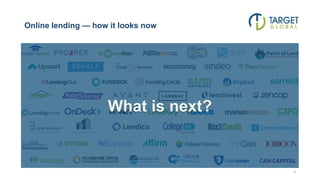

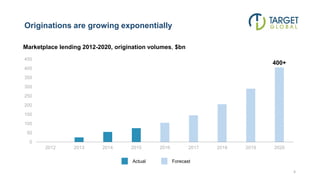

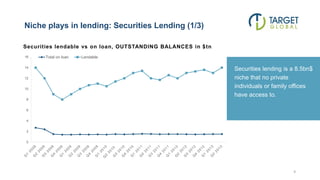

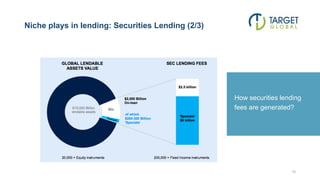

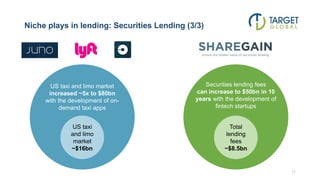

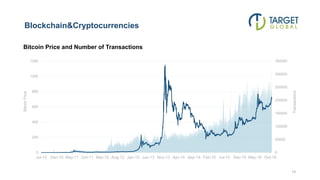

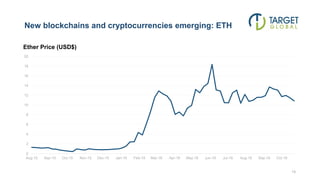

The document highlights investment trends in the fintech sector for 2017, emphasizing the growth of various platforms like online lending and insurance technology. It discusses the potential of niche markets, particularly securities lending and cryptocurrencies, while also detailing the activities of Target Global and Noah Advisors in facilitating investments. The document concludes with insights on the evolving landscape of fintech and the opportunities available for high net worth investors.