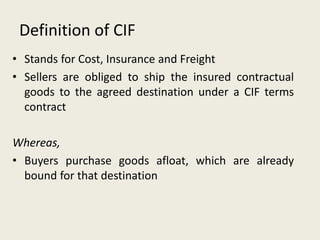

A CIF contract defines that the seller is responsible for shipping insured goods to the agreed destination. This allows the buyer to purchase goods that are already in transit. The key advantages are that the seller does not bear risks during shipping and the buyer can seek compensation from carriers if issues arise. However, sellers take on risks if costs change and are responsible if goods are not delivered on time. Overall, CIF contracts provide balanced protections for buyers and sellers in international trade.