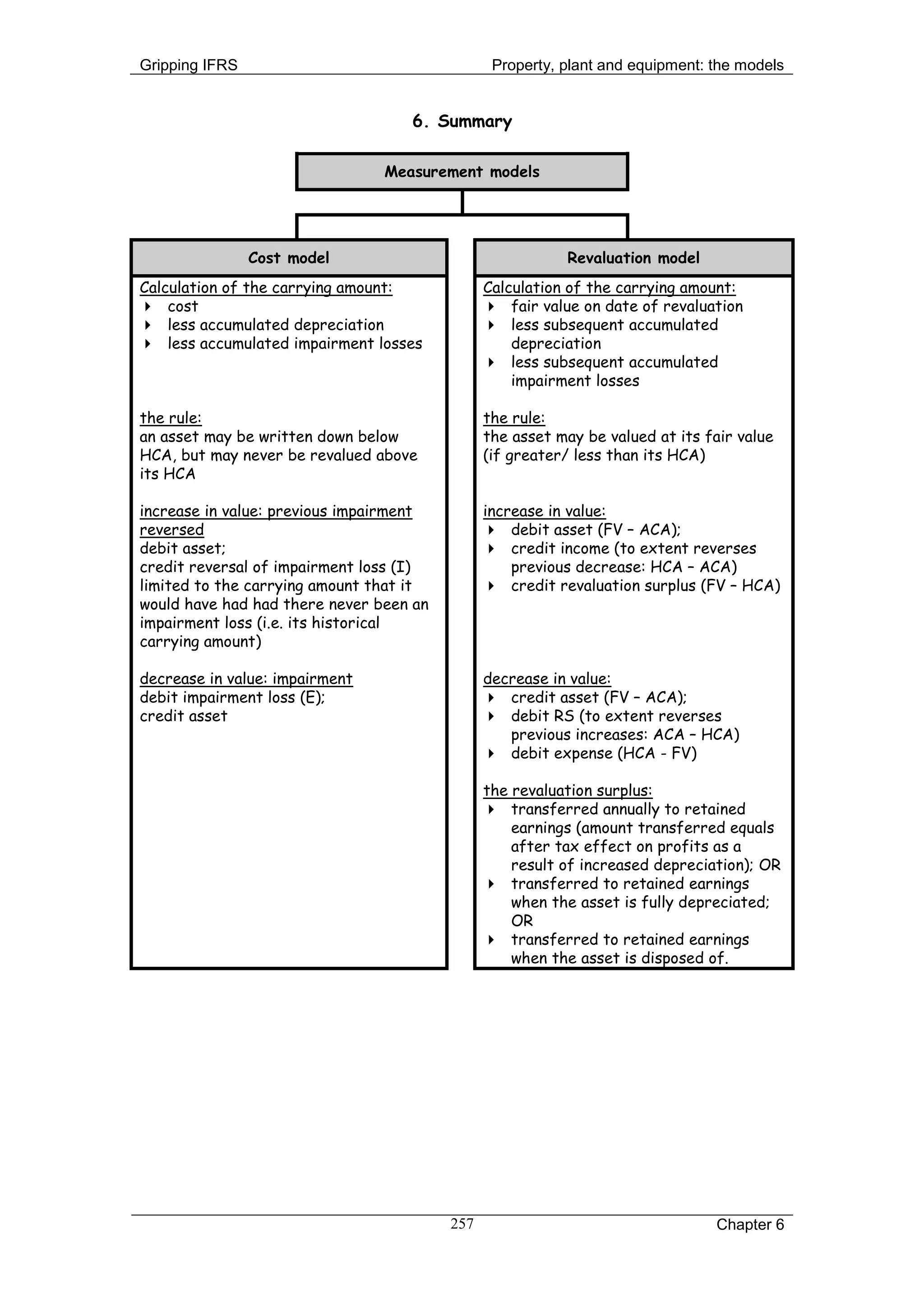

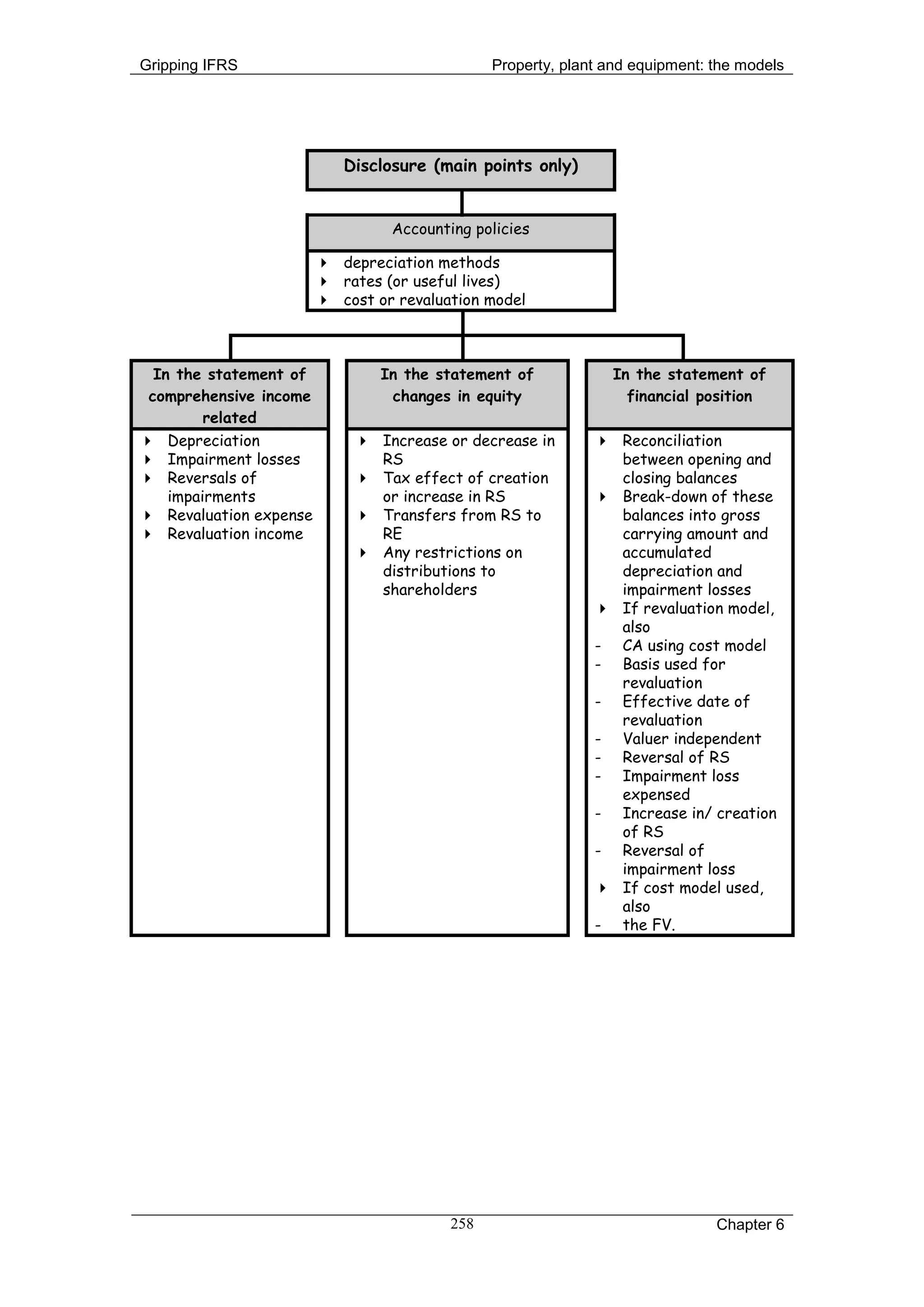

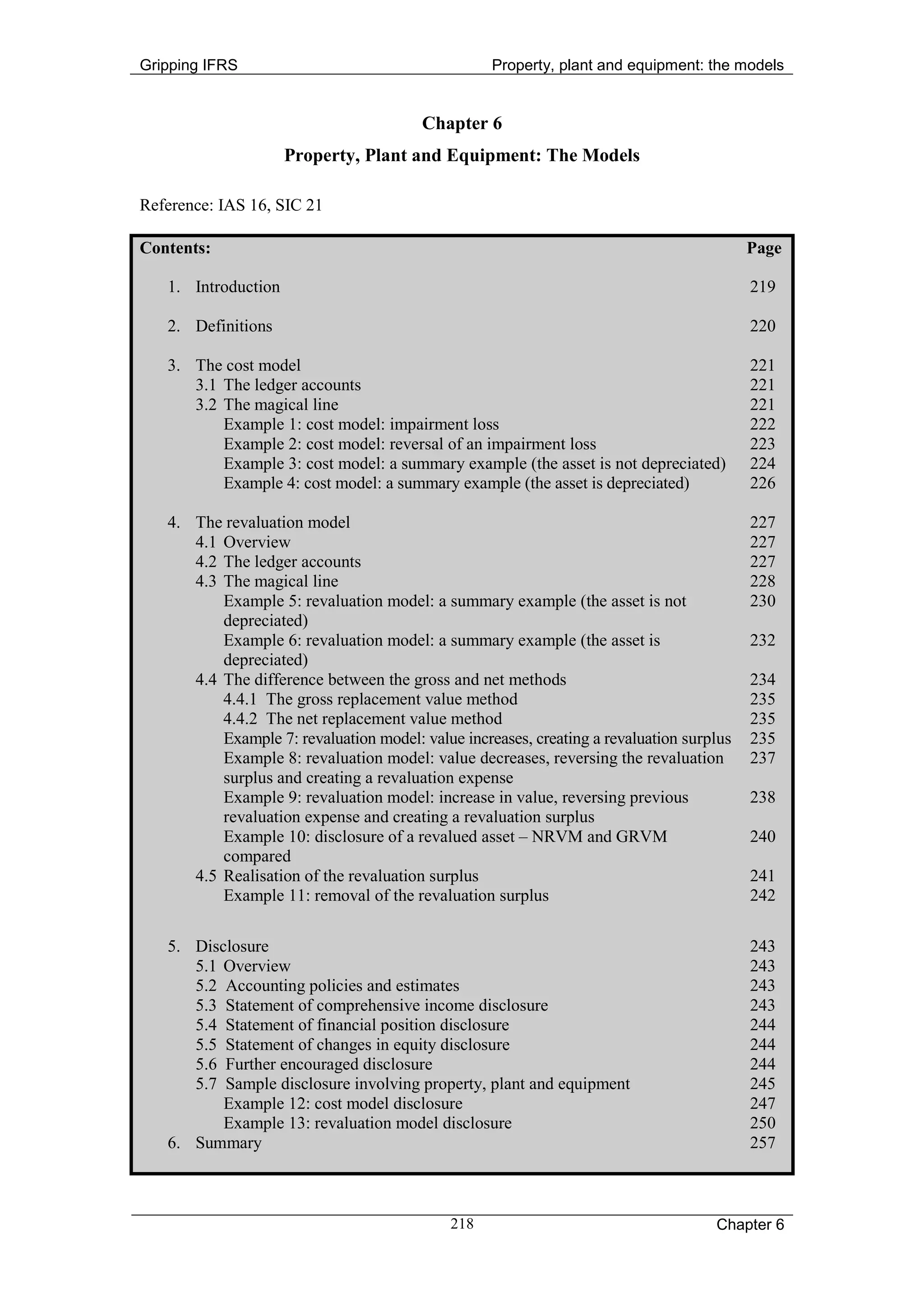

This document provides an overview of the two models for measuring property, plant, and equipment under IAS 16: the cost model and the revaluation model. It defines key terms used in the models and provides examples of accounting entries for impairment losses, reversals of impairment losses, depreciation, and revaluations under each model. The cost model measures assets at cost less accumulated depreciation and impairment losses. The revaluation model measures assets at fair value less subsequent depreciation and impairment losses. The document also discusses disclosure requirements for property, plant, and equipment.

