More Related Content

PDF

Slide_Chapter 2.pdf INTRODUCE TO FINANCIAL STATEMENT PPT

Chapter 2.ppt financial stat analysis and valuation PDF

Solution Manual for Cornerstones of Financial and Managerial Accounting 2nd E... PPT

2. Intr. fin. Statements and Other Fin. Reporting Topics.ppt PPTX

Financial statement analysis intro PPT

PPTX

Introduction to financial accounting PPT

Similar to chapter nember 2 financial statement analysis

PPTX

financial statment anaysis training slide PDF

Solution manual for Financial Accounting Libby Libby Short 8th edition PPT

Chapter 2 Financial Accounting PDF

Solution manual for Financial Accounting Libby Libby Short 8th edition PDF

Solution manual for financial accounting 11th edition robert libby patricia l... PPTX

PPT

Reporting_and_Financial_Statements_1.ppt PPT

PPTX

General-Purpose Financial Statements PPTX

Basic Accounting Concepts PPTX

A12 W4 Financial Statements Powerpoint Presentation DOCX

Financial Reporting & Analysis unit i, ii, iii, vii PPT

Financial Accouting - Chapter 1 PowerPoint PPT

PPTX

Accounting and Financial Statements PPTX

Chapter 07 using accounting information PPT

Ch02 wrd12e instructor_final PPTX

DOCX

DOC

More from ltbenmahjoub

PPTX

chapter number 13 financial statements analysis PPTX

الأصول غير المتداولة (الأصول الثابتة)- رؤى القضاة.pptx PPTX

accounting finalacial costing managerial course PDF

principle of accounting first chapter and 2 PPTX

chap3 financial accounting2 chapter2 chapter 2 chapter2 PPTX

chptaer 5 bak cash financial 1 chapter 5 university PPTX

creditratingagenc555ies-170117183828.pptx PPTX

الفصل5_قائمة التسوية واقفال الحسابات.pptx Recently uploaded

DOCX

Best Platforms to Buy Verified Wise Accounts in the US.docx PDF

30% Offer to Buy Cash App Verified No Issues.pdf PDF

Фінансування МФО для України: як зробити це швидше та простіше? DOCX

Buy Wise Accounts SSN Added Account.docx PPTX

Structure of Office of the dad PCDA O.pptx DOCX

Buy Verified PayPal Accounts 100% Working - Digital Payment Accounts.docx PDF

The $410.7 Billion Question Every CFO Needs to Answer PDF

Buy Verified PayPal Account Legit In the USA.pdf DOCX

Buy TikTok Account - Safe, Verified & Instant Delivery.docx PDF

Best top.,,,, 11 site PayPal Account.pdf PDF

Buying Verified Cash App Accounts_ Step-by-Step Guide for 2026 .pdf PDF

_How to Buy////// TikTok Seller Account.pdf PDF

How to buy a verified// Zelle account.pdf PDF

_How to Buy Twitter Accounts.pdf 2025--- PDF

New Monthly Enterprises Survey. Issue 40. (08.2025) Ukrainian Business in War... PDF

Lion One Presentation November 2025 updated DOCX

CNCPW Market Report: Silk Road Bitcoin Transfers and Liquidity Analysis PPTX

Art of Global Negotiations- Global Commons PDF

How To Sell Sidra Coins In 2026 - Secured PPTX

Beacon Kit slides tech framework for world game (s) pptx chapter nember 2 financial statement analysis

- 1.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or

otherwise on a password-protected website for classroom use.

- 2.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for

classroom use.

