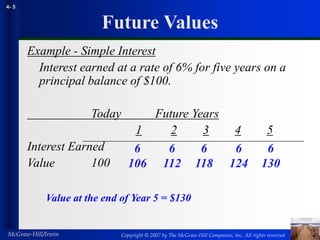

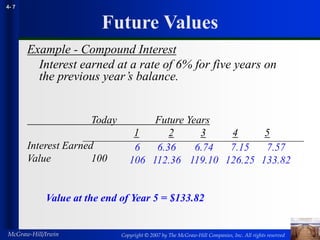

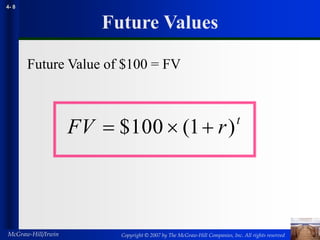

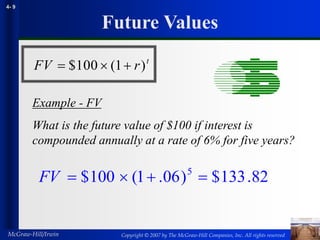

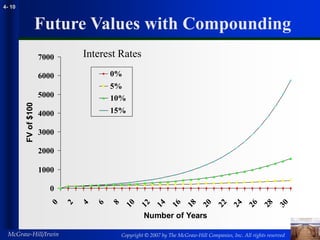

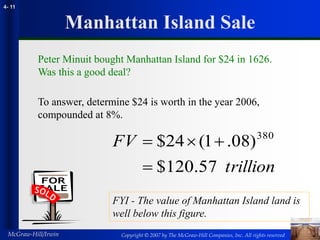

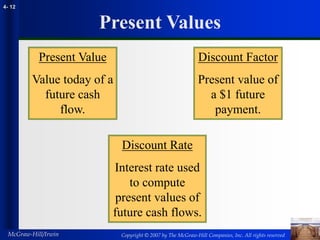

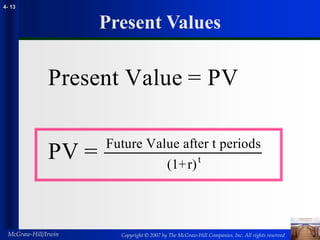

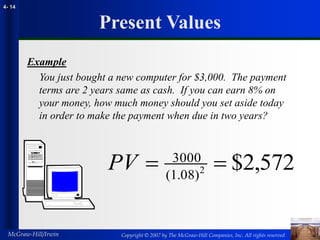

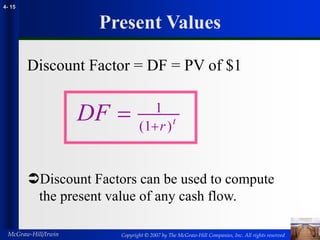

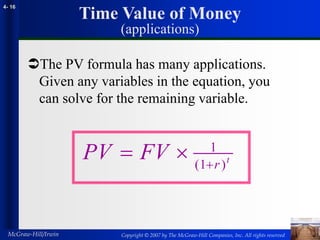

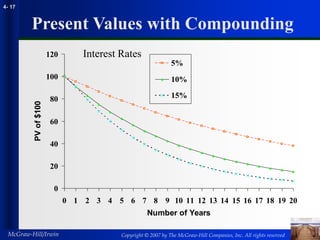

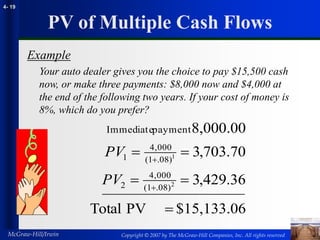

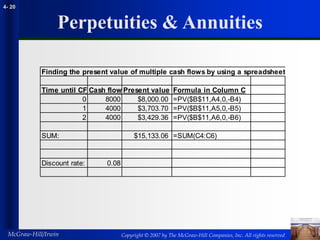

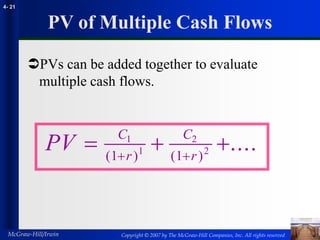

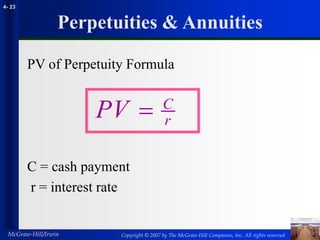

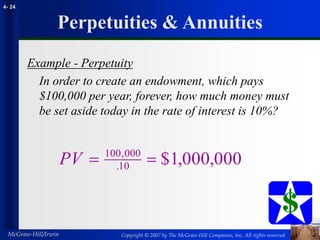

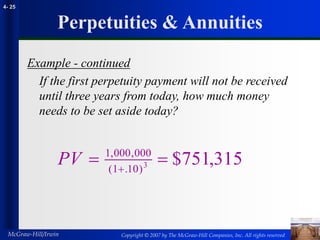

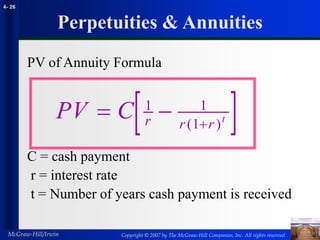

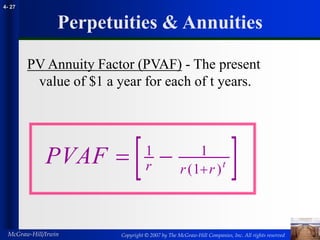

