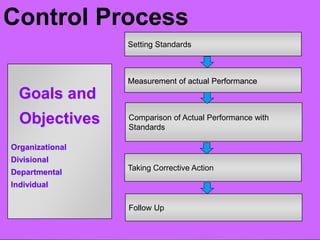

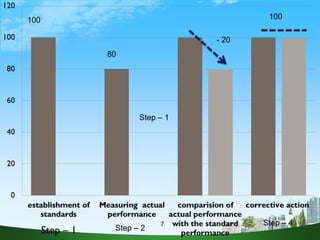

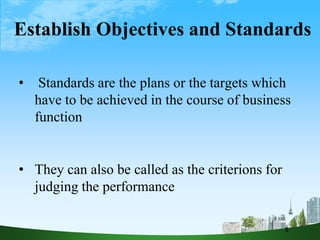

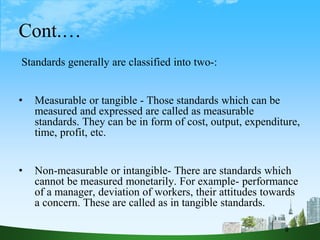

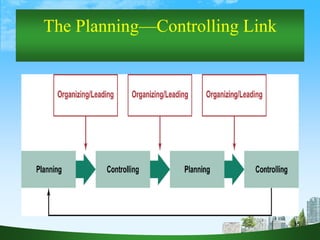

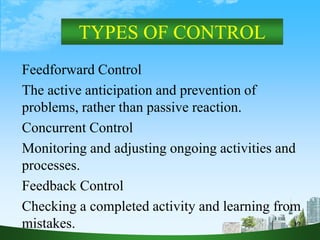

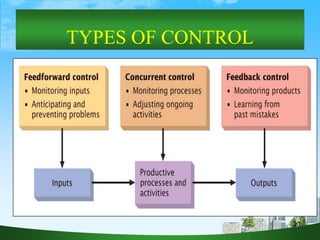

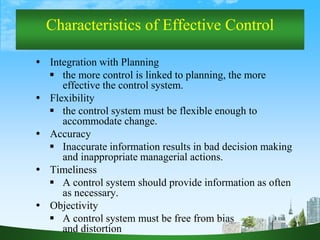

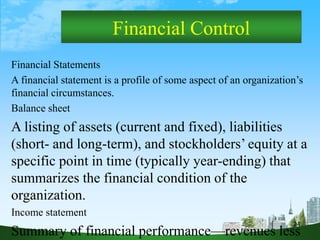

Controlling is the process of evaluating and regulating ongoing activities to ensure organizational goals are achieved. It provides indications of performance and a mechanism to adjust performance to keep organizations moving toward their goals. Controlling evaluates physical, human, information, and financial resources. The control process involves setting standards, measuring actual performance, comparing results to standards, identifying deviations, taking corrective actions, and follow up. Planning and controlling are interrelated functions that reinforce each other. Controls can occur at strategic, tactical, and operational levels and can take the form of feedforward, concurrent, or feedback controls. Effective control systems are integrated with planning, flexible, accurate, timely, objective, and use techniques like financial controls, budgetary controls, and structural controls