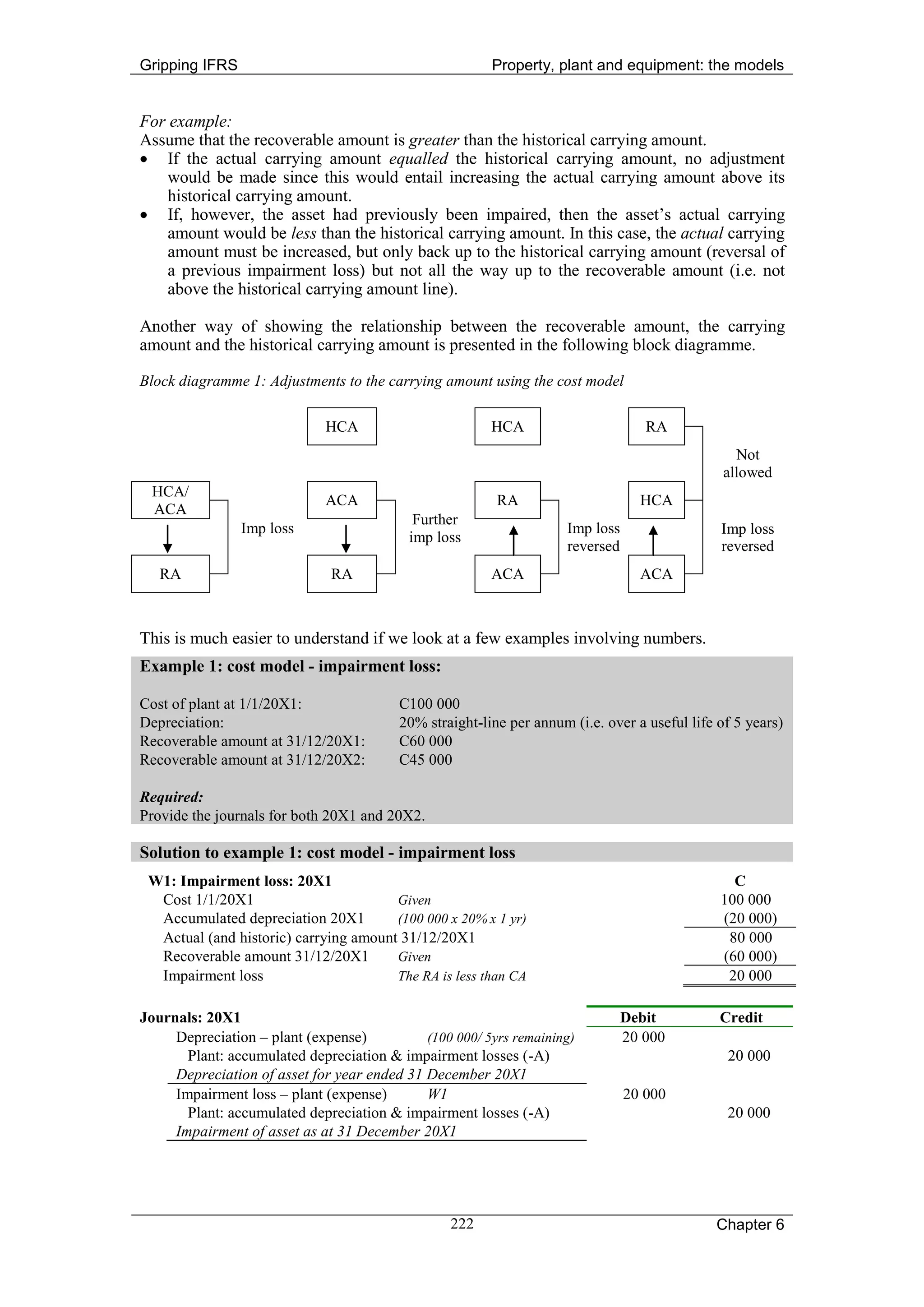

![Gripping IFRS Property, plant and equipment: the models

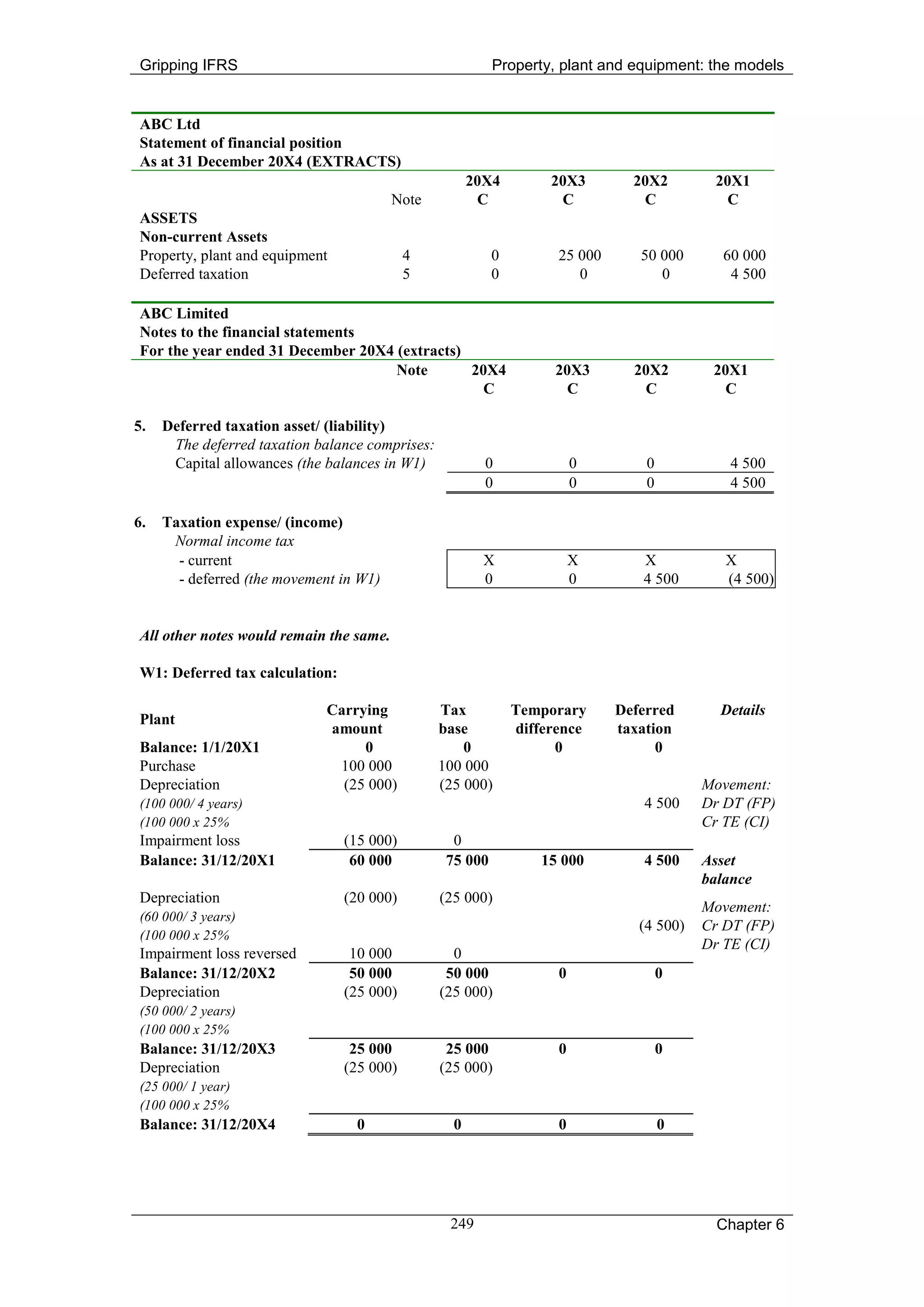

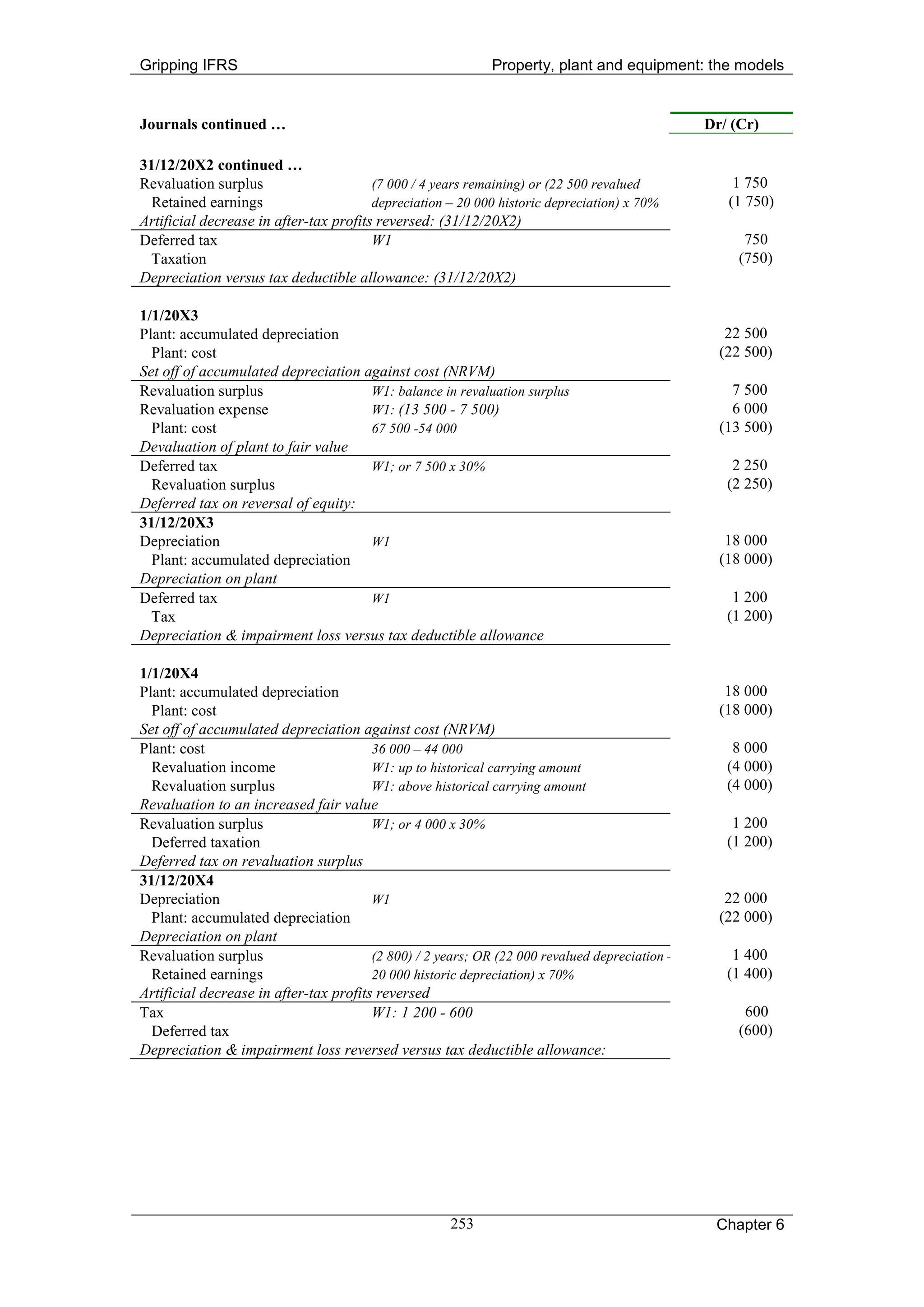

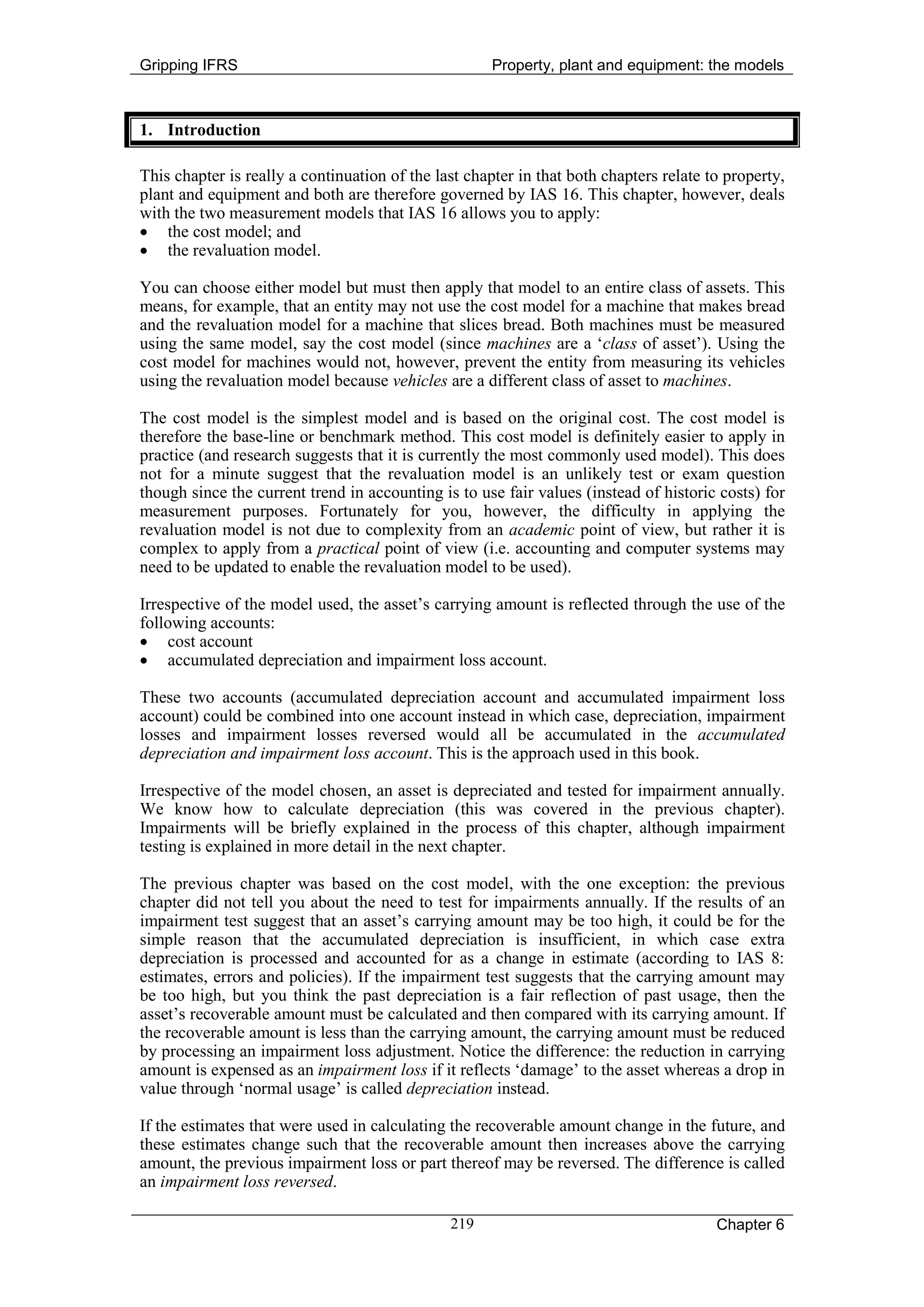

