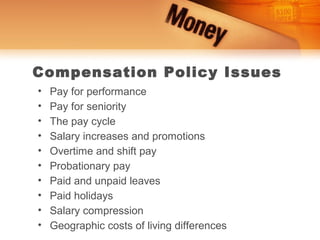

Determining pay rates involves considering several key factors:

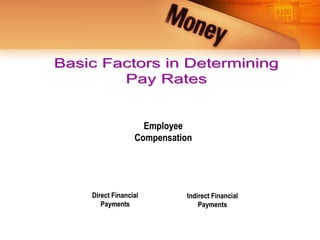

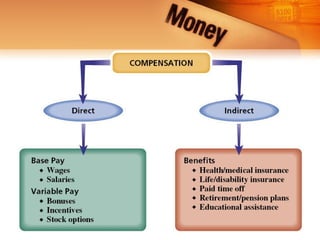

1) Employee compensation includes both direct financial payments like wages and salaries as well as indirect financial payments like benefits.

2) Pay can be based on time, such as hourly or salaried wages, or performance, such as commissions or bonuses.

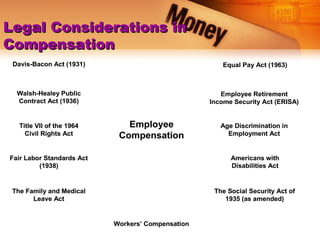

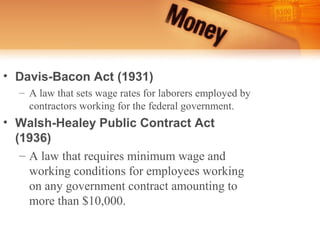

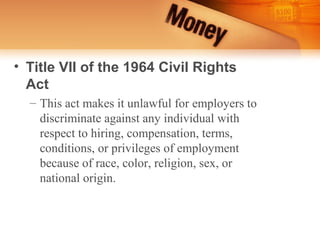

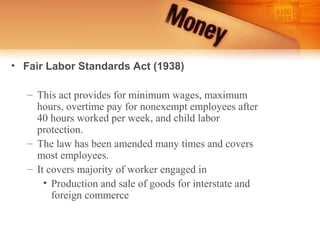

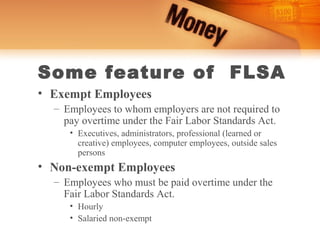

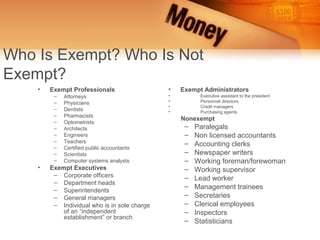

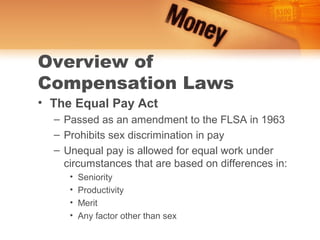

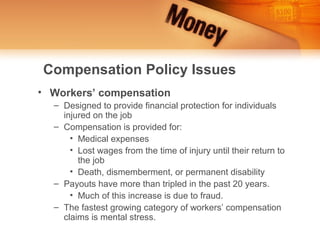

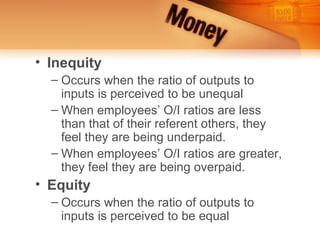

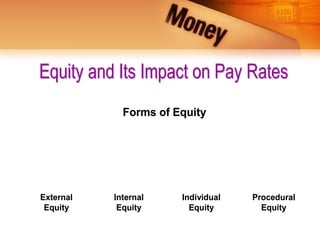

3) Many legal factors must be considered when determining pay rates, including laws around minimum wage, overtime, discrimination, benefits, and leave. Balancing pay equity both within and outside the organization is important.