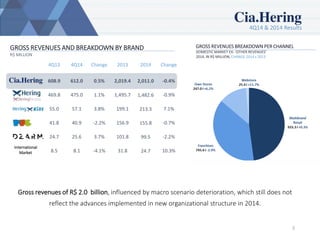

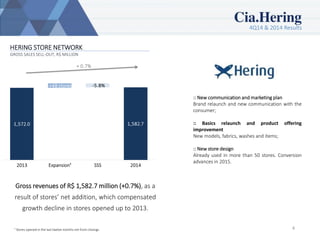

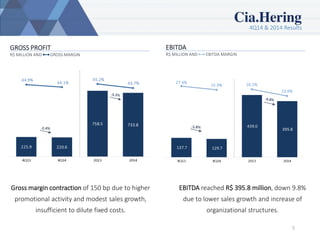

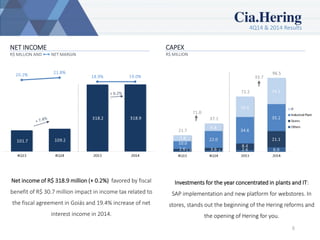

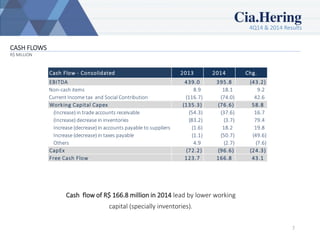

Hering reported its financial results for the fourth quarter and full year of 2014. Gross revenues for the quarter were R$612 million, a slight increase of 0.5% year-over-year. For the full year, gross revenues were R$2.01 billion, a small decrease of 0.4% compared to 2013. EBITDA for 2014 reached R$395.8 million, down 9.8% due to lower sales growth and increased organizational expenses. Net income was R$318.9 million, a slight increase of 0.2% from the prior year. For 2015, Hering aims to resume same-store sales growth, increase multibrand sales to existing customers, and focus on implementing