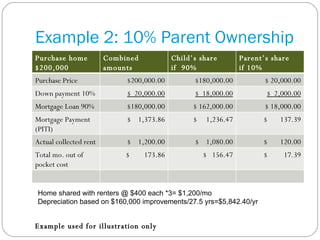

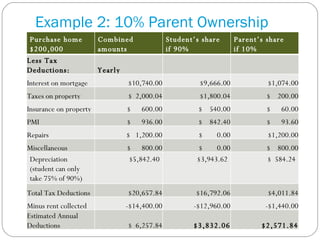

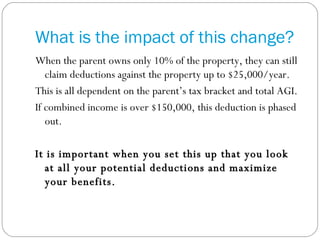

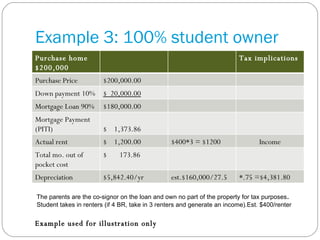

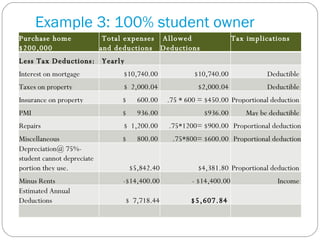

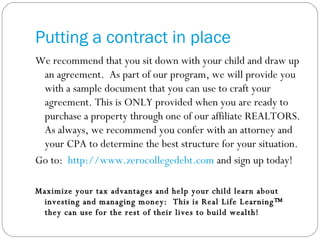

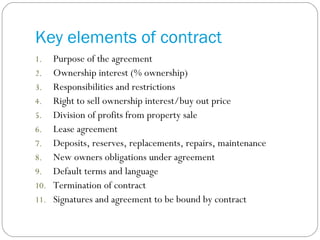

This document discusses different co-ownership structures for property purchased through the Zero College Debt Program. It provides examples of 50/50 ownership and 10% parent ownership, comparing tax implications. For maximum deductions, the student should own 100% but parents can co-sign loans. A legal contract outlining roles and responsibilities is recommended to formalize co-ownership arrangements. Consultation with tax and legal experts is advised to determine the best structure.

![Contact Information: Terry J. Toomey The Zero College Debt Program™ Austin, TX [email_address] or http://www.zerocollegedebt.com and go to Sign Up Developed in cooperation with: Kevin Ruff CPA, Greenville, SC [email_address] http://www.ruffcpa.com Thank you for your participation. © 2009 Copyright ZCD Properties Inc. All Rights Reserved](https://image.slidesharecdn.com/coownershipandsharedequityarrangements-12499300198801-phpapp03/85/Co-Ownership-And-Shared-Equity-Arrangements-15-320.jpg)