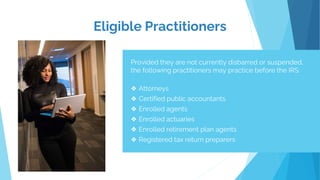

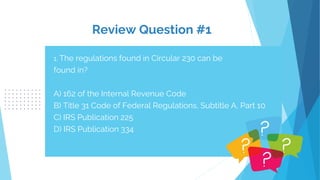

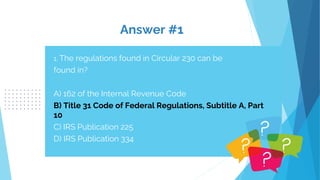

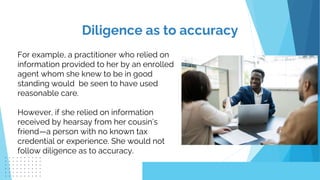

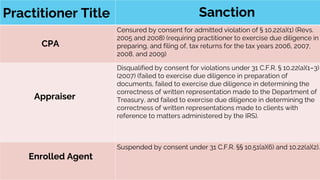

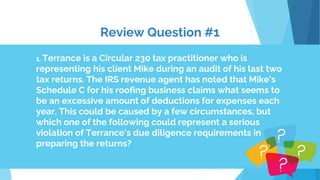

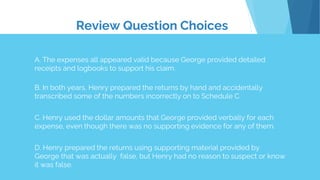

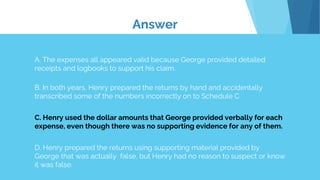

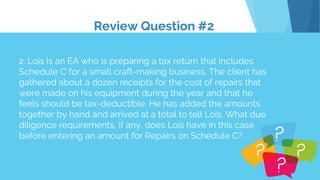

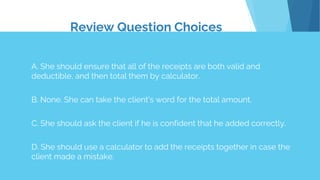

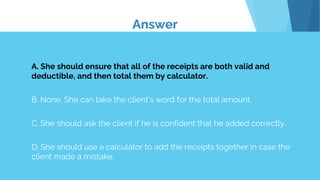

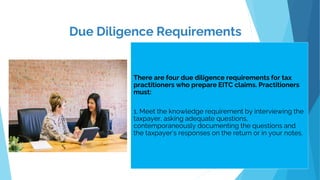

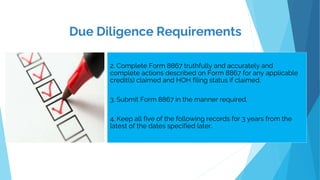

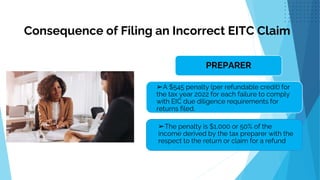

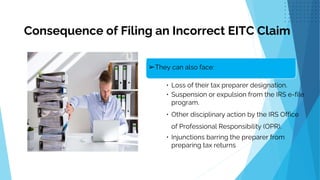

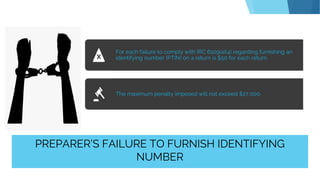

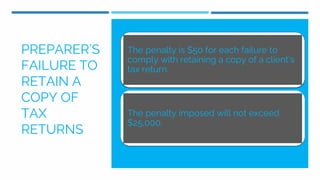

Circular 230 defines the rules and regulations governing practice before the Internal Revenue Service. It establishes who may practice, outlines practitioners' duties and obligations, authorizes sanctions for violations, and describes disciplinary procedures. The Office of Professional Responsibility is responsible for interpreting and enforcing Circular 230. It requires due diligence of practitioners in preparing accurate tax returns and representations. Specific areas like the earned income tax credit involve additional diligence requirements to address high error rates.