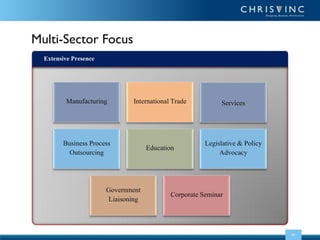

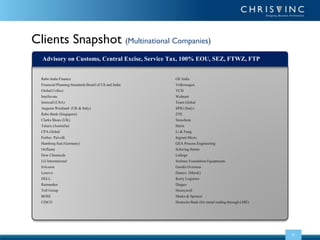

The document discusses the role of Victor M.R. Vincent and his firm, Chrisvinc, in providing business architecture and sustainability solutions within a complex regulatory environment. It emphasizes the firm's ability to impart competitive advantage through proprietary knowledge and a systematic approach across multiple sectors. Services offered include compliance management, advisory on customs and tax regulations, and comprehensive risk management solutions.