Chapter

2

Introduction to Financial

Statements and Other

Financial Reporting Topics

- 3.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

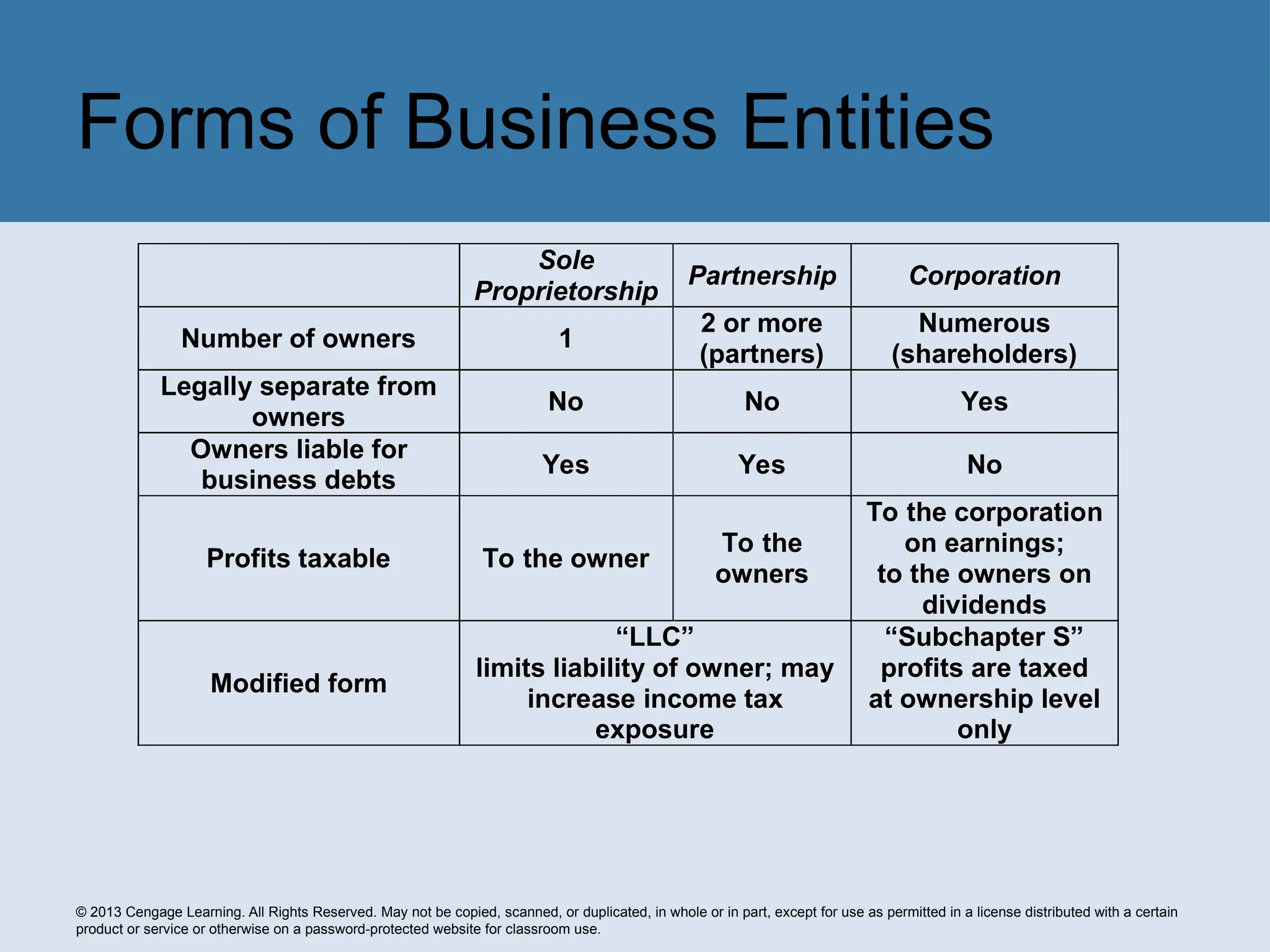

Forms of Business Entities

Sole

Proprietorship

Partnership Corporation

Number of owners 1

2 or more

(partners)

Numerous

(shareholders)