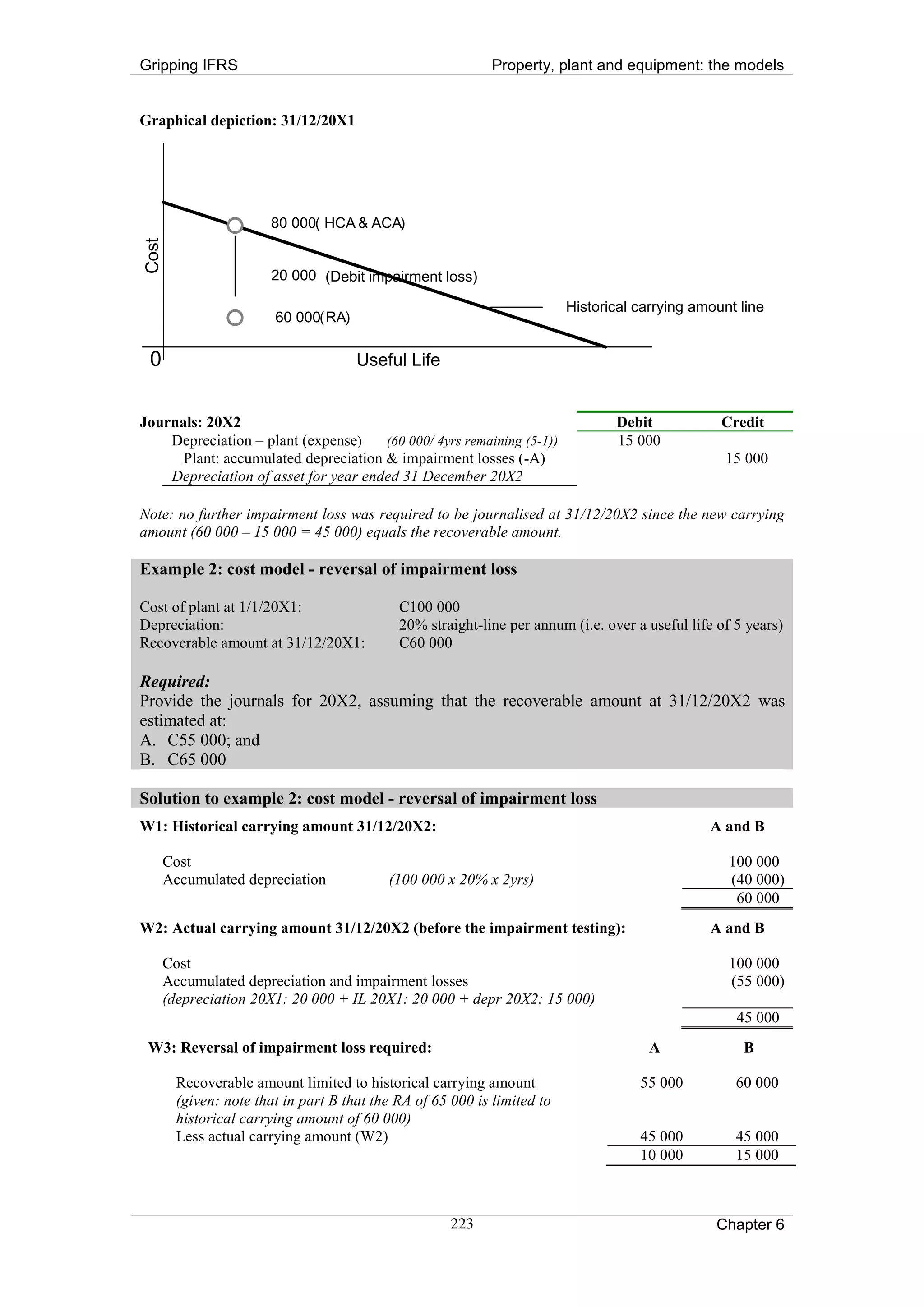

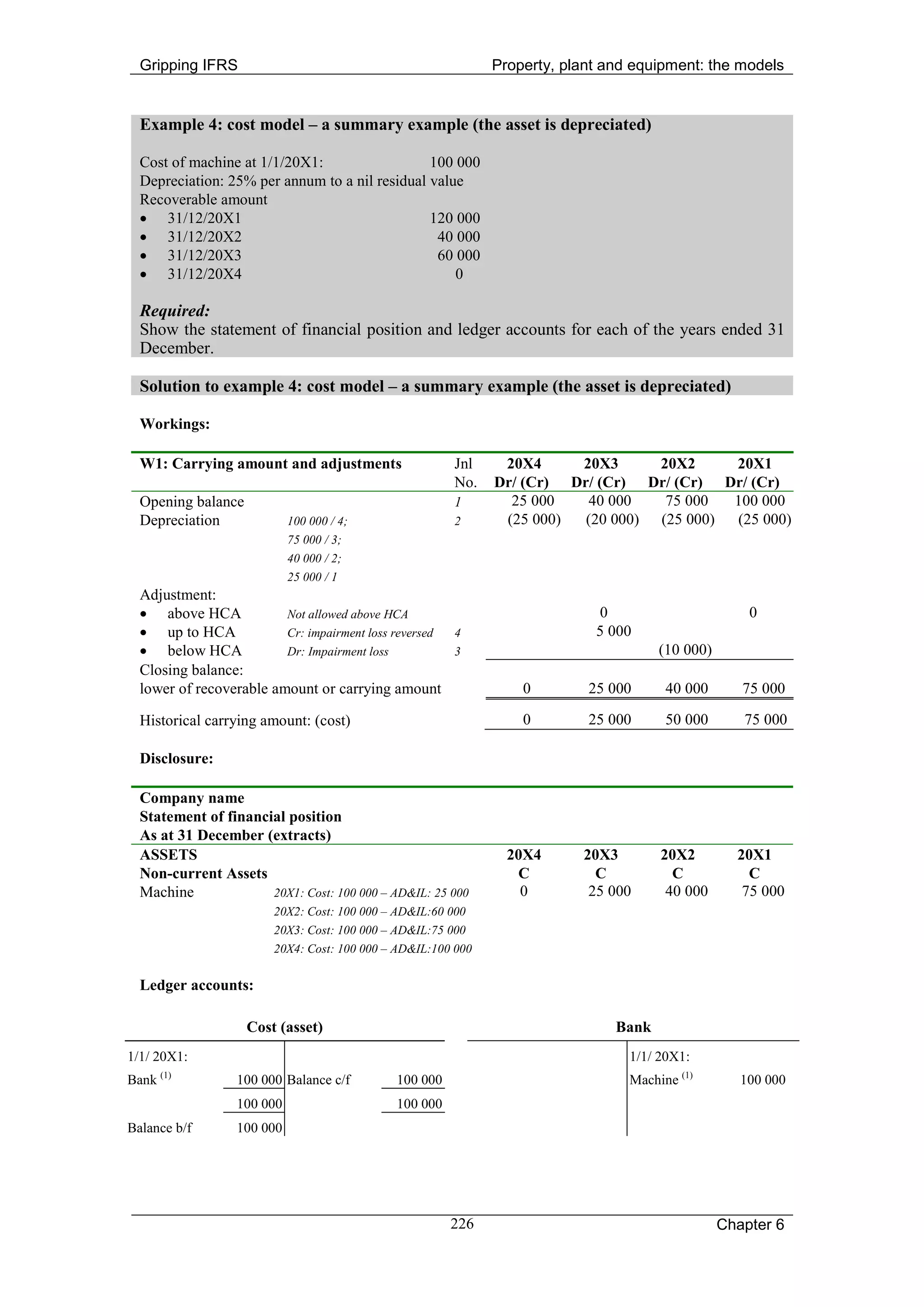

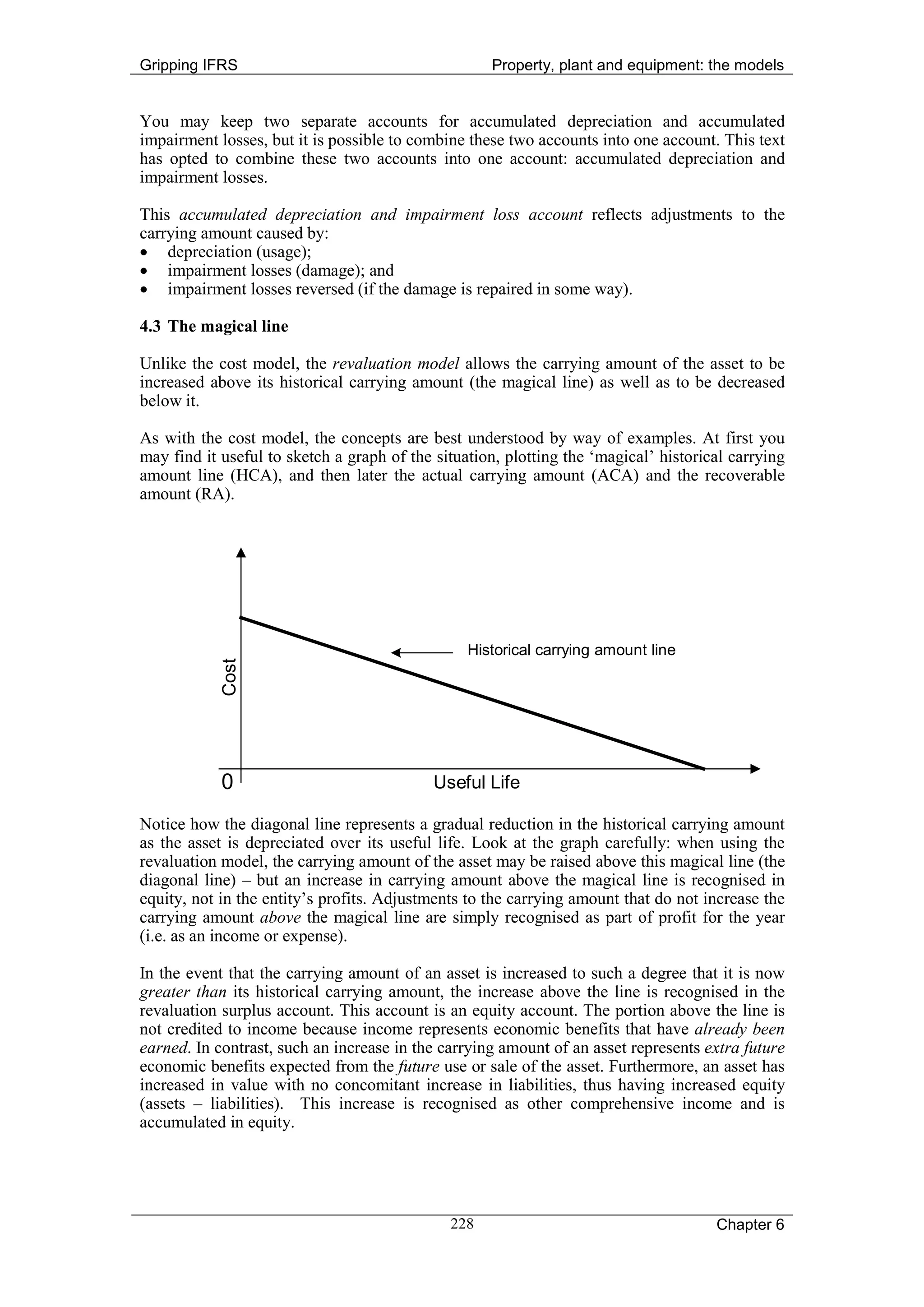

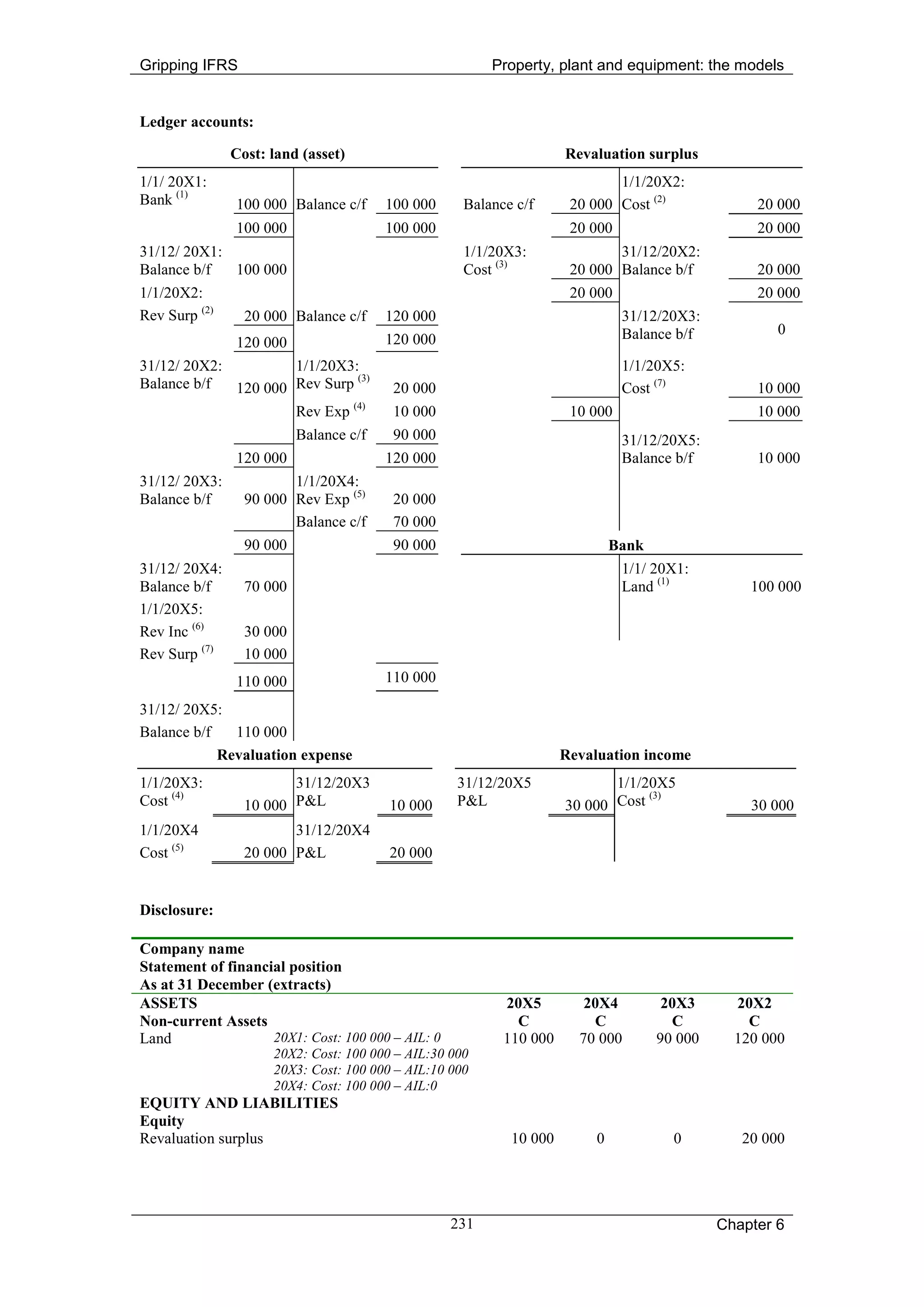

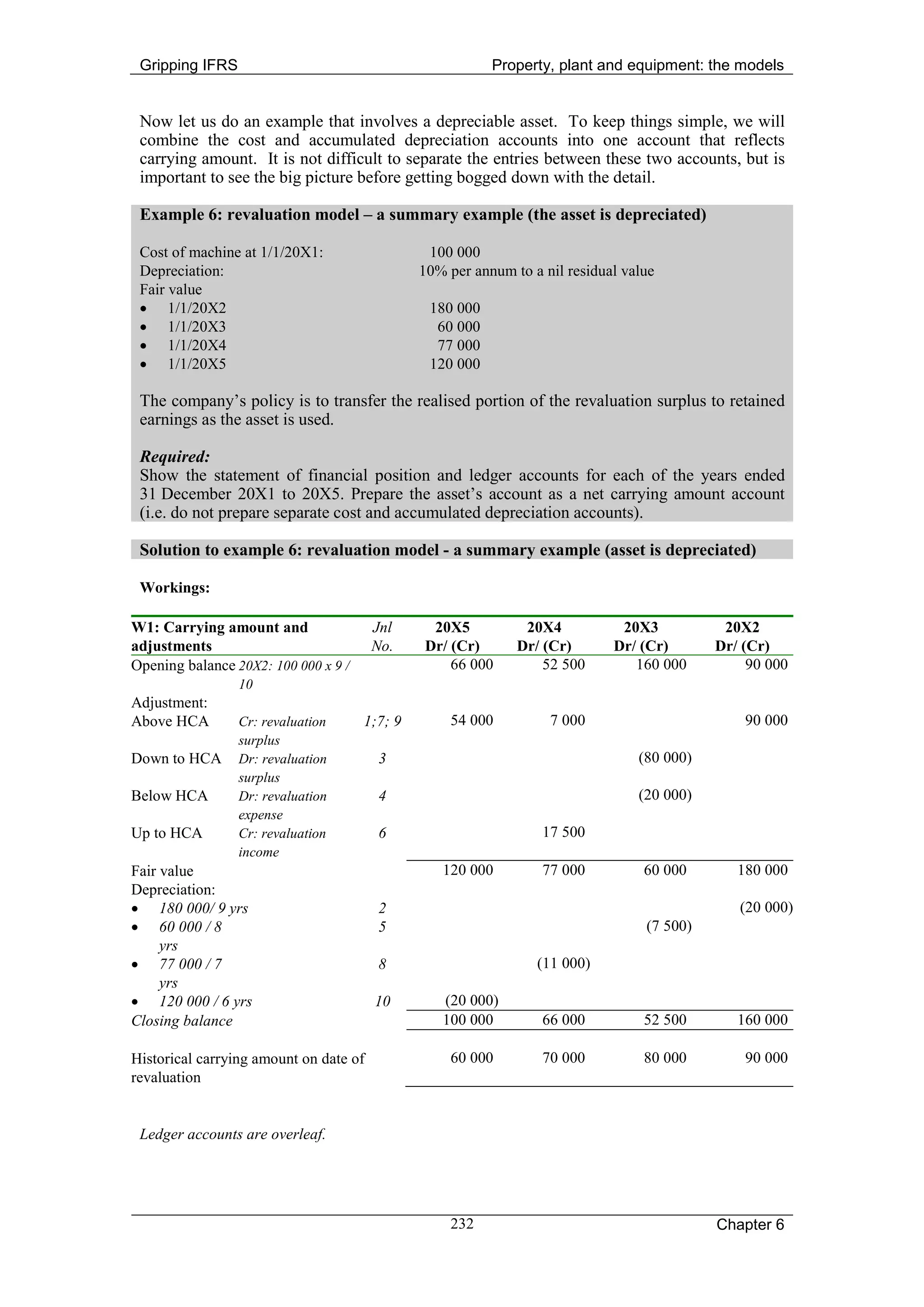

