The document discusses competitive exams in commerce in India. It outlines four main exams: Chartered Accountancy (CA), Company Secretary (CS), Institute of Cost Accountants of India (ICWA), and Management Aptitude Test (MAT). For each exam, it provides details on eligibility, structure, roles and responsibilities of professionals in that field. The conclusion emphasizes that it is important to choose exams based on self-analysis and career interests rather than randomly.

![1.CHARTERED ACCOUNTANCY COURSE

(CA COURSE)

The CA courseis designed to combine theoretical study with practical

training. The Chartered Accountancy courseis considered to be the rigorous

professionalcourses both in India and Worldwidewith only 3-8 % of the students

passing in every attempt in Inter and Final Level. At Present, pass ratein

Foundation is Approx15%, Inter 4-8 %, Final3-7 %, that means students who take

admission in CA Course, only 0.0225% to 0.096%actually pass CA. For instance, in

the November 2013 CA Final exam, the pass percentage was merely 3.11% (Both

Groups) As of April 2010, Theprestigious institute has 874,694 students, studying

various levels of the Chartered Accountancy Course.[4]

The Chartered Accountancy

examinations are divided into three levels. They are

. Common Proficiency Test (CPT)

Integrated Professional Competence Course (IPCC)

Final Examination](https://image.slidesharecdn.com/assignment-170822082827/85/Assignment-5-320.jpg)

![ROLES AND RESPONSIBILITIES

Company secretaries in all sectors havehigh level responsibilities including

governancestructures and mechanisms, corporateconductwithin an

organisation's regulatory environment, board, shareholder and trustee meetings,

compliance with legal, regulatory and listing requirements, the training and

induction of non-executives and trustees, contact with regulatory and external

bodies, reports and circulars to shareholders/trustees, managementof employee

benefits such as pensions and employee shareschemes, insuranceadministration

and organisation, the negotiation of contracts, risk management, property

administration and organisation and the interpretation of financial accounts.

Company secretaries are the primary sourceof advice on the conduct of

business and this can span everything fromlegal advice on conflicts of interest,

through accounting advice on financial reports, to the development of strategy

and corporateplanning.

In India, every listed company and other class of companies (i.e. non-listed

public companies with sharecapital of 50 million (5 Crore) & private Companies

with sharecapital of 50 million [5 crore]) are required to have a Qualified

Company Secretary be appointed as Key Managerial Personnelto performthe

Functions of Company Secretary under section 203 of the Companies Act, 2013

read with Rule 8 of Companies (Appointment and Remuneration of Key

Managerial Personnel) Rules, 2014.Butlater it is clarified by the Ministry of

CorporateAffairs company secretary would be appointed as earlier](https://image.slidesharecdn.com/assignment-170822082827/85/Assignment-12-320.jpg)

![3. INSTITUTE OF COST & WORKS ACCOUNTANTS OF INDIA

(ICWACOURSE)

The Institute of Cost Accountants of India

(ICAI) [previously known as the Instituteof Cost& Works Accountants of India

(ICWAI)] is a premier statutory professionalaccountancy body in India with the

objects of promoting, regulating and developing the profession of Cost

Accountancy. Itis the only licensing cum regulating body of Cost & Management

Accountancy profession in India. It recommends the Cost Accounting Standards to

be followed by companies in India to which statutory maintenance of costrecords

applicable. ICAI is solely responsiblefor setting the auditing and assurance

standards for statutory CostAudit to be followed in the Audit of Cost

statements in India. Italso issues other technical guidelines on severalaspects

like InternalAudit, Management Accounting etc. to be followed by practising Cost

Accountants while discharging their services. Itworks closely with the industries,

various departments of Governmentof India, State governments in India and

other Regulating Authorities in India e.g. Reserve Bank of India, Insurance

Regulatory and Development Authority, Securities and Exchange Board of

India etc. on severalaspects of performance, costoptimisation and reporting.](https://image.slidesharecdn.com/assignment-170822082827/85/Assignment-14-320.jpg)

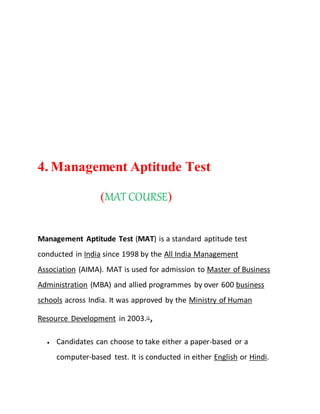

![Eligibility is for graduates in any discipline, though final year

students of graduate courses can also apply.[1] The test is offered

four times in a year in February, May, September and

December.[2] The cost of admission was ₹1,400 (US$22) in 2017

and the test scores are valid for one year.[2]

The tests includes 200 questions, 40 in each subject: language

comprehension, mathematical skills, data analysis and sufficiency,

intelligence and critical reasoning, and Indian and global

environment. Time allotted is 150 minutes

The MAT exam generally comprises 200 questions with 4 marks for every

right answer and 1 mark deducted for every wrong answer. Thevarious

areas which generally have 40 questions each are as follows.

Quantitative ability

Data Interpretation

Data Sufficiently

Verbal Ability and Reading Comprehension

General Awareness

Analytical and Logical reasoning](https://image.slidesharecdn.com/assignment-170822082827/85/Assignment-18-320.jpg)