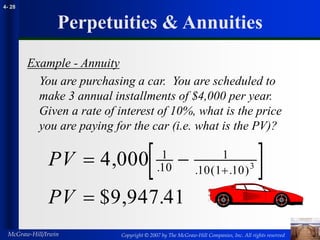

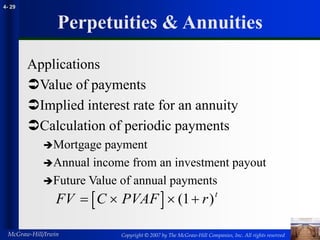

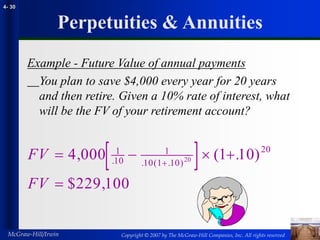

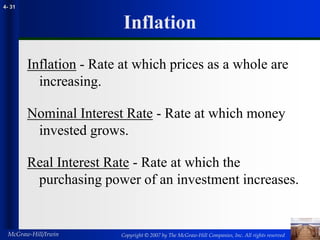

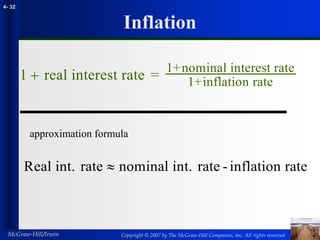

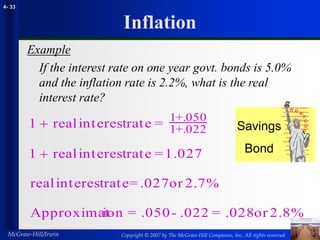

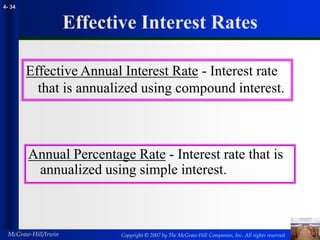

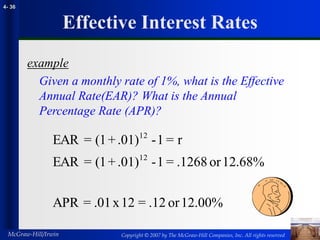

This document summarizes key concepts related to the time value of money, including future values, present values, perpetuities, annuities, inflation, and effective interest rates. It provides examples and formulas for calculating future values, present values, perpetuities, annuities, real interest rates, and effective annual interest rates. The document is from Chapter 4 of a corporate finance textbook and covers topics such as compound interest, discount rates, discount factors, and applications related to the time value of money.