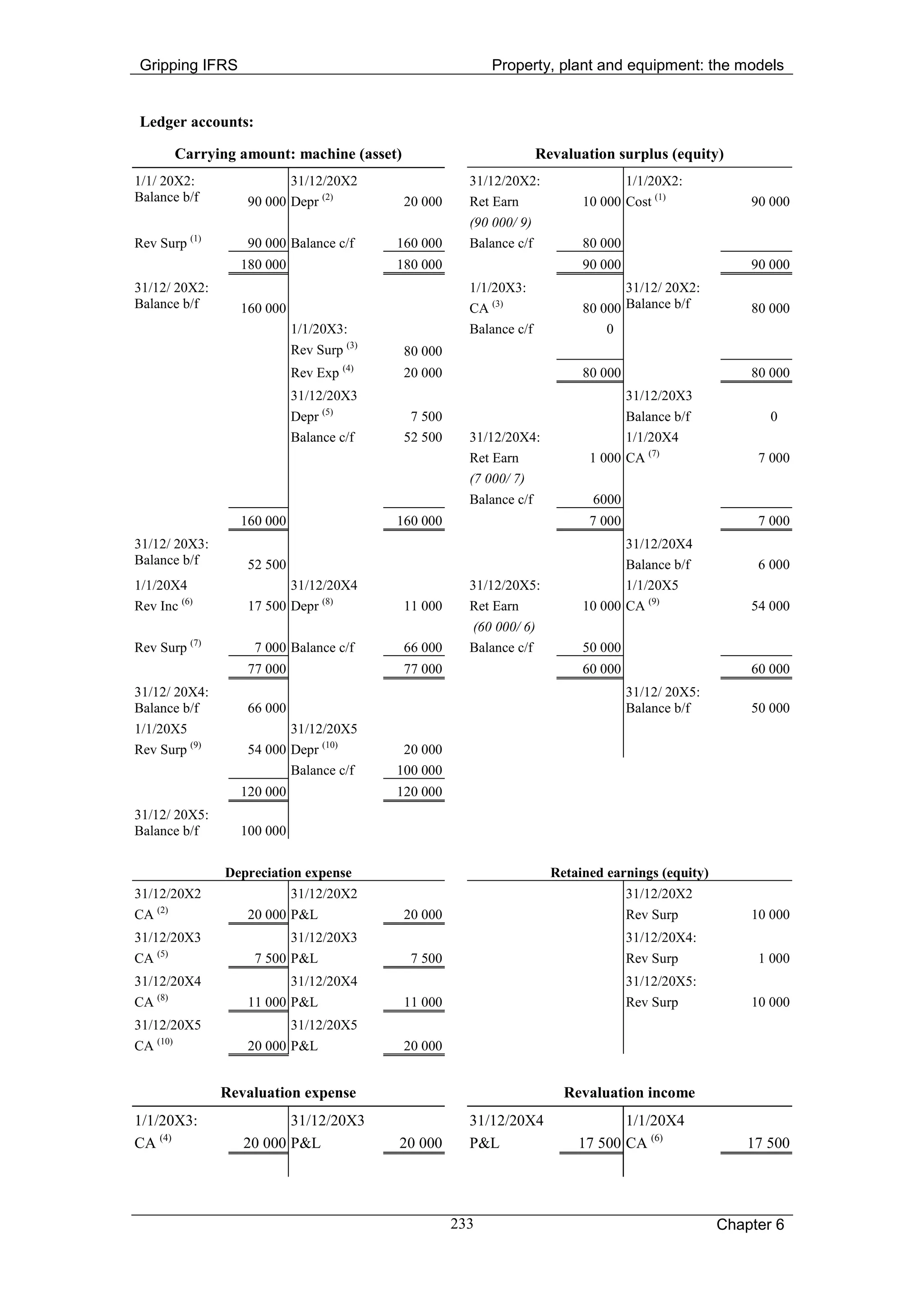

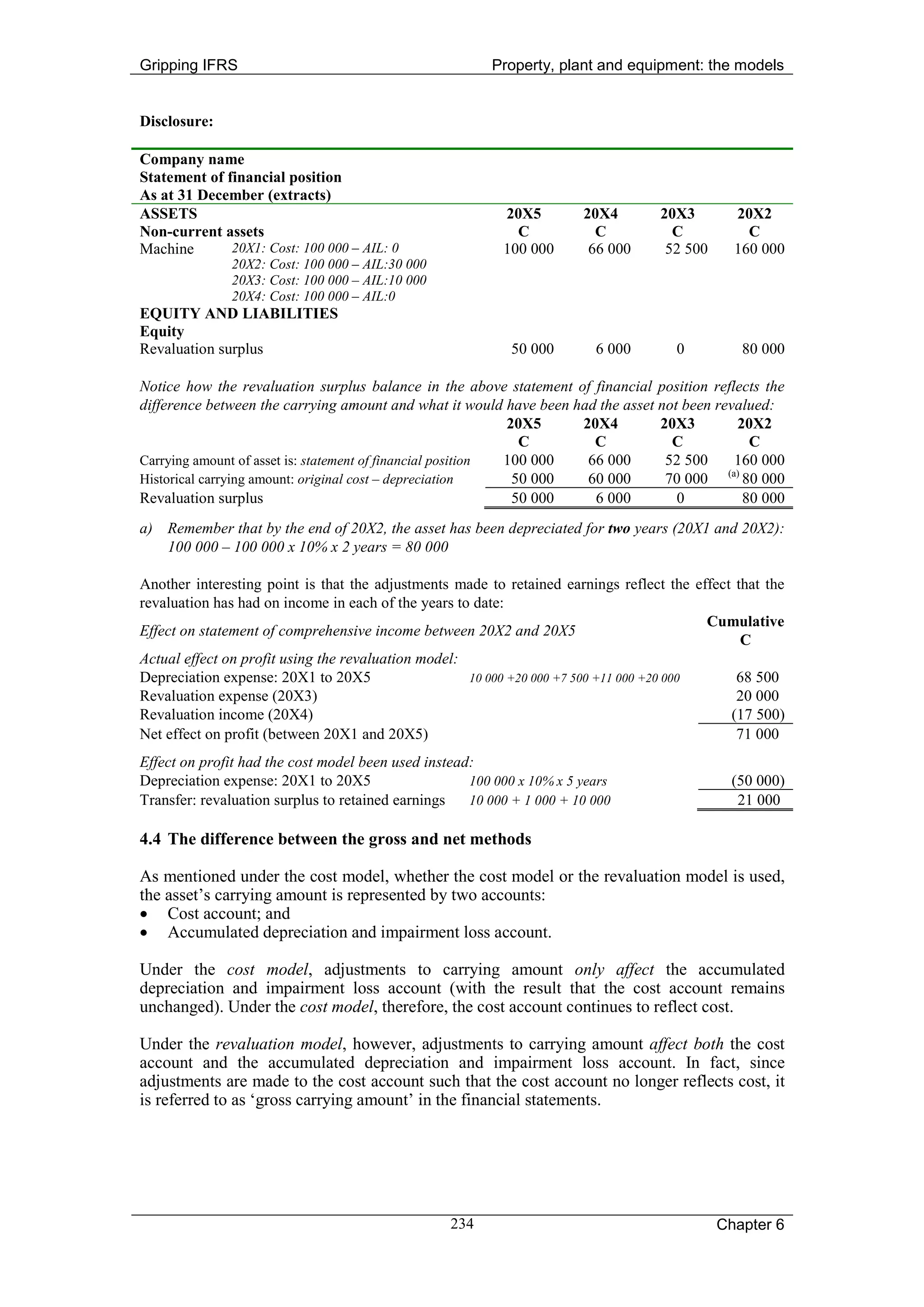

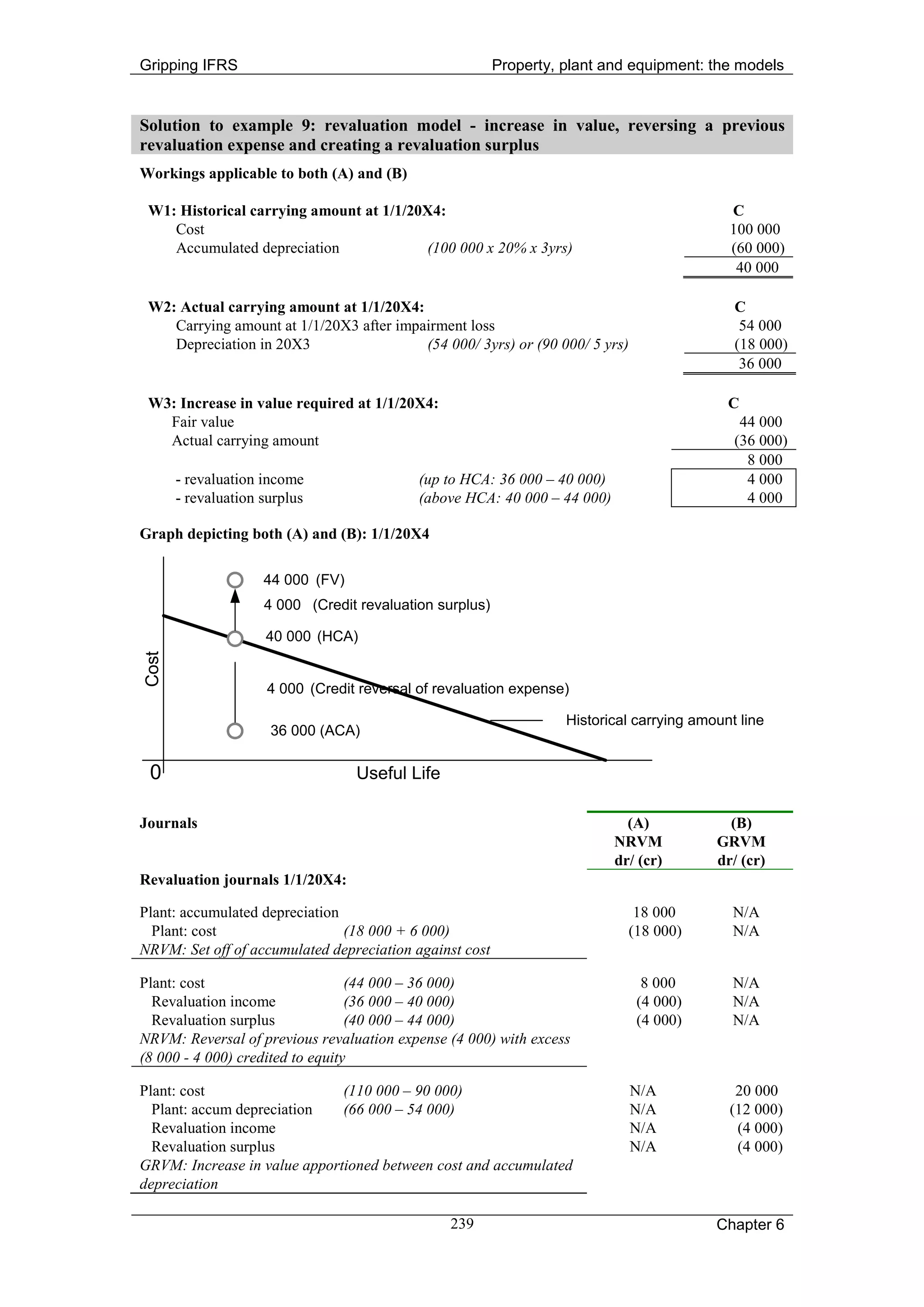

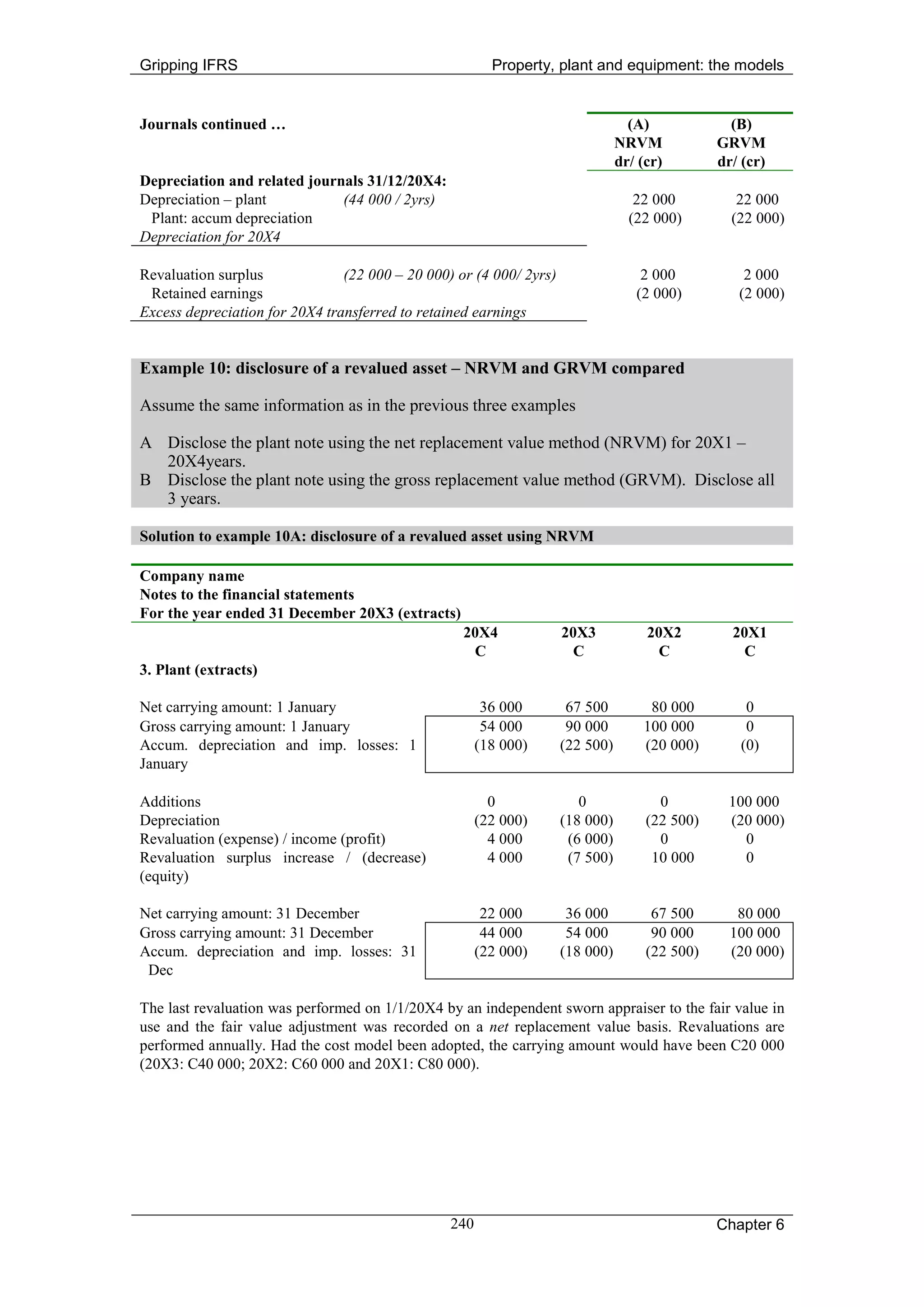

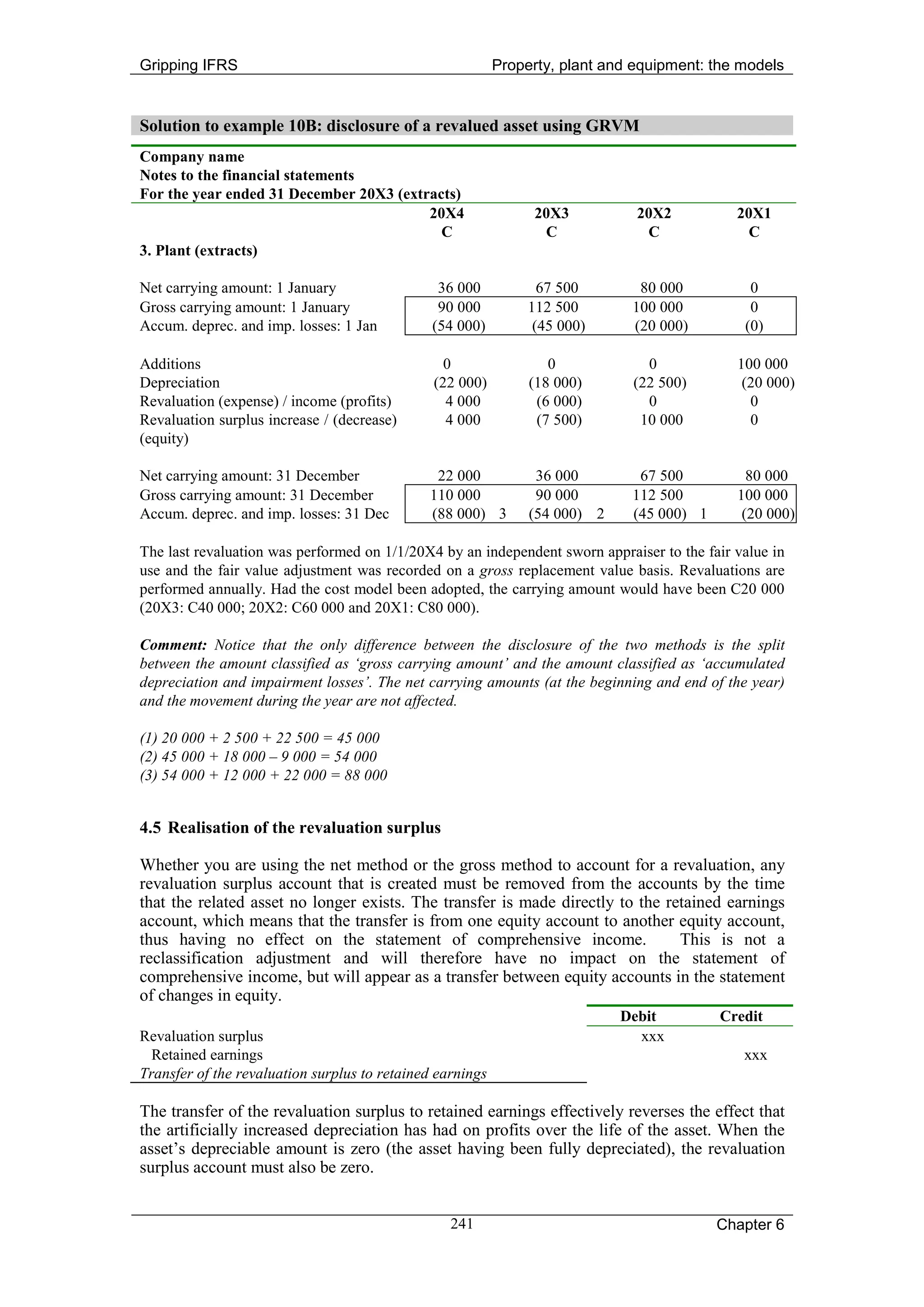

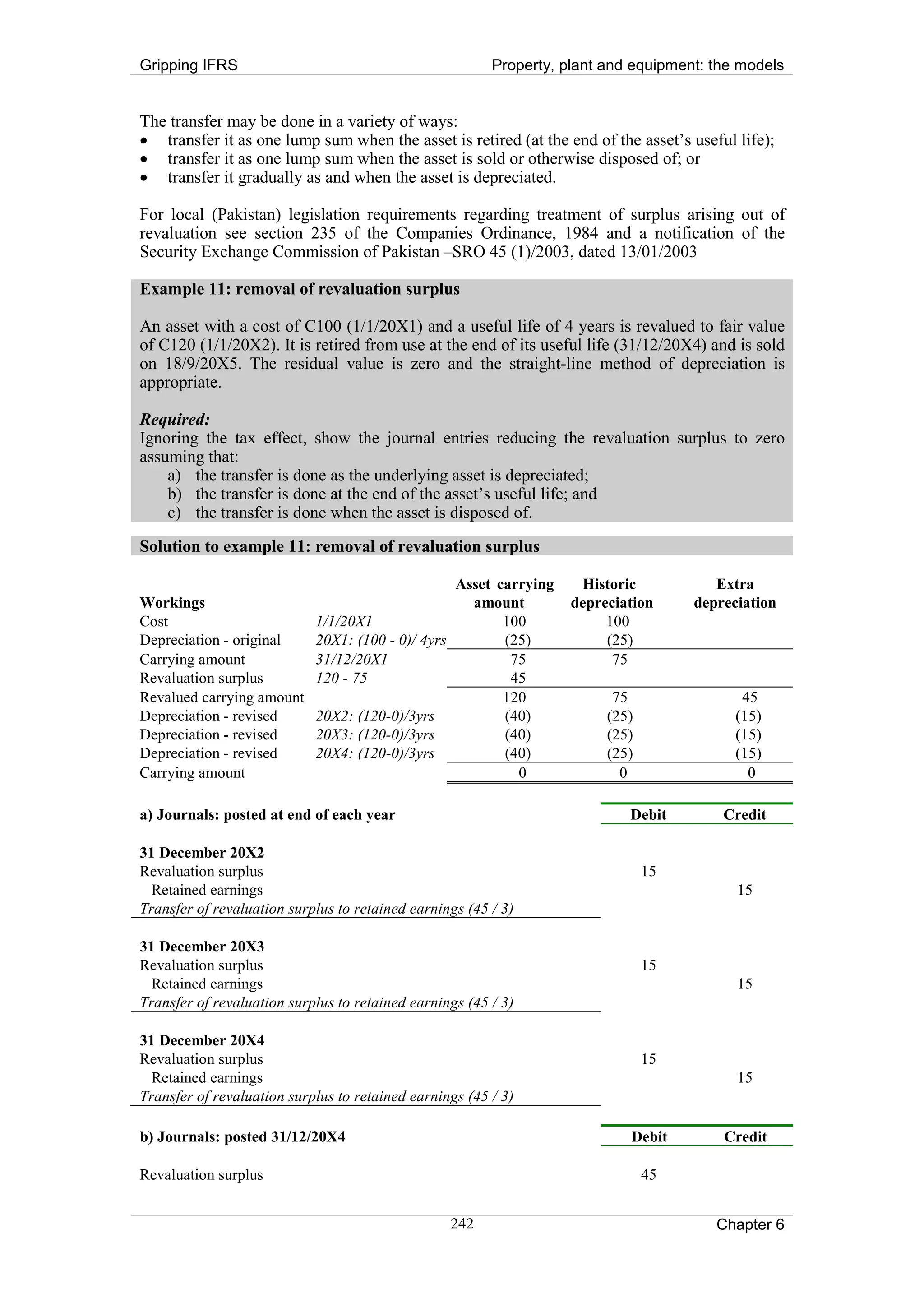

