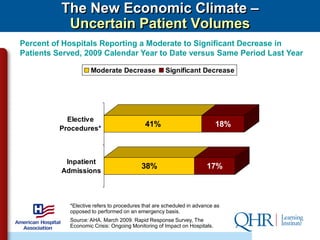

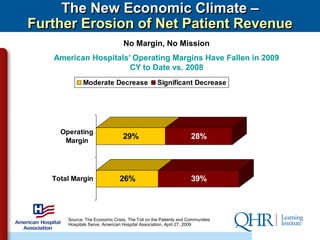

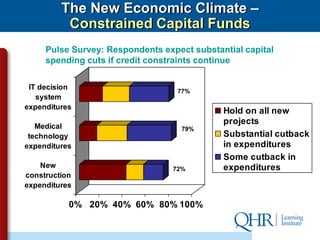

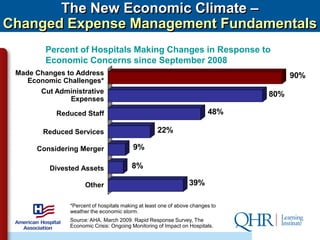

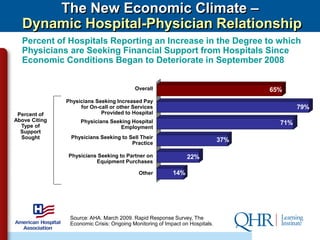

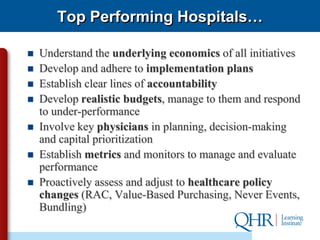

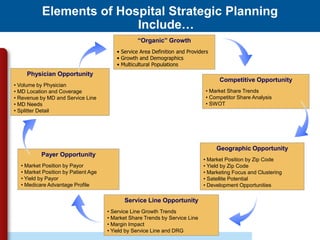

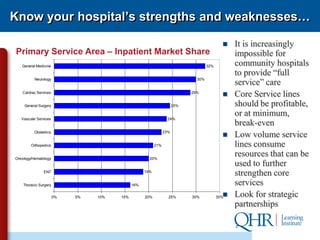

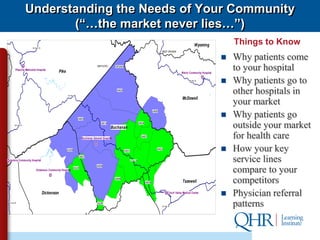

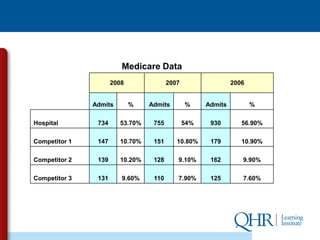

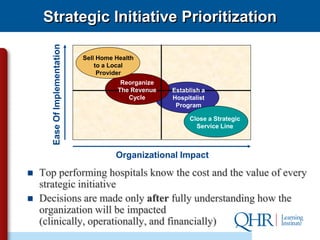

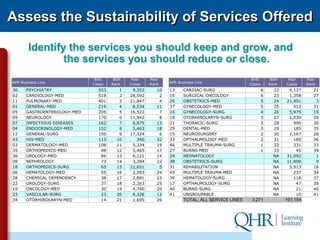

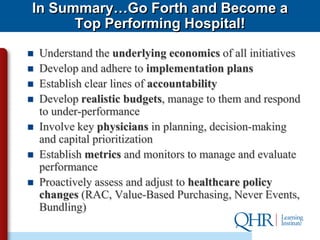

The document discusses the need for active strategic planning to address changing industry trends in healthcare delivery. It outlines political, economic, and regulatory factors impacting hospitals and emphasizes the importance of monitoring performance, making tough decisions around services, physician relationships, and costs. Recommendations include understanding community needs, assessing service line sustainability, and addressing losses.