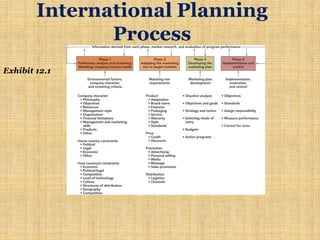

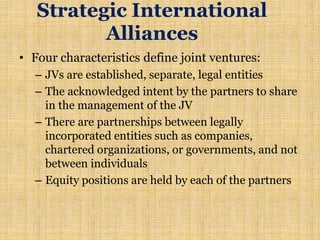

This document discusses international marketing and global market entry strategies. It covers four phases of the international planning process: preliminary analysis and screening, defining target markets and adapting the marketing mix, developing a marketing plan, and implementing and controlling the plan. It also describes alternative market entry strategies such as exporting, contractual agreements like licensing and franchising, strategic alliances like joint ventures and consortia, and direct foreign investment. The best strategy depends on a company's capabilities and a market's characteristics.