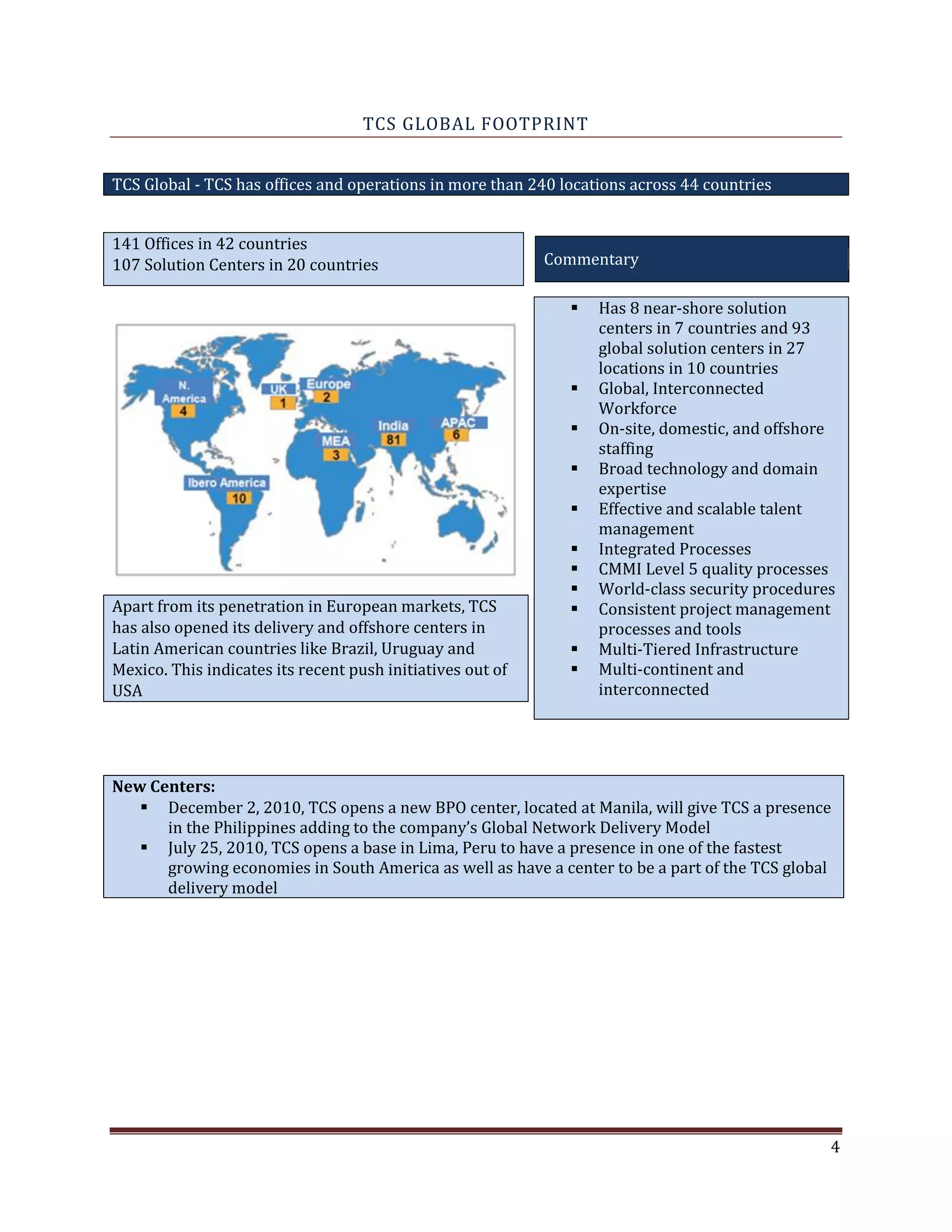

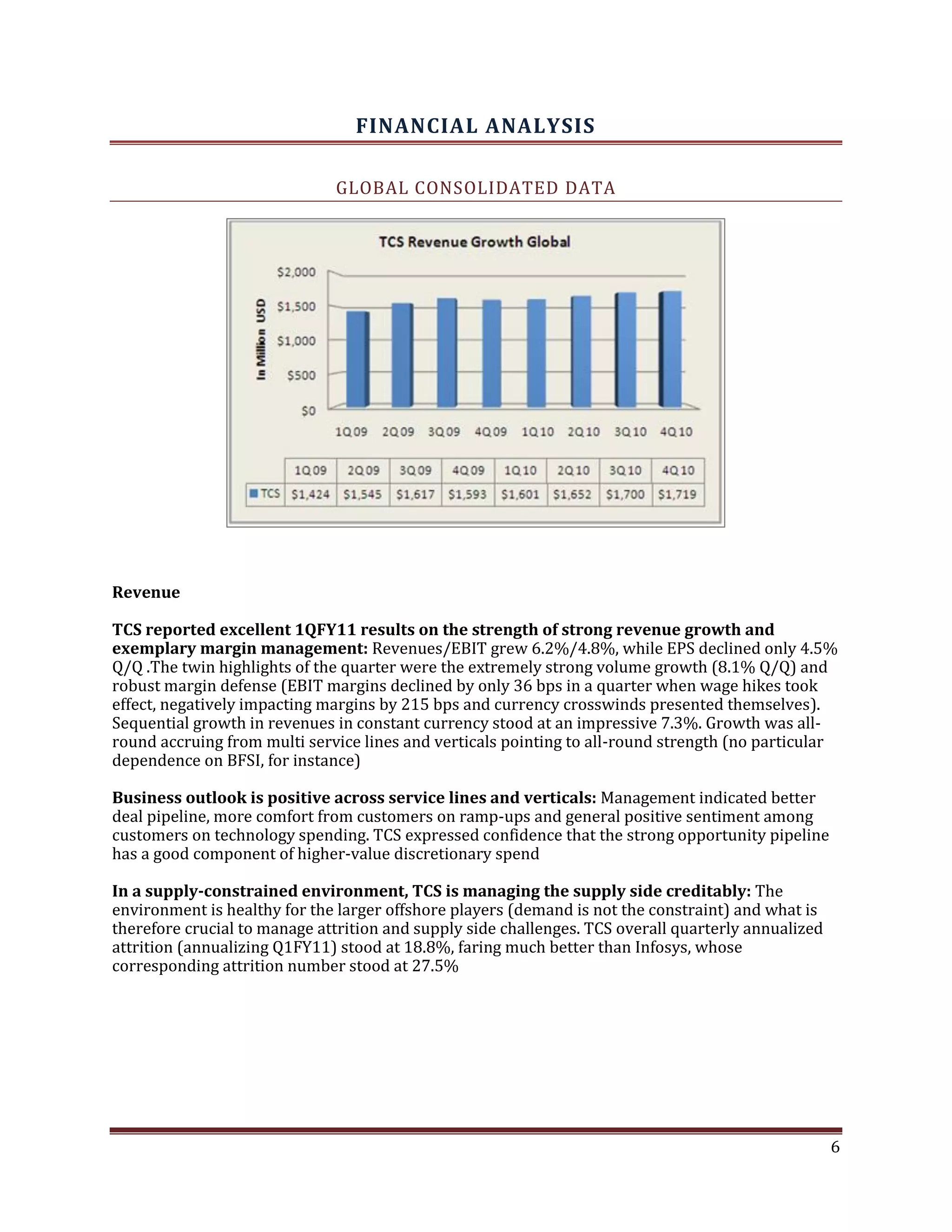

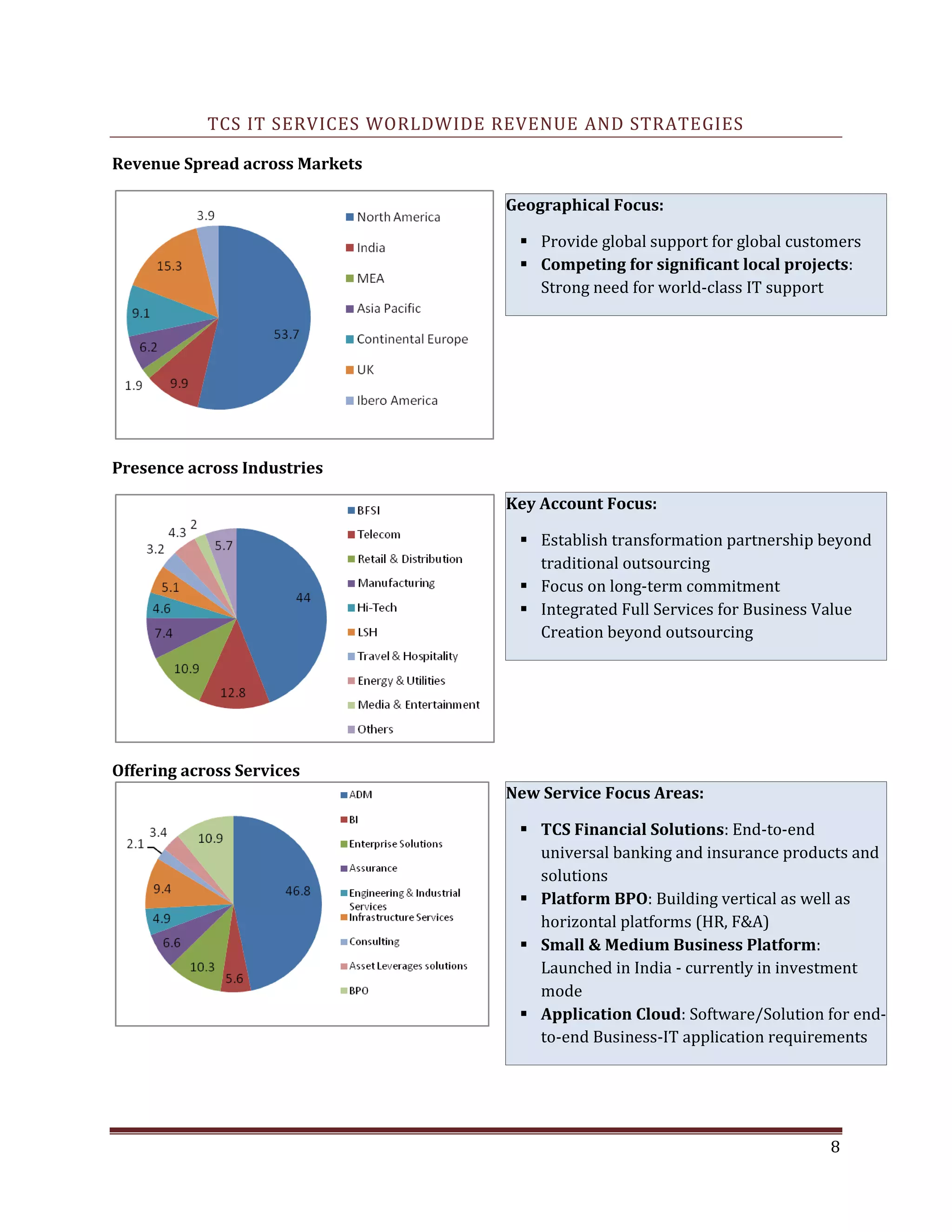

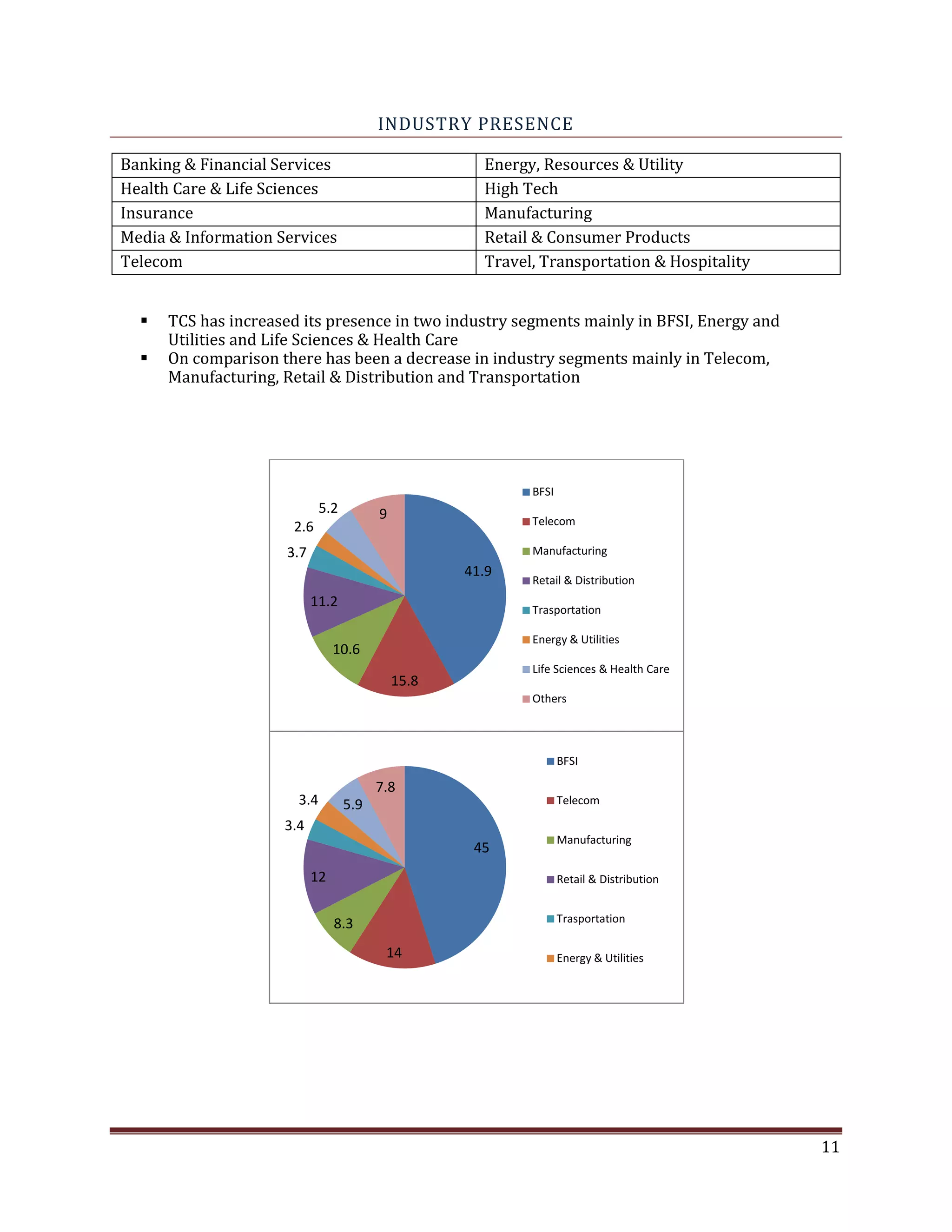

