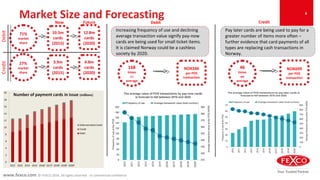

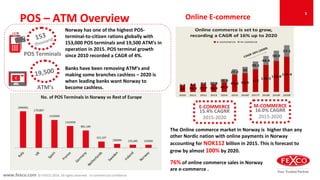

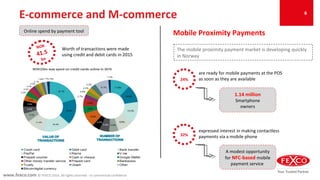

Norway's payment card usage is high, with only 6% using cash daily and a significant adoption of contactless cards. E-commerce is thriving, with a notable increase in online spending projected to double by 2020, and a strong preference for cashback incentives to attract customers. Norway is moving towards becoming a cashless society, with substantial investments needed to enhance payment infrastructure.

![www.fexco.com © FEXCO 2016. All rights reserved - In commercial confidence

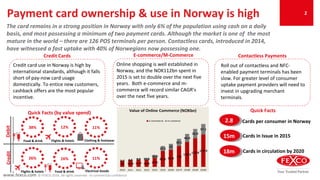

Payments Infrastructure 3

AcquirerIssuer

Top 3 Merchant Acquirers in Norway:

1.Swedbank

2.Nets

3.Handelsbanken

Nets acquired Nordea’s merchant acquiring

business in late 2015 making it the largest

merchant acquirer in Norway

Top 4 Card Issuers in Norway:

1.DNB [5.1m cards]

2.Sparebank 1 Gruppen [3.5m cards]

3.SEB Kort [0.9m cards]

4.Nordea [0.9m cards]

Schemes

Visa handles all foreign transactions on

behalf of Bank Axept – the sole issuer of

debit cards in Norway explaining the

popularity of Visa

Top 4 Card Schemes in Norway:

1.Visa [6.2m cards]

2.Bank Axept [5.3m cards]

3.Mastercard [2.7m cards]

4.American Express [0.4m cards]

60%

of all cards

in Issue (2015)

42%

18%

36% 34% 38%

DNB Market Share

Debit card Credit card Charge/deferred](https://image.slidesharecdn.com/consumerpayments-norway-161011110204/85/Consumer-Payments-Country-Snapshot-3-320.jpg)