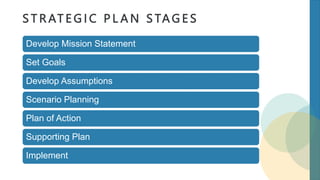

Microscope is a healthcare consultancy that focuses on optimizing financial, operational, and clinical areas for organizations. It discovers solutions that optimize margins and workflows. Microscope applies the extensive experience of its team to create foundations for sustained savings, increased margins, growth, and improved quality of care through strategic planning.