Legally separate from

owners

No No Yes

Owners liable for

business debts

Yes Yes No

Profits taxable To the owner

To the

owners

To the corporation

on earnings;

to the owners on

dividends

Modified form

“LLC”

limits liability of owner; may

increase income tax

exposure

“Subchapter S”

profits are taxed

at ownership level

only

- 4.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

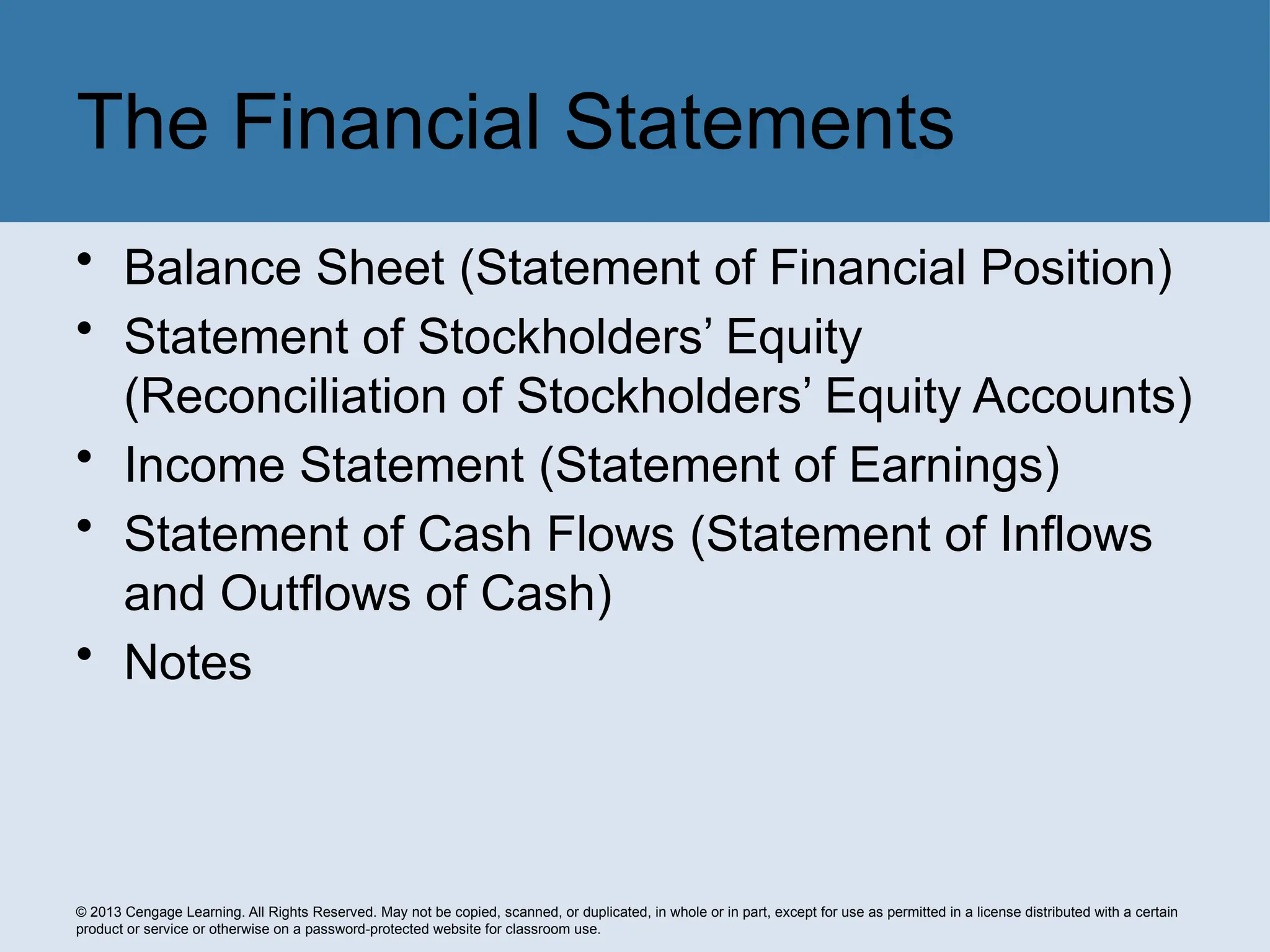

• Balance Sheet (Statement of Financial Position)

• Statement of Stockholders’ Equity

(Reconciliation of Stockholders’ Equity Accounts)

