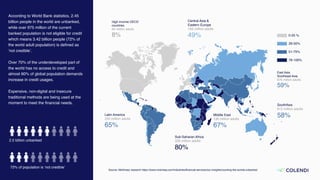

Colendi aims to provide accessible consumer credit solutions for the unbanked and underbanked populations, addressing the lack of financial services affecting 3.42 billion people globally. Utilizing innovative technology and user consented data, Colendi offers a transparent credit scoring system and various financial products without requiring traditional banking history. The platform is designed to disrupt a $4 trillion market by creating new financing opportunities for underserved individuals and businesses.