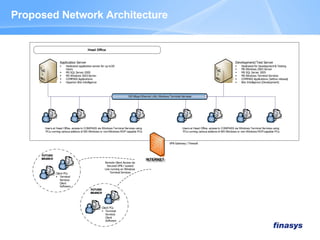

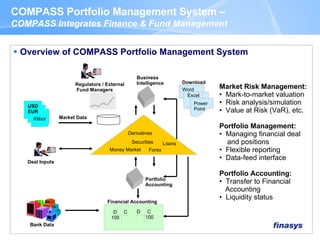

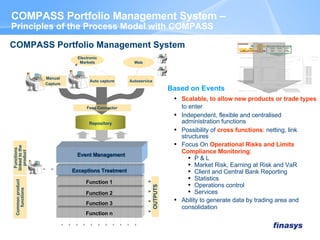

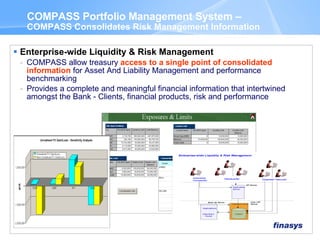

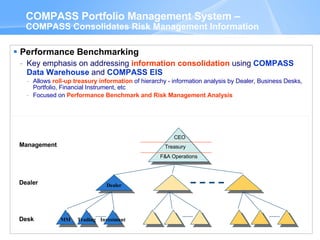

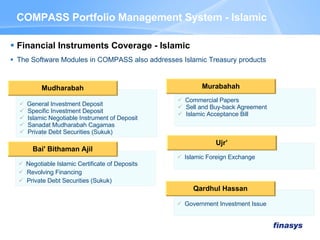

This document proposes implementing the COMPASS Portfolio Management System software solution for asset management companies. It provides an overview of the system's modules and functionality for integrated portfolio management, risk management, accounting, and reporting. Key features highlighted include support for conventional and Islamic financial instruments, a central data repository, and compliance with accounting standard IAS 39. Local implementation and long-term maintenance services are emphasized as benefits of the COMPASS solution.

![The products are exclusively distributed by Finasys in Vietnam. All copyright and intellectual property rights, without limitation, are retained by TriAset . More details , please contact Finasys sales team at [email_address] or landline (+84-4) 936-8623. http://www.finasys.vn Copyright](https://image.slidesharecdn.com/compass-portfolio-management-proposal-1217492629391400-9/85/Compass-Portfolio-Management-Proposal-33-320.jpg)