• Income Statement (Statement of Earnings)

• Statement of Cash Flows (Statement of Inflows

and Outflows of Cash)

• Notes

The Financial Statements

- 5.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Shows the financial position of an entity as of a

particular date

– Assets

– Liabilities

– Stockholders’ Equity

• Accounting Equation:

Balance Sheet

Assets = Liabilities + Stockholders’ Equity

Assets = Liabilities +

Capital Stock + Retained Earnings

- 6.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Reconciles beginning and ending balances of

the stockholders’ equity accounts

– Capital Stock

– Retained Earnings, etc.

• Links the balance sheet to the income statement

Statement of Stockholders’ Equity

- 7.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Summarizes revenues and expenses and gains

and losses, for a specified period

• Reports net income

– Excess of revenues over expense

• Net income is included in retained earnings

Income Statement

- 8.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Details the inflows and outflows of cash during a

specified period of time—same period as the

income statement

• Three sections

– Cash flows from operating activities

– Cash flows from investing activities

– Cash flows from financing activities

Statement of Cash Flows

- 9.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• An integral part of the financial statements

• Required presentation

– Summary of significant accounting policies

– Contingent liabilities

– Subsequent events relating to conditions that existed

at the balance sheet date

• Disclose and adjustment of the financial statements

– Subsequent events relating to conditions that did not

exist at the balance sheet date

• Disclosure but no adjustment of the financial statements

Notes

- 10.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Sequence of accounting procedures completed

during each accounting period

– Recording transactions

– Recording adjusting entries

– Preparing the financial statement

The Accounting Cycle

- 11.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Transaction is an internal or external event that

causes a change in a company’s assets,

liabilities, or stockholders’ equity

• Recorded in a journal (book of original entry)

