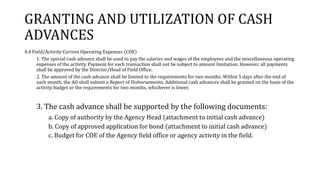

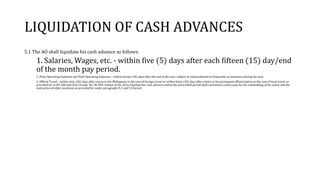

The Commission on Audit Circular No. 97-002 provides guidelines on cash advances for government financial operations, outlining the necessity for updates in regulations to enhance control over granting, utilization, and liquidation of advances. It distinguishes between regular and special cash advances and emphasizes adherence to legal purposes for cash usage. Strict protocols are established regarding cash disbursement, reporting, and accounting practices to prevent misuse or illegal expenditures.