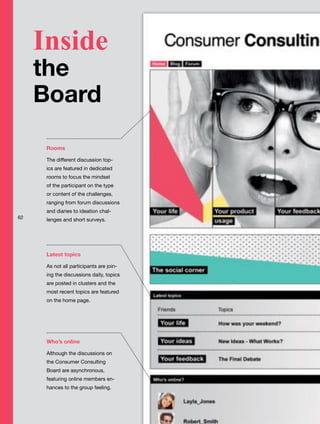

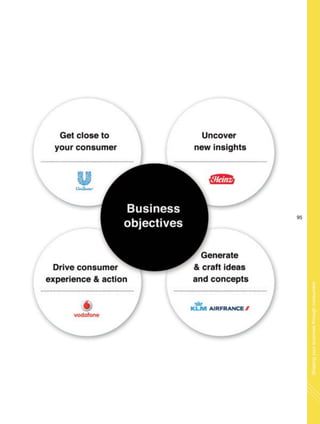

This document provides an introduction to a book about Consumer Consulting Boards. It discusses how InSites Consulting has been a pioneer in online research communities since 2006. It notes that communities are becoming one of the most popular research methodologies. The book shares learnings from over 600,000 conversations InSites has facilitated. It aims to provide guidance on how to set up successful communities to collaborate with consumers and make business decisions. The 5 chapters will discuss adapting to empowered consumers, best practices for communities, case studies, considerations for different cultures, and future trends. The document acknowledges the many contributors to the book.