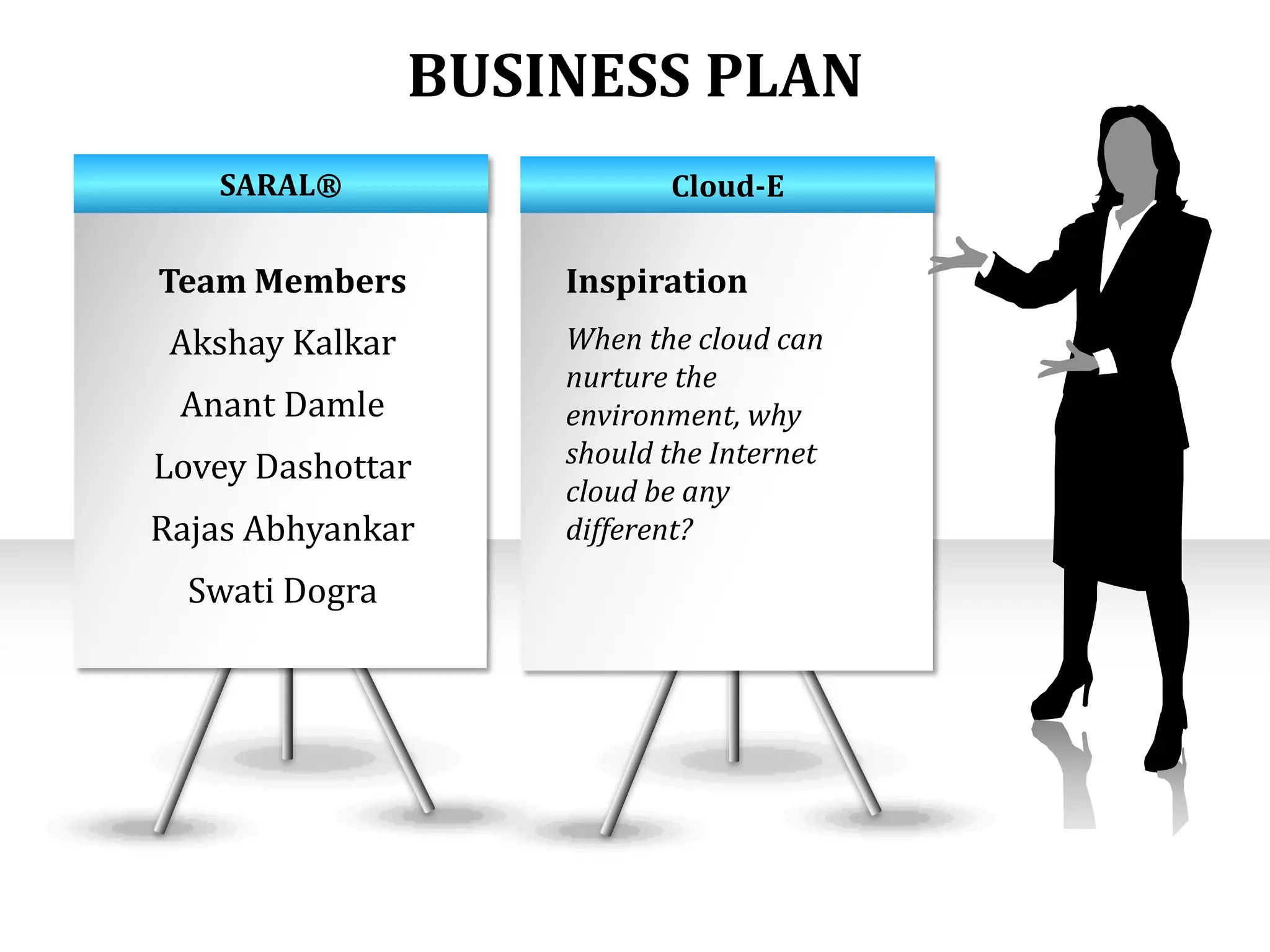

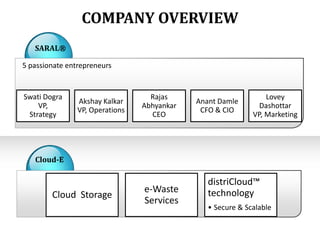

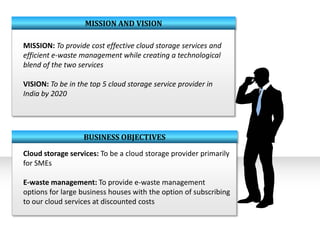

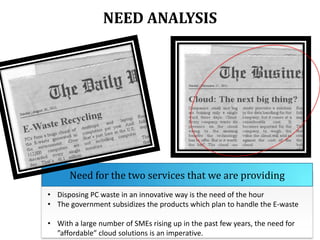

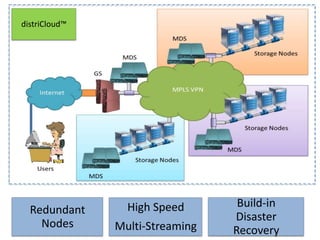

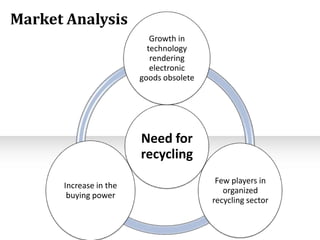

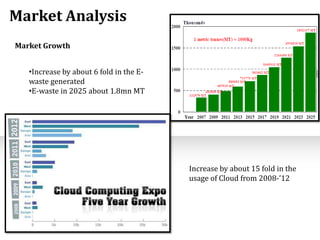

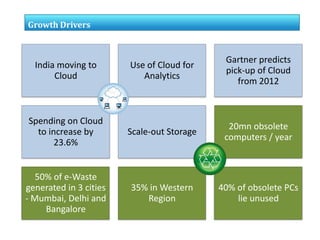

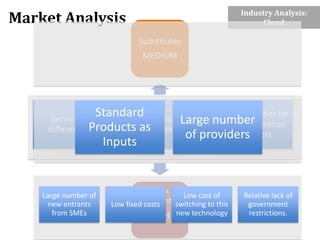

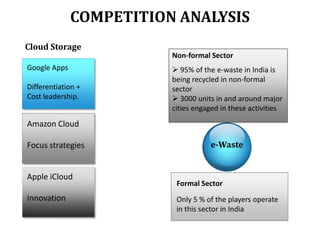

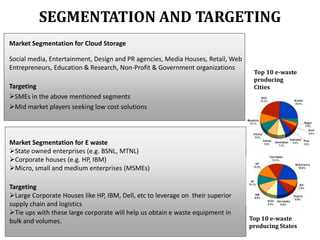

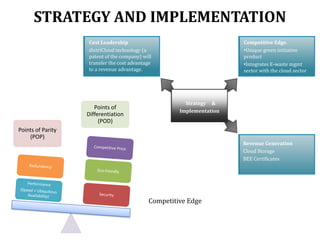

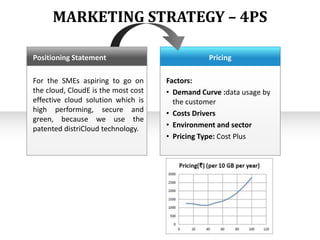

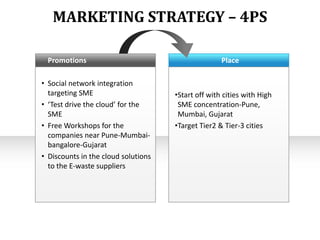

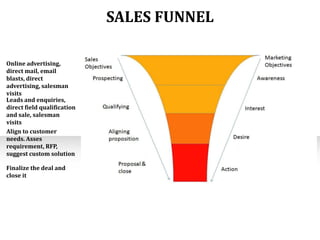

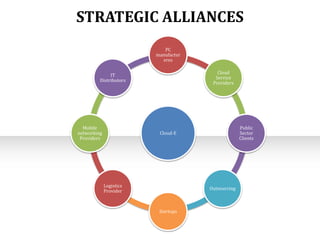

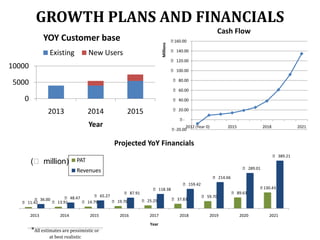

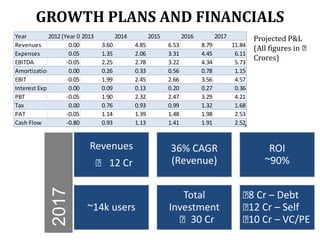

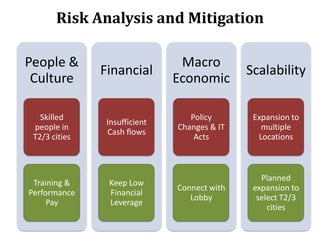

The document outlines a business plan for saral®, a company focused on providing cost-effective cloud storage and e-waste management services in India. It details the company's mission, objectives, market analysis, competition, and growth plans, emphasizing the need for affordable cloud solutions for SMEs and innovative e-waste disposal methods. The company aims to leverage its patented technology, districloud™, to achieve a competitive edge while targeting large corporate clients and environmentally conscious customers.