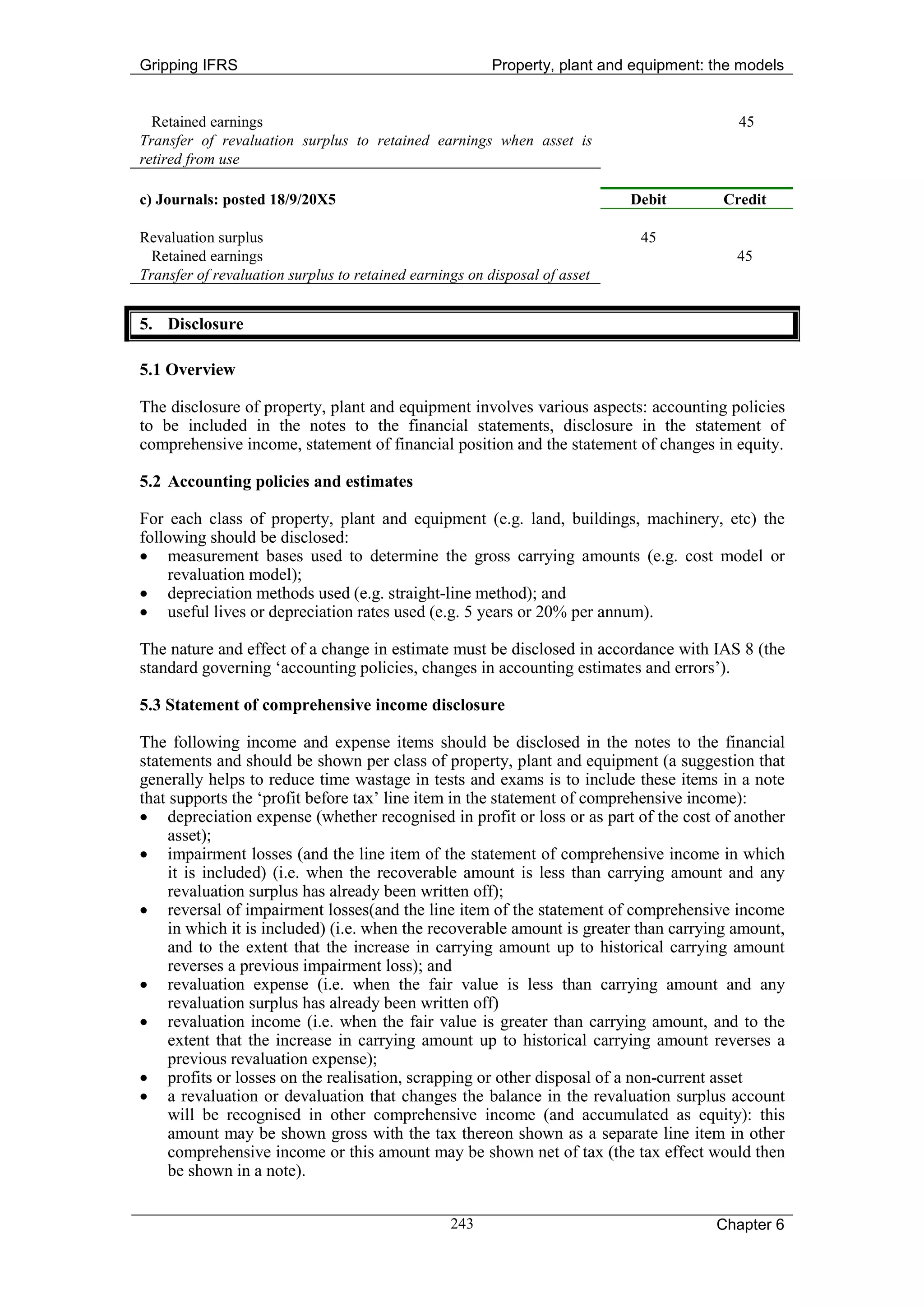

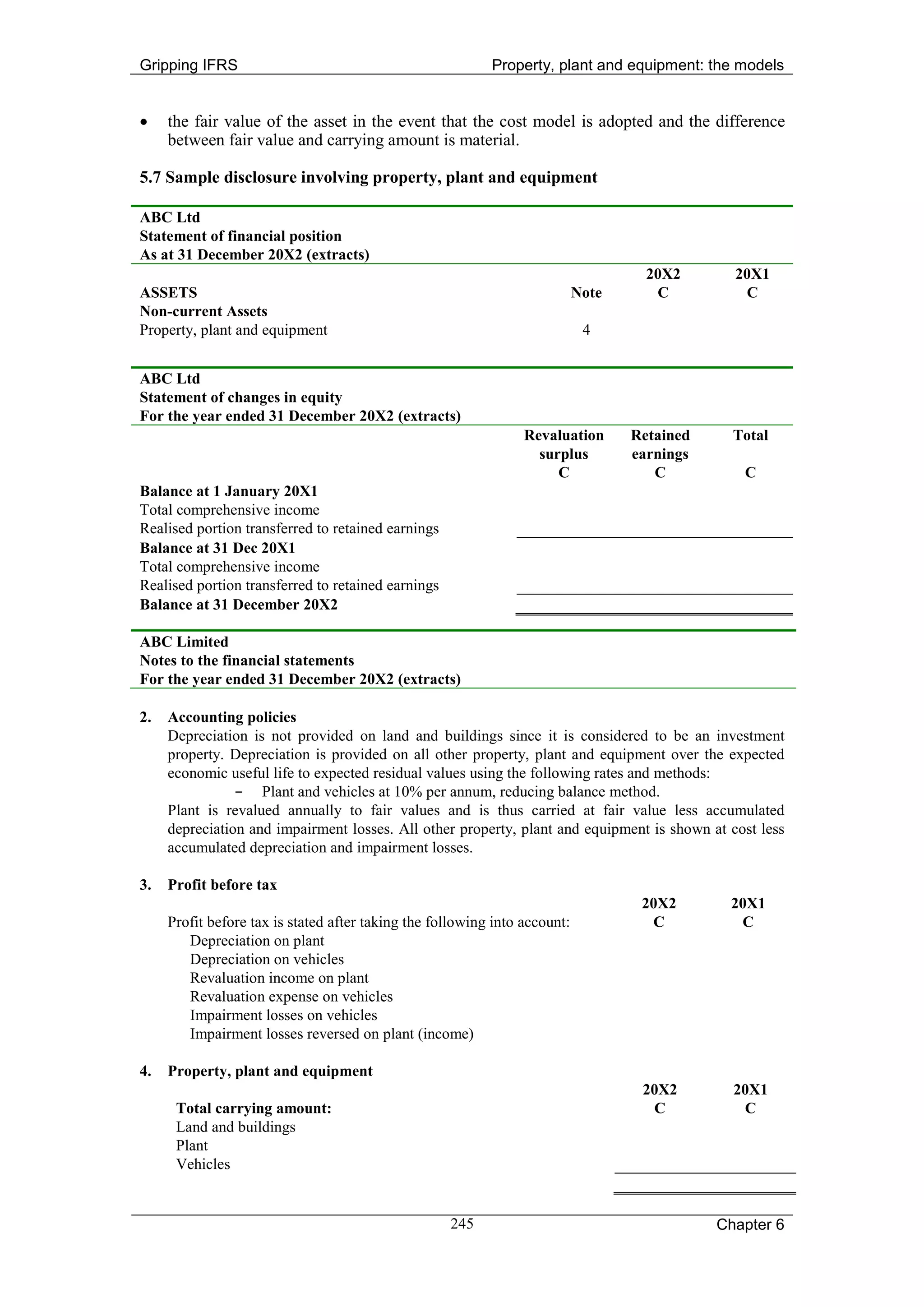

4. Property, plant and equipment (extracts) 20X4 20X3 20X1 20X0

C C C C

Plant

Net carrying amount: 1 January 25 000 50 000 60 000 0

Gross carrying amount: 100 000 100 000 100 000 0

Accumulated depreciation and imp losses: (75 000) (50 000) (40 000) 0

Additions 0 0 0 100 000

Depreciation (25 000) (25 000) (20 000) (25 000)

Impairment loss 0 0 0 (15 000)

Impairment loss reversed 0 0 10 000 0

Net carrying amount: 31 December 0 25 000 50 000 60 000

Gross carrying amount: 100 000 100 000 100 000 100 000

Accumulated depreciation and imp losses: (100 000) (75 000) (50 000) (40 000)

