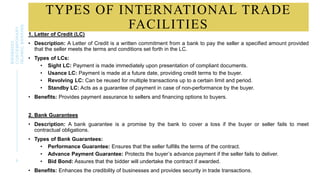

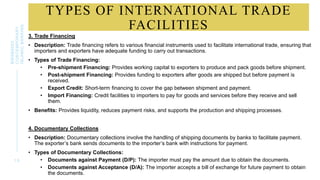

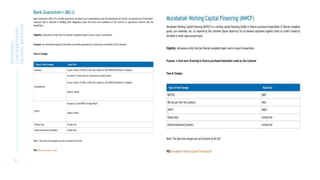

The document discusses international trade financing, highlighting the various financial tools and practices that facilitate global commerce, particularly focusing on Islamic finance principles. It outlines types of trade facilities such as letters of credit, bank guarantees, and trade financing methods compliant with shariah law. Additionally, it covers important aspects of international trade practices, including trade documentation, payment methods, regulatory compliance, and risk management.