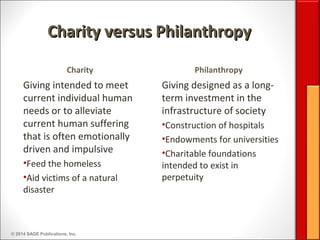

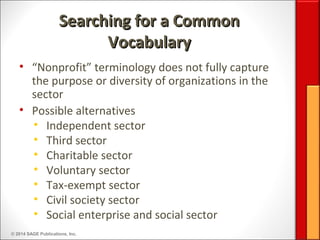

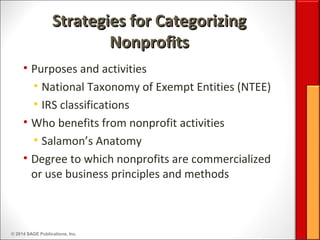

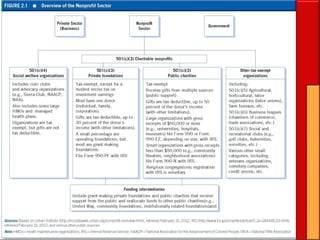

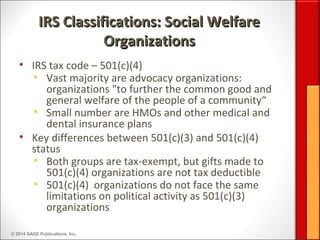

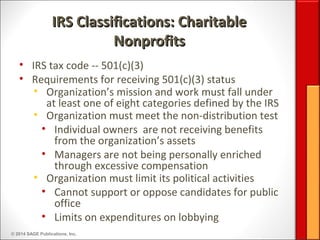

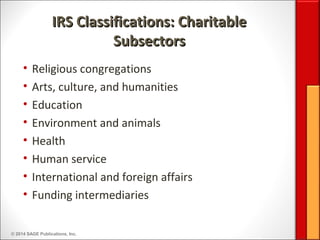

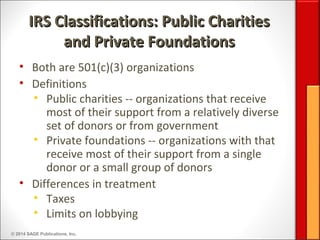

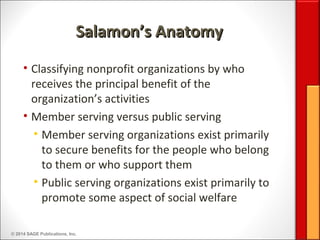

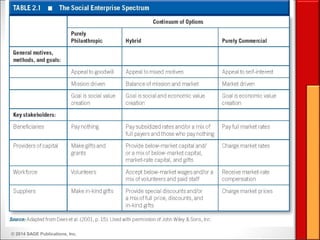

The document provides an overview of the nonprofit sector, including its historical roots in Greco-Roman and Judeo-Christian traditions of community and social responsibility. It discusses the growth of philanthropy following the Industrial Revolution. Key terms like charity, philanthropy, and the various IRS classifications of nonprofits are explained. Statistics are given on the size and economic impact of the nonprofit sector in the US. Different frameworks for categorizing nonprofits are outlined, including their purposes, beneficiaries, and degree of commercialization. Issues around social enterprises and the controversy over nonprofits engaging in commercial activities are also summarized.