• Posted to general ledger

• Double-entry system

– Debit is the left side of an account

– Credit is the right side of an account

– Debits = Credits

Recording Transactions

Account Title

Debit Credit

- 12.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

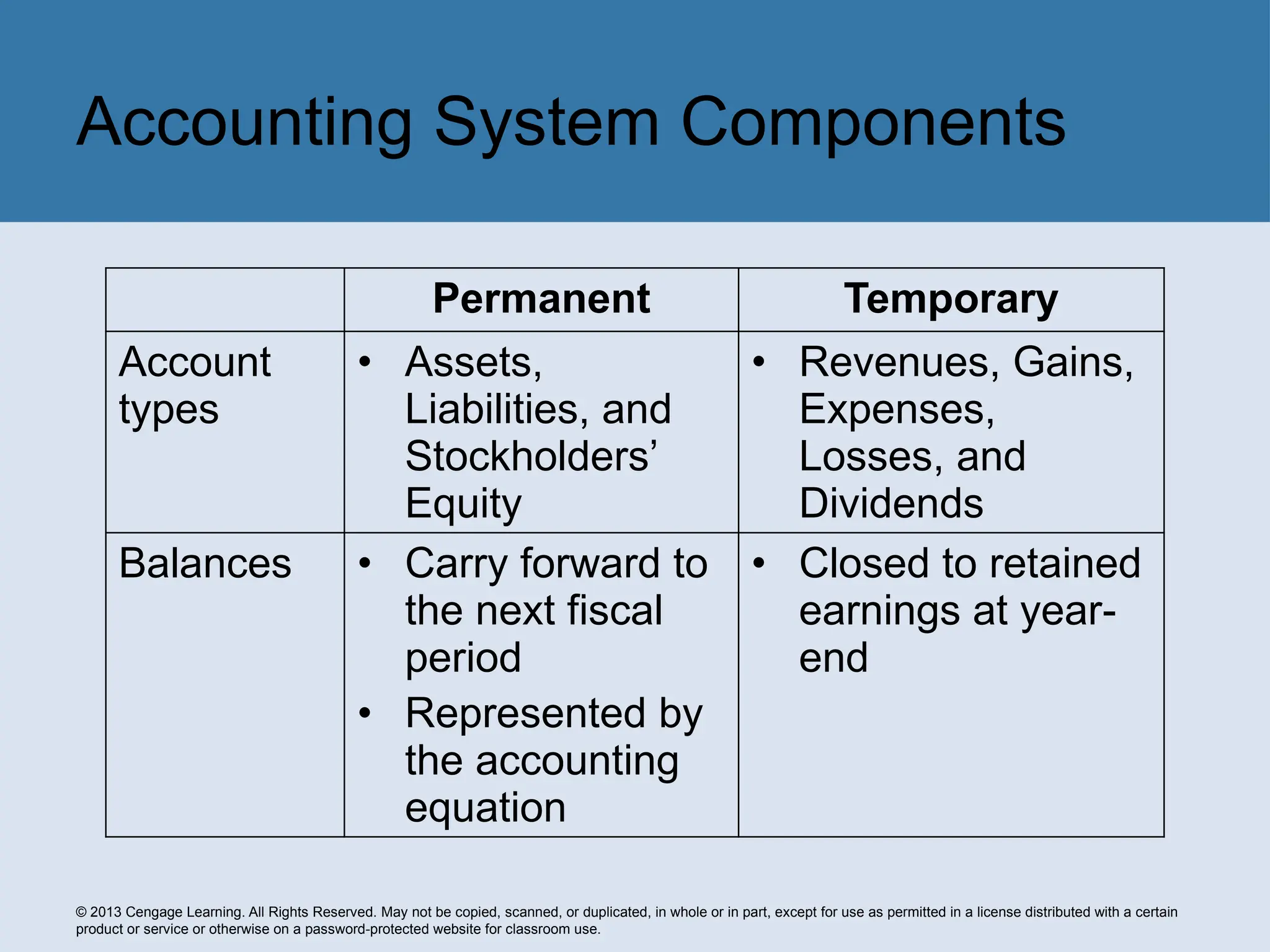

Accounting System Components

Permanent Temporary

Account

types

• Assets,

Liabilities, and

Stockholders’

Equity

• Revenues, Gains,

Expenses,

Losses, and

Dividends

Balances • Carry forward to

the next fiscal

period

• Represented by

the accounting

equation

• Closed to retained

earnings at year-

end

- 13.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

Exhibit 2-4—Double Entry System

- 14.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Required by the accrual basis of accounting

• Prepared at the end of the fiscal period

• Records (recognizes) for the current period

– Expenses when incurred

– Revenues when earned

• Recorded in the general journal and posted to

the general ledger before financial statements

are prepared

Recording Adjusting Entries

- 15.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• The output of the accounting system

• Two statements are prepared directly from the

adjusted accounts

– Income statement

– Balance sheet

• From analysis of general ledger accounts

– Statement of cash flows

Preparing the Financial Statements

- 16.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Voluntary private sector organization

• Committee of Sponsoring Organizations (COSO)

– Released reports detailing internal control systems

• Represent standards for evaluating internal control systems

• Need for internal control emphasized by Section

404 of Sarbanes-Oxley Act

– Independent auditor’s opinion on management’s

assessment of internal control is required

• Management's Report on Internal Control over Financial

Reporting refers to the criteria established by COSO

Treadway Commission

- 17.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Audit is conducted by CPAs

• An auditor’s report is the formal statement of the

auditor’s opinion of the financial statements

– Unqualified opinion

– Qualified opinion

– Adverse opinion

– Disclaimer of opinion

Auditor’s Opinion

- 18.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• The financial statements present fairly

– The financial position

– Results of operations

– Cash flows

• Financial statements are in conformity with

generally accepted accounting principles

• For the user—highest degree of readability

Unqualified Opinion

- 19.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Except for the effects to which the qualification

relates, the financial statements present fairly

– The financial position

– Results of operations

– Cash flows

• Financial statements are in conformity with

generally accepted accounting principles

• For the user—determine the significance of the

exception

Qualified Opinion

- 20.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• The financial statements do not present fairly

