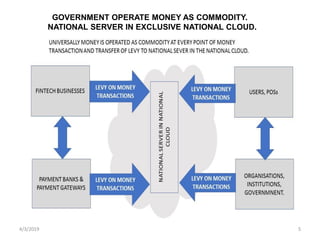

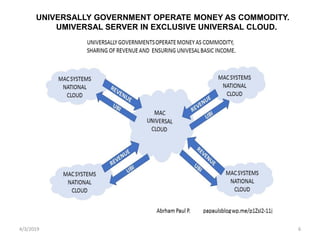

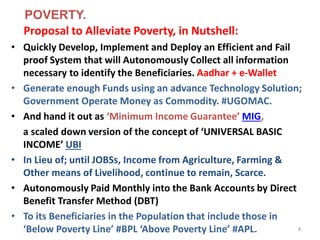

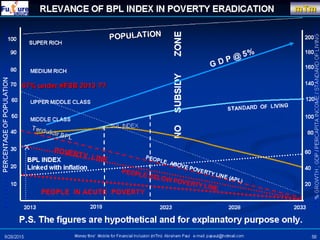

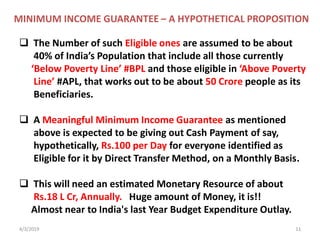

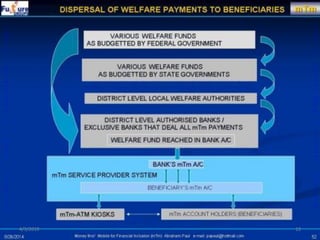

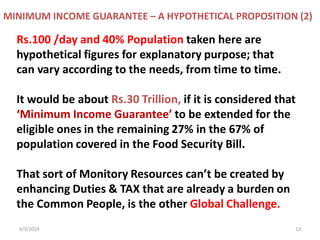

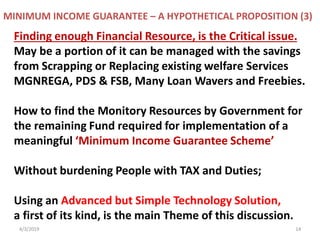

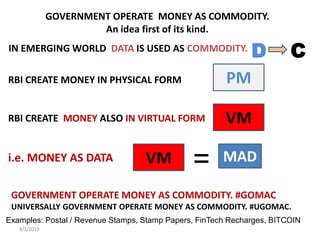

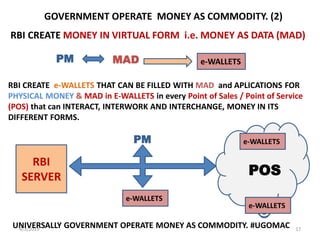

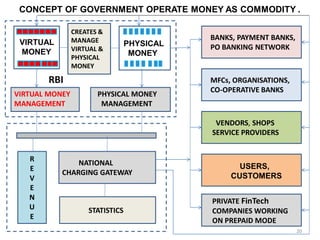

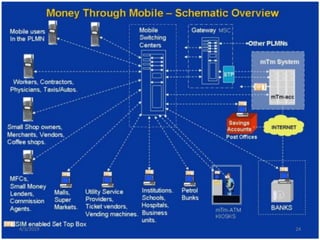

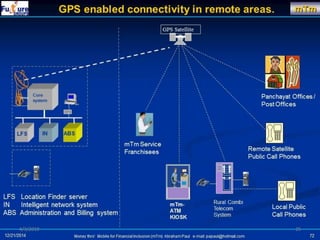

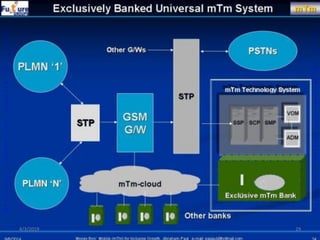

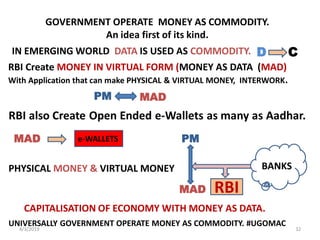

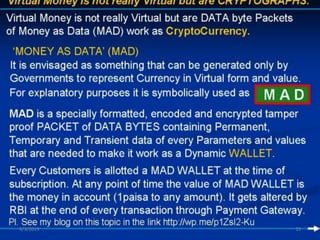

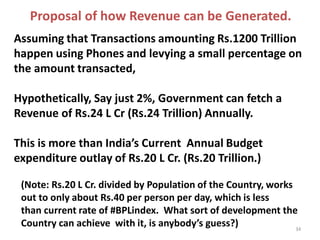

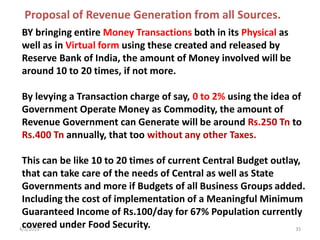

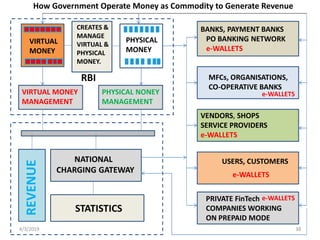

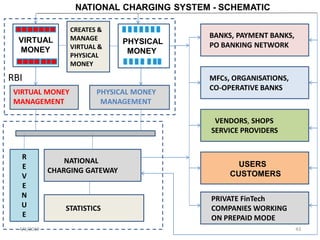

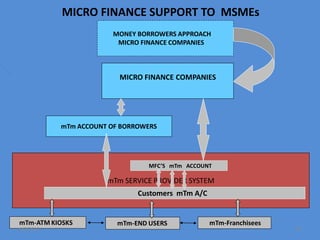

The document addresses contemporary global challenges including poverty, corruption, and the need for advanced cyber security. It proposes a Minimum Income Guarantee (MIG) to alleviate poverty by providing direct cash transfers to low-income citizens, while exploring the concept of governments operating money as a commodity through digital technology. The document ultimately aims to generate sufficient revenue for sustainable welfare programs without increasing tax burdens, suggesting a shift to virtual monetary systems managed by central banks.