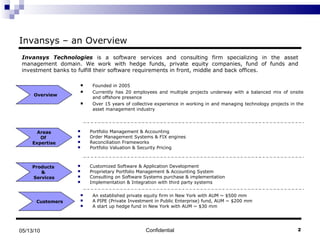

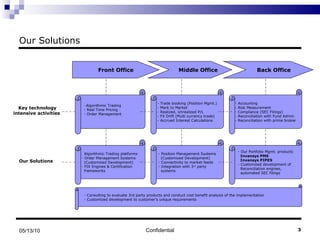

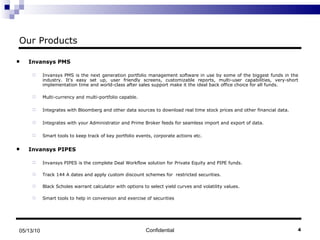

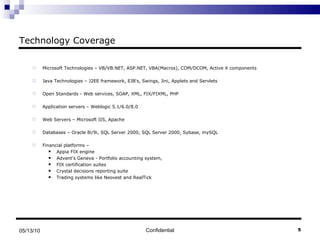

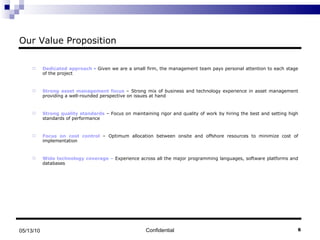

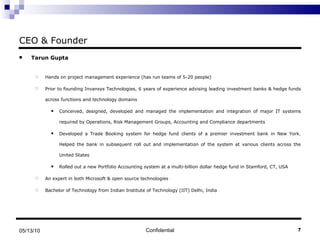

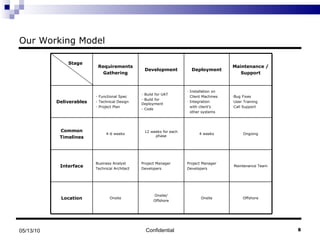

Invansys Technologies is a software services and consulting firm specializing in asset management. It was founded in 2005 and has 20 employees with experience working on technology projects for the asset management industry. Invansys provides services like portfolio management systems, order management, and customized software development for hedge funds, private equity firms, and investment banks.