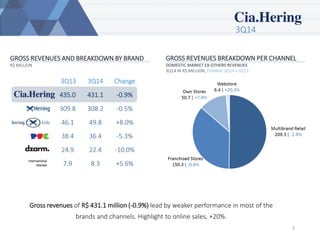

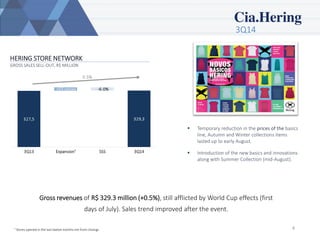

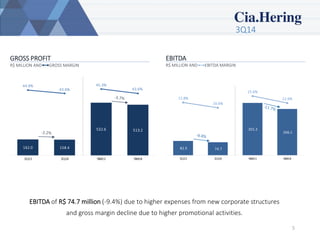

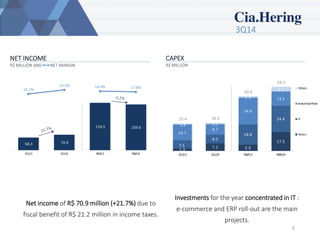

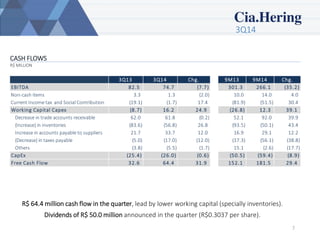

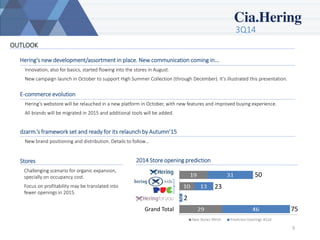

The company reported gross revenues of R$431.1 million for 3Q14, a 0.9% decrease from the previous year. EBITDA was R$74.7 million, down 9.4% due to higher expenses and a decline in gross margin from promotional activities. Net income increased 21.7% to R$70.9 million due to a tax benefit. The outlook expects challenges to organic store expansion due to high occupancy costs and a focus on profitability, which may result in fewer openings in 2015. A new e-commerce platform will launch in October and all brands will migrate to the new platform in 2015.