– The financial position

– Results of operations

– Cash flows

• Financial statements are not in conformity with

generally accepted accounting principles

• For the user—reliability of financial statements

need to be seriously questioned

Adverse Opinion

- 21.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• The auditor does not express an opinion

• Auditor

– Has not preformed an audit sufficient in scope to form

an opinion or

– Is not independent

• For the user—auditor’s statement conveys no

indication of financial statement reliability

Disclaimer of Opinion

- 22.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• The typical unqualified (or clean) opinion for

private companies has three paragraphs

• Paragraph #1

– Financial statements have been audited

– Financial statements are responsibility of company’s

management

– Auditors have responsibility to either express or

disclaim an opinion

Unqualified Auditor’s Opinion

- 23.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Paragraph #2

– Audit conducted in accordance with the standards of

the Public Company Accounting Oversight Board

(U.S.)

– Confirms whether the audit provided a reasonable

basis for opinion

• Paragraph #3

– Gives an opinion on the statement that they are in

conformity with GAAP

Unqualified Auditor’s Opinion—Continued

- 24.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Review

– Less in scope than an audit

– An opinion is not expressed

– Provides negative assurance

• “Not aware of any material misstatements or required

modifications”

• Compilation

– Presents only financial information as provided by

management

– No opinion or any other assurance is given

Other Types of Engagements

- 25.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Required by Sarbanes-Oxley

• May be combined with audit opinion report

Auditor’s Report on the Firm’s Internal

Controls

- 26.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Management is responsible for

– The preparation of the financial statements

– The integrity of the financial statements

• Report of management’s responsibility for

financial statements may be included in the

annual report

Management’s Responsibility for

Financial Statements

- 27.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Required filings

– Form10-K—annual filing (audited)

• Includes financial statements plus

– Information on the business entity

– Market information

– Management discussion and analysis (MDA)

– Disclosure of the domestic and foreign components of

pre-tax income

– Form 10-Q—quarterly filing (unaudited)

– Form 8-K

• To report the occurrence of any material events or corporate

changes

The SEC’s Integrated Disclosure System

- 28.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Proxy

– Notice and authorization of shareholder voting rights

on corporate actions

– Content and form governed by the SEC

• Summary Annual Report

– Highly condensed financial information

– Must be accompanied by a proxy containing full

financial information

– Not adequate for reasonable analysis

Additional Reporting Venues

- 29.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Capital markets generate security prices that

reflect worth

• Publicly available information is reflected in

share prices

• Investors will be harmed if full disclosure is not

made

• Method of disclosure does not impact value

• Disclosure should be made when benefit of

making disclosure outweighs the cost

The Efficient Market Hypothesis

- 30.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

Ethics

• Caring

• Honesty

• Accountability

• Promise keeping

• Pursuit of excellence

• Loyalty

• Fairness

• Integrity

• Respect for others

• Responsible

citizenship

Essential values in interpersonal relationships

- 31.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Determine the facts—what, who, where, when,

how

• Define the ethical issues

• Identify major principles, rules, and values

• Specify the alternatives

• Compare norms, principles, and values with

alternatives

• Assess the consequences

• Make your decision

American Accounting Association Ethical

Decision Framework

- 32.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Enacted under Sarbanes-Oxley Act

• Requires disclosure of a company’s code of

ethics

– Applicable to company’s principal officers

• Code is published in the annual report or on the

company’s web site

SEC Requirements—Code of Ethics

- 33.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Parent company consolidates with subsidiary

– Report results of operations separately, or

– Sum subsidiary and parent results of operations

• Legal control vs. effective control

• Consolidation occurs when parent has effective

control over the subsidiary

– Holds a majority of risks, rewards, and decision-

making ability

Consolidated Statements

- 34.

© 2013 CengageLearning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

product or service or otherwise on a password-protected website for classroom use.

• Effected through merger or acquisition

• Accounted for using the purchase method

– Record identifiable assets and liabilities acquired at

their fair values

• Excess of purchase price over fair value of net

assets acquired is reported as goodwill

• Income of the acquired firm is considered from

the date of acquisition

• Retained earnings of the acquired firm do not

continue

Accounting for Business Combinations