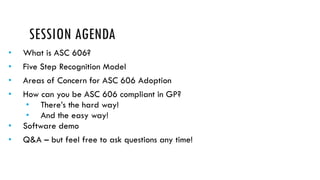

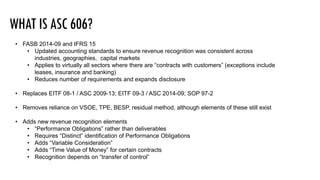

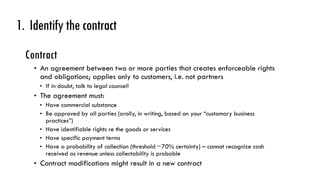

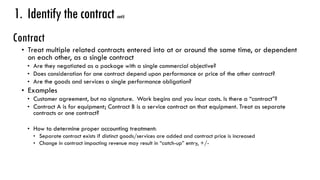

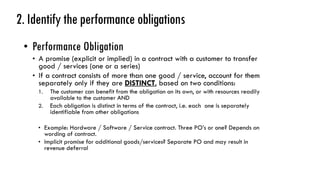

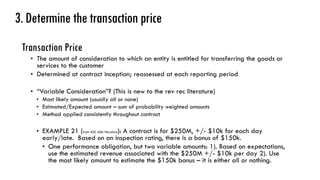

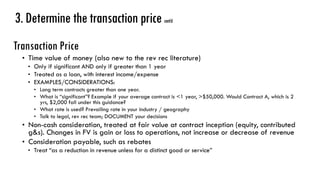

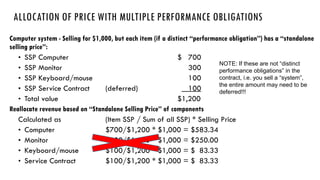

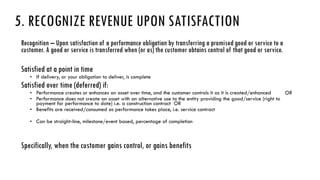

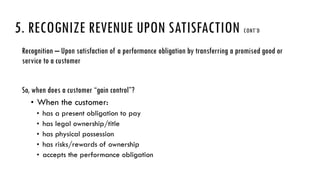

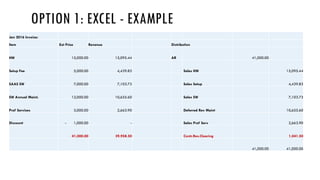

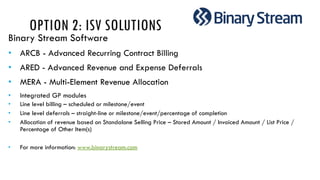

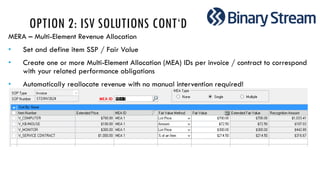

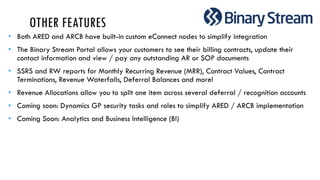

This document provides an overview of the new revenue recognition standards ASC 606 and IFRS 15. It summarizes the 5 steps to comply with the standards: 1) identify contracts with customers, 2) identify performance obligations, 3) determine transaction price, 4) allocate price to obligations, and 5) recognize revenue upon satisfaction. It then discusses options for complying with the standards in Dynamics GP, including using Excel or a third party application to perform the required calculations and revenue allocation.