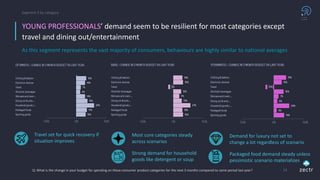

A survey of 900 consumers across Beijing, Shanghai, and Guangzhou revealed that the majority expect the coronavirus crisis to last 4-5 months, significantly impacting consumer sentiment and spending behavior. Brands that demonstrate support for China during this time are more likely to maintain customer loyalty, with spending remaining consistent despite category variances. Consumer segments exhibit distinct preferences and priorities, with potential rapid recovery opportunities if the situation improves.