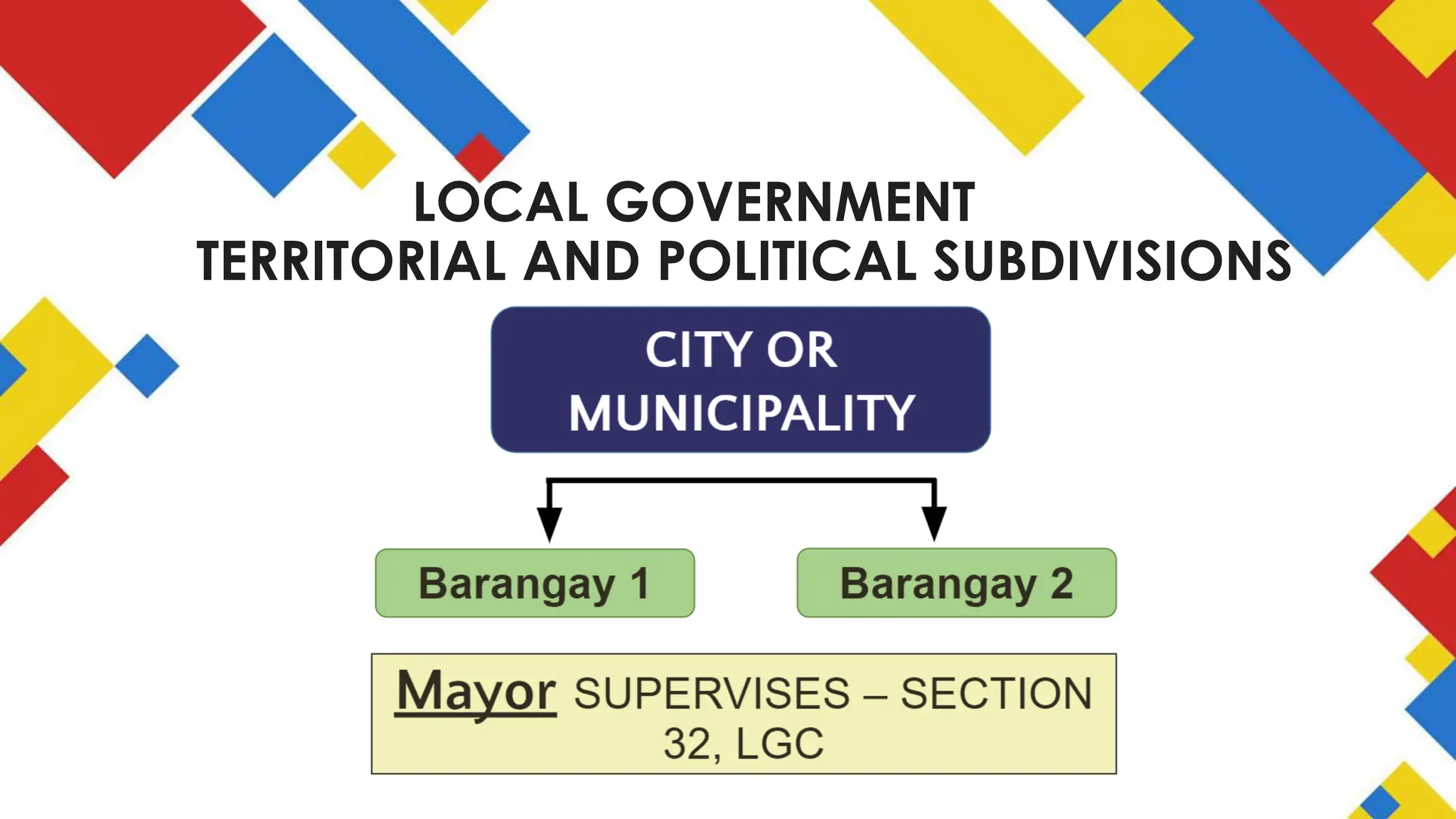

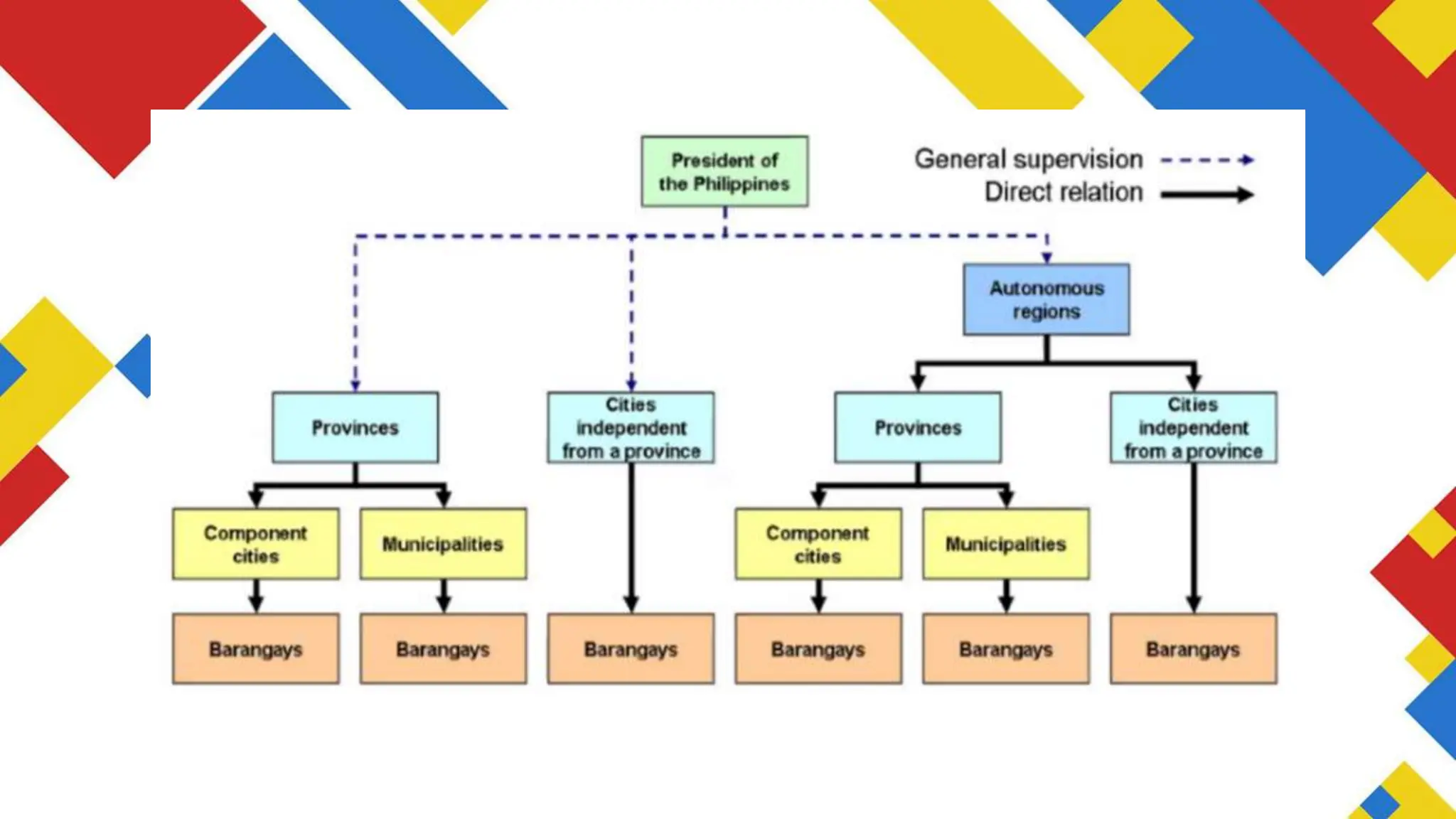

The document discusses local autonomy in the Philippines as established by the 1987 Constitution. It outlines how the Constitution established a system of territorial and political subdivisions with autonomous local governments. It also discusses how a Supreme Court ruling, known as the Mandanas-Garcia case, impacted the allocation of national taxes to local governments by expanding the definition of taxes that are included in local governments' just share. To mitigate the fiscal impact, the national government issued an executive order to fully devolve certain functions to local governments.