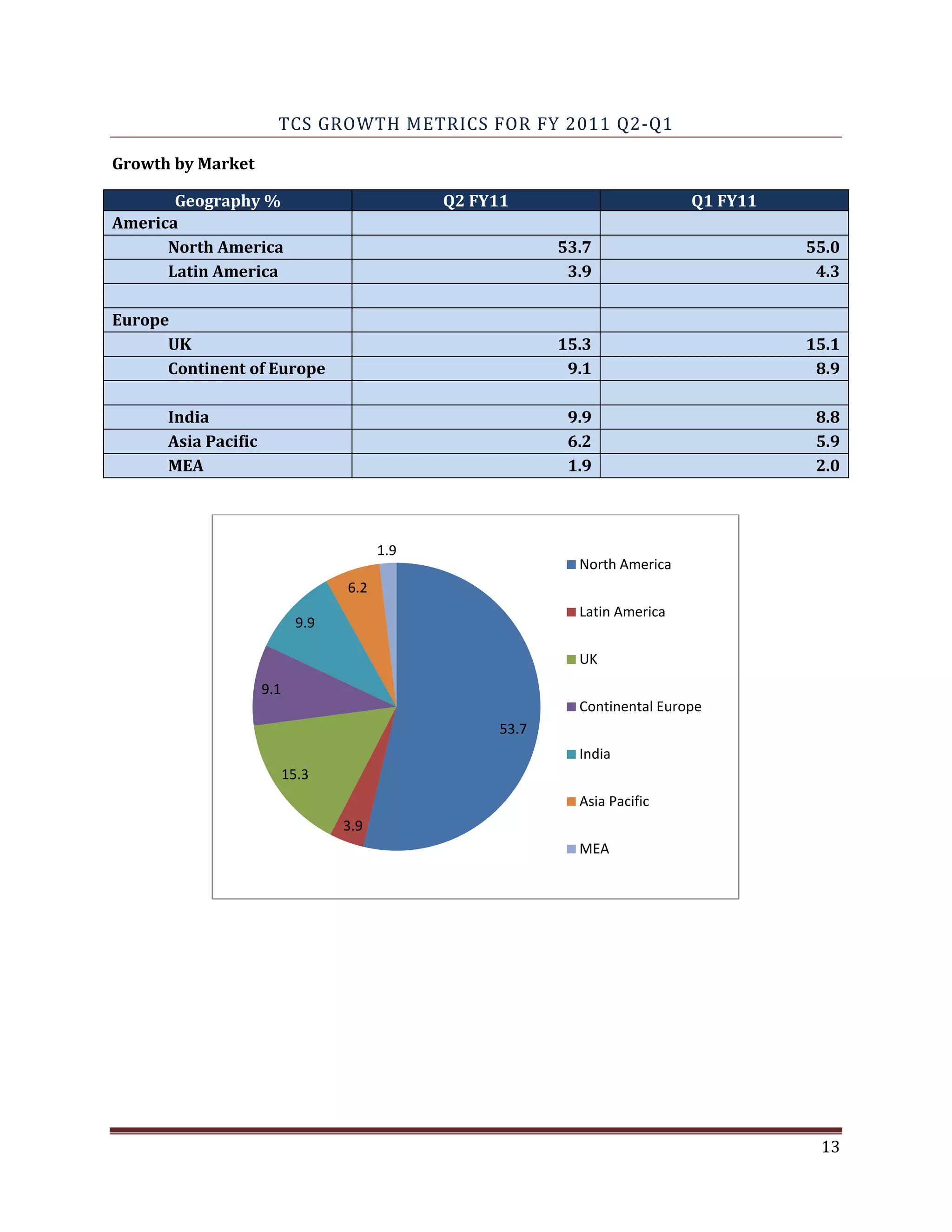

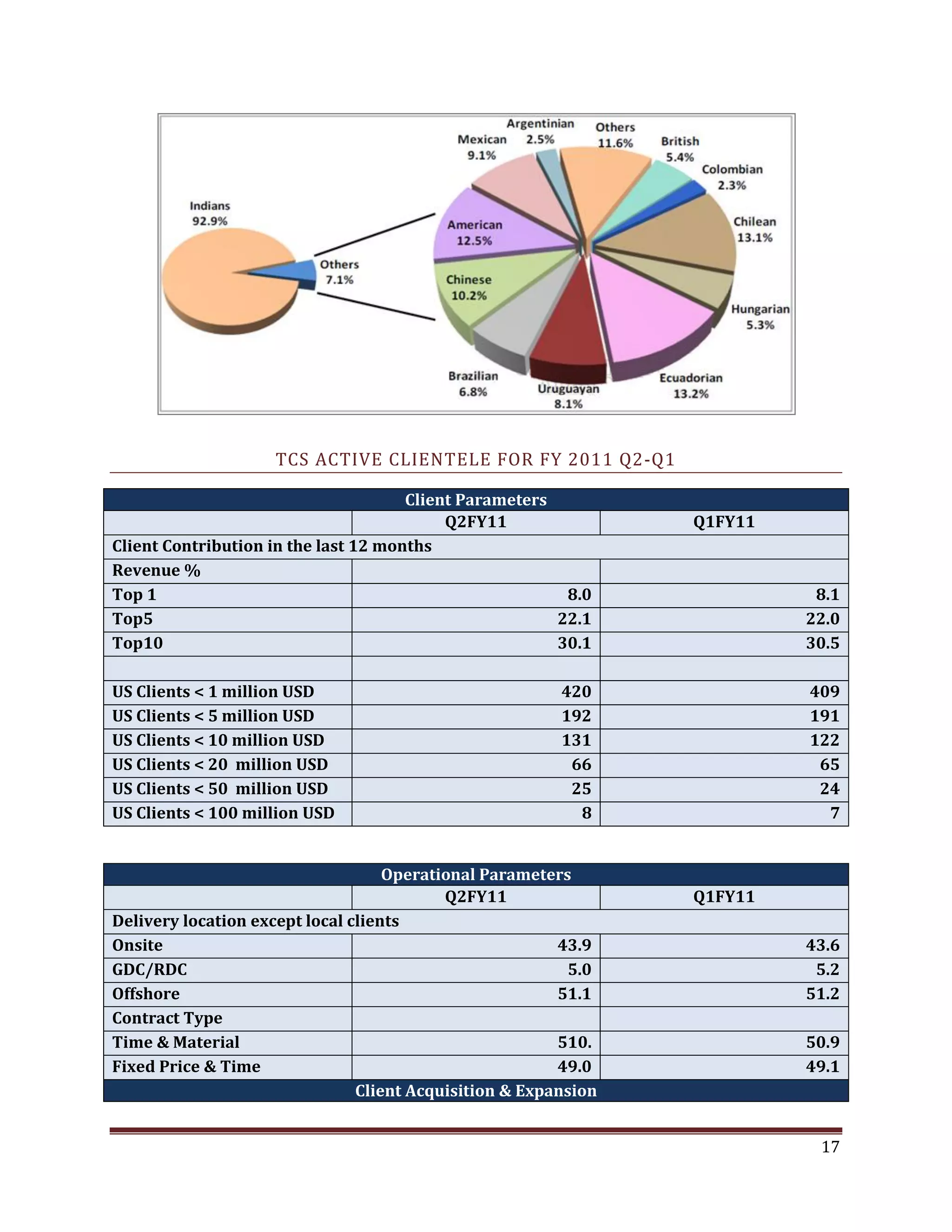

TCS has a large global footprint with offices and operations in over 240 locations across 44 countries. It has 141 offices in 42 countries and 107 solution centers in 20 countries. TCS has expanded its global delivery network through new centers and offices around the world, including in Latin America, to better serve multinational clients. Its global scale and interconnected workforce allow it to provide clients with on-site, domestic, and offshore resources that leverage its technology expertise and consistent processes.