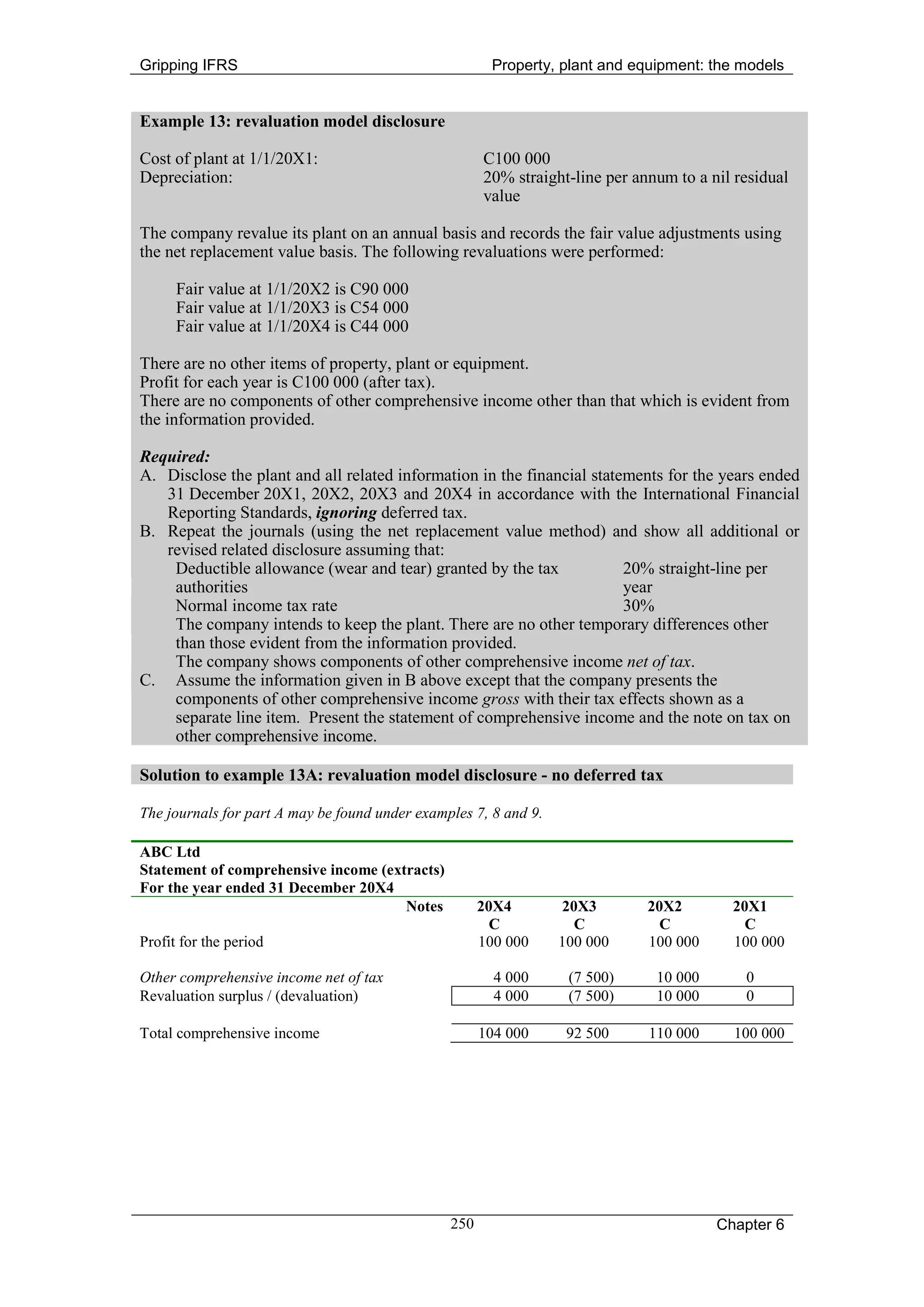

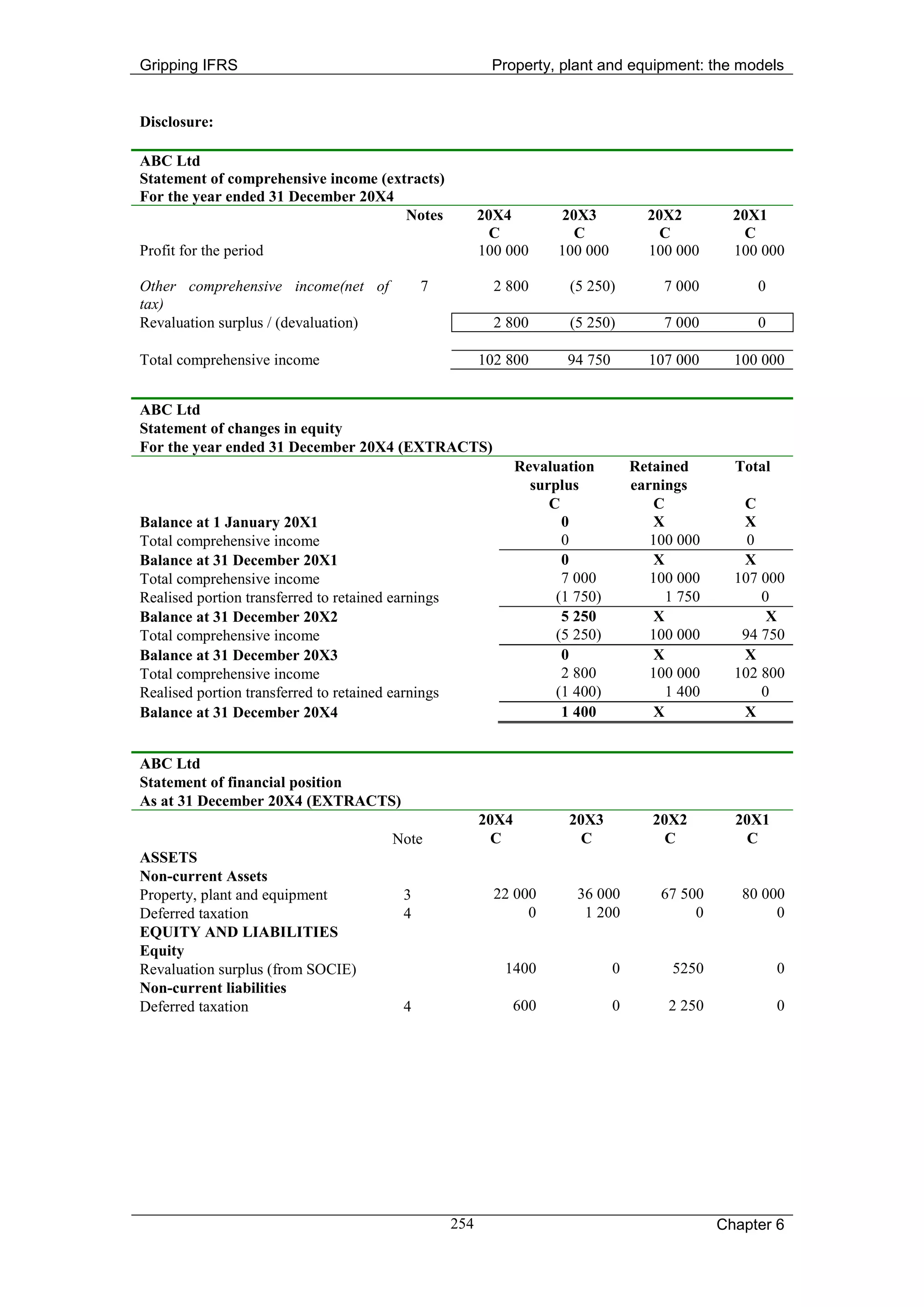

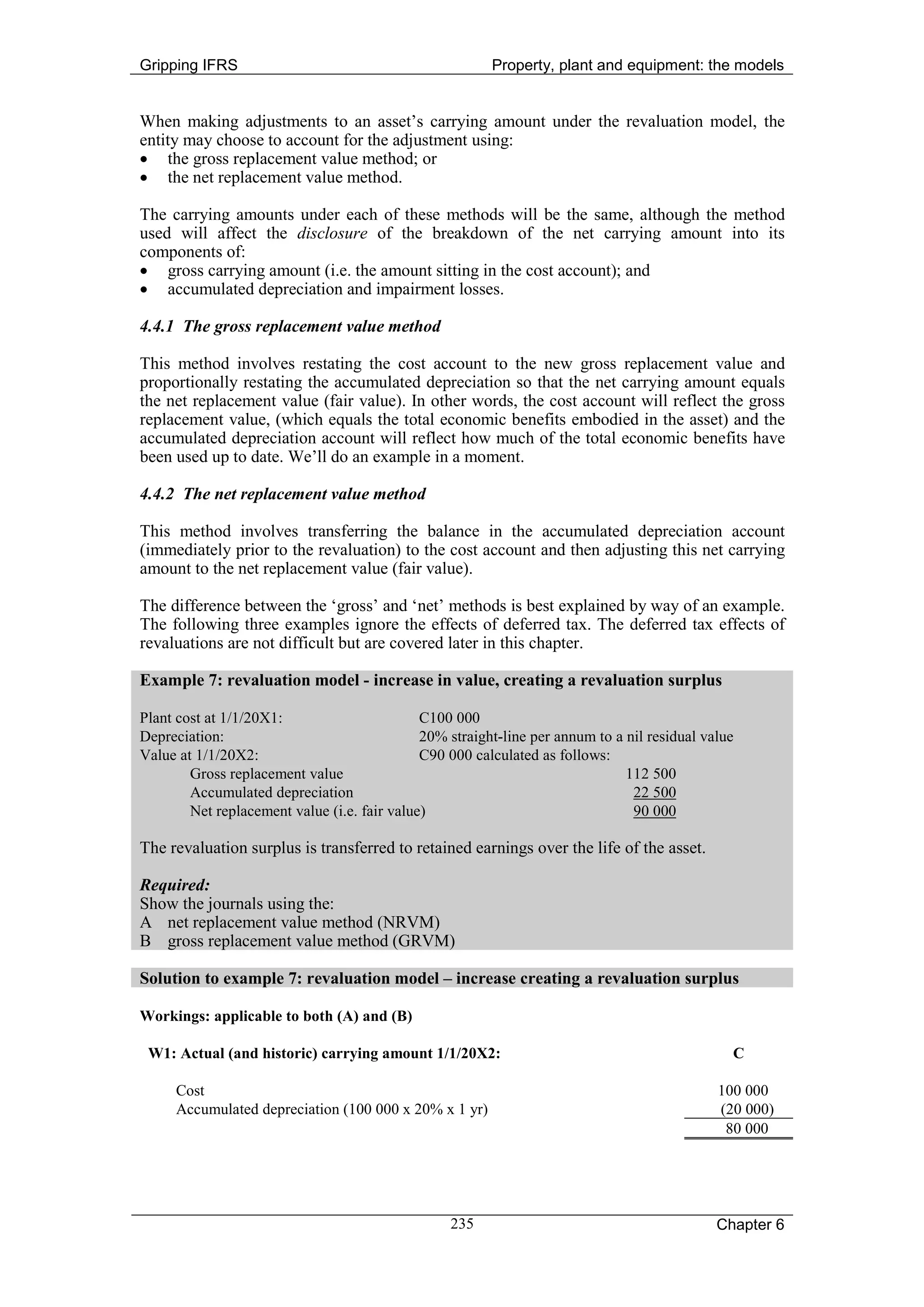

Solution to example 12B: cost model disclosure - with deferred tax

Journals Dr/ (Cr)

20X1:

Plant: cost 100 000

Bank/ Liability (100 000)

Purchase of asset: (1/1/20X1)

Depreciation (100 000 / 4 years remaining) 25 000

Plant: accumulated depreciation and impairment losses (25 000)

Depreciation on plant

Impairment loss CA: (100 000 – 25 000) – RA: 60 000 15 000

Plant: accumulated depreciation and impairment losses (15 000)

Impairment loss

Deferred tax W1 or [(25 000 + 15 000) – (25 000)] x 30% 4 500

Tax expense (4 500)

Deferred tax caused by plant/ impairment loss

20X2:

Depreciation (60 000 / 3 years remaining) 20 000

Plant: accumulated depreciation and impairment losses (20 000)

Depreciation on plant

Plant: accumulated depreciation and impairment losses 10 000

Impairment losses reversed CA: (60 000 – 20 000) – RA: 55 000, ltd to 50 000 cost (10 000)

Impairment loss reversed

Tax expense W1 or [(20 000 - 10 000) – (25 000)] x 30% 4 500

Deferred tax (4 500)

Deferred tax caused by plant/ impairment loss reversed & revised depreciation

20X3

Depreciation (50 000 / 2 years remaining) 25 000

Plant: accumulated depreciation and impairment losses (25 000)

Depreciation on plant

20X4

Depreciation (25 000 / 1 year remaining) 25 000

Plant: accumulated depreciation and impairment losses (25 000)

Depreciation on plant

248 Chapter 6](https://image.slidesharecdn.com/chapter6propertyplantandequipmentmodels2008-111028080657-phpapp02/75/Chapter6-propertyplantandequipmentmodels2008-31-2048.jpg)