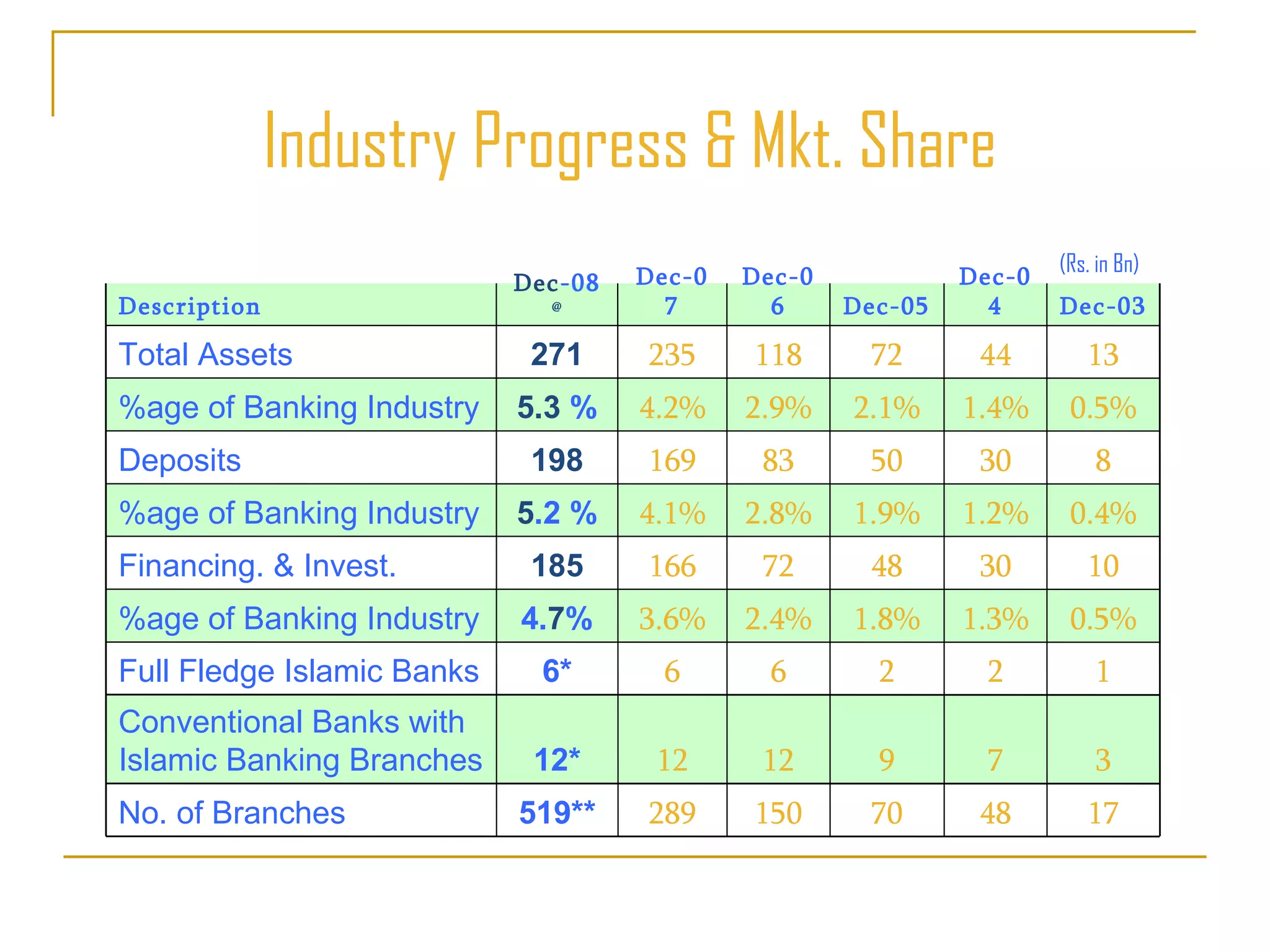

The document discusses Islamic banking and finance, outlining its principles, products, and differences from conventional banking. It highlights the progress of Islamic banking in Pakistan and worldwide, showcasing various Islamic financial institutions and the growth of the Islamic finance industry. Key concepts include microfinance, trade-based financing methods such as murabaha, salam, and istisna, as well as the importance of shariah compliance.